UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

[ ] Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

[X] Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2019 Commission File Number 001-38628

___________________

SILVERCREST METALS INC.

(Exact name of Registrant as specified in its charter)

|

British Columbia, Canada

(Province or other jurisdiction of incorporation or organization)

|

1040

(Primary Standard Industrial Classification Code Number)

|

N/A

(I.R.S. Employer

Identification Number)

|

570 Granville Street Suite 501

Vancouver, British Columbia V6C 3P1

Canada

(604) 694-1730

(Address and telephone number of Registrant's principal executive offices)

___________________

|

CT Corporation System

1015 15th Street N.W., Suite 1000

Washington, DC 20005

(202) 572-3100

(Name, address (including zip code) and telephone number (including

area code) of agent for service in the United States)

|

___________________

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares, no par value

|

SILV

|

NYSE American LLC

|

Securities registered pursuant to Section 12(g) of the Act: None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this Form:

[X] Annual information form [X] Audited annual financial statements

Indicate the number of outstanding shares of each of the registrant's classes of capital or common stock as of the close of the period covered by the annual report: As at December 31, 2019, 107,471,015 common shares of the Registrant were issued and outstanding.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

[X] Yes [ ] No

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company [X]

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. [ ]

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

EXPLANATORY NOTE

SilverCrest Metals Inc. (the "Company" or the "Registrant") is a Canadian issuer that is permitted, under the multijurisdictional disclosure system adopted in the United States, to prepare this annual report on Form 40-F (this "Annual Report") pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company is a "foreign private issuer" as defined in Rule 3b-4 under the Exchange Act and Rule 405 under the Securities Act of 1933, as amended. Equity securities of the Company are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 thereunder.

FORWARD-LOOKING STATEMENTS

The Exhibits incorporated by reference into this Annual Report of the Registrant contain “forward-looking statements”. Such forward‑looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned exploration and development of its properties, planned expenditures and plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on expectations of future performance, including silver and gold production and planned work programs. In addition, these statements include, but are not limited to the future price of commodities, the estimation of mineral resources, the realization of mineral resource estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, timing of completion of exploration programs, technical reports and studies (including the expectation that a feasibility study for the Company’s Las Chispas property will be completed by the second half of 2020, subject to resolution of the COVID-19 pandemic), success of exploration and development activities and mining operations, the timing of construction and mine operation activities, permitting timelines, currency fluctuations, requirements for additional capital, government regulation of exploration and production operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, completion of acquisitions and their potential impact on the Company and its operations, limitations on insurance coverage; maintenance of adequate internal control over financial reporting; and the timing and possible outcome of litigation.

Forward-looking statements are made based upon certain assumptions and other important factors that, while considered reasonable by the Company, are inherently subject to significant business economic, competitive, political and social uncertainties and contingencies. The Company has made assumptions based on many of these factors which include, without limitation, present and future business strategies, the environment in which the Company will operate in the future, including the price of silver and gold, anticipated cost and the ability to achieve goals. Certain important factors that could cause actual results, performances or achievements to differ materially from those in the forward-looking statements include, among others, volatility in the price of silver and gold, discrepancies between actual estimated production, mineral resources and metallurgical recovery, mining operational and development risks, regulatory restrictions, activities by governmental authorities and changes in legislation, community relations, the speculative nature of mineral exploration, the global economic climate, loss of key employees, additional funding requirements and defective title to mineral claims or property. While the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be factors that cause actions, events or results not to be as anticipated, estimated or intended.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ materially from those expressed or implied by the forward-looking statements, including, without limitation: the timing and content of work programs; results of exploration activities; the interpretation of drilling results and other geological data; reliability of mineral resource estimates; receipt, maintenance and security of permits and mineral property titles; enforceability of contractual interests in mineral properties; environmental and other regulatory risks; compliance with changing environmental regulations; dependence on local community relationships; risks of local violence; risks related to natural disasters, terrorism, civil unrest, public health concerns (including health epidemics or outbreaks of communicable diseases such as the coronavirus) and other geopolitical uncertainties; reliability of costs estimates; project cost overruns or unanticipated costs and expenses; precious metals price fluctuations; fluctuations in the foreign exchange rate (particularly the Mexican peso, Canadian dollar and United States dollar); uncertainty in the Company's ability to fund the exploration and development of its mineral properties or the completion of further exploration programs; uncertainty as to whether the Company's exploration programs will result in the discovery, development or production of commercially viable ore bodies or yield reserves; risks related to mineral properties being subject to prior unregistered agreements, transfers, claims and other defects in title; uncertainty in the ability to obtain financing if required; maintaining adequate internal control over financial reporting; dependence on key personnel; and general market and industry conditions. This list is not exhaustive of the factors that may affect the Company's forward-looking statements. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements.

