Full Year 2023

Results-Another record year on

all KPIs

Confident for 2024

February 8, 2024

- Full year 2023 net revenue

organic growth at +6.3% with stronger than expected Q4 at

+5.7%

- Industry-leading financial

ratios: 18.0% operating margin rate; headline EPS up +10% at €6.96;

adjusted free cash flow at €1.7bn1

- #1 rank in new business

over the last 5 years2

- 2023 proposed dividend at

€3.40 per share, fully paid in cash

- Confident in outperforming

in 2024, despite macroeconomic challenges:

- Organic growth expected at

+4% to +5%

- Operating margin rate at

18%

- Free cash flow between €1.8

and €1.9bn

|

FY 2023 Results |

|

|

|

(€m) |

FY 2023 |

2023 vs 2022 |

|

Revenue |

14,802 |

+4.3% |

|

Net revenue |

13,099 |

+4.2% |

|

Organic growth |

+6.3% |

|

|

Operating margin |

2,363 |

+4.3% |

|

Operating margin rate |

18.0% |

- |

|

Headline diluted EPS (euro) |

6.96 |

+9.5% |

|

Adjusted free cash flow |

€1.7bn1 |

|

|

Q4 2023 Revenue |

|

| Net revenue |

3,540 |

| Reported growth |

+2.3% |

|

Organic growth |

+5.7% |

1 Free cash flow (FCF) before change in

working capital requirement.Reported 2023 FCF at

€1,547M when including net cash impact for Rosetta

settlement of €148M.2 JP Morgan rankings 2019 – 2023.

Arthur Sadoun, Chairman and CEO of Publicis Groupe:

“In a very challenging macroeconomic context, and after 6

years of transformation, Publicis definitely extracted

itself from the pack in 2023.

Our +6.3% net revenue organic growth for

the full year, coming after a stronger than expected end to

the year at +5.7% in Q4, means that not only are

we substantially outperforming our holding company peers, we

are also growing twice as fast as the main IT consulting

firms.

What is true for organic growth is also

true for our financial KPIs, be it on margin

or on free cash flow.

At a moment when our clients need

partners that can truly help them

transform in a challenging and

ever-changing environment, our unique model has made the

difference, allowing us to significantly gain market share

and rank first in new business for the fifth year in a

row. With a reported revenue of close to 15

billion euros in 2023, up 35% versus 2019, Publicis has

firmly established itself as our

industry’s second largest player and the first in terms

of market capitalization.

Entering 2024, we feel confident in

sustaining this momentum, just as we’ve done for the last

four years with a +4.7% CAGR, twice the industry

average. We anticipate delivering +4 to +5% organic

growth while maintaining our historically high operating

margin at 18%. When it comes to Q1, we expect to significantly

outperform the industry with an organic growth within our full year

guidance.

I would like to thank of our clients

for their trust during this transformation journey and

our people for their outstanding efforts. Thanks to all of

them, we have reached new heights as a group, and are now in a

position to face what will be another year of uncertainties with

confidence and ambition.”

* *

*

Publicis Groupe’s Supervisory Board met on February 7,

2024, under the chairmanship of Maurice Lévy, to examine the 2023

annual accounts presented by Arthur Sadoun, CEO and Chairman of the

Management Board.

KEY FIGURES

|

EUR million, except per-share data and

percentages |

FY 2023 |

FY 2022 |

2023vs 2022 |

|

Data from the Income Statement and Cash flow

Statement |

|

|

|

|

Net revenue |

13,099 |

12,572 |

+4.2% |

|

Pass-through revenue |

1,703 |

1,624 |

+4.9% |

|

Revenue |

14,802 |

14,196 |

+4.3% |

|

EBITDA |

2,845 |

2,801 |

+1.6% |

|

% of Net revenue |

+21.7% |

22.3% |

- 60 bps |

|

Operating margin |

2,363 |

2,266 |

+4.3% |

|

% of Net revenue |

18.0% |

18.0% |

0 bps |

|

Operating income |

1,740 |

1,767 |

-1.5% |

|

Net income attributable to the Groupe |

1,312 |

1,222 |

+7.4% |

|

Earnings Per Share (EPS) |

5.23 |

4.87 |

+7.4% |

|

Headline diluted EPS1 |

6.96 |

6.35 |

+9.6% |

|

Dividend per share2 |

3.40 |

2.90 |

+17.2% |

|

Free cash flow before WC requirements |

1,547 |

1,807 |

|

|

Underlying free cash flow before WC requirements3 |

1,802 |

1,700 |

|

|

Data from the Balance Sheet |

Dec. 31, 2023 |

Dec. 31, 2022 |

|

|

Total assets |

36,716 |

35,898 |

|

|

Groupe share of Shareholders’ equity |

9,788 |

9,635 |

|

|

Net debt (net cash) |

(909) |

(634) |

|

1 Net income attributable to the Groupe,

after elimination of impairment charges, real estate consolidation

charge, amortization of intangibles arising on acquisitions, the

main capital gains (or losses) on disposals, change in the fair

value of financial assets, the revaluation of earn-out costs,

divided by the average number of shares on a diluted

basis.2 To be proposed to the shareholders at the AGM of May

29, 2024.3 Adjusted for the net impact of the Rosetta

settlement for 148 million euros in 2023 and the additional 107

million euros cash tax payment made in January 2023 relating to

2022 (110 million euros at 2022 rates).

NET REVENUE IN FY 2023

Publicis Groupe’s net revenue for the full year

2023 was 13,099 million euros, up +4.2% compared to 12,572 million

euros in 2022. Exchange rate variations over the period had a

negative impact of 340 million euros and acquisitions (net of

disposals) had a positive impact of 100 million euros.

Organic growth was +6.3% in FY 2023 versus 2022.

Compared to 2019, this implied organic growth of +21%, accelerating

in H2 at +22% after +19% in H1.

The Groupe’s strong and consistent performance

in 2023 was reflected in each and every of its unique

capabilities.Media, one third of revenue, grew double-digit on top

of double digits last year, benefitting from both market shares

gains and organic growth at existing clients. Data and tech

activities, another third of revenue, posted a very solid growth

overall. On the one hand, despite a context of slowdown in digital

business transformation experienced by comparable consulting firms,

Publicis Sapient achieved a solid +3.2% organic growth on top of a

very high comparable base of +19% in FY 2022. On the other hand,

Epsilon’s performance accelerated in the second half of the year,

posting +9.6% organically in FY 2023, supported by a sustained high

demand in first-party data management. Creative, the remaining

third, showed its resilience with organic growth in the low-single

digits for the year.

Breakdown of FY 2023 net revenue by

sector

Based on 3,641 clients representing 91% of the

Groupe’s net revenue.

Breakdown of FY 2023 net revenue by region

|

EUR |

Net revenue |

Reported |

Organic |

|

million |

FY 2023 |

FY 2022 |

growth |

growth |

| North America |

8,050 |

7,869 |

+2.3% |

+4.9% |

| Europe |

3,172 |

2,879 |

+10.2% |

+10.3% |

| Asia Pacific |

1,156 |

1,176 |

-1.7% |

+2.9% |

| Middle East & Africa |

380 |

359 |

+5.8% |

+12.4% |

| Latin America |

341 |

289 |

+18.0% |

+8.9% |

|

Total |

13,099 |

12,572 |

+4.2% |

+6.3% |

In North America, net revenue

was up +4.9% organically. The region grew +2.3% on a reported basis

in 2023, which includes a negative impact of the U.S. dollar to

euro exchange rate. The U.S. posted a very solid

+5.0% organically, on top of a double-digit growth last year,

fueled by Media activities at double-digit. Epsilon saw its net

revenue increase by +9.6% organically on the year, with a

particularly strong performance in Digital Media. Creative

activities were broadly stable on the year. Finally, Publicis

Sapient was up +2.5% organically on a strong comparable base,

impacted by the delays in DBT projects experienced by all

comparable IT consulting firms.

