Bitcoin ETFs Crucial To Sustain Current Buying Pressure – Details

November 02 2024 - 11:00AM

NEWSBTC

The price of Bitcoin recorded significant leaps in the past month

rising by 14.74% according to data from CoinMarketCap. During this

price rally, the premier cryptocurrency came close to establishing

a new market all-time high, reaching a local peak of $73,149 on

October 29. Interestingly, CryptoQuant CEO Ki Young Ju has stated a

certain condition needed to sustain this price gain. Related

Reading: Tracking Bitcoin’s Profit Cycles: Could A New Market High

Be Near? Low Stablecoin Exchange Reserve Provides Need For Bitcoin

ETFs In a series of X posts on November 1, Ki Young Ju stated that

stablecoins currently provide an insufficient amount of liquidity

to sustain the present buying pressure on Bitcoin. This observation

is particularly important as traders commonly rely on stablecoins

to acquire volatile assets such as Bitcoin, due to their fixed

dollar value. Therefore, a higher stablecoin exchange reserve

translates into significant potential for an impending price gain

via wide-scale purchase. However, According to Young Ju, crypto

exchanges currently hold only 21% of the total stablecoin market

i.e. $34 billion of $166 billion, as most of these tokens are

currently being used for storage or remittances. This

development represents a slow rise in the stablecoin exchange

reserve of $30 billion recorded in September 2021 during the last

bull run, despite a 33% growth in total stablecoin shares in the

same period. Currently, the Bitcoin-to-stablecoin reserve ratio is

6.05, similar to the value seen at the last ATH. Therefore, in

order to maintain BTC’s present upward trajectory, Ki Young Ju

postulates that the Spot Bitcoin ETFs, alongside Coinbase USD

reserves, have to provide much-needed market liquidity.

Notably, the Spot Bitcoin ETFs can be said to be behind Bitcoin’s

current rally considering their impressive inflows record of over

$5 billion in the past three weeks. Of this figure, BlackRock’s

IBIT has led the market recording investments of $4.44 billion in

this timeframe. Ki Young Ju states that it is important the Bitcoin

ETFs maintain this momentum as a breakdown in pace will reduce

buying pressure, especially from brokerage firms such as Coinbase

Prime, which may result in Bitcoin falling back into consolidation.

Related Reading: Bitcoin Faces Fifth Consecutive Rejection At

$72,000, Is Another Correction Coming? Bitcoin Price Overview At

the time of writing, Bitcoin was trading at $69,608 reflecting a

1.32% loss in the last 24 hours. However, the asset’s trading

volume is up by 25.61% and is valued at $51.56 billion. For the

premier cryptocurrency, a return to above $73,000 remains much on

the card, especially with the potential of sustained ETF flows and

the upcoming US elections. If pro-crypto Donald Trump secures a

victory on the ballot, Bitcoin should definitely establish a new

all-time high with expectations of reaching $90,000-$100,000 at the

end of 2024. Featured image from Nairametrics, chart from

Tradingview

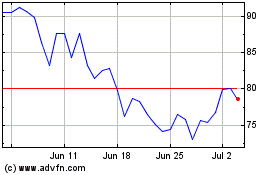

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

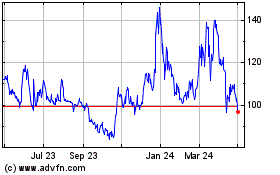

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024