What Are You On The Lookout For? - Real Time Insight

March 15 2013 - 10:18AM

Zacks

At Zacks, the editors get together now and again to discuss the

state of the markets and exchange ideas. This week, we did

this. I took down some notes on what concerned the

editors.

Yes, we are in a strong rally that is now close to five months

old. The last two event-driven rallies lasted six

months. This market could hit some negative pothole to bring

a correction on at any time. Such events we don’t wish

for. But we urge, as good investors -- be on the lookout.

Collectively, we identified six possible means for this rally to

find its way into a leg down, or a correction, however you want to

term it.

Six Ways to a Leg Down:

(1) Possible Federal government shutdown on March

27th. Is this the time when budget

dysfunction reaches market fundamentals? The Republican-controlled

House approved legislation Wed., March 13 to prevent a government

shutdown on March 27 and blunt the impact of newly imposed spending

cuts on the Defense Department. The 267-151 vote sent the measure

to the Senate. Democrats hope to give additional Cabinet

agencies similar flexibility in implementing their share of the $85

billion in cuts.

(2) The European economy in real GDP terms is to shrink

-0.3% this year. When does a new raft of bank loan

problems emerge from the lengthening period of stagnation in

activity and mass jobless-ness? The so-called “strong” German

economy, in the lead in Europe, is set for a pathetic +0.7% y/y

real GDP growth rate. Yes, the Spanish 10-year sovereign bond rate

is pricing at 4.84%, well below the 5% threshold. It last saw

the 6% threshold in Sept. 2012. That sounds

great. Perhaps authorities serve up even more stimulus.

But Germany has a Sept. election, and may not be willing to move

forward now.

(3) Jobs numbers could slow to +100K a month, as in

summer’s past. Yes, we are doing a +200K a month

pace now, but is that going to slow? Budgets in companies for

hiring may now close out the high level of hiring activity early in

the year and cause job growth to settle back.

(4) Steep downward revisions to annual 2013 earnings

projections are coming. What happens when estimates

start to come down? This is the bread and butter of the Zacks

Rank. Many long-time and astute observers of earnings inside

Zacks on revisions think the current projections for growth in the

second half of 2013 and 2014 are way too high.

(5) Investors take profits. Does the

spring rally get tired, as it nears a six-month threshold, much

like the last two event rallies? This is yet another negative cycle

for the market. More profit taking, and the lower go the

stock markets, and the lower go consumer sentiment numbers. It

feeds on itself.

(6) Upward Fed revisions, to a +3.0% growth rate or more

for the U.S. economy, pull forward the end of $85B a month in

QE. We know the Fed is planning to begin to taper

its purchases of bonds in Q1-2014. If the economy is so

strong the unemployment rate of 6.5% is reached by the end of this

year, the timing will change. Members of the FOMC could vote

to begin tapering bond purchases much sooner. Then, once the

bond market stalls, the stock markets follow. The Fed can’t

close out the stimulus without a negative feedback loop in

financial markets.

Two Questions:

What are you on the lookout for? Which of

these possible events listed above concerns YOU the

most

SPDR-DJ IND AVG (DIA): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

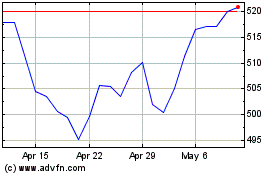

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From May 2024 to Jun 2024

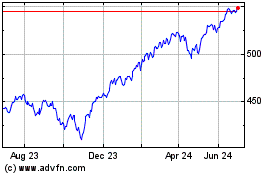

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Jun 2023 to Jun 2024