Amended Statement of Beneficial Ownership (sc 13d/a)

October 01 2020 - 4:26PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of

1934

(Amendment No. 3)*

Agile

Therapeutics, Inc.

(Name of Issuer)

Common Stock

(Title of Class of Securities)

00847L 10 0

(CUSIP Number)

Pasquale DeAngelis

ProQuest Investments

4657 York Road, #406

Buckingham, PA 18912

(609) 319-2929

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 18, 2020

(Date of Event which Requires Filing of

this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required on the remainder of this cover

page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

|

CUSIP

No. 00847L 10 0

|

13D

|

Page

2 of 10 Pages

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

ProQuest Investments III, L.P. 20-0992411

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

¨

|

|

(b)

|

x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS

WC

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

o

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7.

|

SOLE VOTING POWER

0

|

|

8.

|

SHARED VOTING POWER

2,589,586

|

|

9.

|

SOLE DISPOSITIVE POWER

0

|

|

10.

|

SHARED DISPOSITIVE POWER

2,589,586

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,589,586

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

o

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.9%

|

|

14.

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

|

CUSIP

No. 00847L 10 0

|

13D

|

Page

3 of 10 Pages

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

ProQuest Associates III LLC 20-0992451

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

¨

|

|

(b)

|

x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS

AF

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

o

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7.

|

SOLE VOTING POWER

0

|

|

8.

|

SHARED VOTING POWER

2,589,586

|

|

9.

|

SOLE DISPOSITIVE POWER

0

|

|

10.

|

SHARED DISPOSITIVE POWER

2,589,586

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,589,586

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

o

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.9%

|

|

14.

|

TYPE OF REPORTING PERSON

OO

|

|

|

|

|

|

|

|

|

CUSIP

No. 00847L 10 0

|

13D

|

Page

4 of 10 Pages

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

ProQuest Investments IV, L.P. 20-5935001

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

¨

|

|

(b)

|

x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS

WC

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

o

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7.

|

SOLE VOTING POWER

0

|

|

8.

|

SHARED VOTING POWER

1,630,314

|

|

9.

|

SOLE DISPOSITIVE POWER

0

|

|

10.

|

SHARED DISPOSITIVE POWER

1,630,314

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,630,314

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

o

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.9%

|

|

14.

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

|

CUSIP

No. 00847L 10 0

|

13D

|

Page

5 of 10 Pages

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

ProQuest Associates IV LLC 20-5934968

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

¨

|

|

(b)

|

x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS

AF

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

o

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7.

|

SOLE VOTING POWER

0

|

|

8.

|

SHARED VOTING POWER

1,630,314

|

|

9.

|

SOLE DISPOSITIVE POWER

0

|

|

10.

|

SHARED DISPOSITIVE POWER

1,630,314

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,630,314

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

o

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.9%

|

|

14.

|

TYPE OF REPORTING PERSON

OO

|

|

|

|

|

|

|

|

|

CUSIP

No. 00847L 10 0

|

13D

|

Page

6 of 10 Pages

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

Jay Moorin

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

¨

|

|

(b)

|

x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS

AF

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

o

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7.

|

SOLE VOTING POWER

0

|

|

8.

|

SHARED VOTING POWER

4,219,900

|

|

9.

|

SOLE DISPOSITIVE POWER

0

|

|

10.

|

SHARED DISPOSITIVE POWER

4,219,900

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,219,900

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

o

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.8%

|

|

14.

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

|

CUSIP

No. 00847L 10 0

|

13D

|

Page

7 of 10 Pages

|

|

1.

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NO. OF ABOVE PERSONS (ENTITIES ONLY)

Alain Schreiber

|

|

2.

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

¨

|

|

(b)

|

x

|

|

3.

|

SEC USE ONLY

|

|

4.

|

SOURCE OF FUNDS

AF

|

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

o

|

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States Resident Alien

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7.

|

SOLE VOTING POWER

0

|

|

8.

|

SHARED VOTING POWER

4,219,900

|

|

9.

|

SOLE DISPOSITIVE POWER

0

|

|

10.

|

SHARED DISPOSITIVE POWER

4,219,900

|

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,219,900

|

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

o

|

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.8%

|

|

14.

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

|

CUSIP

No. 00847L 10 0

|

13D

|

Page

8 of 10 Pages

|

Item 4. Purpose of Transaction.

The Reporting Persons have determined to

divest certain shares of Common Stock through sales of such shares on the open market.

