Estimates Down for Altera - Analyst Blog

March 15 2012 - 1:54PM

Zacks

Earnings estimates have declined a bit in the last seven days

after Altera Corporation (ALTR) narrowed its

guidance for the first quarter of 2012.

Last week, Altera announced that it now expects revenues to

decline by 7% - 9% compared to the earlier projection of a decline

of 5% - 9%.

The company had previously forecasted revenues to decline as a

result of the program timing in the military vertical

market and continued softness in sales to wireless

customers.

The company expects revenues from wireless segment to move lower

across multiple geographies due to continued inventory depletion

and softening demand in the second half of 2011.

However, as the quarter progressed, Altera experienced a more

pronounced and broader-than-anticipated inventory adjustment

related weakness leading to a more significant decline.

Consequently, sixteen out of the twenty-three analysts covering

the stock have decreased their estimates for FY 2012. The current

Zacks Consensus Estimate for 2012 is $1.75, down by $0.04 in the

last seven days.

Twelve out of the twenty-two analysts covering the stock have

decreased their estimates for the first quarter of 2012.

The new guidance implies revenue guidance between $416.5 million

and $425.9 million compared to the previous forecast of $416.5

million and $434.9 million.

Nevertheless, Altera continues to expect that revenue in the

second quarter of 2012 will be above first quarter levels. The

book-to-bill remains above 1.0 for the quarter.

In January, Altera reported sales of $457.8 million in the

fourth quarter of 2011, down 12% sequentially and 18% year over

year.

The reported revenues surpassed management’s revised guidance of

$438.9 million – $454.6 million and Zacks Consensus Estimate of

$451 million.

Altera reported a net income of $146.6 million or 45 cents per

share compared to a net income of $185.4 million or 57 cents per

share in the third quarter of 2011 and a net income of $231.6

million or 72 cents per share in the year-ago quarter. The reported

figure beat the Zacks Consensus Estimate of 41 cents.

We continue to maintain an Underperform recommendation on

Altera. Currently, we have a Zacks #3 Rank on the stock which

translates into a short-term rating of Hold.

ALTERA CORP (ALTR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

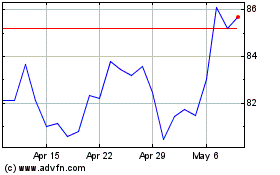

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

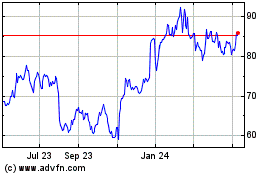

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Jul 2023 to Jul 2024