Net revenue in Europe grew

+10.3% on an organic basis (+10.2% reported), including a very

strong +10.4% in the United Kingdom, +5.2%1 in France, +7.2% in

Germany and +16% in Central and Eastern Europe. Excluding the

impact of our Outdoor Media activities and the Drugstore, organic

growth was +9.0% in Europe.

Asia Pacific saw its net

revenue grow by +2.9% organically and decline by 1.7% on a reported

basis. China posted +2.2% organic growth despite difficult

macroeconomic conditions throughout the year.

The Middle East and Africa

region was up +12.4% organically and +5.8% on a reported basis.

In Latin America, organic

growth was at +8.9%, while reported growth was at +18.0%.

1 Excluding Outdoor Media activities & the

Drugstore.

NET REVENUE IN Q4 2023

Publicis Groupe's net revenue in Q4 2023 was

3,540 million euros compared to 3,462 million euros in Q4 2022, up

+2.3%. Exchange rate variations had a 139 million euros negative

impact. Acquisitions (net of disposals) had a 28 million euros

positive impact.

Organic growth was +5.7% in Q4 2023, ahead of

the Groupe’s upgraded guidance in October 2023.

Media, one third of revenue,

accelerated to double-digit growth in Q4, supported by a solid ramp

up in new business. Data & tech activities,

another third, saw contrasted trends like in Q3. Epsilon, on the

one hand, posted a second consecutive quarter of double-digit

growth, led by the high demand for 1P data. As anticipated,

Publicis Sapient saw ongoing delays in DBT projects, like all

comparable IT consulting firms, leading to a slight organic decline

in Q4. Creative was again resilient in Q4, with

low-single digit growth.

Breakdown of Q4 2023 Net revenue by

region

|

EUR |

Net revenue |

Reported |

Organic |

|

million |

Q4 2023 |

Q4 2022 |

growth |

growth |

| North America |

2,158 |

2,133 |

+1.2% |

+6.0% |

| Europe |

851 |

814 |

+4.5% |

+4.3% |

| Asia Pacific |

318 |

323 |

-1.5% |

+4.0% |

| Middle East & Africa |

106 |

104 |

+1.9% |

+9.7% |

| Latin America |

107 |

88 |

+21.6% |

+13.9% |

|

Total |

3,540 |

3,462 |

+2.3% |

+5.7% |

North America net revenue was

up +6.0% organically in Q4 2023. Taking into account a negative

impact of the U.S. dollar to euro exchange rate, reported growth

was at +1.2%. The U.S. accelerated in Q4 with

+6.1% organic growth as Media grew a strong double-digit, while

Creative activities were softer on the quarter, affected by

localized cuts in classic advertising and on top of a high

comparable base last year. Epsilon posted +10% organic on the

quarter, largely driven by its Digital Media and Data divisions. In

the context of delays in IT consulting projects, Publicis Sapient

was broadly stable, facing a strong comparable base of +15% in Q4

2022.

Europe net revenue was up +4.3%

on an organic basis (+4.5% reported). It grew +2.5% organically

when excluding the contribution of Outdoor Media activities and the

Drugstore. The United Kingdom posted a 4.2% organic decline on the

quarter, facing a particularly high comparable base of +38% in Q4

2022 which was largely fueled by Publicis Sapient. France recorded

a +6.3%1 organic growth, driven by Creative and Publicis Sapient.

In Germany, organic growth was up by +5.3%. Net revenue in Central

& Eastern Europe was up +20.3% organically.

1 Excluding Outdoor Media activities & the

Drugstore

Net revenue in Asia Pacific

grew +4.0% organically and declined 1.5% on a reported basis. This

was led by China that improved sequentially to +1.4% in Q4, thanks

to a more favorable macroeconomic context. South-East Asia was

double-digit again this quarter, mainly driven by India, Singapore,

Thailand, and Malaysia. Australia and New Zealand posted negative

performances, the latter having a very strong comparable in Q4 last

year.

Net revenue in the Middle East and

Africa region was up +9.7% organically (+1.9% on a

reported basis), largely driven by Publicis Sapient.

In Latin America, net revenue

was up +13.9% organically (+21.6% on a reported basis) led by

Argentina, a strong Colombia at double digits and solid Mexico and

Brazil.

ANALYSIS OF FY 2023 KEY

FIGURES

Income Statement

EBITDA amounted to 2,845

million euros in 2023, compared to 2,801 million euros in 2022, up

1.6%. EBITDA was 21.7% as a percentage of net revenue.

Personnel costs totaled 8,514

million euros in 2023, up by 3.7% from 8,211 million euros in 2022.

As a percentage of net revenue, the personnel expenses represented

65.0% in 2023, compared to 65.3% in 2022. Fixed personnel costs

were 7,531 million euros representing 57.5% of net revenue versus

56.5% in 2022. The cost of freelancers decreased by 124 million

euros in 2023, representing 332 million euros. Restructuring costs

reached 111 million euros representing less than 1% of net revenue,

up from 82 million euros in 2022.

Non-personnel costs amounted to

2,222 million euros in 2023, compared to 2,095 million euros in

2022. This represented 17.0% of net revenue versus 16.7% in 2022.

They comprised:

- Other operating

expenses (excluding pass-through costs, depreciation &

amortization) amounted to 1,740 million euros, compared to 1,560

million euros in 2022. This represented 13.3% of net revenue in

2023 compared to 12.4% in 2022.

- Depreciation and

amortization expense was 482 million euros in 2023, versus

535 million euros in 2022, a reduction of 10% or 53 million euros.

It reflects the consolidation of our real estate footprint as well

as an increase in the share of SaaS platforms used by the Groupe

and directly expensed.

The operating margin amounted

to 2,363 million euros, up +4.3% compared to 2022. This represents

a margin rate of 18.0%, stable versus 2022.

Operating margin rates by region were 19.0% in

North America, 17.7% in Europe, 19.0% in Asia-Pacific, 6.7% in

Latin America and 8.7% in the Middle East and Africa region.

Amortization of intangibles arising from

acquisitions totaled 268 million euro in 2023, down 19

million euros from 287 million euros in 2022. Impairment losses

amounted to 153 million euros (109 million euros in 2022),

essentially related to the real estate consolidation plan "All in

One", which leads to a reduction in the number of sites, while

allowing better collaboration between the teams.

In addition, net non-current

income is negative at 202 million euros in 2023 (versus a

negative 103 million euros in 2022), largely reflecting a 203

million euros net charge related to the Rosetta settlement. A

comprehensive resolution was reached with all 50 State Attorneys

General, the District of Columbia, and certain U.S. territories

related to past work undertaken for opioid manufacturers primarily

by former advertising agency Rosetta, bringing to a close almost

three years of discussions. In the context of this settlement,

following the payment of 343 million dollars to the States,

Publicis Health was compensated 130 million dollars by

its insurers. Consequently, it has recorded a non-recurring charge

of 213 million dollars before tax in the fourth quarter of 2023. In

addition, 7 million dollars to be paid to the Attorney Generals for

the cost of investigation and other various costs have been

accounted for. The total impact of the settlement before tax in the

non-current income is a charge of 220 million dollars,

corresponding to 203 million euros. This settlement, in which the

Attorneys General recognized Publicis Health’s ‘good faith and

responsible corporate citizenship’, is in no way an admission of

wrongdoing or liability.

Operating income totaled 1,740

million euros in 2023, after 1,767 million euros in 2022.

The financial result,

comprising the cost of net financial debt and other financial

charges and income, was a charge of 21 million euros compared to a

charge of 117 million euros in 2022.

