Toncoin Reaches New Heights In Daily Active Addresses, Will It Impact TON’s Price?

August 22 2024 - 2:00AM

NEWSBTC

Toncoin (TON), the cryptocurrency associated with the popular

messaging app Telegram, is making headlines as its Masterchain

achieves a record-breaking 946 active addresses per day. This

achievement has driven a nearly 9% increase in Toncoin’s value,

standing out in contrast to the broader market’s downward trend.

Maartunn, an analyst at CryptoQuant Research, claims that since

July 2021, the TON Masterchain’s active address count has

skyrocketed more than sevenfold. This notable uptick points to

growing blockchain adoption, which drives more transactions

and general network activity. User Activity Boosts Toncoin Demand

The rise in active addresses highlights how continuously the TON

ecosystem is building. Expanding the network allows for more

diverse distributed apps (dApps) and work chains, which shows

healthy blockchain development. Related Reading: Toncoin Rally

Thwarted As TON Slips To $6, Can Bulls Prevent A Bearish Breakdown?

Due to extensive inflow, the demand for TON coins has increased.

More network activity affects the general economic condition of the

TON blockchain, which is usually linked to a surge in token value.

It’s important to note that this number reflects activity on the

Master chain alone despite the seemingly modest figure of 946 daily

active addresses. The TON blockchain operates with multiple

sidechains, named workchains, which handle most data management.

The Masterchain primarily focuses on processing messages and

transactions rather than storing data. This result shows a growing

interest in the TON network, as increasing user and developer

involvement usually stimulates the demand for TON tokens. TON

Price Outlook The price of Toncoin (TON) is down 2.8% at the time

of writing, trading at $6.67. Since the price drop, the trading

volume has also dropped by 23% to about $227 million. Toncoin is

the 8th largest cryptocurrency, with a market cap of $16.8 billion.

Analysts pay close attention to the $7 level for Toncoin, a key

support level. If Toncoin goes above this mark, it might keep

bullish momentum. Examining the TON spike of 26% over the next two

weeks can predict its yearly surge of more than

400%. However, if the price falls below $6.43, it could

decrease, testing support around $6.04. According to IntoThe Block

analytics, the TON network has surpassed 39.5 million addresses.

This milestone highlights its growing popularity and strong

network, attracting institutional and retail investors. Related

Reading: Toncoin Rally Above 4-Hour 100-Day SMA Puts TON On The

Path To $7.6 The derivatives market in TON is not trending

positively. Futures traders are looking for short bets. Coinglass

data shows the coin’s funding rate has been mostly negative across

exchanges this month. In the last 24 hours, the price of TON

rotated from $6.74 to $6.93. Although the market is still cautious,

buyers are watching for signs that it might be starting to an

upward trend. Featured image from ideogram, chart from

TradingView.com

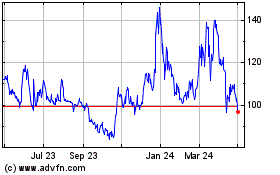

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

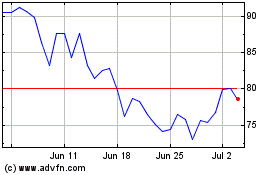

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024