Sharp increase in contributed revenue:

+19%

Sustained organic growth: +12%

2023 business targets confirmed

Regulatory News:

Q1 2023 confirms the continuation of the positive trends of

the last months of 2022 with a high level of activity in most of

Séché’s (Paris:SCHP) businesses and geographical regions.

In France, the Group is fully benefiting from its positioning

in the consistently buoyant circular economy and decarbonization

markets, while its environmental services activities are

experiencing strong growth. Internationally, the Group generally

confirms the positive trends in its markets against the challenging

Q1 2022 baseline.

This good start to the year confirms the Group's expectations

for 2023.

As of March 31, 2023, contributed revenue stood at €249.3

million, representing an increase of +19.2% compared to the same

period last year (€209.1 million).

At constant scope and exchange rates, contributed revenue rose

sharply (+11.9%), which reflects the Group's sustained high

activity levels across all its main geographical regions.

In France, the Group achieved robust performance with

contributed revenue up +14.9% organically1 and confirmed the

solidity of its industrial and municipal markets, underpinned by

the dynamic growth associated with the implementation of the

circular economy and the strong performance of its services

activities.

Internationally, with a +5.1% organic growth, the Group

demonstrated global solid performance and a favorable environment,

despite unequal contributions from the subsidiaries considering the

high level of activity in Q1 2022 bolstered by its exceptional spot

contracts among others.

Séché is confident that it will achieve its growth targets for

2023.

Commentary on business in Q1 2023

As of March 31, 2023, Séché Environnement published consolidated

revenue of €248.0 million, compared to €226.6 million one year

earlier, representing an increase of +17.3%.

The reported revenue includes non-contributed revenue, which can

be broken down as follows:

In €M - as of March 31

2022

2023

IFRIC 12 investments

4.5

2.2

General tax on polluting activities

13.0

14.2

Non-contributed revenue

17.5

16.4

Contributed revenue stood at €249.3 million, compared to €209.1

million as of March 31, 2022, an increase of +19.2% for the

period.

This increase includes a scope effect of +€18.0 million over Q1

2023.

- All'Chem (consolidated as of June 1, 2022): +€4.7 million

- Séché Assainissement 34 (consolidated as of July 1, 2022):

+€1.0 million

- Séché Assainissement Rhône-Isère (consolidated as of January 1,

2023): +€1.2 million

- Séché Traitement Effluents Industriels (consolidated as of

December 1, 2022): €11.1 million

At constant scope, contributed revenue totaled €231.3 million,

representing an increase of +10.7% at current exchange rates and

+11.9% at constant exchange rates vs. Q1 2022.

Breakdown by geographic scope

Consolidated data in €m

As of March 31

2022

2023

Gross change

Organic change

Subsidiaries in France

145.2

184.8

+27.2%

+14.9%

o/w scope effect

18.0

International subsidiaries

63.8

64.5

+1.2%

+5.1%

o/w scope effect

-

Contributed revenue

209.1

249.3

+19.2%

+11.9%

As of March 31, 2022, contributed revenue at constant exchange

rates amounted to €206.7 million, showing a negative currency

effect of €(2.4) million over the period.

The performance in France confirms the Group's dynamic

industrial and municipal markets, while international growth

relates to the challenging Q1 2022 baseline:

- In France, contributed revenue stood at €184.8 million, a

strong increase of +27.2% compared to March 31, 2022. This increase

includes a scope effect of €18.0 million. At constant scope, growth

came to +14.9%, illustrating the Group's buoyant markets.

Séché benefits from strong industrial markets driven by growing

sustainability challenges, while the local authority markets

confirmed their solid performance boosted by the implementation of

regulations on the circular economy.

Therefore, over the period, this scope saw strong momentum in

Service activities (+22.6% at constant scope) and activities

relating to the circular economy and decarbonization (+14.4% at

constant scope).

- International revenue was €64.5 million, up +5.1% at constant

exchange rates compared to Q1 2022.

This increase reflects uneven contributions from the different

geographical regions and subsidiaries, some of which registered

especially high levels of activity in Q1 2022 due to either the

spot contracts in the Environmental Emergencies business lines

(Spill Tech), or to a strong market resurgence after the 2020-2021

downturn caused by the Covid crisis (Solarca).

Analysis by activity

Consolidated data in €m

As of March 31

2022

2023

Gross change

Organic change

Services

92.3

120.7

+30.8%

+20.0%

o/w scope effect

-

13.3

Circular economy

66.4

78.2

+17.8%

+10.5%

o/w scope effect

-

4.7

Hazardousness

50.4

50.5

+0.2%

-0.4%

o/w scope effect

-

-

Contributed revenue

209.1

249.3

+19.2%

+11.9%

The Service activities posted a tremendous increase (+30.8% in

reported data), which partly reflects the scope effect associated

with the integration of STEI and the Wastewater Sanitation

activities acquired during 2022 and early 2023 (+€13.3

million).

At constant scope and exchange rates, Service activities rose

considerably (+20.0%), which illustrates the dynamic growth driving

the environmental emergencies and total waste management solutions

activities in France and internationally (especially in Peru).