The Reporting Persons do not at the present

time have any plans or proposals which relate to or would result in:

|

|

(a)

|

The acquisition by any person of additional securities of the Issuer, or the disposition of securities of the Issuer, except the acquisition of Common Stock that may be acquired by, directly or upon the exercise of stock options granted to, an affiliate of the Reporting Persons as compensation for service as a member of the Issuer’s board of directors;

|

|

|

(b)

|

An extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries;

|

|

|

(c)

|

A sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries;

|

|

|

(d)

|

Any change in the present Board of Directors or management of the Issuer, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the Board;

|

|

|

(e)

|

Any material change in the present capitalization or dividend policy of the Issuer;

|

|

|

(f)

|

Any other material change in the Issuer’s business or corporate structure;

|

|

|

(g)

|

Changes in the Issuer’s Certificate of Incorporation, by-laws or instruments corresponding thereto or other actions which may impede the acquisition of control of the Issuer by any person;

|

|

|

(h)

|

Causing a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association;

|

|

|

(i)

|

A class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934; or

|

|

|

(j)

|

Any action similar to any of those enumerated above.

|

Item

5. Interest in Securities of the Issuer.

(a)-(b) As

of the date hereof and as more fully described in Item 3, the Reporting Persons may be deemed to be the direct and indirect beneficial

owners of an aggregate of 4,219,900 shares of Common Stock over all of which securities they have shared voting and shared dispositive

power.

The 4,219,900 shares of Common Stock beneficially

owned by the Reporting Persons as of the date hereof represent 4.8% of the issued and outstanding shares of Common Stock based

on 87,297,605 shares of Common Stock outstanding as of August 7, 2020 based on information set forth by the Issuer in its Quarterly

Report on Form 10-Q for the quarter ended June 30, 2020. Of such 4,219,900 shares, 2,589,586, or 2.9%, are beneficially owned by

each of Investments III and Associates III; 1,630,314 or 1.9%, are beneficially owned by each of Investments IV and Associates

IV; and 4,219,900, or 4.8%, are beneficially owned by each of Moorin and Schreiber.

|

CUSIP

No. 00847L 10 0

|

13D

|

Page

9 of 10 Pages

|

(c) Except

for the open market sales set forth below, there have been no transaction in the securities of the Issuer by any of the Reporting

Persons during the past sixty days:

|

Date

|

Reporting Person

|

Security

|

Amount Disposed

|

Price per share

|

|

9/14/20

|

Investments IV

|

Common Stock

|

31,222

|

$3.81

|

|

9/15/20

|

Investments IV

|

Common Stock

|

33,249

|

$3.79

|

|

9/16/20

|

Investments IV

|

Common Stock

|

83,751

|

$3.77

|

|

9/17/20

|

Investments IV

|

Common Stock

|

36,665

|

$3.69

|

|

9/18/20

|

Investments IV

|

Common Stock

|

143,284

|

$3.77

|

|

9/21/20

|

Investments IV

|

Common Stock

|

390

|

$3.78

|

|

9/14/20

|

Investments III

|

Common Stock

|

48,834

|

$3.81

|

|

9/15/20

|

Investments III

|

Common Stock

|

52,005

|

$3.79

|

|

9/16/20

|

Investments III

|

Common Stock

|

130,995

|

$3.77

|

|

9/17/20

|

Investments III

|

Common Stock

|

57,348

|

$3.69

|

|

9/18/20

|

Investments III

|

Common Stock

|

224,110

|

$3.77

|

|

9/21/20

|

Investments III

|

Common Stock

|

610

|

$3.78

|

(e) On

September 18, 2020, the Reporting Persons ceased to be beneficial owners of more than 5% of the Common Stock.

|

CUSIP

No. 00847L 10 0

|

13D

|

Page

10 of 10 Pages

|

Signatures

After reasonable inquiry and to the best

knowledge and belief of the undersigned, the undersigned certify that the information set forth in this statement is true, complete

and correct.

|

DATED: October 1, 2020

|

|

|

|

/s/ Pasquale DeAngelis

|

|

|

Pasquale DeAngelis, as a member of ProQuest Associates III LLC and on behalf of ProQuest Investments III, L.P., and as a member of ProQuest Associates IV LLC and on behalf of ProQuest Investments IV, L.P.

|

|

|

|

|

|

*

|

|

|

Jay Moorin, individually

|

|

|

|

|

|

*

|

|

|

Alain Schreiber, individually

|

|

|

|

|

*By:

|

/s/

Pasquale DeAngelis

|

|

|

|

Pasquale DeAngelis, Attorney-in-Fact

|

|

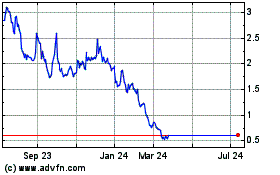

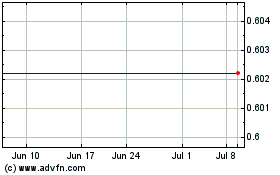

Agile Therapeutics (NASDAQ:AGRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Agile Therapeutics (NASDAQ:AGRX)

Historical Stock Chart

From Apr 2023 to Apr 2024