- The cost of net financial

debt was an income of 78 million euros in 2023 compared to

a charge of 17 million euros in 2022. It included 99 million euros

of interest largely related to Epsilon’s acquisition debt (102

million euros in 2022), partly mitigated by financial income of 178

million euros, improving from 85 million euros in 2022, largely

reflecting higher remuneration on cash balances.

- Other financial income and

expenses were a charge of 99 million euros in 2023,

notably composed by 79 million euros interest on lease liabilities

and 1 million in income from the fair value remeasurement of Mutual

Funds. In 2022, other financial income and expenses were a charge

of 100 million euros, notably composed of 87 million euros interest

on lease liabilities and 9 million in income from the fair value

remeasurement of Mutual Funds.

The revaluation of earn-out

payments amounted to an income of 12 million euros

compared to a loss of 2 million euros in 2022.

The income tax charge was 415

million euros in 2023, corresponding to an effective tax rate of

24.1%. This compared to 431 million euros in 2022, corresponding to

an effective tax rate of 24.8%.

The share in profit of

associates was an income of 6 million euros (versus an

income of 5 million euros in 2022).

Minority interests were a gain

of 10 million euros in 2023, when they were negligible in 2022.

Overall, net income

attributable to the Groupe was 1,312 million euros

in 2023, an increase of 7.4% compared to 1,222 million euros in

2022.

Finally, the Groupe’s earnings per

share was 5.23 euros in 2023, an increase of 7.4% compared

to 4.87 euros in 2022.

Free cash flow

|

EUR million |

FY 2023 |

FY 2022 |

|

EBITDA |

2,845 |

2,801 |

|

Financial interest paid (net) |

93 |

(17) |

|

Repayment of lease liabilities and related interests |

(423) |

(404) |

|

Tax paid |

(669) |

(430) |

|

Other |

(121) |

51 |

|

Cash flow from operations before change in

WCR |

1,725 |

2,001 |

|

Investments in fixed assets (net) |

(178) |

(194) |

|

Reported free cash flow before changes in WCR |

1,547 |

1,807 |

|

TCJA transitional cash tax related to 2022 paid in January

2023 |

107 |

(107) |

|

Rosetta settlement |

148 |

- |

|

Underlying free cash flow before changes in

WCR1 |

1,802 |

1,700 |

The reported Groupe’s free cash

flow, before change in working capital requirements, was

1,547 million euros.

This included two main non-recurring cash

outflows.

- TCJA, for a net impact of 107

million euros: In January 2023, the Groupe proceeded to an

additional 107 million euros cash payment related to 2022 fiscal

year (110 million euros at 2022 USD/EUR exchange rate), reflecting

the implementation of the Tax Cuts and Jobs Act in the U.S. (TCJA)

that was confirmed late December 2022. This change in tax

legislation requires companies to capitalize and amortize U.S.

R&D expenses over five years and has no impact on effective tax

rate. Including this additional payment, the free cash flow for the

Groupe was 1,700 million euros for 2022.

- Rosetta settlement, for a net

impact of 148 million euros. Adjusted for this settlement, the free

cash flow for the Groupe was 1,695 million euros for 2023, in line

with the guidance of the Groupe of close to 1.7 billion euros.

Financial interests were an income of 93 million

euros, compared to financial interest paid of 17 million euros in

2022, reflecting higher remuneration on cash balances.

1 Adjusted for the net impact of the Rosetta settlement for

148 million euros in 2023 and the additional 107 million euros cash

tax payment made in January 2023 relating to 2022 (110 million

euros at 2022 rates).

Repayment of lease liabilities and related

interests amounted to 423 million euros in 2023 (404 million euros

in 2022). Net investments in fixed assets amounted to 178 million

euros, decreasing by 16 million euros compared to 194 million euros

in 2022.

Tax paid amounted to 669 million euros, compared

to 430 million euros in 2022, rising by 239 million euros of which

107 million euros were due to the additional TCJA tax payment

realized in January 2023 and related to 2022.

Net debt

The Groupe reported a net cash position of 909

million euros as of December 31, 2023 compared to a 634 million

euros net cash position as of December 31, 2022. The Groupe's

average net debt in 2023 amounted to 432 million euros, down from

685 million euros in 2022.

GROUPE AI STRATEGY

On January 25, 2024, the Groupe announced its

ambition to become the industry’s first AI-powered Intelligent

System.

In a presentation hosted by Arthur Sadoun,

Chairman and CEO, and Directoire+ members Carla Serrano, Chief

Strategy Officer, Nigel Vaz, CEO Publicis Sapient and Dave Penski,

CEO Publicis Media, the Groupe introduced CoreAI, which infuses a

layer of AI across the Groupe’s platform organization to connect

its enterprise knowledge under a single entity.

Held at the centre of the Groupe, CoreAI unifies

and standardizes Publicis’ expansive bank of proprietary data and

combines this with 35 years of business transformation data and

coding owned exclusively by Publicis Sapient. CoreAI makes these

assets shareable and accessible to everyone across the Groupe,

empowering them across five key disciplines: Insight, Media,

Creative and Production, Software and Operations.

Publicis plans to invest 300

million euros in this strategy over the next three years. In 2024,

the Groupe anticipates an investment of 100 million euros with 50%

dedicated to people, focused on upskilling, training and

recruitment, and 50% to technology, through licenses, IT software

and cloud infrastructure. This investment will be fully accounted

for in the P&L. It will have no dilutive impact on the Groupe’s

operating margin in 2024 as it will be funded by internal

efficiencies. It will be slightly accretive on the operating margin

in 2025.

The Groupe began engineering CoreAI in the

second half of 2023 and plans to iteratively roll out capabilities

in the first half of 2024. It will present MVPs at Viva Tech in May

2024.

ACQUISITIONS AND DISPOSALS

On January 4, 2023, Publicis

announced the acquisition of Yieldify, a

London-based marketing technology company. Founded in 2013,

Yieldify’s leading platform and service enable companies to better

personalize consumers’ website experiences, driving incremental

revenue and other desired outcomes by delivering the right message

at the right time based on a consumer's profile and stage in their

purchase journey. Yieldify will become part of Epsilon, and its

onsite personalization, conversion optimization and customer

journey offerings will complement Epsilon PeopleCloud to better

address the mid-market.

On January 10, 2023, Publicis

announced the acquisition of Advertise BG, one of

the leading performance marketing agencies in Bulgaria. The

strategic acquisition will further reinforce Publicis Groupe

Bulgaria’s competencies in digital transformation, adding firepower

to its existing offering across digital strategy, data, social

media, and digital content creation.

On March 30, 2023, Publicis

announced the acquisition of Practia, based in

Buenos Aires, a leading Latin America independent technology

company and provider of digital business transformation services.

With its 1,200 experienced professionals, this acquisition will

position Publicis Sapient to enter the Latin America market while

establishing a foundation for a nearshore delivery platform that

will enable the company to better service clients based in North

America.

On May 23, 2023, Publicis

announced the acquisition of full stake in Publicis Sapient

AI Labs, an innovative artificial intelligence research

and development joint venture launched in 2020 in partnership

between Publicis Sapient, Elder Research and Tquila. The

acquisition will further strengthen Publicis Sapient’s data &

AI capabilities and enable the company to develop innovative

solutions across industries for a wide range of applications, such

as generative AI, natural language processing (NLP), computer

vision and autonomous systems.

On June 5, 2023, Publicis

announced the acquisition of Corra, based in New

York, an ecommerce leader recognized by Adobe as one of the top

commerce firms in North America. Corra will augment Publicis

Sapient’s existing expertise in commerce solutions, including Adobe

Commerce, while extending Publicis Sapient’s offerings in digital

and omnichannel commerce. By acquiring Corra, Publicis Sapient will

further establish itself as a global leader across the entire Adobe

Product Suite, in addition to further cementing its already leading

capabilities.

