UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended December 31, 2008

Commission File Number I-4383

ESPEY MFG. & ELECTRONICS CORP.

(Exact name of registrant as specified in its charter)

NEW YORK 14-1387171

-------- ----------

(State of incorporation) (I.R.S. Employer's Identification No.)

|

233 Ballston Avenue, Saratoga Springs, New York 12866

(Address of principal executive offices)

Registrant's telephone number, including area code 518-584-4100

Indicate by check mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

Yes |X| No [ ]

Indicate by check mark whether the registrant is an accelerated filer, a

non-accelerated filer, or a smaller reporting company. See the definitions of

"large accelerated filer," "accelerated filer" and "smaller reporting company"

in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting company |X|

Indicated by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act).

Yes [ ] No |X|

Indicate the number of shares outstanding of each of the issuer's classes of

common stock, as of the latest practicable date.

Class Outstanding at February 11, 2009

----- --------------------------------

Common stock, $.33-1/3 par value 2,329,153 shares

|

ESPEY MFG. & ELECTRONICS CORP.

Quarterly Report on Form 10-Q

I N D E X

PART I FINANCIAL INFORMATION PAGE

Item 1 Financial Statements:

Balance Sheets -

December 31, 2008 (Unaudited) and June 30, 2008 1

Statements of Income (Unaudited) -

Three Months Ended December 31, 2008 and 2007 3

Statements of Cash Flows (Unaudited)-

Three Months Ended December 31, 2008 and 2007 4

Notes to Financial Statements (Unaudited) 5

Item 2 Management's Discussion and Analysis of 9

Financial Condition and Results of Operations

Item 3 Quantitative and Qualitative Disclosures About Market

Risk 12

Item 4 Controls and Procedures 12

PART II OTHER INFORMATION AND SIGNATURES 13

Item 1 Legal Proceedings 13

Item 2 Unregistered Sales of Equity Securities 13

Item 4 Submission of Matters to a Vote of Security Holders 13

Item 5 Other Information 14

Item 6 Exhibits 14

SIGNATURES 14

|

PART I: FINANCIAL INFORMATION

ESPEY MFG. & ELECTRONICS CORP.

Balance Sheets

December 31, 2008 (Unaudited) and June 30, 2008

2008 2008

December 31, June 30,

----------- -----------

ASSETS:

Cash and cash equivalents $ 1,299,601 $ 6,851,753

Short term investments 9,566,000 7,336,000

Trade accounts receivable, net 3,039,829 3,646,127

Income tax receivable 516,310 276,087

Other receivables 6,363 4,348

ESOP receivable due to dividends on unallocated shares 246,656 36,809

Inventories:

Raw materials 1,516,264 1,575,116

Work-in-process 1,025,538 1,151,332

Costs relating to contracts in process, net of advance

payments of $830,215 at December 31, 2008 and

$959,175 at June 30, 2008 8,803,035 7,461,786

----------- -----------

Total inventories 11,344,837 10,188,234

Deferred income taxes 167,422 169,853

Prepaid expenses and other current assets 215,519 355,688

----------- -----------

Total current assets 26,402,537 28,864,899

----------- -----------

Property, plant and equipment, net 2,891,876 2,956,590

Loan receivable 51,937 65,003

----------- -----------

Total assets $29,346,350 $31,886,492

=========== ===========

See accompanying notes to the financial statements. (Continued)

|

1

ESPEY MFG. & ELECTRONICS CORP.

Balance Sheets

December 31, 2008 (Unaudited) and June 30, 2008

2008 2008

December 31, June 30,

------------ ------------

LIABILITIES AND STOCKHOLDERS' EQUITY:

Accounts payable $ 1,894,957 $ 600,931

Accrued expenses:

Salaries, wages and commissions 99,314 184,377

Vacation 450,940 542,441

ESOP payable -- --

Other 66,747 46,253

Payroll and other taxes withheld and accrued 47,041 42,175

------------ ------------

Total current liabilities 2,558,999 1,416,177

------------ ------------

Deferred income taxes 114,557 132,578

------------ ------------

Total liabilities 2,673,556 1,548,755

------------ ------------

Common stock, par value $.33-1/3 per share. Authorized 10,000,000

shares; issued 3,029,874 shares on December 31, 2008 and June 30,

2008. Outstanding 2,326,953 and 2,325,902 (includes 213,333 and

225,000 Unearned ESOP Shares on December 31, 2008

and June 30, 2008, respectively) 1,009,958 1,009,958

Capital in excess of par value 13,604,470 13,476,609

Retained earnings 22,051,959 25,796,703

------------ ------------

36,666,387 40,283,270

Less: Unearned ESOP shares (3,251,248) (3,251,248)

Treasury shares, cost of 702,921 shares on December

31, 2008 and 703,972 shares on June 30, 2008 (6,742,345) (6,694,285)

------------ ------------

Total stockholders' equity 26,672,794 30,337,737

------------ ------------

Total liabilities and stockholders' equity $ 29,346,350 $ 31,886,492

============ ============

|

See accompanying notes to the financial statements.

