false

2024

FY

--06-30

0001488917

P15Y

P40Y0M0D

P15Y0M0D

P20Y0M0D

P3Y0M0D

P10Y0M0D

P3Y

P7Y0M0D

P3Y

P15Y

P12Y

2023-12-13

0

0

2025-12-18

3000000

275000

P3Y0M0D

P1Y11M26D

P2Y7M2D

P6Y

P6Y

P5Y4M6D

P5Y4M6D

P4Y10M25D

P6Y4M24D

P4Y8M5D

P6Y4M24D

P3Y

1692000

708000

P1Y1M6D

P1Y6M0D

P21Y0M0D

0001488917

2023-07-01

2024-06-30

0001488917

2023-12-31

0001488917

2024-08-20

0001488917

2024-06-30

0001488917

2023-06-30

0001488917

2022-07-01

2023-06-30

0001488917

us-gaap:CommonStockMember

2022-06-30

0001488917

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001488917

us-gaap:RetainedEarningsMember

2022-06-30

0001488917

2022-06-30

0001488917

us-gaap:CommonStockMember

2023-06-30

0001488917

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001488917

us-gaap:RetainedEarningsMember

2023-06-30

0001488917

us-gaap:CommonStockMember

2022-07-01

2023-06-30

0001488917

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2023-06-30

0001488917

us-gaap:RetainedEarningsMember

2022-07-01

2023-06-30

0001488917

us-gaap:CommonStockMember

2023-07-01

2024-06-30

0001488917

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2024-06-30

0001488917

us-gaap:RetainedEarningsMember

2023-07-01

2024-06-30

0001488917

us-gaap:CommonStockMember

2024-06-30

0001488917

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0001488917

us-gaap:RetainedEarningsMember

2024-06-30

0001488917

elmd:InternationalMember

2023-07-01

2024-06-30

0001488917

elmd:InternationalMember

2022-07-01

2023-06-30

0001488917

us-gaap:ShippingAndHandlingMember

2023-07-01

2024-06-30

0001488917

us-gaap:ShippingAndHandlingMember

2022-07-01

2023-06-30

0001488917

elmd:HomeCareMember

2023-07-01

2024-06-30

0001488917

elmd:HomeCareMember

2022-07-01

2023-06-30

0001488917

elmd:HospitalMember

2023-07-01

2024-06-30

0001488917

elmd:HospitalMember

2022-07-01

2023-06-30

0001488917

elmd:HomeCareDistributorMember

2023-07-01

2024-06-30

0001488917

elmd:HomeCareDistributorMember

2022-07-01

2023-06-30

0001488917

elmd:OtherMember

2023-07-01

2024-06-30

0001488917

elmd:OtherMember

2022-07-01

2023-06-30

0001488917

elmd:HomeCareMember

elmd:CommercialMember

2023-07-01

2024-06-30

0001488917

elmd:HomeCareMember

elmd:CommercialMember

2022-07-01

2023-06-30

0001488917

elmd:HomeCareMember

elmd:MedicareMember

2023-07-01

2024-06-30

0001488917

elmd:HomeCareMember

elmd:MedicareMember

2022-07-01

2023-06-30

0001488917

elmd:HomeCareMember

elmd:MedicareSupplementalMember

2023-07-01

2024-06-30

0001488917

elmd:HomeCareMember

elmd:MedicareSupplementalMember

2022-07-01

2023-06-30

0001488917

elmd:HomeCareMember

elmd:MedicaidMember

2023-07-01

2024-06-30

0001488917

elmd:HomeCareMember

elmd:MedicaidMember

2022-07-01

2023-06-30

0001488917

elmd:HomeCareMember

elmd:OtherMember

2023-07-01

2024-06-30

0001488917

elmd:HomeCareMember

elmd:OtherMember

2022-07-01

2023-06-30

0001488917

us-gaap:BuildingAndBuildingImprovementsMember

srt:MinimumMember

2024-06-30

0001488917

us-gaap:BuildingAndBuildingImprovementsMember

srt:MaximumMember

2024-06-30

0001488917

us-gaap:BuildingAndBuildingImprovementsMember

2024-06-30

0001488917

us-gaap:BuildingAndBuildingImprovementsMember

2023-06-30

0001488917

us-gaap:LandMember

2024-06-30

0001488917

us-gaap:LandMember

2023-06-30

0001488917

us-gaap:LandImprovementsMember

srt:MinimumMember

2024-06-30

0001488917

us-gaap:LandImprovementsMember

srt:MaximumMember

2024-06-30

0001488917

us-gaap:LandImprovementsMember

2024-06-30

0001488917

us-gaap:LandImprovementsMember

2023-06-30

0001488917

us-gaap:EquipmentMember

srt:MinimumMember

2024-06-30

0001488917

us-gaap:EquipmentMember

srt:MaximumMember

2024-06-30

0001488917

us-gaap:EquipmentMember

2024-06-30

0001488917

us-gaap:EquipmentMember

2023-06-30

0001488917

elmd:SoftwareMember

srt:MinimumMember

2024-06-30

0001488917

elmd:SoftwareMember

srt:MaximumMember

2024-06-30

0001488917

elmd:SoftwareMember

2024-06-30

0001488917

elmd:SoftwareMember

2023-06-30

0001488917

elmd:DemonstrationAndRentalEquipmentMember

2024-06-30

0001488917

elmd:DemonstrationAndRentalEquipmentMember

2023-06-30

0001488917

us-gaap:ConstructionInProgressMember

2024-06-30

0001488917

us-gaap:ConstructionInProgressMember

2023-06-30

0001488917

us-gaap:PatentsMember

2024-06-30

0001488917

us-gaap:TrademarksMember

2024-06-30

0001488917

us-gaap:RevolvingCreditFacilityMember

2023-07-01

2024-06-30

0001488917

us-gaap:RevolvingCreditFacilityMember

2024-06-30

0001488917

us-gaap:RevolvingCreditFacilityMember

2023-06-30

0001488917

us-gaap:RevolvingCreditFacilityMember

us-gaap:PrimeRateMember

2024-06-30

0001488917

elmd:CapitalStockMember

2024-06-30

0001488917

elmd:AuthorizedSharesUndesignatedStockMember

2024-06-30

0001488917

srt:BoardOfDirectorsChairmanMember

2021-05-26

0001488917

srt:MaximumMember

2023-07-01

2024-06-30

0001488917

srt:MinimumMember

2023-07-01

2024-06-30

0001488917

srt:WeightedAverageMember

2023-07-01

2024-06-30

0001488917

elmd:CurrentPlanMember

2024-06-30

0001488917

elmd:PriorPlansMember

2024-06-30

0001488917

elmd:CurrentPlanMember

2023-06-30

0001488917

us-gaap:RestrictedStockMember

elmd:EmployeeMember

2023-07-01

2024-06-30

0001488917

us-gaap:RestrictedStockMember

elmd:EmployeeMember

2022-07-01

2023-06-30

0001488917

us-gaap:EmployeeStockOptionMember

elmd:EmployeeMember

2023-07-01

2024-06-30

0001488917

us-gaap:RestrictedStockMember

2023-07-01

2024-06-30

0001488917

us-gaap:RestrictedStockMember

2022-07-01

2023-06-30

0001488917

us-gaap:RestrictedStockMember

elmd:DirectorsMember

2023-07-01

2024-06-30

0001488917

us-gaap:RestrictedStockMember

elmd:DirectorsMember

2022-07-01

2023-06-30

0001488917

us-gaap:RestrictedStockUnitsRSUMember

2023-07-01

2024-06-30

0001488917

us-gaap:RestrictedStockUnitsRSUMember

2024-06-30

0001488917

us-gaap:EmployeeStockOptionMember

2022-06-30

0001488917

us-gaap:EmployeeStockOptionMember

2022-07-01

2023-06-30

0001488917

us-gaap:EmployeeStockOptionMember

2023-06-30

0001488917

us-gaap:EmployeeStockOptionMember

2023-07-01

2024-06-30

0001488917

us-gaap:EmployeeStockOptionMember

2024-06-30

0001488917

us-gaap:RestrictedStockMember

2022-06-30

0001488917

us-gaap:RestrictedStockMember

2023-06-30

0001488917

us-gaap:RestrictedStockMember

2024-06-30

0001488917

us-gaap:StateAndLocalJurisdictionMember