On June 15, 2023, Publicis and

Carrefour announced the launch of their joint venture

Unlimitail, to address the booming retail media

market in Continental Europe, Brazil and Argentina. The launch of

the company comes six months after the initiative was announced and

has been unveiled during Viva Tech. Unlimitail will partner with

retailers and brands, bringing the scale, connectivity and

consistency for retail media to reach its full potential in those

geographies. It is built on the most advanced technologies,

“CitrusAd powered by Epsilon”, and the deepest retail expertise

from Carrefour. Unlimitail has already converted its first 13

retail partners, representing together more than 120 million

loyalty customers.

OUTLOOK

While the macroeconomic context remains

uncertain as we enter 2024, the Groupe is confident in its ability

to deliver profitable growth that outperforms the market.

For the full year 2024, the Groupe aims

at delivering a 4% to 5% organic growth. Publicis intends

to achieve a solid +4% despite the macroeconomic challenges that

currently affect classic advertising and delay business

transformation projects. Organic growth could reach +5% assuming an

improvement in global conditions in the second half of the

year.

In Q1 2024, the Groupe expects to deliver

organic growth within the full year range.

The Groupe expects to maintain financial

ratios again in 2024 at historical highs, including:

- Operating margin at

18%. This includes the Groupe’s Opex investment of 100

million euros in its AI plan.

- Free cash flow between 1.8

and 1.9 billion euros1 in 2024.

CASH ALLOCATION

Based on its free cash flow prospects and on its

strong financial structure, the Groupe has set the following cash

allocation for 2024:

- Dividend for a total of

close to 900 million euros fully paid in cash,

corresponding to a 3.40 euros dividend per share that will be

submitted to the vote of its shareholders at its next AGM on May

29, 2024. This corresponds to a 49% payout and is a 17% increase

compared to prior year.

- A share repurchase plan of

circa 200 million euros in order to stabilize the number

of shares in circulation. The repurchase plan aims to cover the

existing Long Term Incentive Plans of the Groupe for a total of

circa 2 million shares.

- An envelope for selective

M&A between 700 and 800 million euros, to further

strengthen the Groupe’s data, tech, commerce and AI

capabilities.

1 Before change in working capital requirements.

GROUPE CSR POLICY IN 2023

With a view to the entry into force in 2025 of

the European CSRD (Corporate Sustainability Reporting Directive),

which requires companies to carry out in-depth sustainability work,

in 2023 Publicis Groupe launched internal projects to prepare the

required double materiality exercise, as well as the expected level

of granularity for the 12 themes set out in the ESRS (European

Sustainability Reporting Standards). ESG risk mapping has been

presented to the Audit Committee and the ESG Committee of the

Supervisory Board.

CSR was one of the themes discussed with

employees at the fourth Viva la Difference internal seminar, which

brought together virtually all the Groupe's employees in December

2023 to review the year and look ahead to 2024. This seminar

provided an opportunity to detail the Groupe's strategic ambitions

in terms of artificial intelligence and its application to the

Groupe's various businesses. This was followed by a day of internal

round-table discussions with each region, to enable Top Management

to respond at greater length to any questions employees might

have.

E – Environment & the fight against

Climate Change

The Groupe's climate targets, validated by SBTi

(Science Based Targets Initiative), outline a trajectory to reduce

carbon emissions by 50% by 2030 (Near-Term Target - Scopes 1+2+3)

and by 90% by 2040 (Long-Term Target - Scopes 1+2+3). The Groupe

remains aligned with the Paris Agreement and the 1.5° scenario, and

continues to focus all its efforts on drastically reducing carbon

emissions. In terms of direct-source renewable energies, the Groupe

is making progress towards its target of 100% by 2030, having

reached the 2023 milestone at over 50%.

Reducing all environmental impacts remains the

absolute priority, and various initiatives have been launched to

strengthen direct and indirect action levers. In view of the

residual unavoidable carbon emissions, and to anticipate the

Groupe's future needs to achieve Net Zero by 2040, Publicis Groupe

has joined the Climate Fund for Nature (Mirova/Natixis). The fund

will support projects dedicated to the protection and restoration

of nature with associated benefits for biodiversity and

communities. This represents a commitment of €20 million for the

delivery of voluntary carbon credits over fifteen years.

Following on from the work carried out in 2022

on climate risks, an ad hoc project was carried out in 2023 to

analyse the impact on biodiversity, with the support of an external

consultancy.

S – Social, Diversity, Equity and

Inclusion

The end of 2023 was marked by the Hamas attacks

in Israel, where the Groupe has some 440 employees. The absolute

priority was to ensure the safety of the teams and their families,

as had been the case in February 2022 during the Russian invasion

of Ukraine. These wars disrupt many lives and each time we have to

put in place tailor-made measures to help our employees. In

Ukraine, the Groupe has continued to pay the salaries of local

teams in 2023, as it did in 2022. Donations made by employees and

the Groupe to a fund dedicated to employees and their families in

Ukraine have helped 32 families since July 2022.

By the end of 2023, the international

#WorkingWithCancer programme launched by the Chairman of the

Directoire to combat the taboo of cancer in the workplace had been

signed up by 1,500 companies, representing 40 million employees

worldwide.

The Groupe's objective of having 45% women in

key positions of responsibility within the Groupe by 2025, with a

target of 43% by 2023, has been achieved. In the United States, the

United Kingdom, France, India and many other countries, efforts

have continued to focus on more open and inclusive recruitment, in

particular for young people who are far removed from our

businesses, with several programmes, such as the MCTP for the 14th

year in the United States, or Publicis Track in France. The

diversity and inclusion programmes in place in the United States

were presented to the ESG Committee.

In terms of training, the Marcel Classes

platform has stepped up its personalised support for employees with

the Growth Dashboard. In October 2023, the organisation of remote

working was specified for 2024, requiring everyone to be in the

office three days a week, in order to give priority to

interpersonal relations in situ and encourage team cooperation.

The #WorkYourWorld internal programme, which

enables employees to work for six weeks in a country or city of

their choice, continues to be very popular in 2023: more than 2,500

employees have taken advantage of it (bringing to more than 4,000

the number of trips made since the programme was launched in

January 2022) for an average stay of 29 days.

The 19th Global Meeting of the Women's Forum for

the Economy and the Society took place over two days in Paris in

November 2023, bringing together over 1,500 people in person and

more than 12,000 online participants from 122 countries.

G – Governance, Business Ethics and

Responsible Marketing

A.L.I.C.E (Advertising Limiting Impacts &

Carbon Emissions), the Groupe's proprietary tool for assessing the

impact of customer campaigns and projects, has been enhanced to

refine the calculations for the Groupe's different businesses, and

has been certified e-accessible. In 2023, this calculator was used

for +250 brands/customers in 30 countries. At the same time, the

Groupe is continuing to take part in various sectoral projects,

both nationally and internationally, in particular those led by Ad

Net Zero, aimed at standardising the methodologies used to

calculate the carbon footprint of our businesses, particularly the

media.

The Groupe's objective remains to advance

professional practices and standards in favour of inclusion and the

reduction of environmental impacts. The level of maturity of French

agencies is an example of mobilisation; Publicis France maintains

its leading position with 11 agencies certified as 'RSE Active' by

the French interprofessional body in partnership with Afnor.

In the United States, the OnceForAllCoalition

initiated by Publicis Media includes more than 70 active partners,

including more than 30 brands and advertisers, all working to

promote innovative media and content aimed at under-represented or

minority populations. Advertisers have increased their investment

in these audiences by 50% over the year.

Business ethics issues are an integral part of

the Groupe's businesses and the aim is to train all employees to

maintain our high standards in fundamental areas detailed in our

Janus Code of Ethics, such as anti-corruption, data protection and

information systems security. Lastly, the Groupe was rated 958/1000

by Cybervadis, illustrating continuous improvement linked in

particular to effective cooperation between the GDPO (Group Data

Protection Office) teams and the GSO (Global Security Office)

security teams.