The Company's forward-looking statements are based on beliefs, expectations and opinions of management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this Annual Report if these beliefs, expectations and opinions or other circumstances should change, except as otherwise required by applicable law.

NOTE TO UNITED STATES READERS - DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Registrant is permitted, under a multijurisdictional disclosure system adopted by the United States Securities and Exchange Commission (the "SEC"), to prepare this Annual Report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Registrant prepares its financial statements, which are filed with this Annual Report in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board, and which are not comparable to financial statements of United States companies.

RESOURCE ESTIMATES

The Company's Annual Information Form ("AIF") filed as Exhibit 99.1 to this annual report on Form 40-F and management's discussion and analysis ("MD&A") for the fiscal year ended December 31, 2019 filed as Exhibit 99.3 to this annual report on Form 40-F have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms "mineral resource", "measured mineral resource", "indicated mineral resource" and "inferred mineral resource" are defined in and required to be disclosed by Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"); however, these terms are not defined terms under SEC Industry Guide 7 under the United States Securities Act of 1933, as amended (the "Securities Act") and historically have not been permitted to be used in reports and registration statements filed with the SEC pursuant to Industry Guide 7. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. "Inferred mineral resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, SEC Industry Guide 7 historically only permitted issuers to report mineralization that does not constitute "reserves" as in-place tonnage and grade without reference to unit measures.

Accordingly, information contained in this annual report and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies who prepare their disclosure in accordance with SEC Industry Guide 7.

The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC. These amendments became effective February 25, 2019 (the "SEC Modernization Rules") and, following a two-year transition period, the SEC Modernization Rules will replace the historical property disclosure requirements for mining registrants that are included in SEC Industry Guide 7. Following the transition period, as a foreign private issuer that files its annual report on Form 40-F with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101. If the Company ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the multi-jurisdictional disclosure system, then the Company will be subject to the SEC Modernization Rules which differ from the requirements of NI 43-101.

CURRENCY

Unless otherwise indicated, all dollar amounts in this Annual Report on Form 40-F are in Canadian dollars. The exchange rate of Canadian dollars into United States dollars, on December 31, 2019 based upon the daily exchange rate as quoted by the Bank of Canada was U.S.$1.00 = Cdn.$1.2988.

ANNUAL INFORMATION FORM

The AIF for the fiscal year ended December 31, 2019 is filed as Exhibit 99.1 to this Annual Report and is incorporated by reference herein.

AUDITED ANNUAL FINANCIAL STATEMENTS

The audited consolidated financial statements of the Company for the years ended December 31, 2019 and December 31, 2018, including the reports of the independent auditors thereon, are filed as Exhibit 99.2 to this Annual Report, and are incorporated by reference herein.

MANAGEMENT'S DISCUSSION AND ANALYSIS

The Company's MD&A for the year ended December 31, 2019 is filed as Exhibit 99.3 to this Annual Report, and is incorporated by reference herein.

TAX MATTERS

Purchasing, holding, or disposing of the Company's securities may have tax consequences under the laws of the United States and Canada that are not described in this Annual Report.

CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

At the end of the period covered by this annual report for the fiscal year ended December 31, 2019, an evaluation was carried out under the supervision of, and with the participation of, the Company's management, including its Chief Executive Officer ("CEO") and Chief Financial Officer ("CFO"), of the effectiveness of the design and operation of the Company's disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) of the Exchange Act). Based upon that evaluation, the Company's CEO and CFO have concluded that the disclosure controls and procedures were effective to give reasonable assurance that the information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is (i) recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms, and (ii) accumulated and communicated to management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Management's Annual Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rule 13a-15(f) under the Exchange Act. The Company's management has employed a framework consistent with Exchange Act Rule 13a-15(c), to evaluate the Company's internal control over financial reporting described below. A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

A company's internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements. It should be noted that a control system, no matter how well conceived or operated, can only provide reasonable assurance, not absolute assurance, that the objectives of the control system are met. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with policies and procedures may deteriorate.

Management, including the CEO and CFO, is responsible for establishing and maintaining adequate internal control over financial reporting, and has used the 2013 framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (the "2013 COSO Framework") to evaluate the effectiveness of the Company's controls in 2019. Based on this evaluation, management concluded that the Company's internal control over financial reporting was effective as at December 31, 2019, and provided a reasonable assurance of the reliability of the Company's financial reporting and preparation of financial statements.

It should be noted that while the Company's CEO and CFO believe that the Company's internal controls over financial reporting provide a reasonable level of assurance that they are effective, they do not expect that the Company's internal controls over financial reporting will prevent all errors and fraud.

Attestation Report of the Registered Public Accounting Firm

This Annual Report does not include an attestation report of the Company's registered public accounting firm because emerging growth companies are exempt from this requirement for so long as they remain emerging growth companies.

Changes in Internal Control over Financial Reporting

During the period covered by this Annual Report, no change occurred in the Company's internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the Company's internal control over financial reporting.

CORPORATE GOVERNANCE

The Company's Board of Directors (the "Board of Directors") is responsible for the Company's corporate governance and has a separately designated standing Corporate Governance and Nominating Committee, Compensation Committee and an Audit Committee. The Board of Directors has determined that all of the members of the Corporate Governance and Nominating Committee, Compensation Committee and Audit Committee are independent, based on the criteria for independence prescribed by Rule 10A-3 of the Exchange Act and Section 803A of the NYSE American LLC Company Guide.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee is responsible for, among other things:

-

developing, recommending to the Board and maintaining corporate governance principles applicable to the Company;

-

identifying and recommending qualified individuals for nomination to the Board of Directors;

-

arranging for evaluations of the Board;

-

providing such assistance as the Chair of the Board, if independent, or alternatively the lead director of the Board, may require; and

-

addressing any related matters required by applicable law.

The Company's Corporate Governance and Nominating Committee is comprised of Ross Glanville, Hannes Portmann and John H. Wright, all of whom are independent based on the criteria for independence prescribed by Rule 10A-3 of the Exchange Act and Section 803A of the NYSE American LLC Company Guide.

Compensation Committee

Compensation of the Company's CEO and all other executive officers is recommended to the Board of Directors for determination by the Compensation Committee. The Company's Compensation Committee is comprised of Hannes Portmann, Ross O. Glanville and John H. Wright, all of whom are independent based on the criteria for independence prescribed by Rule 10A-3 of the Exchange Act and Section 803A of the NYSE American LLC Company Guide.

AUDIT COMMITTEE

The Board of Directors has a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act and Section 803B of the NYSE American LLC Company Guide. The Company's Audit Committee is comprised of Hannes Portmann, Ani Markova and Graham C. Thody, all of whom, in the opinion of the Company's Board of Directors, are independent (as determined under Rule 10A-3 of the Exchange Act and Section 803A and 803B(2) of the NYSE American LLC Company Guide). All three members of the Audit Committee are financially literate, meaning they are able to read and understand the Company's financial statements and to understand the breadth and level of complexity of the issues that can reasonably be expected to be raised by the Company's financial statements. The Audit Committee meets the composition requirements set forth by Section 803B(2) of the NYSE American LLC Company Guide.

