Current Report Filing (8-k)

April 27 2020 - 9:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 2, 2020

ALPHATEC HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

000-52024

|

|

20-2463898

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

5818 El Camino Real

Carlsbad, California 92008

(Address of Principal Executive Offices)

(760) 431-9286

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14.a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, par value $.0001 per share

|

ATEC

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

|

|

|

|

|

ITEM 1.01

|

Entry into a Material Definitive Agreement.

|

Paycheck Protection Program Loan

On April 23, 2020, Alphatec Spine, Inc. a wholly-owned subsidiary of Alphatec Holdings, Inc. (“Alphatec,” or the “Company”), received the proceeds from a loan in the amount of approximately $4.3 million (the “PPP Loan”) from Silicon Valley Bank, as lender, pursuant to the Paycheck Protection Program (“PPP”) of the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”). The PPP Loan matures on April 21, 2022 and bears interest at a rate of 1.0% per annum. Commencing November 21, 2020, the Company is required to pay the lender equal monthly payments of principal and interest as required to fully amortize by April 21, 2022 the principal amount outstanding on the PPP Loan as of October 21, 2020. The PPP Loan is evidenced by a promissory note dated April 21, 2020 (the “Note”), which contains customary events of default relating to, among other things, payment defaults and breaches of representations and warranties. The PPP Loan may be prepaid by the Company at any time prior to maturity with no prepayment penalties.

All or a portion of the PPP Loan may be forgiven by the U.S. Small Business Administration (“SBA”) upon application by the Company beginning 60 days but not later than 120 days after loan approval and upon documentation of expenditures in accordance with the SBA requirements. Under the CARES Act, loan forgiveness is available for the sum of documented payroll costs, covered rent payments, covered mortgage interest and covered utilities during the eight-week period beginning on the date of loan approval. For purposes of the CARES Act, payroll costs exclude compensation of an individual employee in excess of $100,000, prorated annually. Not more than 25% of the forgiven amount may be for non-payroll costs. Forgiveness is reduced if full-time headcount declines, or if salaries and wages for employees with salaries of $100,000 or less annually are reduced by more than 25%. In the event the PPP Loan, or any portion thereof, is forgiven pursuant to the PPP, the amount forgiven is applied to outstanding principal. No assurance is provided that the Company will apply for and obtain forgiveness of the PPP Loan in whole or in part.

The Company intends to use all proceeds from the PPP Loan to retain employees and maintain payroll.

The foregoing description of the Note is not complete and is qualified in its entirety by reference to the complete text of the Note, a copy of which is the Company plans to file as an exhibit to its Form 10-Q for the quarterly period ended June 30, 2020.

|

|

|

|

ITEM 1.02

|

Termination of a Material Definitive Agreement.

|

Background

On February 28, 2020, the Company entered into a Tender Offer Agreement (the “Tender Offer Agreement”) with EOS Imaging S.A., a société anonyme organized and existing under the laws of France (“EOS”), pursuant to which Alphatec or one of its affiliates would commence a public tender offer (the “Offer”) to purchase all of the issued and outstanding ordinary shares, nominal value €0.01 per share (collectively, the “Shares”), and outstanding convertible bonds (“OCEANEs”), of EOS. The Offer would have consisted of a cash tender offer price of €2.80 (or approximately $3.08) per Share and €7.01 (or approximately $7.71) per OCEANE, respectively (the “Cash Offer”), or at the option of EOS shareholders, 0.50 shares of common stock, par value $0.0001 per share, of Alphatec per Share, for a total purchase price of up to $121.9 million. The Offer was expected to occur in late April 2020.

In connection with entry into the Tender Offer Agreement, the Company entered into a commitment letter, dated February 28, 2020 (the “Commitment Letter”), with Perceptive Credit Holdings III, LP (together with its affiliates, “Perceptive”), pursuant to which, subject to the terms and conditions set forth therein, Perceptive committed to provide $130 million in secured debt financing, up to $60 million of which (the “Refinancing Portion”) would have retired Alphatec’s existing credit facilities with MidCap Funding IV, LLC and Squadron Medical Finance Solutions, LLC (the “Refinancing”). The remaining commitment by Perceptive would have provided an additional $70 million (which may have been increased to up to $100 million at the request of Alphatec if agreed by Perceptive in its sole discretion) in secured debt financing (the “Tender Offer Portion”) available to fund the Cash Offer portion of the Offer.