2

ESPEY MFG. & ELECTRONICS CORP.

Statements of Income (Unaudited)

Three and Six Months Ended December 31, 2008 and 2007

Three Months Six Months

2008 2007 2008 2007

---------------------------------- ---------------------------------

Net sales $ 6,194,177 $ 6,732,144 $ 12,247,696 $ 13,033,930

Cost of sales 5,568,247 5,049,559 10,470,491 10,002,235

--------------- --------------- --------------- ---------------

Gross profit 625,930 1,682,585 1,777,205 3,031,695

Selling, general and

administrative expenses 789,585 701,819 1,467,812 1,369,372

--------------- --------------- --------------- ---------------

Operating (loss) income (163,655) 980,766 309,393 1,662,323

--------------- --------------- --------------- ---------------

Other income

Interest and dividend income 92,969 203,324 195,884 399,445

Other 4,672 29,077 15,913 48,562

--------------- --------------- --------------- ---------------

97,641 232,401 211,797 448,007

--------------- --------------- --------------- ---------------

(Loss) income before income taxes (66,014) 1,213,167 521,190 2,110,330

(Benefit) provision for income taxes (23,602) 416,081 165,306 721,661

--------------- --------------- --------------- ---------------

Net (loss) income $ (42,412) $ 797,086 $ 355,884 $ 1,388,669

=============== =============== =============== ===============

Net (loss) income per share:

Basic $ (.02) $ .38 $ .17 $ .67

Diluted $ (.02) $ .37 $ .17 $ .65

--------------- --------------- --------------- ---------------

Weighted average number of shares outstanding:

Basic 2,107,257 2,074,789 2,104,782 2,070,334

Diluted 2,114,363 2,109,650 2,115,201 2,125,632

--------------- --------------- --------------- ---------------

Dividends per share: $ 1.7250 $ .1750 $ 1.9500 $ .3500

=============== =============== =============== ===============

|

See accompanying notes to the financial statements.

3

ESPEY MFG. & ELECTRONICS CORP.

Statements of Cash Flows (Unaudited)

Six Months Ended December 31, 2008 and 2007

December 31,

2008 2007

------------ ------------

Cash Flows From Operating Activities:

Net income $ 355,884 $ 1,388,669

Adjustments to reconcile net income to net

cash provided by operating activities:

Excess tax benefits from share-based compensation 30,245 83,471

Stock-based compensation 58,166 83,331

Depreciation 247,973 246,473

ESOP compensation expense 228,903 263,174

Loss on disposal of assets 2,542 5,681

Deferred income tax (15,590) (26,979)

Changes in assets and liabilities:

Decrease (increase) in trade receivables, net 606,298 (1,337,174)

Increase in income taxes receivable (240,223) (5,273)

Increase in other receivables (2,015) (717)

Increase in ESOP receivable due to dividends on unallocated shares (209,847) --

(Increase) decrease in inventories (1,156,603) 1,022,965

Decrease in prepaid expenses and other current assets 140,169 247,405

Increase (decrease) in accounts payable 1,294,026 (130,775)

Decrease in accrued salaries, wages and commissions (85,063) (31,470)

Decrease in vacation accrual (91,501) (105,627)

Decrease in ESOP payable (228,903) (87,208)

Increase in other accrued expenses 20,494 3,512

Increase (decrease) in payroll & other taxes withheld and accrued 4,866 (4,417)

Decrease in income taxes payable (30,245) (283,414)

------------ ------------

Net cash provided by operating activities 929,576 1,331,627

------------ ------------

Cash Flows From Investing Activities:

Additions to property, plant & equipment (185,801) (292,436)

Payment for issuance of loan receivable -- (80,000)

Proceeds from loan receivable 13,066 --

Purchase of short term investments (6,550,000) (4,543,000)

Maturity of short term investments 4,320,000 2,016,000

------------ ------------

Net cash used in investing activities (2,402,735) (2,899,436)

------------ ------------

Cash Flows From Financing Activities:

Dividends on common stock (4,100,628) (722,569)

Purchase of treasury stock (102,510) (571,763)

Proceeds from exercise of stock options 93,900 246,040

Excess tax benefits from share-based compensation 30,245 83,471

------------ ------------

Net cash used in financing activities (4,078,993) (964,821)

------------ ------------

(Decrease) increase in cash and cash equivalents (5,552,152) (2,532,630)

Cash and cash equivalents, beginning of period 6,851,753 11,096,111

------------ ------------

Cash and cash equivalents, end of period 1,299,601 8,563,481

============ ============

Supplemental disclosures of cash flow information:

Income Taxes Paid $ 400,000 $ 880,000

============ ============

|

See accompanying notes to the financial statements.

4

ESPEY MFG. & ELECTRONICS CORP.