2024-06-30

0001488917

us-gaap:StateAndLocalJurisdictionMember

2023-06-30

0001488917

elmd:OfficeAndWarehouseSpaceMember

srt:MinimumMember

2023-07-01

2024-06-30

0001488917

elmd:OfficeAndWarehouseSpaceMember

srt:MaximumMember

2023-07-01

2024-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

| (Mark

One) |

|

| ☑ |

Annual

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For

the Fiscal Year Ended June 30, 2024

or

|

|

| ☐ |

Transition

Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Transition Period From ________ to ________. |

| |

Commission

File number 001-34839

| Electromed,

Inc. |

| (Exact

Name of Registrant as Specified in its Charter) |

| Minnesota |

|

41-1732920 |

| (State or other jurisdiction of |

|

(IRS Employer |

| incorporation or organization) |

|

Identification No.) |

500

Sixth Avenue NW, New Prague, MN 56071

| |

(Address

of principal executive offices, including zip code) |

|

| (952)

758-9299 |

| (Registrant’s

telephone number, including area code) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.01 per share |

|

ELMD |

|

NYSE

American LLC |

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

No ☑

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☑

Indicate by check mark

whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”,

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☑

|

Smaller reporting company ☑

Emerging

growth company ☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the

registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The

aggregate market value of the common stock held by non-affiliates of the registrant as of December 31, 2023 was approximately

$83,862,301 based upon the closing price of the registrant’s common stock, as reported on the NYSE American, on such date.

There

were 8,638,917 shares of the registrant’s common stock outstanding as of August 20, 2024.

DOCUMENTS

INCORPORATED BY REFERENCE

Portions

of the Definitive Proxy Statement for the registrant’s annual meeting of shareholders, to be filed within 120 days of June

30, 2024, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Electromed,

Inc.

Index

to Annual Report on Form 10-K

INFORMATION

REGARDING FORWARD-LOOKING STATEMENTS

Statements

contained in this Annual Report on Form 10-K that are not statements of historical fact should be considered forward-looking statements

within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward- looking statements include, but are

not limited to, statements regarding: our business strategy, including our intended level of investment in research and development

and marketing activities; our expectations with respect to earnings, gross margins and sales growth, industry relationships, marketing

strategies and international sales; estimated sizes of markets into which our products are or may be sold; our business strengths

and competitive advantages; our ability to grow additional sales distribution channels; our intent to retain any earnings for

use in operations rather than paying dividends; our expectation that our products will continue to qualify for reimbursement and

payment under government and private insurance programs; our intellectual property plans and practices; the expected impact of

applicable regulations on our business; our beliefs about our manufacturing processes; our expectations and beliefs with respect

to our employees and our relationships with them; our belief that our current facilities are adequate to support our growth plans;

our expectations with respect to ongoing compliance with the terms of our credit facility; our expectations regarding the ongoing

availability of credit and our ability to renew our line of credit; enhancements to our products and services; expected excise

tax exemption for the SmartVest System; and our anticipated revenues, expenses, capital requirements and liquidity. Words such

as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “ongoing,” “plan,” “potential,” “project,”

“goal,” “target,” “should,” “will,” “would,” and similar expressions,

including the negative of these terms, are intended to identify forward-looking statements but are not the exclusive means of

identifying such statements. Although we believe these forward-looking statements are reasonable, they involve risks and uncertainties

that may cause actual results to differ materially from those projected by such statements. Such statements involve known and

unknown risks, uncertainties and other factors that may cause our actual results or our industry’s actual results, levels

of activity, performance, or achievements to be materially different from the information expressed or implied by the forward-looking

statements.

Factors

that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited

to, the following:

| ● | ability

to obtain reimbursement from Medicare, Medicaid, or private insurance payers for our

products; |

| ● | component

or raw material shortages, changes to lead times or significant price increases; |

| ● | adverse

changes to state and federal health care regulations; |

| ● | our

ability to maintain regulatory compliance and to gain future regulatory approvals and

clearances; |

| ● | entry

of new competitors including new drug or pharmaceutical discoveries; |

| ● | adverse

economic and business conditions or intense competition; |

| ● | wage

and component price inflation; |

| ● | technical

problems with our research and products; |

| ● | the

risks associated with cyberattacks, data breaches, computer viruses and other similar

security threats; |

| ● | changes

affecting the medical device industry; |

| ● | our

ability to develop new sales channels for our products such as the homecare distributor

channel; |

| ● | adverse

international health care regulation impacting current international business; |

| ● | our

ability to renew our line of credit or obtain additional credit as necessary; and |

| ● | our

ability to protect and expand our intellectual property portfolio. |

This

list of factors is not exhaustive, however, and these or other factors, many of which are outside of our control, could have a

material adverse effect on us and the results of our operations. Therefore, you should consider these risk factors with caution

and form your own critical and independent conclusions about the likely effect of these risk factors on our future performance.