In terms of external ESG ratings, Publicis Groupe finished 2023

at the top of its sector with 8/10 of the main rating agencies, and

the company is included in several ESG indices such as DSJI Europe

and DJSI World.

NEW BUSINESS

EUROPE

Santen France (Health), GlaxoSmithKline (Health

& Media), Comité Colbert (Creative), Speedy (Data), Carlsberg

(Creative), Abeille Assurances (Creative), Visa (Technology &

Creative), DomusVi (Technology), DocuSign (Creative), The Football

Association Premier League (Creative), Allwyn (Creative), Pivovara

Daruvar (Creative), heroal (Creative), Deutsche Telekom (Creative),

DATEV (Influence), Samsung (DTC), PepsiCo (Media), L’Oréal (Media),

Tesco (Creative), Asda (Technology), Renault (Influence), FoodWell

(Media), Notino (Media), Casavo (Creative), La Poste (Media), Dream

Games (Media), Cassa Depositi e Prestiti (Media), Meggle (Media),

Île-de-France Mobilités (Creative), TotalEnergies (Creative),

Bioderma (Creative), Pernod Ricard (Influence), Ovo Energy

(Creative), Le manège à bijoux (Creative), Inserm (Media), SNCF

(Digital), John Lewis (Creative), Alfa Romeo (Air France KLM

(Influence), Ikea (Creative & media), Gruppo Iren (Creative),

Bulgari (Creative), Gruppo Campari (Influence), Western Union

(Media), Beko (Influence), Société Générale (DBT), Iveco (Media),

Sony Music (Digital), Legrand (Creative), Nexity (Creative), Skoda

(Social Media), Charlotte Tilbury (Media), Ferrero

(Media/Creative/Influence), Laya Healthcare (Creative),

PublicJobs.ie (Creative), ADAC (Influence), Innomotics (Media),

Bosch (Media), ASOS (Media), Sodexo (Media, Portu (Media),

Bundesministerium fuer Arbeit und Soziales (DBT), Belvedere Vodka

(Creative), SAS Bagel Chef (Creative), Answear.com (Creative),

Miele (Commerce), Sandoz (Content), Orange (Creative), Confused.com

(Creative), Bundesministerium fuer Arbeit und Soziales (DBT),

Grunenthal (Influence), Tediber (Media), Zoopla (Media), Signify

Iberia (Media), Glovo App (Media), Stiftelsen Norsk Rikstoto

(Media), Henkel (Media), Bausch Health (Media), Stiftelsen Norsk

Rikstoto (Content), Norske Boligbyggelags Landsforbund (Content),

Storck (Media), Hyundai Motor Company (Influence), Totalizator

Sportowy (Media), Interlacto, (Media), Hisense Group Company

(Influence), Simba Dickie Group (Media), Waitrose (Retail Media),

Burger King (Digital), NDL Pro-Health (Digital), Akind Group

(Media), OBI (Media), Salone del Mobile Milano (Media &

DBT)

NORTH AMERICA

Krafton (Influence), Intuit (Creative), Shelter

Movers (Influence), Universite de Sherbrooke (Creative), Steak 'n

Shake (Creative & CRM), Loblaws (Cretaive), Mattress Firm

(Creative), Jasco Games (Creative), Wondery (CRM), McDonalds (CRM),

Milton Hershey School (Influence), University of Oklahoma

(Production), Progress Residential (Production), Wyndham Hotels

& Resorts (Production), Robert Walters (Production), HP

(Commerce), Sun Life of Canada (Commerce), Rite Aid (Media), The

PUR Company (Media), MTY Food Group (Influence), General Mills

(Commerce), Dunkin’ (Creative & Digital), Walgreens (Media), KB

Home (Creative), Burger King (Creative), Sanofi (Influence), Virgin

Mobile (Creative), Toronto Parking Authority (Creative),

HealthPartners Canada (Influence), Groupe Atallah (Media), Kicking

Horse Coffee (Creative & Influence), General Motors Company

(Production), Tillamook County Creamery Association (Creative),

Signet Jewelers (Media & Production), Blue Diamond Growers

(Media), Turo (Creative & Production), UPS (Creative), LVMH

(Media), Shark Beauty (Creative), New Age Products (Media), Samsung

(Commerce), TGI Fridays (Media), National Life Insurance (Media),

Sierra Nevada Brewing Company (Creative), Coopers Hawk Winery and

Restaurants (CRM), Haribo of America (Creative & Influence),

Air Transat (Influence), The Cadillac Fairview Corporation (CRM),

Kellogg Company (Content), The Procter And Gamble Company

(Influence), Duracell (Creative), Kimberly-Clark (Media), The

Container Store (Data), Dicks Sporting Goods (CRM), ConAgra Foods

(Creative), QuadReal Property (Content & Influence),

GlaxoSmithKline (Production), Edo Japan Restaurants (Influence),

Starbucks (Influence), Olymel (Creative), Insurance Brokers

Association of Ontario (Influence), Foresters Life Insurance

(Production), The TJX Companies (Content), Teachers Insurance and

Annuity Association of America (CRM), Turo (Production), Edo Japan

Restaurants (Influence), Toronto Metropolitan University

(Influence), Daily Bread Food Bank (Content), Pricewaterhouse

Coopers (Production), Mary Brown's Chicken (Influence), Heineken

(Commerce), Nestlé Health Science (Media), KFC (Creative), DSW

(Media), Molson Coors (Creative), Cisco Systems (Media), Cuisinart

(Content), Perrigo (Creative), AH Capital Management (Content),

Jazwares (Influence), Xsolla (Influence), Bath and Body Works

(Creative), Quest Nutrition (Creative)

ASIA PACIFIC/MEA

Miele (CRM), United Homeware Company (Creative),

Krungthai Bank (Creative), Anker (Media), Royal Automobile Club

(Media), Charles & Keith (Commerce), Nick Did This (Media),

Nine Network (Creative), Essity (Media), OSHO (DBT), La Trobe

University (DBT), LVMH (Production), Cathay Pacific Airways

(Commerce), Pepsico (Production), Duolingo (Creative), Aeries

Financial Technologies (Media), Central Provident Fund Board

(Production), AIA Company (Media), Haleon (Production), LOréal

(Media & Production), The Standard Bank of South Africa

(Creative), Sanofi (Creative), Nestlé (Production), Diageo

(Commerce), Mondelez (Production), Pizza Hut (Creative), Cancer

Council Victoria (Media), Emirates NBD (Creative), Grupo Bimbo

(Creative), Microsoft (Influence), JioMart (Creative), AkBank

(Media), Novartis (Creative & Production), United Breweries

(Production), Charlotte Tilbury Beauty (Creative & Production),

Genesis Motor (Creative), Torrent Pharmaceuticals (Creative), More

Retail (Media), GlaxoSmithKline (Creative), Crocs (Creative),

Shanghai Neobio (Creative), FWD Group (Media), Bank of China

(Media), Yili (Creative), Singhealth (Digital), P&G (Digital),

Oritain (Creative & Media), Neom Company (Creative), Renault

(Media), Bosideng (Production), HSBC (Creative), BASF (Creative),

Union Bank of the Philippines (Creative), Roborock (Production),

Indeed (Influence), Samsonite (Media), New Balance (Production),

Keypath Education (Media), Jio-bp (Digital), Enamor (Digital),

UniScholars (Creative), The Procter And Gamble Company (Commerce),

Friesland Campina (Media), Sony Playstation (Creative), TPG

(Media), Iveco (Media), Sace (Media), PUMA (Creative), Microtek

(Creative), BikesOnline (Digital), Reliance Retail (Creative),

Shimao Hotel Group (Influence), Hong Kong Technology Venture

Company (Content), Honor (Influence), Hang Lung Properties

(Creative), Amway (Production), BMW (Media), Apoidea Web3 (Media),

Dairy Farm International (Media), First Class Innovation

(Creative), Walt Disney (Content), Absa Bank (Media), ALDI (CRM),

Superloop (Media), Abu Dhabi Investment Office (Media), Huawei

(Creative), Auckland International Airport (Creative), Beiersdorf

(Production), Tsingtao (Creative), Jindal SAW (Influence), Temple

& Webster (Media & Influence), upGrad (Creative)