Notes to Financial Statements (Unaudited)

Note 1. Basis of Presentation

In the opinion of management the accompanying unaudited financial statements

contain all adjustments (consisting of only normal recurring adjustments)

necessary for a fair presentation of the results for such periods. The results

for any interim period are not necessarily indicative of the results to be

expected for the full fiscal year. Certain information and footnote disclosures

normally included in financial statements prepared in accordance with United

States generally accepted accounting principles have been condensed or omitted.

The preparation of these financial statements requires us to make estimates and

judgments that affect the reported amounts of assets, liabilities, revenues and

expenses, and related disclosure of assets and liabilities. On an ongoing basis,

we evaluate our estimates and judgments, including those related to revenue

recognition, inventories, income taxes, and stock-based compensation. Management

bases its estimates on historical experience and on various other factors that

are believed to be reasonable under the circumstances, the results of which form

the basis for making judgments about the carrying values of assets and

liabilities that are not readily apparent from other sources. Actual results may

differ from these estimates under different assumptions or conditions. These

financial statements should be read in conjunction with the Company's most

recent audited financial statements included in its report on Form 10-KSB for

the year ended June 30, 2008.

Note 2. Net Income per Share

Basic net income per share excludes dilution and is computed by dividing net

income available to common stockholders by the weighted average number of common

shares outstanding for the period. Diluted net income per share reflects the

potential dilution that could occur if securities or other contracts to issue

common stock were exercised or converted into common stock or resulted in the

issuance of common stock that then shared in the income of the Company. As

Unearned ESOP shares are released or committed-to-be-released the shares become

outstanding for earnings-per-share computations.

Note 3. Stock Based Compensation

Effective July 1, 2006, the Company adopted Statement of Financial Accounting

Standards No. 123 (Revised 2004),"Share-Based Payment" ("SFAS No. 123 (R)"),

which amends SFAS No. 123 and supersedes Accounting Principles Board Opinion

("APB") No. 25 in establishing standards for the accounting for transactions in

which an entity exchanges its equity instruments for goods or services, as well

as transactions in which an entity incurs liabilities in exchange for goods or

services that are based on the fair value of the entity's equity instruments or

that may be settled by the issuance of those equity instruments. SFAS No. 123(R)

requires that the cost resulting from all share-based payment transactions be

recognized in the financial statements based on the fair value of the

share-based payment. SFAS No.123(R) establishes fair value as the measurement

objective in accounting for share-based payment transactions with employees,

except for equity instruments held by employee share ownership plans. As allowed

under SFAS No. 123(R), the Company elected the modified prospective method of

adoption, under which compensation cost is recognized in the financial

statements beginning with the effective date of SFAS No. 123(R) for all

share-based payments granted after that date, and for all unvested awards

granted prior to the effective date of SFAS No. 123(R). Accordingly, prior

period amounts have not been restated.

Total stock-based compensation expense recognized in the Statement of Income for

the three months ended December 31, 2008 and 2007, was $29,083 and $32,491,

respectively, before income taxes. The related total deferred tax benefit was

approximately $2,477 and $2,487, for the three months ended December 31, 2008

and 2007, respectively. Total stock-based compensation expense recognized in the

Statement of Income for the six months ended December 31, 2008 and 2007, was

$58,166 and $83,331, respectively, before income taxes. The related total

deferred tax benefit was approximately $4,954 and $6,504, for the six months

ended December 31, 2008 and 2007, respectively. Prior to the adoption of SFAS

No. 123(R), the Company presented all tax benefits for deductions resulting from

the exercise of stock options as operating cash flows in the Statements of Cash

Flows. SFAS No. 123(R) requires the tax benefits resulting from tax deductions

in excess of the compensation cost recognized for those options to be classified

and reported as both an operating cash outflow and a financing cash inflow on a

prospective basis upon adoption.

5

As of December 31, 2008, there was approximately $89,900 of unrecognized

compensation cost related to stock option awards that is expected to be

recognized as expense over a period of 1.5 years.

The Company has one employee stock option plan under which options may be

granted, the 2007 Stock Option and Restricted Stock Plan (the "2007 Plan"). The

Board of Directors may grant options to acquire shares of common stock to

employees of the Company at the fair market value of the common stock on the

date of grant. Generally, options granted have a two-year vesting period based

on two years of continuous service and have a ten-year contractual life. Option

grants provide for accelerated vesting if there is a change in control. Shares

issued upon the exercise of options are from those held in Treasury. The 2007

Plan was approved by the Company's shareholders at the Company's Annual Meeting

on November 30, 2007 and supercedes the Company's 2000 Stock Option Plan (the

"2000 Plan"). Options covering 400,000 shares are authorized for issuance under

the 2007 Plan, of which 34,400 have been granted as of December 31, 2008. While

no further grants of options may be made under the 2000 Plan, as of December 31,

2008, 83,100 options were outstanding of which 49,900 are vested and

exercisable.

SFAS No. 123(R) requires the use of a valuation model to calculate the fair

value of stock-based awards. The Company has elected to use the Black-Scholes

option valuation model, which incorporates various assumptions including those

for volatility, expected life and interest rates.