Forward-looking statements speak only as of the date on which the statements are made, and we undertake no obligation, and expressly

disclaim any such obligation, to update any forward-looking statement for any reason other than as required by law, even if new

information becomes available or other events occur in the future. You should carefully review the disclosures and the risk factors

described in this and other documents we file from time to time with the Securities and Exchange Commission (the “SEC”).

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by

the cautionary statements set forth herein.

PART

I

Item

1. Business.

Overview

Electromed,

Inc. (“we,” “our,” “us,” “Electromed” or the “Company”) develops,

manufactures, markets and sells innovative products that provide airway clearance therapy, including the SmartVest®

Airway Clearance System (“SmartVest System”) to patients with compromised pulmonary function with a commitment to

excellence and compassionate service. Our goal is to make High Frequency Chest Wall Oscillation (“HFCWO”) treatments

as effective, convenient, and comfortable as possible, so our patients can breathe easier and live better with improved respiratory

function and fewer exacerbations.

We

primarily employ a direct-to-patient and provider model, through which we obtain patient referrals from clinicians, manage insurance

claims on behalf of our patients, and deliver the SmartVest System to patients, training them on proper use in their homes. This

model allows us to directly approach patients and clinicians, whereby we disintermediate the traditional durable medical equipment

(“DME”) channel and capture both the manufacturer and distributor margins. We also sell our products in the acute

care setting for patients in a post-surgical or intensive care unit, or who were admitted for a lung infection brought on by compromised

airway clearance. Electromed was incorporated in Minnesota in 1992. Our common stock is listed on the NYSE American under the

ticker symbol “ELMD.”

The

SmartVest System generates HFCWO, an airway clearance therapy. The SmartVest System features a programmable air pulse generator,

a therapy garment worn over the upper body and a connecting hose, which together provide safe, comfortable, and effective therapy

to clear the lung and airway from retained secretions and mucus which can harbor bacteria and lead to infection. One important

factor of respiratory health is the ability to clear secretions from airways. Impaired airway clearance, when mucus cannot be

expectorated, may result in labored breathing, inflammatory response and/or immune systems boosting mucus production that invites

bacteria trapped in stagnant secretions to cause infections. Studies show that HFCWO therapy is as effective an airway clearance

method for patients who have compromised pulmonary function as traditional chest physical therapy (“CPT”) administered

by a respiratory therapist.1 However, HFCWO can be self-administered, relieving a caregiver of participation in the

therapy, and eliminating the attendant cost of an in-home care provider. We believe that HFCWO treatments are cost-effective primarily

because they reduce a patient’s risk of respiratory infections and other secondary complications that are associated with

impaired airway clearance and often result in costly hospital visits and repeated antibiotic use.

The

SmartVest System is designed for patient comfort and ease of use which promotes adherence to prescribed treatment schedules, leading

to improved airway clearance, patient outcomes and quality of life, and a reduction in healthcare utilization. We offer a broad

range of garments, referred to as vests and wraps, in sizes for children and adults that allow for a tailored fit. User-friendly

controls allow patients to administer their daily therapy with minimal or no assistance. Our direct product support services provide

patient and clinician education, training, and follow-up to ensure that the product is integrated into each patient’s daily

treatment regimen. Additionally, our reimbursement department works on behalf of the patient by processing their physician paperwork,

providing clinical support and billing the applicable insurance provider. We believe that the advantages of the SmartVest System

and the Company’s customer services to the patient include:

| ● | improved

quality of life; |

| ● | reduction

in healthcare utilization; |

| ● | independence

from a dedicated caregiver; |

| ● | consistent

treatments at home; |

| ● | improved

comfort during therapy; and |

| ● | eligibility

for reimbursement by private insurance, federal or state government programs or combinations

of the foregoing. |

1Nicolini

A, et al. Effectiveness of treatment with high-frequency chest wall oscillation in patients with bronchiectasis. BMC Pulmonary

Medicine. 2013;13(21).

Our

Products

Since

2000, we have marketed the SmartVest System and its predecessor products to patients suffering from bronchiectasis, cystic fibrosis,

and neuromuscular conditions such as cerebral palsy and amyotrophic lateral sclerosis (“ALS”). Our products are sold

into the home health care market and the acute care setting for patients in a post-surgical or intensive care unit, or who were

admitted for a lung infection brought on by compromised airway clearance. Accordingly, our sales points of contact include adult

pulmonology clinics, cystic fibrosis centers, neuromuscular clinics and hospitals.

We

have received clearance from the U.S. Food and Drug Administration (“FDA”) to market the SmartVest System to promote

airway clearance and improve bronchial drainage. In addition, Electromed is approved for HFCWO device sales in other, select international

countries. The SmartVest System is available only with a physician’s prescription.

The

SmartVest System is currently available in two models, The SmartVest SQL® and SmartVest Clearway®–

which are sold into homecare and hospital markets. In November 2022, we announced the introduction of SmartVest Clearway®,

our next generation HFCWO system designed around an enhanced patient experience and modern design. We will continue to support

and service earlier SmartVest models pursuant to the applicable product warranty. As part of our growth strategies, we evaluate

opportunities involving products and services, especially those that may provide value to the respiratory homecare and hospital

market.

The

SmartVest Clearway System

The

SmartVest Clearway System consists of an inflatable therapy garment, a programmable air pulse generator and a patented single-hose

that delivers air pulses from the generator to the garment to create oscillatory pressure on the chest wall. The SmartVest Clearway

is designed for maximum comfort and lifestyle convenience, so patients can readily fit therapy into their daily routines. The

SmartVest Clearway was designed with patient experience in mind, continuing our history of offering the smallest, lightest weight

generator on the market and featuring an intuitive touch screen to simplify use. The enhanced features make it easier to use and

enable greater patient freedom in completing therapy.