LATAM

LOréal (Media), Bayer (Media), Samsung (Media),

Nestlé (Creative), PicPay (Creative), Pizza Hut (Commerce), Polla

Chilena (Media), Telecom Argentina (Media), Paper Excellence

(Media), Comgás (Media), Sportingbet (Content), Mondelez (Media),

Decathlon (Creative)

GLOBAL

Adobe (Media), Mondelez (Production), King

(Creative), Ninjacart (Creative), Alvarium Tiedemann (Creative),

Amplifon (Creative), Pfizer (Creative, Media, Data, Production),

Miele (Media), Ancestry (Media), Essity (Creative)

* *

*

Disclaimer

Certain information contained in this document,

other than historical information, may constitute forward-looking

statements or unaudited financial forecasts. These

forward-looking statements and forecasts are subject to risks and

uncertainties that could cause actual results to differ materially

from those projected. These forward-looking statements and

forecasts are presented at the date of this document and, other

than as required by applicable law, Publicis Groupe does not assume

any obligation to update them to reflect new information or events

or for any other reason. Publicis Groupe urges you to carefully

consider the risk factors that may affect its business, as set out

in the Universal Registration Document filed with the French

Autorité des Marchés Financiers (AMF) and which is available on the

website of Publicis Groupe (www.publicisgroupe.com), including an

unfavorable economic climate, a highly competitive industry,

risks associated with the confidentiality of personal data, the

Groupe’s business dependence on its management and employees, risks

associated with mergers and acquisitions, risks of IT system

failures and cybercrime, the possibility that our clients could

seek to terminate their contracts with us on short notice, risks

associated with the reorganization of the Groupe, risks of

litigation, governmental, legal and arbitration proceedings, risks

associated with the Groupe’s financial rating and exposure to

liquidity risks.

About Publicis Groupe - The Power of One

Publicis Groupe [Euronext Paris FR0000130577,

CAC 40] is a global leader in communication. The Groupe is

positioned at every step of the value chain, from consulting to

execution, combining marketing transformation and digital business

transformation. Publicis Groupe is a privileged partner in its

clients’ transformation to enhance personalization at scale. The

Groupe relies on ten expertise concentrated within four main

activities: Communication, Media, Data and Technology. Through a

unified and fluid organization, its clients have a facilitated

access to all its expertise in every market. Present in over 100

countries, Publicis Groupe employs around 101,000 professionals.

www.publicisgroupe.com | Twitter: @PublicisGroupe | Facebook |

LinkedIn | YouTube | Viva la Difference!

ContactsPublicis

Groupe

|

Amy Hadfield |

Corporate Communications |

+ 33 1 44 43 70 75 |

amy.hadfield@publicisgroupe.com |

|

Alessandra Girolami |

Investor Relations |

+ 33 1 44 43 77 88 |

alessandra.girolami@publicisgroupe.com |

|

Jean-Michel Bonamy |

Investor Relations |

+ 33 1 44 43 74 88 |

jean-michel.bonamy@publicisgroupe.com |

|

Lorène Fleury |

Investor Relations |

+ 33 1 44 43 57 24 |

lorene.fleury@publicisgroupe.com |

|

Maxine Miller |

Investor Relations |

+ 33 1 44 43 74 21 |

maxine.miller@publicisgroupe.com |

Appendices

Net revenue: organic growth

calculation

|

(million euro) |

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

Impact of currency at end December 2023

(million euro) |

|

2022 net revenue |

2,800 |

3,073 |

3,237 |

3,462 |

12,572 |

|

GBP (2) |

(22) |

|

Currency impact (2) |

61 |

(73) |

(189) |

(139) |

(340) |

|

USD (2) |

(196) |

|

2022 net revenue at 2023 exchange rates (a) |

2,861 |

3,000 |

3,048 |

3,323 |

12,232 |

|

Others |

(122) |

|

2023 net revenue before acquisition impact (1) (b) |

3,065 |

3,213 |

3,209 |

3,512 |

12,999 |

|

Total |

(340) |

|

Net revenue from acquisitions (1) |

14 |

26 |

32 |

28 |

100 |

|

|

|

2023 net revenue |

3,079 |

3,239 |

3,241 |

3,540 |

13,099 |

|

|

|

Organic growth (b/a) |

+7.1% |

+7.1% |

+5.3% |

+5.7% |

+6.3% |

|

|

(1) Acquisitions (Practia, Profitero,

Corra, Tquila, Yieldify, Tremend, Retargetly, Wiredcraft, Bizon,

VivNetworks, Cheat, ARBH, Changi, Perlu, Advertise Bulgaria,

Publicis Sapient AI Labs), net of disposals (Russia, Qorvis, Makers

Lab)

(2) EUR = USD 1.082 on average in 2023 vs. USD 1.054 average in

2022 EUR = GBP 0.870 on average in 2023 vs. GBP 0.853 on average in

2022

Definitions

Net revenue or Revenue less pass-through

costs: Pass-through costs mainly concern production and

media activities, as well as various expenses incumbent on clients.

These items that can be re-billed to clients do not come within the

scope of assessment of operations, net revenue is a more relevant

indicator to measure the operational performance of the Groupe’s

activities.

Organic growth: Change in net

revenue excluding the impact of acquisitions, disposals and

currencies

EBITDA (Earnings Before Interest, Taxes,

Depreciation and Amortization): Operating margin before

depreciation & amortization

Operating margin: Revenue after

personnel costs, other operating expenses (excl. non-current income

and expense) and depreciation (excl. amortization of intangibles

arising on acquisitions)

Operating margin rate:

Operating margin as a percentage of net revenue

Headline Group Net Income: Net

income attributable to the Groupe, after elimination of impairment

charges / real estate transformation expenses, amortization of

intangibles arising on acquisitions, the main capital gains (or

losses) on disposals, change in the fair value of financial assets

and the revaluation of earn-out costs

EPS (Earnings per share): Group

net income divided by average number of shares, not diluted

EPS, diluted (Earnings per share,

diluted): Group net income divided by average number of

shares, diluted

Headline EPS, diluted (Headline Earnings

per share, diluted): Headline group net income, divided by

average number of shares, diluted

Capex: Net acquisitions of

tangible and intangible assets, excluding financial investments and

other financial assets

Free cash flow before changes in working

capital requirements: Net cash flow from operating

activities less interests paid & received, repayment of lease

liabilities & related interests and before changes in WCR

linked to operating activities

Free cash flow: Net cash flow

from operating activities less interests paid & received,

repayment of lease liabilities & related interests

Net debt (or financial net

debt): Sum of long and short financial debt and associated

derivatives, net of treasury and cash equivalents, excluding lease

liability since 1st January 2018

Average net debt: Average of

monthly net debt at end of month

Dividend pay-out: Dividend per

share / Headline diluted EPS

Organic Growth vs. 2019:

calculated as ([1 + organic growth (n-3)] * [1 + organic growth

(n-2)] * [1 + organic growth (n-1)] * [1 + organic growth

(n)])-1

Consolidated income statement

|

(in millions of euros) |

|

2023 |

2022 |

| Net revenue (1) |

|

13,099 |

12,572 |

| Pass-through revenue |

|

1,703 |

1,624 |

| Revenue |

|

14,802 |

14,196 |

| Personnel costs |

|

(8,514) |

(8,211) |

| Other operating costs |

|

(3,443) |

(3,184) |

| Operating margin before

depreciation & amortization |

|

2,845 |

2,801 |

| Depreciation and amortization

expense (excluding acquired intangibles) |

|

(482) |

(535) |

| Operating margin |

|

2,363 |

2,266 |

| Amortization of intangibles

from acquisitions |

|

(268) |

(287) |

| Impairment loss |

|

(153) |

(109) |

| Non-current income and

expenses |

|

(202) |

(103) |

| Operating income |

|

1,740 |

1,767 |

| Financial expense |

|

(120) |

(118) |

| Financial income |

|

198 |

101 |

| Cost of net financial

debt |

|

78 |

(17) |

| Revaluation of earn-out

payments |

|

12 |

(2) |

| Other financial income and

expenses |

|

(99) |

(100) |

| Pre-tax income of consolidated

companies |

|

1,731 |

1,648 |

| Income taxes |

|

(415) |

(431) |

| Net income of consolidated

companies |

|

1,316 |

1,217 |

| Share of profit of

associates |

|

6 |

5 |

| Net

income |

|

1,322 |

1,222 |

| Of which: |

|

|

|

- Net income attributable to

non-controlling interests

|

|

10 |

- |

- Net income attributable to equity

holders of the parent company

|

|

1,312 |

1,222 |

|

|

| Per-share data (in euros) –

Net income attributable to equity holders of the parent

company |

|

|

|

| Number of shares |

|

250,706,485 |

250,972,110 |

| Earnings per share |

|

5.23 |

4.87 |

| Number of diluted shares |

|

253,999,363 |

253,605,167 |

| Diluted earnings per

share |

|

5.17 |

4.82 |

|

(1) Net revenue: Revenue less pass-through costs. Those costs

are mainly production & media costs and out-of-pocket expenses.