The table below outlines the weighted average assumptions that the Company used

to calculate stock-based employee compensation for the three and six months

ended December 31, 2008 and 2007:

Three Months Ended Six Months Ended

December 31, December 31,

2008 2007 2008 2007

-------------------- ----------------------

Dividend yield 3.34% 2.59% 3.34% 2.40%

Expected stock price volatility 24.41% 20.50% 24.41% 22.29%

Risk-free interest rate 3.91% 4.80% 3.91% 4.54%

Expected option life (in years) 4.0 yrs 5 yrs 4.0 yrs 5 yrs

Weighted average fair value per share of

options granted during the period $3.59 $3.66 $3.59 $3.84

|

The Company pays dividends quarterly and does plan to pay dividends in the

foreseeable future. Expected stock price volatility is based on the historical

volatility of the Company's stock. The risk-free interest rate is based on the

implied yield available on U.S. Treasury issues with an equivalent term

approximating the expected life of the options. The expected option life (in

years) represents the estimated period of time until exercise and is based on

the safe harbor calculation under SFAS No. 123.

The following table summarizes stock option activity during the three months

ended December 31, 2008:

Employee Stock Options Plan

-------------------------------------

Weighted

Number of Weighted Average

Shares Average Remaining

Subject Exercise Contractual

To Option Price Term

-------------------------------------

Balance at July 1, 2008 126,500 $18.40 7.85

Granted -- --

Exercised (6,600) $14.23

Forfeited or expired (2,400) $17.82

-------------------------------------

Balance December 31, 2008 117,500 $18.65 7.94

=====================================

Exercisable at December 31, 2008 49,900 $16.89 6.81

=====================================

|

The intrinsic value of stock options exercised was $18,495 and $179,365, during

the six months ended December 31 2008 and 2007, respectively. The intrinsic

value of stock options outstanding and exercisable as of December 31, 2008 and

2007 was $90,637 and $207,917, respectively.

6

Note 4. Commitments and Contingencies

The Company at certain times enters into standby letters of credit agreements

with financial institutions primarily relating to the guarantee of future

performance on certain contracts. Contingent liabilities on outstanding standby

letters of credit agreements aggregated to zero at December 31, 2008. As a

government contractor, the Company is continually subject to audit by various

agencies of the U.S. Government to determine compliance with various procurement

laws and regulations. As a result of such audits and as part of normal business

operations of the Company, various claims and charges can be asserted against

the Company. It is not possible to predict the outcome of such actions.

Currently the Company has no claims or assertions pending or threatened against

it.

Note 5. Recently Issued Accounting Standards

In May 2008, the Financial Accounting Standards Board ("FASB") issued Statement

of Financial Accounting Standard No. 162 ("SFAS 162"), The Hierarchy of

Generally Accepted Accounting Principals. SFAS 162 identifies the sources of

accounting principles and the framework for selecting the principles used in the

preparation of financial statements of nongovernmental entities that are

presented in conformity with generally accepted accounting principles (GAAP) in

the United States. SFAS 162 is effective 60 days following the SEC's approval of

the Public Company Accounting Oversight Board amendments to AU Section 411, The

Meaning of Present Fairly in Conformity With Generally Accepted Accounting

Principles. SFAS 162 does not have a material effect on the company's financial

statements.

In March 2008, the FASB issued Statement of Financial Accounting Standard No.

161 ("SFAS 161"), Disclosures about Derivative Instruments and Hedging

Activities, an amendment of FASB Statement No. 133. SFAS 161 requires enhanced

disclosures about an entity's derivative and hedging activities. SFAS 161 is

effective for financial statements issued for fiscal years and interim periods

beginning after November 15, 2008 with early application encouraged. As such,

the Company was required to adopt these provisions at the beginning of the

fiscal year ended June 30, 2009. The adoption of the provisions of SFAS 161 will

not have a material effect on the Company's financial statements.

In December 2007, the FASB issued Statement of Financial Accounting Standard No.

160 ("SFAS 160"), Noncontrolling Interests in Consolidated Financial Statements,

an amendment of ARB No. 51. SFAS 160 establishes accounting and reporting

standards for the noncontrolling interest in a subsidiary and for the

deconsolidation of a subsidiary. SFAS 160 is effective for fiscal years, and

interim periods within those fiscal years, beginning on or after December 15,

2008. As such, the Company was required to adopt these provisions on January 1,

2009. The adoption of the provisions of SFAS 160 will not have a material effect

on the Company's financial statements.

In December 2007, the FASB issued Statement of Financial Accounting Standard No.

141(R) ("SFAS 141(R)"), Business Combinations. SFAS 141(R) establishes

principles and requirements for how the acquirer recognizes and measures in its

financial statements the identifiable assets acquired, the liabilities assumed,

an any noncontrolling interest in the acquiree, recognizes and measures the

goodwill acquired in the business combination or a gain from a bargain purchase,

and determines what information to disclose to enable users of the financial

statements to evaluate the nature and financial effects of the business

combination. SFAS 141(R) is effective for fiscal years, and interim periods

within those fiscal years, beginning on or after December 15, 2008. As such, the

Company was required to adopt these provisions January 1, 2009. The adoption of

the provisions of SFAS 160 will not have a material effect on the Company's

financial statements.