| ● | 360°

oscillation coverage and patented Soft Start(R) technology: All SmartVest

garments provide 360° oscillation coverage, which delivers simultaneous treatment

to all lobes of the lungs. The oscillatory squeeze-and-release technology delivers therapeutic

pressure to the chest wall to loosen, sheer and propel mucus into the upper airways where

it can be more easily expectorated. Our patented Soft Start technology gently inflates

the garment to better acclimate the patient to therapy. |

| ● | Open

system design with Breathing RoomTM: The active inflate – active

deflate mechanism of the SmartVest System enables patients to take deep breaths during

therapy without feeling restricted, providing patients with a more comfortable treatment

experience. |

| ● | Programmable

generator with user-friendly device operation: The SmartVest Clearway introduces

an intuitive touchscreen with single touch start. The improved user interface enhances

device programming and simplifies everyday use. The system features multiple operating

modes, including ramp, favorite settings designations, and options for saving, locking

and restoring protocols. An enhanced pause feature allows the physician to program dedicated

times for the patient to clear secretions during therapy. |

| ● | Patented

single-hose design: A single-hose delivers oscillations to the SmartVest garment,

which we believe provides therapy in a more comfortable and unobtrusive manner than a

two-hose system. Oscillations are delivered evenly from the base of the SmartVest garment,

extending the forces upward and inward in strong but smooth cycles surrounding the chest. |

| ● | Soft-fabric

garment is lightweight and comfortable: The SmartVest garment is the lightest HFCWO

garment available and is designed to resemble an article of clothing. The garment’s

design takes weight off of the patient’s shoulders and torso, enhancing the therapy

experience. Quick fit Velcro®-like closures allow for a secure, comfortable

fit without bulky straps and buckles. The simple design creates a broad size adjustment

range to ensure a properly tailored fit to accommodate pediatric and adult patients. |

| ● | Smaller

and lighter: SmartVest Clearway is the smallest and lightest HFCWO generator on the

market, weighing less than 14 pounds. The lightweight design, ergonomic carrying handle

and compact storage case make it easier for patients to move throughout their home as

well as store and integrate HFCWO therapy into their daily lives. |

Other

Products

We

market the Single Patient Use (“SPU”) SmartVest and SmartVest Wrap® to health care providers in the

acute care setting. Hospitals issue the SPU SmartVest or SmartVest Wrap to an individual patient for managing airway clearance

while inpatient. Both SPU products provide full coverage oscillation and facilitate continuity of care when the SmartVest System

is prescribed for patients with a chronic condition upon discharge for use in the home.

Our

Market

We

estimate the U.S. market for HFCWO was approximately $235 million in 2023 growing at an 8% compound annual growth rate based on

independent third-party market research15. We believe the market for HFCWO is under recognized and underdiagnosed and

is continuing to expand due to an aging population, higher incidence of chronic lung disease, growing awareness by physicians

of diseases and conditions for which patients can benefit from using HFCWO therapy, and treatments moving to lower cost homecare

settings. Indications for when HFCWO may be prescribed are not specific to any one disease. A physician may elect to prescribe

HFCWO when they believe the patient will benefit from improved airway clearance and external chest manipulation as the best treatment

to enhance mucus transport and improve bronchial drainage.

The

SmartVest System is primarily prescribed for patients with bronchiectasis, cystic fibrosis, and neuromuscular conditions such

as cerebral palsy and ALS. We believe that bronchiectasis represents the fastest growing diagnostic category and greatest potential

for HFCWO growth in the United States growing at 12% annually in recent years 15. Bronchiectasis is an irreversible,

chronic lung condition characterized by enlarged and permanently damaged bronchi. The condition is associated with recurrent lower

respiratory infections, inflammation, reduction in pulmonary function, impaired respiratory secretion clearance, increased hospitalizations

and medication use, and increased morbidity and mortality.

We

are driven to make life’s important moments possible, one breath at a time, by leading the HFCWO therapy market in clinical

evidence that supports the therapeutic imperative of clearing excess mucus from the lungs. Electromed continues to add to the

body of evidence in support of HFCWO with multiple published clinical outcome studies demonstrating a significant improvement

in quality of life and reduction in exacerbation rates, hospitalizations, emergency department visits, and antibiotic prescriptions

in bronchiectasis patients using the SmartVest System. This includes a 2022 publication in the American Journal of Respiratory

and Critical Care Medicine reviewing outcomes among non-cystic fibrosis bronchiectasis patients with HFCWO Therapy2-6.

In addition, we designed and ran a quality-of-life study for COPD patients using SmartVest, which was shared at the 2023 American

Thoracic Society International Conference and published in American Journal of Respiratory and Critical Care Medicine. The study’s

results demonstrated statistically significant favorable responses to HFCWO as add on therapy for patients with a primary diagnosis

of COPD. We have also shared data from our bronchiectasis quality of life trial at the 2023 World Bronchiectasis and NTM

Conference, highlighting the effects of HFCWO with SmartVest on clinical symptoms of patients with bronchiectasis. Generating

additional clinical evidence to further support the SmartVest System as a preferred treatment for bronchiectasis patients

will remain a focus in the fiscal year ended June 30, 2025 (“fiscal 2025”).

We

believe that bronchiectasis is underrecognized and under-diagnosed but is experiencing a surge in clinical interest and awareness,

including the relationship to COPD, commonly referred to as bronchiectasis COPD overlap syndrome. The overlap of bronchiectasis

and COPD increases exacerbations and hospitalizations, reduces pulmonary function, and increases mortality. Several recent studies

have estimated prevalence of bronchiectasis, which we believe are helpful for estimating a range of the overall market size.

| ● | Weycker

(2017) projected 4.2 million adults in the United States over the age of 40 may have

bronchiectasis, suggesting there is a large pool of patients with undiagnosed disease.7 |

| ● | Henkle

(2018) confirmed a high prevalence of bronchiectasis in the United States, identifying

over 600,000 unique patients with at least one bronchiectasis claim (ICD-9 claims 494.0

or 494.1). The study also observed that patients with dual diagnosis of bronchiectasis

and COPD were in poorer health, with more office visits, more inpatient admissions and

more acute respiratory infections.8 |

| ● | Seitz

(2012) estimated that 190,000 unique cases of bronchiectasis were diagnosed in Medicare

patients in 2007 and bronchiectasis prevalence increased 8.7% annually between 2000 and

2007.9 Based on historic growth in prevalence and assuming a constant growth

rate, the estimated number of bronchiectasis diagnoses in Medicare patients in 2021 exceeded

608,000. |

| ● | Aksamit

(2017) found 20% (n=350) of patients with bronchiectasis enrolled in the U.S. Bronchiectasis

Research Registry between 2008 and 2014 also had COPD and 29% (n=515) also had asthma.7