As these are items that can be passed on to clients are not

included in the scope of analysis of transactions, the net revenue

indicator is the most appropriate for measuring the Groupe’s

operational performance. |

Consolidated statement of comprehensive

income

|

(in millions of euros) |

2023 |

2022 |

| Net

income for the period (a) |

1,322 |

1,222 |

| Comprehensive income that will

not be reclassified to income statement |

|

|

- Actuarial gains (and losses) on

defined benefit plans

|

12 |

42 |

- Deferred taxes on comprehensive

income that will not be reclassified to income statement

|

(3) |

(10) |

| Comprehensive income that may

be reclassified to income statement |

|

|

- Remeasurement of hedging

instruments

|

34 |

(21) |

- Consolidation translation

adjustments

|

(390) |

311 |

|

Total other comprehensive income (b) |

(347) |

322 |

| Total comprehensive

income for the period (a) + (b) |

975 |

1,544 |

| Of which: |

|

|

- Total comprehensive income for the

period attributable to non-controlling interests

|

4 |

- |

- Total comprehensive income for the

period attributable to equity holders of the parent company

|

971 |

1,544 |

Consolidated balance sheet

|

(in millions of euros) |

|

December 31, 2023 |

December 31, 2022 |

|

Assets |

|

|

|

| Goodwill |

|

12,422 |

12,546 |

| Intangible assets, net |

|

958 |

1,247 |

| Right-of-use assets related to

leases |

|

1,614 |

1,753 |

| Property, plant and equipment,

net |

|

596 |

610 |

| Deferred tax assets |

|

212 |

186 |

| Investments in associates |

|

46 |

55 |

| Other financial assets |

|

316 |

394 |

|

Non-current assets |

|

16,164 |

16,791 |

| Inventories and

work-in-progress |

|

341 |

327 |

| Trade receivables |

|

13,400 |

12,089 |

| Contract assets |

|

1,297 |

1,149 |

| Other receivables and current

assets |

|

1,264 |

926 |

| Cash and cash equivalents |

|

4,250 |

4,616 |

|

Current assets |

|

20,552 |

19,107 |

| Total

assets |

|

36,716 |

35,898 |

| |

| Equity

and liabilities |

|

|

|

| Share capital |

|

102 |

102 |

| Additional paid-in capital and

retained earnings, Group share |

|

9,686 |

9,533 |

|

Equity attributable to holders of the parent company, Group

share |

|

9,788 |

9,635 |

| Minority interests |

|

(40) |

(35) |

|

Total equity |

|

9,748 |

9,600 |

| Long-term borrowings |

|

2,462 |

2,989 |

| Long-term lease

liabilities |

|

1,992 |

2,197 |

| Deferred tax liabilities |

|

98 |

219 |

| Pension commitments and other

long-term benefits |

|

265 |

244 |

| Long-term provisions |

|

319 |

260 |

|

Non-current liabilities |

|

5,136 |

5,909 |

| Trade payables |

|

17,077 |

15,660 |

| Contract liabilities |

|

513 |

549 |

| Short-term borrowings |

|

726 |

627 |

| Short-term lease

liabilities |

|

360 |

360 |

| Income taxes payable |

|

378 |

486 |

| Pension commitments and other

short-term benefits |

|

21 |

20 |

| Short-term provisions |

|

255 |

271 |

| Other creditors and current

liabilities |

|

2,502 |

2,416 |

|

Current liabilities |

|

21,832 |

20,389 |

|

Total equity and liabilities |

|

36,716 |

35,898 |

Consolidated statement of cash flows

|

(in millions of euros) |

|

2023 |

2022 |

| Cash flow from operating

activities |

|

|

|

| Net income |

|

1,322 |

1,222 |

| Neutralization of non-cash

income and expenses: |

|

|

|

| Income taxes |

|

415 |

431 |

| Cost of net financial

debt |

|

(78) |

17 |

| Capital losses (gains) on

disposal of assets (before tax) |

|

(1) |

103 |

| Depreciation, amortization and

impairment losses |

|

903 |

931 |

| Share-based compensation |

|

85 |

64 |

| Other non-cash income and

expenses |

|

79 |

86 |

| Share of profit of

associates |

|

(6) |

(5) |

| Dividends received from

associates |

|

7 |

3 |

| Taxes paid |

|

(669) |

(430) |

| Change in working capital

requirements (1) |

|

(9) |

(5) |

|

Net cash flows generated by (used in) operating activities (I) |

|

2,048 |

2,417 |

| Cash flow from investing

activities |

|

|

|

| Purchases of property, plant

and equipment and intangible assets |

|

(180) |

(198) |

| Disposals of property, plant

and equipment and intangible assets |

|

2 |

4 |

| Purchases of investments and

other financial assets, net |

|

13 |

11 |

| Acquisitions of

subsidiaries |

|

(194) |

(523) |

| Disposals of subsidiaries |

|

11 |

(43) |

|

Net cash flows generated by (used in) investing activities

(II) |

|

(348) |

(749) |

| Cash flow from financing

activities |

|

|

|

| Dividends paid to holders of

the parent company |

|

(726) |

(603) |

| Dividends paid to

non-controlling interests |

|

(9) |

(4) |

| Proceeds from borrowings |

|

5 |

- |

| Repayment of borrowings |

|

(502) |

(10) |

| Repayment of lease

liabilities |

|

(344) |

(317) |

| Interest paid on lease

liabilities |

|

(79) |

(87) |

| Interest paid |

|

(99) |

(101) |

| Interest received |

|

192 |

84 |

| Buy-outs of non-controlling

interests |

|

(4) |

(3) |

| Net (buybacks)/sales of

treasury shares and warrants |

|

(189) |

41 |

|

Net cash flows generated by (used in) financing activities

(III) |

|

(1,755) |

(1,000) |

| Impact of exchange rate

fluctuations (IV) |

|

(311) |

300 |

|

Change in consolidated cash and cash equivalents (I + II + III +

IV) |

|

(366) |

968 |

| Cash and cash equivalents on

January 1 |

|

4,616 |

3,659 |

| Bank overdrafts on January

1 |

|

(1) |

(12) |

| Net cash and cash equivalents

at beginning of year (V) |

|

4,615 |

3,647 |

| Cash and cash equivalents at

closing date |

|

4,250 |

4,616 |

| Bank overdrafts at closing

date |

|

(1) |

(1) |

| Net cash and cash equivalents

at end of the year (VI) |

|

4,249 |

4,615 |

|

Change in consolidated cash and cash equivalents (VI - V) |

|

(366) |

968 |

|

(1) Breakdown of changes in working capital

requirementsChange in inventory and work-in-progressChange in trade

receivables and other receivablesChange in trade payables, other

payables and provisionsChange in working capital

requirements |

|

(22)(2,303)2,316(9) |

(46)(710)751(5) |

Consolidated statement of changes in

equity

|

Number of outstanding shares |

(in millions of euros) |

Share capital |

Additional paid-in capital |

Reserves and earnings brought forward |

Translation reserve |

Fair value reserve |

Equity attributable to equity holders of the parent company |

Non-controlling interests |

Total equity |

|

251,992,065 |

December 31,

2022 |

102 |

4,037 |

5,324 |

85 |

87 |

9,635 |

(35) |

9,600 |

| |

Net income |

- |

- |

1,312 |

- |

- |

1,312 |

10 |

1,322 |

| |

Other comprehensive income,

net of tax |

- |

- |

114 |

(384) |

(71) |

(341) |

(6) |

(347) |

|

|

Total

comprehensive income for the year |

- |

- |

1,426 |

(384) |

(71) |

971 |

4 |

975 |

| - |

Dividends |

- |

(701) |

(25) |

- |

- |

(726) |

(9) |

(735) |

| 1,545,833 |

Share-based compensation, net

of tax |

- |

- |

102 |

- |

- |

102 |

- |

102 |

| |

Effect of acquisitions and

commitments to buy-out non-controlling interests |

- |

- |

(5) |

- |

- |

(5) |

- |

(5) |

| - |

Equity warrants exercise |

- |

- |

- |

- |

- |

- |

- |

- |

| (2,963,405) |

(Buybacks)/Sales of treasury

shares |

- |

- |

(189) |

- |

- |

(189) |

- |

(189) |

|

250,574,493 |

December 31,

2023 |

102 |

3,336 |

6,633 |

(299) |

16 |

9,788 |

(40) |

9,748 |

| |

|

|

|

|

|

249,600,509 |

December 31,

2021 |

101 |

4,581 |

4,056 |

(226) |

76 |

8,588 |

(33) |

8,555 |

| |

Net income |

|

|

1,222 |

|

|

1,222 |

- |

1,222 |

| |

Other comprehensive income,

net of tax |

|

|

|

311 |

11 |

322 |

- |

322 |

|

|

Total

comprehensive income for the year |

- |

- |

1,222 |

311 |

11 |

1,544 |

- |

1,544 |

| - |

Dividends |

|

(559) |

(44) |

|

|

(603) |

(4) |

(607) |

| 246,225 |

Share-based compensation, net

of tax |

|

|

66 |

|

|

66 |

|

66 |

| |

Effect of acquisitions and

commitments to buy-out non-controlling interests |

|

|

(1) |

|

|

(1) |

2 |

1 |

| 603,226 |

Equity warrants exercise |

1 |

15 |

|

|

|

16 |

|

16 |

| 1,542,105 |

(Buybacks)/Sales of treasury

shares |

|

|

25 |

|

|

25 |

|

25 |

|

251,992,065 |

December 31, 2022 |

102 |

4,037 |

5,324 |

85 |

87 |

9,635 |

(35) |

9,600 |

Earnings per share (basic and

diluted)

|

(in millions of euros, except for share data) |

|

2023 |

2022 |

| Net income used for the

calculation of earnings per share |

|

|

|

| Net income share attributable

to equity holders of the parent company |

A |

1,312 |

1,222 |

| Impact of dilutive

instruments: |

|

|

|

- Savings in financial expenses

related to the conversion of debt instruments, net of tax

|

|

- |

- |

| Group net income –

diluted |

B |

1,312 |

1,222 |

| Number of shares used to

calculate earnings per share |

|

|

|

| Number of shares at January

1 |

|

254,311,860 |

253,462,409 |

| Shares created over the

year |

|

- |

393,965 |

| Treasury shares to be deducted

(average for the year) |

|

(3,605,375) |

(2,884,264) |

| Average number of shares used

for the calculation |

C |

250,706,485 |

250,972,110 |

| Impact of dilutive

instruments: |

|

|

|

- Free shares and dilutive stock

options (1)

|

|

3,292,878 |

2,633,057 |

| Number of diluted shares |

D |

253,999,363 |

253,605,167 |

| (in euros) |

|

|

|

| Earnings per

share |

A/C |

5.23 |

4.87 |

|

Diluted earnings per share |

B/D |

5.17 |

4.82 |

|

(1) Only stock options and warrants with a dilutive impact,

i.e. whose strike price is lower than the average strike price, are

included in the calculation. As of

December 31, 2023, there were no more stock options to be

exercised. |

Headline earnings per share (basic and

diluted)

|

(in millions of euros, except for share data) |

|

2023 |

2022 |

| Net income used to calculate

headline earnings per share (1) |

|

|

|

| Net income – Group share |

|

1,312 |

1,222 |

| Items excluded: |

|

|

|

- Amortization of intangibles from

acquisitions, net of tax

|

|

199 |

215 |

- Impairment loss (2), net of tax

|

|

115 |

80 |

- Main capital gains and losses on

disposal of assets and fair value adjustment of financial assets,

net of tax

|

|

1 |

92 |

- Revaluation of earn-out

payments

|

|

(12) |

2 |

- Settlement Rosetta / Publicis

Health LLC

|

|

152 |

- |

| Headline Group net income |

E |

1,767 |

1,611 |

| Impact of dilutive

instruments: |

|

|

|

- Savings in financial expenses

related to the conversion of debt instruments, net of tax

|

|

- |

- |

| Headline Group net income,

diluted |

F |

1,767 |

1,611 |

| Number of shares used to

calculate earnings per share |

|

|

|

| Number of shares at January

1 |

|

254,311,860 |

253,462,409 |

| Shares created over the

year |

|

- |

393,965 |

| Treasury shares to be deducted

(average for the year) |

|

(3,605,375) |

(2,884,264) |

| Average number of shares used

for the calculation |

C |

250,706,485 |

250,972,110 |

| Impact of dilutive

instruments: |

|

|

|

- Free shares and dilutive stock

options

|

|

3,292,878 |

2,633,057 |

| Number of diluted shares |

D |

253,999,363 |

253,605,167 |

| (in euros) |

|

|

|

| Headline earnings per

share (1) |

E/C |

7.05 |

6.42 |

|

Headline earnings per share – diluted

(1) |

F/D |

6.96 |

6.35 |

|

(1) Headline EPS after elimination of impairment losses,

amortization of intangibles from acquisitions, the main capital

gains and losses on disposal and fair value adjustment of financial

assets, the revaluation of earn-out payments and the settlement

Rosetta/ Publicis Health LLC(2) This amount includes impairment

losses on goodwill for euro 6 million and on right-of-use assets

related to leases for euro 109 million in 2023. In 2022, impairment

losses on goodwill were euro 19 million and euro 61 million on

right-of-use assets related to leases. |

Please find the press release here

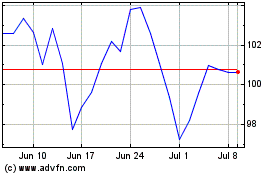

Publicis Groupe (EU:PUB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Publicis Groupe (EU:PUB)

Historical Stock Chart

From Nov 2023 to Nov 2024