In February 2007, the FASB issued Statement of Financial Accounting Standard No.

159 ("SFAS 159"), The Fair Value Option for Financial Assets and Financial

Liabilities. SFAS 159 provides companies with an option to report selected

financial assets and financial liabilities at fair value. Unrealized gains and

losses on items for which the fair value option has been elected are reported in

earnings at each subsequent reporting date. SFAS 159 is effective beginning July

1, 2008. The adoption of the provisions of SFAS 159 did not have a material

effect on the Company's financial statements.

In September 2006, the FASB issued Statement of Financial Accounting Standard

No. 157 ("SFAS 157"), Fair Value Measurements. SFAS 157 defines fair value,

establishes a framework for measuring fair value, and expands disclosures about

fair value measurements. SFAS 157 applies to other accounting pronouncements

7

that require or permit fair value measurements, but does not require any new

fair value measurements. SFAS 157 is effective for financial statements issued

for fiscal years beginning after November 15, 2007, and interim periods within

those years. SFAS 157 did not have a material effect on the Company's financial

statements.

Note 6. Employee Stock Ownership Plan

The Company sponsors a leveraged employee stock ownership plan (the "ESOP") that

covers all nonunion employees who work 1,000 or more hours per year and are

employed on June 30.

The Company makes annual contributions to the ESOP equal to the ESOP's debt

service less dividends on unallocated shares received by the ESOP. All dividends

on unallocated shares received by the ESOP are used to pay debt service.

Dividends on allocated ESOP shares are recorded as a reduction of retained

earnings. As the debt is repaid, shares are released and allocated to active

employees, based on the proportion of debt service paid in the year. The Company

accounts for its ESOP in accordance with Statement of Position 93-6.

Accordingly, the shares purchased by the ESOP are reported as Unearned ESOP

Shares in the statement of financial position. As shares are released or

committed-to-be-released, the Company reports compensation expense equal to the

current average market price of the shares, and the shares become outstanding

for earnings-per-share (EPS) computations. ESOP compensation expense was

$110,485 for the quarter ended December 31, 2008 and $228,903 for the six-month

period ending December 31, 2008. The ESOP shares as of December 31, 2008 were as

follows:

Allocated Shares 437,593

Committed-to-be-released shares 11,667

Unreleased shares 213,333

----------

Total shares held by the ESOP 662,593

==========

Fair value of unreleased shares at December 31, 2008 $3,991,460

==========

|

8

Item 2. Management's Discussion and Analysis of Financial Condition and Results

of Operations

Overview

Espey Mfg. & Electronics Corp. (the "Company") located in Saratoga Springs, New

York, is engaged principally in the development, design, production and sale of

specialized electronic power supplies, a wide variety of transformers and other

types of iron-core components, and electronic system components. In some cases,

the Company manufactures such products in accordance with pre-developed

mechanical and electrical requirements ("build to print"). In other cases, the

Company is responsible for both the overall design and manufacture of the

product. The Company does not generally manufacture standardized components and

does not have a product line. The products manufactured by the Company find

application principally in (i) shipboard and land based radar, (ii) locomotives,

(iii) aircraft, (iv) short and medium range communication systems, (v)

navigation systems, and (vi) land-based military vehicles.

Business is solicited from large industrial manufacturers and defense companies,

the government of the United States, foreign governments and major foreign

electronic equipment companies. In certain countries the Company has external

sales representatives to help solicit and coordinate foreign contracts. The

Company is also on the eligible list of contractors of agencies of the United

States Department of Defense and generally is automatically solicited by such

agencies for procurement needs falling within the major classes of products

produced by the Company. In addition, the Company directly solicits bids from

the United States Department of Defense for prime contracts.

There is competition in all classes of products manufactured by the Company from

divisions of the largest electronic companies, as well as many small companies.

The Company's sales do not represent a significant share of the industry's

market for any class of its products. The principal methods of competition for

electronic products of both a military and industrial nature include, among

other factors, price, product performance, the experience of the particular

company and history of its dealings in such products. The Company, as well as

other companies engaged in supplying equipment for military use, is subject to

various risks, including, without limitation, dependence on United States and

foreign government appropriations and program allocations, the competition for

available military business, and government termination of orders for

convenience.

New orders received in the first six months of fiscal 2009 were approximately

$11.5 million, representing a 40.4% increase over the amount of new orders

received in the first six months of fiscal 2008. These orders are predominately

follow-on production quantities for mature products. These orders are in line

with the Company's strategy of getting involved in long-term high quantity

military and industrial products. The Company's backlog was $44.0 million at

December 31, 2008 and is $43.6 million at February 10, 2009, which includes

$23.8 million from two significant customers. The backlog for the Company

represents the estimated remaining sales value of work to be performed under

firm contracts. These contracts include significant orders for military and

industrial power supplies, and contracts to manufacture certain customer

products in accordance with pre-engineered requirements.