Termination of Tender Offer Agreement and Commitment Letter

On April 27, 2020, the Company announced that it has terminated the Tender Offer Agreement. This decision follows Alphatec’s consideration and analysis of the expected ongoing market effects of the COVID-19 pandemic, including the magnitude and duration of its impact on capital equipment priorities and purchases in significant EOS markets, including the United States. Based upon its assessment, ATEC concluded that a “Material Adverse Effect” (as defined in the Tender Offer Agreement) has occurred, resulting in circumstances that are no longer conducive to completion of the transaction described in the Tender Offer Agreement. Alphatec notified EOS of its termination decision, as required by the Tender Offer Agreement, in a letter dated April 24, 2020.

On April 27, 2020, the Company also announced that, in connection with the termination of the Tender Offer Agreement, Alphatec and Perceptive have agreed to terminate the Commitment Letter, including the exclusivity obligations thereunder.

|

|

|

|

|

|

|

ITEM 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

|

The information contained in Item 1.01 of this report under the heading “Paycheck Protection Program Loan” is incorporated by reference under this Item 2.03.

|

|

|

|

ITEM 7.01

|

Regulation FD Disclosure.

|

On April 27, 2020, Alphatec issued a press release announcing the termination of the Tender Offer Agreement and the transactions contemplated thereby. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

The information furnished under this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

|

|

|

|

ITEM 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

The following exhibits are filed as part of this report:

Forward-Looking Statements

Alphatec cautions you that statements included in this Current Report on Form 8-K that are not a description of historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainty. Such statements are based on management’s current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. The Company cautions investors that there can be no assurance that actual results will not differ materially from those projected or suggested in such forward-looking statements as a result of various factors. Forward-looking statements contained herein include, but are not limited to, references to uses of the PPP loan and potential forgiveness thereof, future strategic and/or financing collaborations between the Company and EOS and any potential benefits or synergies resulting therefrom, potential effects of the termination of the Tender Offer Agreement, and the terms of the Perceptive termination. The important factors that could cause actual results to differ significantly from those expressed or implied herein, include, but are not limited to: negative publicity and governmental legal action related to the PPP loan; potential litigation related to the Company’s termination of the Tender Offer Agreement; the Company and EOS may not further explore a strategic or similar colloboration or may fail to reach a definitive agreement related to such a colloboration; risks related to the final terms of the Perceptive termination; and other risks detailed in the Company's most recent annual report, and any subsequent quarterly and current reports, filed with the Securities and Exchange Commission. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law.

Certain Legal Matters

This communication is not intended to, and does not, constitute, represent or form part of any offer, invitation or solicitation of an offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of, any securities whether pursuant to this Current Report on Form 8-K, the attached press release or otherwise.

The distribution of this communication in jurisdictions outside the United States or France may be restricted by law or regulation and therefore any person who comes into possession of this communication should inform themselves about, and comply with, such restrictions. Any failure to comply with such restrictions may constitute a violation of the securities laws or regulations of any such relevant jurisdiction.

EOS is incorporated in France and listed on Euronext and any offer for its securities will be subject to French disclosure and procedural requirements, which differ from those that are applicable to offers conducted solely in the United States, including with respect to withdrawal rights, offer timetable, settlement procedures and timing of payments. The transactions described above will be structured to comply with French and U.S. securities laws and regulations applicable to transactions of this type.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ALPHATEC HOLDINGS, INC.

|

|

|

|

|

|

|

Date: April 27, 2020

|

|

|

|

By:

|

|

/s/ Jeffrey G. Black

|

|

|

|

|

|

|

|

Name: Jeffrey G. Black

Title: Chief Financial Officer

|

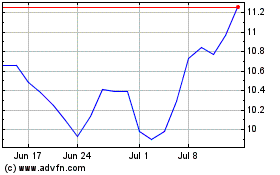

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

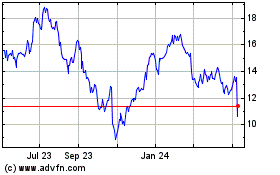

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Apr 2023 to Apr 2024