The members of the Audit Committee are appointed by the Company's Board of Directors annually. Each member of the Audit Committee will remain on the committee until the next annual meeting of shareholders after his or her appointment, unless otherwise removed or replaced by the Board of Directors at any time.

The full text of the Audit Committee Charter is available on the Company's website at www.silvercrestmetals.com and is attached as Appendix A to the AIF, which is filed as Exhibit 99.1 to this Annual Report.

Audit Committee Financial Expert

The Board of Directors has determined that each of Hannes Portmann, Ani Markova and Graham C. Thody (i) is financially sophisticated within the meaning of Rule 803B of the NYSE American LLC Company Guide; (ii) is an "audit committee financial expert" as defined in Item 407(d)(5)(ii) and (iii) of Regulation S-K; and (iii) is independent (as determined under Exchange Act Rule 10A-3 and Section 803A of the NYSE American LLC Company Guide).

PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES PROVIDED BY

INDEPENDENT AUDITOR

The Audit Committee pre-approves all audit services to be provided to the Company by its independent auditors. Non-audit services that are prohibited to be provided to the Company by its independent auditors may not be pre-approved. In addition, prior to the granting of any pre-approval, the Audit Committee must be satisfied that the performance of the services in question will not compromise the independence of the independent auditors. All non-audit services performed by the Company's auditor for the fiscal year ended December 31, 2019 were pre-approved by the Audit Committee of the Company. No non-audit services were approved pursuant to the de minimis exemption to the pre-approval requirement.

PRINCIPAL ACCOUNTANT FEES AND SERVICES - INDEPENDENT AUDITORS

PricewaterhouseCoopers LLP, Chartered Professional Accountant, has been the Company’s independent auditor since December 20, 2019. During the last two fiscal years, there were no fees billed to the Company by PricewaterhouseCoopers LLP when they acted as the Company’s independent auditor.

Davidson & Company LLP, Charter Professional Accountants, was the Company’s independent auditor until December 20, 2019The following table shows the aggregate fees billed to the Company by Davidson & Company, LLP, Chartered Professional Accountants, when they acted as the Company’s independent auditor in each of the last two fiscal years.

|

|

|

2018

|

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

Audit Fees

|

$

|

32,130

|

|

$

|

40,488

|

|

|

Audit-Related Fees (1)

|

|

9,690

|

|

|

37,141

|

|

|

Tax Fees (2)

|

|

Nil

|

|

|

13,000

|

|

|

All Other Fees (3)

|

|

15,810

|

|

|

15,610

|

|

|

Total

|

$

|

57,630

|

|

$

|

106,239

|

|

(1) "Audit-Related Fees" refers to the aggregate audit related fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company's financial statements and are not reported as "Audit Fees"

(2) "Tax Fees" refers to the aggregate tax fees billed for tax compliance, advice, planning and assistance with the preparation of tax returns.

(3) "All Other Fees" refers to the aggregate fees billed relating to the preparation of a certain prospectus, reverse takeover transaction implications, enterprise resource planning vendor request for information and other accounting advice.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance sheet arrangements.

CODE OF ETHICS

The Company has adopted a Code of Business Conduct and Ethics that applies to directors, officers and employees of, and consultants and contractors to, the Company (the "Code"). The Code has been posted on the Company's website at www.silvercrestmetals.com. The Code meets the requirements for a "code of ethics" within the meaning of that term in General Instruction 9(b) of the Form 40-F.