The sales backlog gives the Company a solid base of future sales. Based upon the

backlog and the anticipated schedule for the fulfillment of orders, management

expects sales for fiscal 2009 to be higher than fiscal 2008 sales. In addition

to the backlog, the Company currently has outstanding quotations and potential

business representing approximately $49.0 million in the aggregate for both

repeat and new programs.

Net sales to two significant customers represented 67.1% and 58.5% of the

Company's total sales for the three-month period ended December 31, 2008 and

2007, respectively. Sales to these two customers for the six-month period ended

December 31, 2008 and 2007 represented 69.4% and 57.7% of total sales,

respectively. While the Company has always had a small number of customers that

account for a large percentage of its total sales in any given year, management

is pursuing business opportunities involving significant product programs with

new and current customers with an overall objective of lowering the

concentration of sales and minimizing the impact of a significant customer or

excessive reliance upon a single major product program of a particular customer.

9

The outstanding quotations encompass various new and previously manufactured

power supplies, transformers, and subassemblies. However, there can be no

assurance that the Company will acquire any or all of the anticipated orders

described above, many of which are subject to allocations of the United States

defense spending and factors affecting the defense industry and military

procurement generally.

Management, along with the Board of Directors, continues to evaluate the need

and use of the Company's working capital. Expectations are that the working

capital will be required to fund any increase in orders over the next several

quarters, dividend payments, and general operations of the business. Also, the

Mergers and Acquisitions Committee of the Board of Directors continues to

evaluate potential strategic options on a periodic basis.

Critical Accounting Policies and Estimates

Management believes our most critical accounting policies include revenue

recognition and estimates to completion.

A significant portion of our business is comprised of development and production

contracts. Generally, revenues on long-term fixed-price contracts are recorded

on a percentage of completion basis using units of delivery as the measurement

basis for progress toward completion.

Percentage of completion accounting requires judgment relative to expected

sales, estimating costs and making assumptions related to technical issues and

delivery schedule. Contract costs include material, subcontract costs, labor and

an allocation of overhead costs. The estimation of cost at completion of a

contract is subject to numerous variables involving contract costs and estimates

as to the length of time to complete the contract. Given the significance of the

estimation processes and judgments described above, it is possible that

materially different amounts of expected sales and contract costs could be

recorded if different assumptions were used, based on changes in circumstances,

in the estimation process. When a change in expected sales value or estimated

cost is determined, changes are reflected in current period earnings.

Results of Operations

Net sales for the three months ended December 31, 2008 were $6,194,177 as

compared to $6,732,144 for the same period in 2007, representing an 8% decrease.

Net sales for the six months ended December 31, 2008 were $12,247,696 as

compared to $13,033,930 for the same period in 2007, representing a 6% decrease.

Generally, these decreases can be attributed to the contract specific nature of

the Company's business. Management expected sales to be higher for the three and

six months ended December 31, 2008, however, anticipated shipments of products

under two engineering development contracts were delayed for reasons described

below.

For the three months ended December 31, 2008 and 2007 gross profits were

$625,930 and $1,682,585, respectively. Gross profit as a percentage of sales was

10.1% and 25.0%, for the three months ended December 31, 2008 and 2007,

respectively. For the six months ended December 31, 2008 and 2007 gross profits

were $1,777,205 and $3,031,695, respectively. Gross profit as a percentage of

sales was 14.5% and 23.3%, for the six months ended December 31, 2008 and 2007,

respectively. The primary factor in determining gross profit and net income is

product mix. The gross profits on mature products and build to print contracts

are higher as compared to products which are still in the engineering

development stage or in the early stages of production. In any given accounting

period the mix of product shipments between higher margin mature programs and

less mature programs, including loss contracts, has a significant impact on

gross profit and net income. The decreased gross profit and gross profit

percentage in the three and six months ended December 31, 2008, was primarily

the result of unexpected losses incurred on two programs with significant

engineering and production time required for design efforts. These two programs

experienced significant cost overruns in the current quarter due to extended

product qualification testing and difficulties moving the products from

engineering design into full production. Currently, one program has completed

qualification testing and has moved into full production. The other program is

still in qualification testing and has made significant progress towards

completion. Management is not anticipating any more losses on these two

contracts. Management continues to evaluate the Company's workforce to ensure

that production and overall execution of the backlog orders and additional

anticipated orders are successfully obtained and executed. Employment of full

time equivalents at December 31, 2008 was 171 compared to 175 people at December

31, 2007.

Selling, general and administrative expenses were $789,585 for the three months

ended December 31, 2008; an increase of $87,766, compared to the three months

ended December 31, 2007. Selling, general and administrative expenses were

10

$1,467,812 for six months ended December 31, 2008, an increase of $98,440

compared to the six months ended December 31, 2007. The increase for the three

and six months ended December 31, 2008, relates primarily to an increase in

salaries and an increase in legal and accounting fees.