Other studies have found that the overlap between bronchiectasis and COPD is observed

in 27% to 57% of patients with COPD. 10-13–8 |

| ● | Chalmers

(2017) found that prevalence of bronchiectasis in patients with COPD ranged from a low

of 4% to as high as 69% with mean prevalence of 54%. In many studies in patients with

COPD, the presence of bronchiectasis was associated with reduced lung function, greater

sputum production, more frequent exacerbations and increased mortality versus those with

COPD alone.14 |

These

studies indicate a wide range of potential prevalence of bronchiectasis patients in the United States. We also believe that it

is difficult to estimate from these studies which patients will need or benefit from HFCWO. Internal company estimates derived

from a 2023 analysis of claims data indicate a 15% penetration of HFCWO within the 824,000 diagnosed Bronchiectasis population

(see Figure 1 below). We believe that bronchiectasis is underdiagnosed in the U.S. based on clinical study and epidemiology evidence

with an even greater number of patients that could potentially benefit from diagnosis and treatment. We believe that HFCWO is

under prescribed for bronchiectasis patients resulting in a large, underpenetrated US market opportunity and growth potential

for HFCWO therapy.

2Sievert

C, et al. Using High Frequency Chest Wall Oscillation in a Bronchiectasis Patient Population: An Outcomes-Based Case Review. Respiratory

Therapy Journal. 2016;11(4): 34–38.

3Sievert

C, et al. Cost-Effective Analysis of Using High Frequency Chest Wall Oscillation (HFCWO) in Patients with Non-Cystic Fibrosis

Bronchiectasis. Respiratory Therapy Journal. 2017;12(1): 45–49.

4Sievert

C, et al. Incidence of Bronchiectasis-Related Exacerbation Rates After High Frequency Chest Wall Oscillation (HFCWO) Treatment

— A Longitudinal Outcome-Based Study. Respiratory Therapy Journal. 2018;13(2): 38–41.

5Powner

J, et al. Employment of an algorithm of care including chest physiotherapy results in reduced hospitalizations and stability

of lung function in bronchiectasis. BMC Pulmonary Medicine. 2019;19(82).

6

DeKoven M, Mandia K, DeFabis N, Chen J, Ruscio A. Patient Characteristics, Healthcare Resource Utilization And Outcomes

Among Non-Cystic Fibrosis Bronchiectasis Patients With High Frequency Chest Wall Oscillation (HFCWO) Therapy. American Journal

of Respiratory and Critical Care Medicine. 2022. Vol 205:A3090

7Weycker

D, Hansen G, Seifer F. Prevalence and incidence of noncystic fibrosis bronchiectasis among US adults in 2013. Chronic Respiratory

Disease. 2017; 14(4):377-384.

8Henkle

E, et al. Characteristics and Health-care Utilization History of Patients with Bronchiectasis in US Medicare Enrollees With Prescription

Drug Plans, 2006 to 2014. Chest. 2018;154(6), 1311–1320.

9Seitz

A, et al. Trends in Bronchiectasis Among Medicare Beneficiaries in the United States, 2000 to 2007. Chest. 2012;142(2),

432–439.

10Aksamit

T, et al. Bronchiectasis Research Registry C. Adult Patients With Bronchiectasis: A First Look at the US Bronchiectasis Research

Registry. Chest. 2017;151:982-92.

11Patel

I.S., et al. Bronchiectasis, exacerbation indices, and inflammation in chronic obstructive pulmonary disease. Am J Respir Crit

Care Med. 2004;170:400-7.

12O’Brien

C, et al. Physiological and radiological characterization of patients diagnosed with chronic obstructive pulmonary disease in

primary care. Thorax. 2000;55:635-42.

13Bafadhel

M, et al. The role of CT scanning in multidimensional phenotyping of COPD. Chest. 2011;140:634-42.

14Chalmers

J. and Sethi S. Raising awareness of bronchiectasis in primary care: overview of diagnosis and management strategies in adults.

NPJ Prim Care Respir Med. 2017;27:18.

15

Internal company estimates derived from VGM claims database

16

M. Bruner, C. Bazan, B. Liu, C. Marion, K.S. Skarvan, L. Edwards, G. Solomon. Effects of High Frequency Chest Wall Oscillation

(HFCWO) on Clinical Symptoms in COPD. American Journal of Respiratory and Critical Care Medicine. 2023. Vol 207:C96

17

C. Cheng, M. Bruner, C. Bazan, B. Liu, C. Marion, L. Edwards, G. Solomon. Effects of High Frequency Chest Wall Oscillation

(HFCWO) on Quality of Life in Bronchiectasis. 6th World Bronchiectasis & NTM Conference. 2023. Poster Abstract 310-B

18

Internal company estimates derived from Guidehouse 2023 literature review and 2023 CDC NHANES data

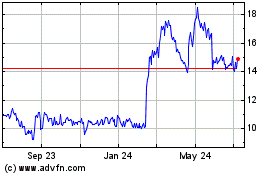

Estimated

HFCWO Market Opportunity - Bronchiectasis Patients (U.S.) – Figure 1

The

heightened awareness of bronchiectasis speaks to the growing body of clinical evidence supporting treatments to improve symptoms

and manage disease progression.

| ● | In

2019, an observational comparative retrospective cohort study published in BMC Pulmonary

Medicine evaluated the efficacy of a treatment algorithm in 65 patients with radiographic

and symptom confirmed bronchiectasis, centered on initiation of HFCWO therapy with the

SmartVest System.5 Patients were treated per the algorithm if they reported

greater than two exacerbations in the previous year and symptoms, including chronic cough,

sputum production, or dyspnea. Results show that at one-year: exacerbations requiring

hospitalization and antibiotic use were significantly reduced and mean forced expiratory

volume remained stable post enrollment, suggesting early initiation of HFCWO therapy

with SmartVest may slow the otherwise normal progression of the disease. |

| ● | In

2022, the American Journal of Respiratory and Crucial Care Medicine published the results

of a third-party retrospective cohort analysis of 101 qualifying NCFBE patients who received

HFCWO. Key findings revealed that patients who used HFCWO therapy experienced improved

health outcomes, a reduction in healthcare resource utilization and reduction in medication

usage.6 |

Marketing,

Sales and Distribution

Our

sales and marketing efforts are focused on driving adoption of our products and services with physicians, clinicians, patients,

and third-party payers and building market awareness to the benefits of HFCWO for treatment of bronchiectasis. Because the sale

of the SmartVest System requires a physician’s prescription, we market to physicians and health care providers as well as

directly to patients. Most of our revenue comes from domestic homecare sales through a physician referral model. We have established

our own domestic sales force and support network, which we believe is able to provide superior education, support, and training

to our customers.

