Current Report Filing (8-k)

February 22 2021 - 4:32PM

Edgar (US Regulatory)

false

0001350653

0001350653

2021-02-18

2021-02-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 18, 2021

ALPHATEC HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

000-52024

|

|

20-2463898

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1950 Camino Vida Roble

Carlsbad, California 92008

(Address of Principal Executive Offices)

(760) 431-9286

(Registrant’s telephone number, including area code)

5818 El Camino Real

Carlsbad, California 92008

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14.a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $.0001 per share

|

ATEC

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

On February 18, 2021, Alphatec Holdings, Inc. (the “Company”) entered into new Severance Agreements with the Company’s Chief Executive Officer, Patrick S. Miles (“Miles Agreement”), and its Executive Vice President, Craig E. Hunsaker (“Hunsaker Agreement”).

The Miles Agreement provides that Mr. Miles will be eligible to receive the following severance and other benefits if his employment with the Company is terminated: (a) the payment of cash severance in a lump sum equal to two times the sum of his regular annual base salary plus his annual target bonus in effect for the calendar year in which the termination of the employment occurs; (b) the payment of premiums for the continuation of his health and dental insurance coverage pursuant to COBRA for a period of 18 months; (c) the full vesting of all time-based vesting incentive awards granted to Mr. Miles that vest within 24 months of the termination date and the continued eligibility to vest performance-based incentive awards based on the achievement of performance criteria and (d) the extension of the post-termination exercise period for any vested stock options held by Mr. Miles at the date of termination through the later of (i) 90 days after his date of termination or (ii) the remaining term of such awards. Mr. Miles’ right to receive the severance and other benefits under the Miles Agreement is subject to satisfaction of certain conditions set forth in the Miles Agreement, including (1) the termination of employment is involuntary, except for a termination by Mr. Miles for Good Reason, as defined in the Miles Agreement, (2) the termination is not due to the death or disability of Mr. Miles, (3) the termination of employment is not for Cause, as defined in the Miles Agreement, (4) Mr. Miles is not eligible to receive severance benefits under any other agreement of plan offered by the Company or has not agreed to waive severance benefits otherwise available from the Company, and (5) Mr. Miles executed a general release of claims in favor of the Company and returns to the Company all property and equipment assigned to or under control of Mr. Miles.

The Hunsaker Agreement provides that Mr. Hunsaker will be eligible to receive the following severance and other benefits if his employment with the Company is terminated: (a) the payment of cash severance in a lump sum equal to one and one half times the sum of his regular annual base salary plus his annual target bonus in effect for the calendar year in which the termination of the employment occurs; (b) the payment of premiums for the continuation of his health and dental insurance coverage pursuant to COBRA for a period of 18 months; (c) the full vesting of all time-based vesting incentive awards granted to Mr. Hunsaker that vest within 18 months of the termination date and the continued eligibility to vest performance-based incentive awards based on the achievement of performance criteria and (d) the extension of the post-termination exercise period for any vested stock options held by Mr. Hunsaker at the date of termination through the later of (i) 90 days after his date of termination or (ii) the remaining term of such awards. Mr. Hunsaker’s right to receive the severance and other benefits under the Hunsaker Agreement is subject to satisfaction of certain conditions set forth in the Hunsaker Agreement, including (1) the termination of employment is involuntary, except for a termination by Mr. Hunsaker for Good Reason, as defined in the Hunsaker Agreement, (2) the termination of employment is not due to the death or disability of Mr. Hunsaker, (3) the termination is not for Cause, as defined in the Hunsaker Agreement, (4) Mr. Hunsaker is not eligible to receive severance benefits under any other agreement of plan offered by the Company or has not agreed to waive severance benefits otherwise available from the Company, and (5) Mr. Hunsaker executed a general release of claims in favor of the Company and returns to the Company all property and equipment assigned to or under control of Mr. Hunsaker.

The foregoing description of the Miles Agreement and the Hunsaker Agreement is not complete and is qualified in its entirety by reference to the full text of each of the Miles Agreement and the Hunsaker Agreement, copies of which are filed herewith as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K, respectively, and are incorporated herein by reference.

|

|

|

|

Item 9.01.

|

Financial Statements and Exhibits

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: February 22, 2021

|

|

|

|

ALPHATEC HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Jeffrey G. Black

|

|

|

|

|

|

Name: Jeffrey G. Black

|

|

|

|

|

|

Its: Executive Vice President and Chief Financial Officer

|

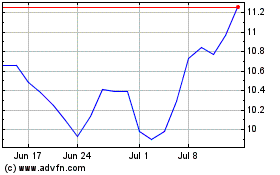

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

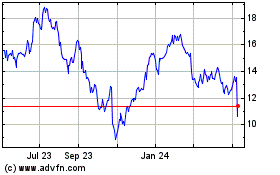

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Apr 2023 to Apr 2024