Activities relating to the circular economy confirmed their high

performance with growth of +17.8% (reported data) and +10.5%

organic growth. They were supported in France and abroad by

regulations and the growing level of demand from customers on the

lookout for low-carbon solutions and for regenerated materials or

recovery energy.

Hazard Management activities were stable over the period, which

tends to conceal their robust performance in France (+6.3%), where

these activities posted positive commercial effects (volume, price

and mix effects), while internationally (especially Latin America)

revenue dipped slightly when compared to the same period in the

previous year (business strong rebound after 2020 and 2021 hit by

the Covid crisis).

Analysis by division

Consolidated data in €m

As of March 31

2022

2023

Gross change

Organic change

Hazardous Waste

132.7

165.2

+24.6%

+12.3%

o/w scope effect

-

15.8

Non-Hazardous Waste

76.4

84.2

+10.1%

+11.4%

o/w scope effect

-

2.2

Contributed revenue

209.1

249.3

+19.2%

+11.9%

The recovery and treatment divisions posted a sustained level of

activity and delivered an equal contribution to organic growth:

- The Hazardous Waste division recognized revenue of €165.2

million, up by +24.6% compared to Q1 2022.

At constant scope and exchange rates, the division's growth was

up +12.3%, reflecting the driving force of all the activities in

France and, internationally, the increase in Service activities

(particularly Latin America).

- The Non-Hazardous Waste division achieved revenue of €84.2

million, an increase of +10.1% over the period.

Subtracting the scope effect related to the consolidation of the

Wastewater Sanitation activities acquired in 2022 and early 2023,

the division's growth reached +11.4% at constant exchange rates,

which mainly reflects the dynamic performance of the activities

associated with the Circular Economy in France and Services in

France and internationally (particularly Interwaste in South

Africa).

Growth outlook confirmed

This good start to the year confirms Séché Environnement's

growth prospects for the current year.

While Q2 should again provide a high baseline for comparing

activities in France and internationally, Séché is reiterating its

confidence in its ability to achieve its business growth targets in

2023.

The Group has confirmed its expectation of achieving organic

growth of about 5% in its historical scope and aiming for

contributed revenue of close to €1,000 million, including the pro

rata contribution of the scopes acquired in 2022 and early

20232.

Conference call

A conference call to describe the business activity for Q1 2023

will be held (in French only) on April 25, 2023, at 6 pm (Paris

time).

To participate in the conference, dial +33 (0)1 70 37

71 66 and give the following code to the operator:

"Séché"

Material to accompany the presentation will be available from

5:45 pm on Séché Environnement's website:

https://www.groupe-seche.com/fr/investisseurs/accueil

A reply of the conference will be available from April 26, 2023,

on the Séché Environnement website at the same address.

Upcoming events

Combined General Meeting Friday, April 28, 2023

Consolidated results at June 30, 2023 September 11, 2023 after

market close

About Séché Environnement

Séché Environnement is a leading player in waste management,

including the most complex and hazardous waste, and in

environmental services, particularly in the event of an

environmental emergency. Thanks to its expertise in the creation of

circular economy loops, decarbonization, and hazard containment,

the Group has been contributing to the ecological transition of

industries and territories, as well as to the protection of the

living world, for nearly 40 years. A French family-owned industrial

group, Séché Environnement deploys the cutting-edge technologies

developed by its R&D department at the heart of territories in

more than 120 locations in 15 countries, including some 50

industrial sites in France. With over 5,700 employees, including

2,500 in France, Séché Environnement generated revenue of nearly

€900 million in 2022, 30% of which from its international

operations.

Séché Environnement has been listed on the Euronext Eurolist

(Compartment B) since November 27, 1997. It is included in the CAC

Mid&Small, EnterNext Tech 40 and EnterNext PEA-PME 150 indexes.

ISIN: FR 0000039139 – Bloomberg: SCHP.FP – Reuters: CCHE.PA

1 At constant scope and exchange rates

2 All’Chem, Séché Assainissement 34, STEI, Séché ARI

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230425005735/en/

SÉCHÉ ENVIRONNEMENT

Analyst/Investor Relations Manuel ANDERSEN Head of

Investor Relations m.andersen@groupe-seche.com +33

(0)1 53 21 53 60

Media Relations Anna JAEGY Head of Communications

a.jaegy@groupe-seche.com +33 (0)1 53

21 53 53

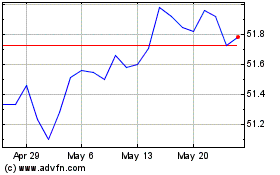

Schwab US TIPs (AMEX:SCHP)

Historical Stock Chart

From Apr 2024 to May 2024

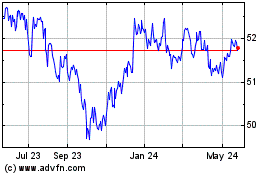

Schwab US TIPs (AMEX:SCHP)

Historical Stock Chart

From May 2023 to May 2024