Our

direct U.S. sales force works with physicians and clinicians, primarily pulmonologists, in defined territories to help them understand

our products and services and the value they provide to their respective patients. As of June 30, 2024, we had 62 field sales

employees, including six regional sales managers, 53 clinical area managers (“CAMs”) and three clinical educators.

We also have developed a network of approximately 170 respiratory therapists across the U.S. to assist with in-home SmartVest

System patient training on a non-exclusive, independent contractor basis. These independent contractors are credentialed by the

National Board for Respiratory Care as either Certified Respiratory Therapists or Registered Respiratory Therapists and provide

national coverage to an internal team of Registered Respiratory Therapists dedicated to supporting SmartVest patients. Additionally,

Electromed employs a team of reimbursement specialists dedicated to managing insurance and payer relations and supporting prescribers

and patients in navigating financial considerations. The availability of reimbursement is an important consideration for health

care professionals and patients. Because our product has an assigned Healthcare Common Procedure Coding System (“HCPCS”)

code, a claim can be billed for reimbursement using that code. We must demonstrate the effectiveness of our products to public

and private insurance providers. The availability of reimbursement exists primarily due to an established HCPCS code for HFCWO.

A HCPCS code is assigned to services and products by the Centers for Medicare and Medicaid Services (“CMS”).

Of

the $54.2 million of our revenue derived from the U.S. in fiscal 2024, approximately 94.7% represented homecare, inclusive of

homecare distributor sales, and 4.7% represented hospital sales. We expect to achieve future sales, earnings, and overall market

share growth through a continued focus on product innovation, differentiation and improved patient experiences and outcomes in

the homecare market. We believe that our position in the market, direct sales team and a dedication to advancing education on

HFCWO awareness positions us to drive market awareness and growth to the benefits of HFCWO in treatment of bronchiectasis. We

believe that dedicated service to our providers and patients is a key component of achieving future sales. Providers seek companies

that are easy to work with, are responsive and care for their patients as an extension of their practices.

We

generate sales interest through multiple channels that include visits to pulmonology clinics and medical centers, participation

in medical conferences, maintenance of industry contacts to increase the visibility and acceptance of our products by physicians

and health care professionals, support of industry through the COPD Foundation, as well as through a focus on increasing patients

by word of mouth and traffic to our website and social media channels. We continue to evaluate opportunities to offer the SmartVest

System through selected Home Medical Equipment (“HME”) distributors. We maintain agreements with a limited number

of HME distributors to distribute and sell the SmartVest System in the United States homecare market. We expect to continue our

direct sales channel as our primary homecare revenue source.

Approximately

1.0% of our net revenues were from sales outside of the U.S. in both of our fiscal 2024 and our fiscal year ended June 30, 2023

(“fiscal 2023”), respectively. We sell our products outside of the U.S. primarily through independent distributors

specializing in respiratory products. Through June 30, 2024, most of our distributors operated in exclusive territories. Our principal

distributors are located in Europe, the Arab states of the Persian Gulf, Southeast Asia, and Central America. Units are sold at

a fixed contract price with payments made directly from the distributor, rather than being tied to reimbursement rates of a patient’s

insurance provider as is the case for domestic sales. Our sales strategy outside of the U.S. is to support our current distributors

with less emphasis on contracting with new distributors.

Third-Party

Reimbursement

In

the U.S., individuals who use the SmartVest System generally rely on third-party payers, including private payers and governmental

payers such as Medicare and Medicaid, to cover and reimburse all or part of the cost of using the SmartVest System. Our homecare

revenue comes from reimbursement from commercial payers, Medicare, Medicaid, Veterans Affairs and direct patient payments. Reimbursement

for HFCWO therapy and the SmartVest System varies among public and private insurance providers.

A

key strategy to grow sales is achieving world class customer service and support for our patients and clinicians and increasing

the number of covered lives across a broad payer market. We do this with an established and effective reimbursement department

working on behalf of the patient by processing physician paperwork, seeking insurance authorization and processing claims. The

skill and knowledge gained and offered by our reimbursement department is an important factor in building our revenue and serving

patients’ financial interests. Our payment terms generally allow patients to acquire the SmartVest System over a period

of one to 15 months, which is consistent with reimbursement procedures followed by Medicare and other third parties. The payment

amount we receive for any single referral may vary based on several factors, including Medicare and third-party reimbursement

processes and policies. The reimbursement department includes our payer relations function working directly with all payer types

to increase the covered lives for the SmartVest System with national and regional private insurers and applicable state and federal

government entities as well as to maintain the current licenses with state and federal government and payer contracts.

Our

SmartVest System is reimbursed under HCPCS code E0483. Currently, the Medicare total allowable amount of reimbursement for this

billing code is approximately $15,000. The allowed amount for state Medicaid programs ranges from approximately $8,000 to $15,000,

which is similar to commercial payers. Actual reimbursement from third-party payers can vary and can be significantly less than

the full allowable amount. Deductions from the allowable amount, such as co-payments, deductibles and/or maximums on durable medical

equipment, decrease the reimbursement received from the third-party payer. Collecting a full allowable amount depends on our ability

to obtain reimbursement from the patient’s secondary and/or supplemental insurance if the patient has additional coverage,

or our ability to collect amounts from individual patients.

Most

patients can qualify for reimbursement and payment from Medicare, Medicaid, private insurance or combinations of the foregoing.

Our sales continue to be dependent, in part, on the availability of coverage and reimbursement from third-party payers, even though

our devices have been cleared for marketing by the FDA. The way reimbursement is sought and obtained varies based upon the type

of payer involved and the setting in which the procedure is furnished.

Research

and Development

Our

research and development (“R&D”) capabilities consist of full-time engineering staff and several consultants.

We periodically engage consultants and contract engineering employees to supplement our development initiatives. Our team has

a demonstrated record of developing new products that receive the appropriate product approvals and regulatory clearances around

the world as demonstrated by the FDA 510(k) clearance for the SmartVest Clearway Airway Clearance System received November 2022.

During

fiscal 2024 and 2023, we incurred R&D expenses of approximately $656,000 and $916,000, or 1.2% and 1.9% of our net revenues,

respectively.

Intellectual

Property

As

of June 30, 2024, we held 12 United States and 44 foreign-issued patents covering the SmartVest System and its underlying technology.