Other income for the three and six months ended December 31, 2008 decreased as

compared to the three and six months ended December 31, 2007 due to decreased

interest income on the Company's cash and cash equivalents and short-term

investments. The Company does not believe that there is a significant risk

associated with its investment policy, since at December 31, 2008 all of the

investments were primarily represented by short-term liquid investments

including certificates of deposit and money market funds.

The effective income tax rate at December 31, 2008 and 2007 was 31.7% and 34.3%,

respectively. The effective tax rate is less than the statutory tax rate mainly

due to the benefit the Company receives on its Qualified Production Activities

and the benefit derived from the ESOP dividends paid on allocated shares.

Net (loss) income for the three months ended December 31, 2008, was $(42,412) or

$(.02) per share, both basic and diluted, compared to $797,086 or $.38 and $.37

per share, basic and diluted, respectively, for the three months ended December

31, 2007. Net income for the six months ended December 31, 2008, was $355,884 or

$.17 per share, both basic and diluted, compared to $1,388,669 or $.67 and $.65

per share, basic and diluted, for the six months ended December 31, 2007. The

decrease in net income per share was primarily due to the loss programs

explained above and decreased interest income.

Liquidity and Capital Resources

The Company's working capital is an appropriate indicator of the liquidity of

its business, and during the past three fiscal years, the Company, when

possible, has funded all of its operations with cash flows resulting from

operating activities and when necessary from its existing cash and investments.

The Company did not borrow any funds during the last three fiscal years.

The Company's working capital as of December 31, 2008 and 2007 was approximately

$23.8 million and $28.7 million, respectively. During the three months ended

December 31, 2008 and 2007 the Company repurchased 2,805 and 8,977 shares,

respectively, of its common stock for a total purchase price of $50,471 and

$200,905, respectively. Of the total purchases, 800 shares and 8,977 shares,

respectively, were purchased from the Company's Employee Retirement Plan and

Trust ("ESOP") for a purchase price of $14,400 and $200,905, respectively. All

remaining shares were purchased on the open market. During the six months ended

December 31, 2008 and 2007 the Company repurchased 5,549 and 25,720 shares,

respectively, of its common stock for a total purchase price of $102,510 and

$571,763, respectively. Of the total purchases, 800 shares and 25,720 shares,

respectively, were purchased from the Company's Employee Retirement Plan and

Trust ("ESOP") for a purchase price of $14,400 and $571,763, respectively. All

remaining shares were purchased on the open market. Under existing

authorizations from the Company's Board of Directors, as of December 31, 2008,

management is authorized to purchase an additional $1,897,489 million of Company

stock.

Six Months Ended December 31,

2008 2007

---------- -----------

Net cash provided by operating activities $ 929,576 $ 1,331,627

Net cash used in investing activities (2,402,735) (2,899,436)

Net cash used in financing activities (4,078,993) (964,821)

|

Net cash provided by operating activities fluctuates between periods primarily

as a result of differences in net income, the timing of the collection of

accounts receivable, purchase of inventory, level of sales and payment of

accounts payable. Net cash used in investing activities decreased in the first

half of fiscal 2009 due to more short-term investments maturing during the

period. The increase in cash used in financing activities and the reduction in

the Company's working capital is due primarily to dividends paid on common stock

which included a special dividend of $1.50 per share paid in December.

The Company currently believes that the cash flow generated from operations and

when necessary, from cash and cash equivalents, will be sufficient to meet its

long-term funding requirements for the foreseeable future.

11

During the six months ended December 31, 2008 and 2007, the Company expended

$185,801 and $292,436, respectively, for plant improvements and new equipment.

The Company has budgeted approximately $350,000 for new equipment and plant

improvements in fiscal 2009. Management anticipates that the funds required will

be available from current operations.

The Company at certain times enters into standby letters of credit agreements

with financial institutions primarily relating to the guarantee of future

performance on certain contracts. Contingent liabilities on outstanding standby

letters of credit agreements aggregated to zero at December 31, 2008 and

December 31, 2007.

CAUTIONARY STATEMENT FOR PURPOSES OF THE "SAFE HARBOR" PROVISIONS OF THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This report contains "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. The terms "believe,"

"anticipate," "intend," "goal," "expect," and similar expressions may identify

forward-looking statements. These forward-looking statements represent the

Company's current expectations or beliefs concerning future events. The matters

covered by these statements are subject to certain risks and uncertainties that

could cause actual results to differ materially from those set forth in the

forward-looking statements, including the Company's dependence on timely

development, introduction and customer acceptance of new products, the impact of

competition and price erosion, supply and manufacturing constraints, potential

new orders from customers and other risks and uncertainties. The foregoing list

should not be construed as exhaustive, and the Company disclaims any obligation

subsequently to revise any forward-looking statements to reflect events or

circumstances after the date of such statements or to reflect the occurrence of

anticipated or unanticipated events. The Company wishes to caution readers not

to place undue reliance on any such forward-looking statements, which speak only

as of the date made.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

The Company is a smaller reporting company as defined under Securities and

Exchange Commission Rule 12b-2. Pursuant to the exemption available to smaller

reporting company issuers under Item 305 of Regulation S-K, quantitative and

qualitative disclosures about market risk, the Company is not required to

provide the information for this item.

