Cardano Price Poised To Hit $2.88, Following Solana’s Fractal: Crypto Analyst

August 23 2024 - 7:00AM

NEWSBTC

Crypto analyst @XForceGlobal shared a new video chart analysis

focused on Cardano (ADA), a cryptocurrency that many are dismissing

as a “dinosaur coin” at the moment. In the analysis, XForceGlobal

(@XForceGlobal) provided an in-depth look at Cardano’s current

position within the Elliott Wave cycle, suggesting that ADA is on

the of entering a strong upward phase, commonly referred to as

“Wave 3.” Cardano Price Could Soar To $2.88 The analyst compares

the current price action of ADA to that of Solana (SOL). Earlier

this year, Solana demonstrated a similar price trajectory under

comparable market conditions. The comparison is drawn using

logarithmic price charts, which clearly displays the Elliott Wave

structures, identifying a WXY corrective pullback followed by a new

impulse wave setup. “If we look at the actual wave count of Solana

you can see that it did a WXY pullback. Now this corrected pullback

caught us all off guard, it didn’t look like a correction pullback

in the first place. It looked better as an impulse to the downside

[…] it caught everyone off guard. Even the bulls and even the

bears,” explained XForceGlobal. Related Reading: Cardano Chang

Upgrade Launch: ADA Sees 52% Explosion In Major Metric The Elliott

Wave Theory, which is central to his analysis, posits that markets

move in repetitive cycles of waves driven by investor psychology.

According to XForceGlobal, ADA is mirroring the early stages of

Solana’s previous rally, which saw significant gains as it entered

the third wave of its cycle. The crypto analyst outlined that ADA

is currently positioned in what appears to be the second wave,

following a corrective pullback, which typically precedes strong

bullish momentum. “In the previous bull market alone, we did an

18,000% […] and I’m not sure why people are just brushing this coin

off as a dead coin. I believe it’s a very good coin but we just

need to find the right opportunity in terms of the timing,” stated

the analyst during the video. Delving into the potential future of

ADA, the analyst projects a conservative estimate of a 5x to 10x

times increase in its price. This prediction is based not only on

Elliott Wave analysis but also on comparative historical data from

other high market cap altcoins like XRP, which are currently in

similar positions within their market cycles. Related Reading:

Cardano Rises 8% As Hoskinson Reveals Launch Date For Highly

Anticipated Chang Fork “Wave 3’s are usually the most profitable,

if not arguably better than what XRP is going to be giving us

because XRP right now is on Wave 3 to 4 and we don’t know how wave

five is going to be completed and that’s usually the end of a

trend. ADA is in a wave three and it may be even going for a wave

five which can be even bringing us to higher levels that could be

giving us a potential break of the all-time high,” XForceGlobal

remarked. To quantify the risk-reward ratio, the analyst uses a

long positioning tool that suggests a 14 or 15 : 1 one risk-reward

potential, based on a prospective 600% run. Additionally, the

crypto analyst emphasized the importance of historical context and

the apparent neglect of “dinosaur coins,” in favor of more recent,

meme-driven cryptocurrencies: “I believe dinosaur coins, AKA coins

that have been trading since 2018 or so, that have a relatively

long price history, may be setting us up for another run since they

haven’t gone for a run during this whole memecoin narrative.” In

conclusion, @XForceGlobal’shighlights a highly optimistic outlook

for ADA. Via X, he stated: “Cardano did an 18,000% run in its last

bull run, but it also did one of the strongest pullbacks during the

bear market. Structure looks very similar to when SOL was creating

a bottom as well for a 1-2 sequence. Wave 3 targets would be around

$3.” At press time, ADA traded at $0.3842. Featured image created

with DALL.E, chart from TradigView.com

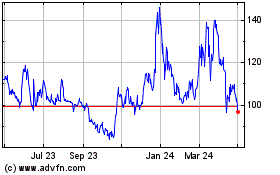

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

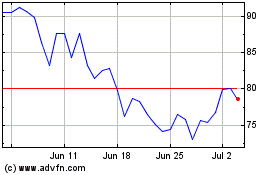

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024