These patents and patent applications offer coverage in the field of air pressure pulse delivery to a human in support of airway

clearance.

We

generally pursue patent protection for patentable subject matter in our proprietary devices in foreign countries that we have

identified as key markets for our products. These markets include the European Union, Japan, and other countries.

We

have 13 U.S. trademark registrations along with 111 foreign trademark registrations.

Manufacturing

Our

headquarters in New Prague, Minnesota includes a dedicated manufacturing and engineering facility of more than 14,000 square feet,

and we are certified on an annual basis to be compliant with International Organization for Standardization (“ISO”)

13485 quality system standards. Our site has been audited regularly by the FDA and Notified Body, in accordance with their practices,

and we maintain our operations in a manner consistent with their requirements for a medical device manufacturer. While components

are outsourced to meet our detailed specifications, each SmartVest System is assembled, tested, and approved for final shipment

at our manufacturing site in New Prague, consistent with FDA, Underwriters Laboratory, and ISO standards. Many of our strategic

suppliers are located within 100 miles of our headquarters, which enables us to closely monitor our component supply chain. We

continually review our suppliers and component sources to ensure adequate availability of critical components and we maintain

established inventory levels for critical components and finished goods to assure continuity of supply.

Product

Warranties

We

provide a warranty on the SmartVest System that covers the cost of replacement parts and labor, or a new SmartVest System in the

event we determine a full replacement is necessary. For each homecare SmartVest System initially purchased and currently located

in the U.S., we provide a lifetime warranty to the individual patient for whom the SmartVest System is prescribed. For sales to

hospitals and HME distributors within the U.S., and for all international sales, we provide a one to five year warranty.

Competition

The

original HFCWO technology was licensed to American Biosystems, Inc. (formerly Hill-Rom Holdings, Inc., now part of Baxter International

Inc.) (“Baxter”), which, until the introduction of our original MedPulse Respiratory Vest System® in

2000, was the only manufacturer of a product with HFCWO technology cleared for market by the FDA (Hill Rom’s The Vest®

Airway Clearance System). Respiratory Technologies, Inc. (formerly RespirTech, now part of Koninklijke Phillips N.V.) (“Philips”)

received FDA clearance to market their HFCWO product, the inCourage® Airway Clearance Therapy in 2005. Both Baxter

and Philips employ a direct-to-patient model, with Philips additionally offering its HFCWO device through selected DME distributors.

The

AffloVest® from Tactile Systems Technology Inc. (“Tactile Medical”) also participates in the same market

as our SmartVest System. Tactile Medical primarily sells its device through HME companies who distribute homecare medical devices

and supplies.

Alternative

products for administering pulmonary therapy include: Positive Expiratory Pressure, Intrapulmonary Percussive Ventilation, CPT

and breathing techniques. Physicians may prescribe some or all of these devices and techniques, depending upon each patient’s

health status, severity of disease, compliance, or personal preference.

Key

drivers of HFCWO product sales continue to be improved quality of life through documented clinical outcomes and reduction in healthcare

costs through resource utilization evidence. Technology innovations and enhancements to the patient experience such as size and

weight of the generator, as well as optimized user interaction increase product reputation and patient satisfaction. We believe

we distinguish ourselves in these areas with competitive advantages over alternative treatments ultimately improving the patient

comfort, ease of use, and the effectiveness of HFCWO treatment. Because HFCWO is not “technique dependent,” as compared

to most other alternative pulmonary therapy products, therapy remains consistent and controlled for the duration of treatment.

Governmental

Regulation

Medicare

and Medicaid

Recent

government and private sector initiatives in the U.S. and foreign countries aim at limiting the growth of health care costs including

price regulation, competitive pricing, coverage and payment policies, comparative effectiveness of therapies, technology assessments,

and managed-care arrangements. These initiatives are causing the marketplace to put increased emphasis on the delivery of more

cost-effective medical devices that result in better clinical outcomes. Government programs, including Medicare and Medicaid,

have attempted to control costs by limiting the amount of reimbursement the program will pay for procedures or treatments, restricting

coverage for certain products or services, and implementing other mechanisms designed to constrain utilization and contain costs.

Many private insurance programs look to Medicare as a guide in setting coverage policies and payment amounts. These initiatives

have created an increasing level of price sensitivity among our customers.

Home

Medical Equipment Licensing

Although

we do not fall under competitive bidding for Medicare, we often must satisfy the same licensing requirements as other HME providers

that qualify for competitive bidding. In response to out-of-state businesses winning the competitive bidding process, which had

a significant impact on small local HME businesses, many states have enacted regulations that require a HME provider to have an

in-state business presence, specifically through state HME licensing boards or through state Medicaid programs. In order to do

business with any patients in the state or to be a provider for the state Medicaid program, a HME provider must have an in-state

presence. In addition to Minnesota, the location of our corporate headquarters, we have a licensed in-state presence in seven

other states. We also maintain an in-state presence in California to meet their state Medicaid requirements. In-state presence

requirements vary from state to state, but generally require a physical location that is staffed and open during regular business

hours. We are licensed to do business in all 50 states.

Product

Regulations

Our

medical devices are subject to regulation by numerous government agencies, including the FDA and comparable foreign regulatory

agencies. To varying degrees, each of these agencies requires us to comply with laws and regulations governing the development,

testing, manufacturing, labeling, marketing, and distribution of our medical devices, and compliance with these laws and regulations

entails significant costs for us. Our regulatory and quality assurance departments provide detailed oversight in their areas of

responsibility to support required clearances and approvals to market our products.

In

addition to the clearances and approvals discussed below, we obtained ISO 13485 certification in January 2005 and receive annual

certification of our compliance to the current ISO quality standards.

FDA

Requirements

We

have received clearance from the FDA to market our products, including the SmartVest System. We may be required to obtain additional

FDA clearance before marketing a new or modified product in the U.S., either through the 510(k)-clearance process or the more

complex premarket approval process. The process may be time consuming and expensive, particularly if human clinical trials are

required. Failure to obtain such clearances or approvals could adversely affect our ability to grow our business.