All waivers of the Code with respect to any of the employees, officers or directors covered by it will be promptly disclosed as required by applicable securities rules and regulations. During the fiscal year ended December 31, 2019, the Company did not waive or implicitly waive any provision of the Code with respect to any of the Company's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The following table lists as of December 31, 2019 information with respect to the Company's known contractual obligations:

|

|

|

Payments due by period

|

|

|

Contractual Obligations

|

|

Total

|

|

|

Less than 1 year

|

|

|

1-3 years

|

|

|

3-5 years

|

|

|

More than 5 years

|

|

|

Operating Lease Obligations

|

$

|

626,299

|

|

$

|

189,050

|

|

$

|

437,249

|

|

$

|

Nil

|

|

$

|

Nil

|

|

|

Total

|

$

|

626,299

|

|

$

|

189,050

|

|

$

|

437,249

|

|

$

|

Nil

|

|

$

|

Nil

|

|

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR that the Company sent during the year ended December 31, 2019 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

MINE SAFETY DISCLOSURE

We do not operate any mine in the United States and have no mine safety incidents to report for the year ended December 31, 2019.

NYSE AMERICAN STATEMENT OF GOVERNANCE DIFFERENCES

The Company's common shares are listed on the NYSE American. Section 110 of the NYSE American Company Guide permits the NYSE American to consider the laws, customs and practices of foreign issuers in relaxing certain NYSE American listing criteria, and to grant exemptions from NYSE American listing criteria based on these considerations. A company seeking relief under these provisions is required to provide written certification from independent local counsel that the non-complying practice is not prohibited by home country law. A description of the significant ways in which the Company's governance practices differ from those followed by domestic companies pursuant to NYSE American standards is as follows:

Shareholder Meeting Quorum Requirement: The NYSE American minimum quorum requirement for a shareholder meeting is one-third of the outstanding shares of common stock. In addition, a company listed on the NYSE American is required to state its quorum requirement in its bylaws. The Company's quorum requirement as set forth in its Articles are two shareholders whether present by proxy, holding in the aggregate at least 5% of the issued shares entitled to be voted at the meeting.

Shareholder Approval for Equity Compensation Plans. The NYSE American Company Guide requires shareholder approval in connection with the establishment of an equity compensation arrangement pursuant to which options or stock may be acquired by officers, directors, employees, or consultants of a company. The Company will follow the shareholder approval requirements of the TSX Venture Exchange in connection with the establishment of equity compensation arrangements pursuant to which its officers, directors, employees, or consultants may acquire options or common shares.

Dissemination of Interim Reports. The NYSE American Company Guide requires a listed company to disseminate information related to its interim financial reports in the form of a press release to one or more newspapers of general circulation in New York regularly publishing financial news and to one or more of the national news-wire services. The Company follows the public dissemination requirements of the TSX Venture Exchange and applicable Canadian securities laws in connection with the dissemination of information related to its interim financial reports.

UNDERTAKING

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Company has previously filed with the SEC a written consent to service of process on Form F-X. Any change to the name or address of the Company's agent for service shall be communicated promptly to the SEC by amendment to the Form F-X referencing the file number of the Company.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

SILVERCREST METALS INC.

|

|

|

|

|

|

|

By:

|

/s/ Anne Yong

|

|

|

|

Name: Anne Yong

|

|

|

|

Title: Chief Financial Officer

|

Date: March 30, 2020

EXHIBIT INDEX

The following documents are being filed with the Commission as Exhibits to this Annual Report:

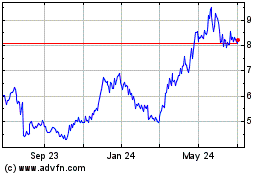

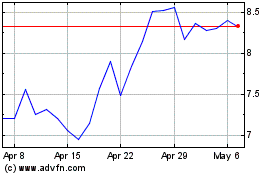

SilverCrest Metals (AMEX:SILV)

Historical Stock Chart

From Aug 2024 to Sep 2024

SilverCrest Metals (AMEX:SILV)

Historical Stock Chart

From Sep 2023 to Sep 2024