Item 4T. Controls and Procedures

(a) The Company's management, with the participation of the Company's chief

executive officer and chief financial officer, carried out an evaluation of the

effectiveness of our disclosure controls and procedures (as defined in Rule

13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934) as of the end

of the period covered by this Quarterly Report on Form 10-Q. Based on such

evaluation, our chief executive officer and chief financial officer have

concluded that our disclosure controls and procedures were effective as of the

end of the period covered by this report.

(b) There have been no changes in our internal controls over financial reporting

during the period covered by this report that have materially affected, or are

reasonably likely to materially affect, our internal controls over financial

reporting.

12

PART II: Other Information and Signatures

Item 1. Legal Proceedings

None

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

(a) None

(c) Securities Repurchased

Purchases of Equity Securities

Total Number Maximum Number

of Shares (or Approximate

Purchased Dollar Value)

as Part of of Shares

Total Average Publicly that May Yet

Number Price Announced Be Purchased

of Shares Paid Plan or Under the Plan

Period Purchased per Share Program or Program (1)

------------------------------------------------------------------------------------------

October 1 to

October 31, 2008 562 $18.6155 562 $1,937,499

November 1 to

November 30, 2008 1,443 $17.7197 1,443 $1,911,929

December 1 to

December 31, 2008 800 $18.0500 800 $1,897,489

|

(1) Pursuant to a prior Board of Directors authorization, as of

December 31, 2008 the Company can repurchase up to $1,897,489 of

its common stock pursuant to an ongoing plan.

Item 3 Defaults Upon Senior Securities

None

Item 4. Submission of Matters to a Vote of Security Holders

(a) The Company's Annual Meeting of Shareholders (the "Annual

Meeting") was held on November 21, 2008.

(b) Paul Corr and Michael Wool were re-elected as Class C

directors each to serve for a three-year term. Continuing as

directors after the Annual Meeting were:

Class A (term expiring 2009): Howard Pinsley

Alvin Sabo

Carl Helmetag

Class B (term expiring 2010): Barry Pinsley

Seymour Saslow

Class C (term expiring 2011): Paul J. Corr

Michael W. Wool

|

13

(c) The following matters were voted upon at the annual meeting:

The election of two Class C directors. The votes were cast as

follows:

Nominee: Voted For: Voted Against or Withheld: Broker Non-Votes:

------- --------- ------------------------- ----------------

Paul Corr 2,268,817 21,367 0

Michael Wool 1,773,524 516,660 0

|

Ratification of Rotenberg & Company LLP, as independent

auditors for the Corporation for the fiscal year ending June

30, 2009. The votes were cast as follows:

Shares in favor 2,258,201

Shares against 31,056

Abstentions 926

Broker non-votes 0

Item 5. Other Information

None

Item 6. Exhibits

31.1 Certification of the Chief Executive Officer pursuant

to Rules 13a-14(a) and 15d-14(a) under the Securities

Exchange Act of 1934, as adopted pursuant to Section

302 of the Sarbanes-Oxley Act of 2002

31.2 Certification of the Principal Financial Officer

pursuant to Rules 13a-14(a) and 15d-14(a) under the

Securities Exchange Act of 1934, as adopted pursuant

to Section 302 of the Sarbanes-Oxley Act of 2002

32.1 Certification of the Chief Executive Officer pursuant

to 18 U.S.C. Section 1350, as adopted pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002

32.2 Certification of the Principal Financial Officer

pursuant to 18 U.S.C. Section 1350, as adopted

pursuant to Section 906 of the Sarbanes-Oxley Act of

2002

|

S I G N A T U R E S

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

ESPEY MFG. & ELECTRONICS CORP.

/s/ Howard Pinsley

-----------------------------

Howard Pinsley, President and

Chief Executive Officer

/s/ David O'Neil

-----------------------------

David O'Neil, Treasurer and

Principal Financial Officer

February 12, 2009

-----------------

Date

|

14

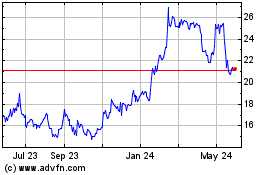

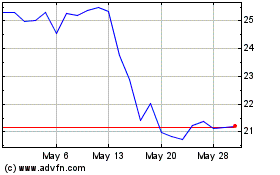

Espey Manufacturing and ... (AMEX:ESP)

Historical Stock Chart

From May 2024 to Jun 2024

Espey Manufacturing and ... (AMEX:ESP)

Historical Stock Chart

From Jun 2023 to Jun 2024