Continuing

Product Regulation

In

addition to its approval processes for new products, the FDA may require testing and post-market surveillance programs to monitor

the safety and effectiveness of previously cleared products that have been commercialized and may prevent or limit further marketing

of products based on the results of post-mark surveillance results. At any time after marketing clearance of a product, the FDA

may conduct periodic inspections to determine compliance with both the FDA’s Quality System Regulation (“QSR”)

requirements and current medical device reporting regulations. Product approvals by the FDA can be withdrawn due to failure to

comply with regulatory standards or the occurrence of unforeseen problems following initial market clearance. The failure to comply

with regulatory standards or the discovery of previously unknown problems with a product or manufacturer could result in fines,

delays or suspensions of regulatory clearances, seizures or recalls of products (with the attendant expenses), the banning of

a particular device, an order to replace or refund the cost of any device previously manufactured or distributed, operating restrictions

and criminal prosecution, as well as decreased sales as a result of negative publicity and product liability claims.

We

must register annually with the FDA as a device manufacturer and, as a result, are subject to periodic FDA inspection for compliance

with the FDA’s QSR requirements that require us to adhere to certain extensive regulations. In addition, the federal Medical

Device Reporting regulations require us to provide information to the FDA whenever there is evidence that reasonably suggests

that a device may have caused or contributed to a death or serious injury or, if a malfunction were to occur, could cause or contribute

to a death or serious injury. We also must maintain certain certifications to sell products internationally, and we undergo periodic

inspections by notified bodies to obtain and maintain these certifications.

Advertising

and marketing of medical devices, in addition to being regulated by the FDA, are also regulated by the Federal Trade Commission

and by state regulatory and enforcement authorities. Recently, promotional activities for FDA-regulated products of other companies

have been the subject of enforcement action brought under health care reimbursement laws and consumer protection statutes. Competitors

and others also can initiate litigation relating to advertising and/or marketing claims. If the FDA were to determine our promotional

or training materials constitute promotion of an unapproved or uncleared claim of use, it is possible we would need to modify

our training or promotional materials or be subject to regulatory or enforcement actions that could result in civil fines or criminal

penalties. Other federal, state or foreign enforcement authorities could also take similar action if they were to determine that

our promotional or training materials constitute promotion of an unapproved use, which could result in significant fines or penalties.

Federal

Physician Payments Sunshine Act

The

Federal Physician Payments Sunshine Act (Section 6002 of the PPACA) (the “Sunshine Act”) was adopted on February 1,

2013, to create transparency for the financial relationship between medical device companies and physicians and/or teaching hospitals

(covered recipients). In January 2021, the Sunshine Act was expanded to cover payments made to these additional covered recipients,

physician assistants, nurse practitioners, clinical nurse specialists, certified nurse anesthetists, and certified nurse midwives. The

Sunshine Act requires all manufacturers of drugs and medical devices to annually report to CMS any payments or any other “transfers

of value” made to any covered recipients, including but not limited to consulting fees, grants, clinical research support,

royalties, honoraria, meals, and value of long-term use (over 90 days) of evaluation equipment. This information is then posted

on a public website so that consumers can learn how much was paid to their physician by drug and medical device companies. The

Sunshine Act requires ongoing data collection and annual management and reporting by us and imposes civil penalties for manufacturers

that fail to report timely, accurately, or completely to CMS.

Fraud

and Abuse Laws

Federal

health care laws apply to the marketing of our products and when we or our customers submit claims for items or services that

are reimbursed under Medicare, Medicaid or other federally funded health care programs. The principal applicable federal laws

include:

| ● | the

False Claims Act, which prohibits the submission of false or otherwise improper claims

for payment to a federally funded health care program; |

| ● | the

Anti-Kickback Statute, which prohibits offers to pay or receive remuneration of any kind

for the purpose of inducing or rewarding referrals of items or services reimbursable

by a federal health care program; and |

| ● | the

Stark Law, which prohibits physicians from profiting (actually or potentially) from their

own referrals. |

There

are often similar state false claims, anti-kickback, and anti-self-referral and insurance laws that apply to state-funded Medicaid

and other health care programs and private third-party payers. In addition, the U.S. Foreign Corrupt Practices Act can be used

to prosecute companies in the U.S. for arrangements with physicians, or other parties outside the U.S. if the physician or party

is a government official of another country and the arrangement violates the law of that country. Enforcement of these regulations

has become increasingly stringent, particularly due to more prevalent use of the whistleblower provisions under the False Claims

Act, which allow a private individual to bring actions on behalf of the federal government alleging that the defendant has submitted

a false claim to the federal government and to share in any monetary recovery. If a governmental authority were to conclude that

we are not in compliance with applicable laws and regulations, we and our officers and employees could be subject to severe criminal

and civil penalties and disbarment from participation as a supplier of product to beneficiaries covered by Medicare or Medicaid.

Health

care fraud and false statement statutes, such as the Health Insurance Portability and Accountability Act of 1996 and its implementing

regulations (“HIPAA”) and the Health Information Technology for Economic and Clinical Health Act (“HITECH”),

also prohibit, among other things, knowingly and willfully executing, or attempting to execute, a scheme to defraud any health

care benefit program, including private payers, and knowingly and willfully falsifying, concealing, or covering up a material

fact or making any materially false, fictitious or fraudulent statement or representation in connection with the delivery of or

payment for health care benefits, items or services.

HIPAA,

HITECH and Other Privacy Regulations

Federal

and state laws protect the confidentiality of certain patient health information, including patient records, and restrict the

use and disclosure of such information. HIPAA and HITECH set forth privacy and security standards that govern the use and disclosure

of protected electronic health information by “covered entities,” which include healthcare providers, health plans

and healthcare clearinghouses. Because we provide our products directly to patients and bill third-party payers such as Medicare,

Medicaid, and insurance companies, we are a “covered entity” and must comply with these standards. Failure to comply

with HIPAA and HITECH or any state or foreign laws regarding personal data protection may result in significant fines or penalties

and/or negative publicity. In addition to federal regulations issued under HIPAA and HITECH, some states have enacted privacy

and security statutes or regulations that, in some cases, are more stringent than those issued under HIPAA and HITECH. In those

cases, it may be necessary to modify our planned operations and procedures to comply with the more stringent state laws. If we

fail to comply with applicable state laws and regulations, we could be subject to additional sanctions.

Environmental

Laws

We

are subject to various environmental laws and regulations both within and outside the U.S. Like other medical device companies,

our operations involve the use of substances regulated under environmental laws, primarily manufacturing, sterilization, and disposal

processes. We do not expect that compliance with environmental protection laws will have a material impact on our results of operations,

financial position, or cash flows.

Human

Capital

We

believe that our dedicated, talented employees are our most valuable resource and a key strength in accomplishing our collective

mission and goals. As of June 30, 2024, we had 174 employees, who are in 31 states throughout the United States. 18 of our

employees were respiratory therapists licensed by appropriate state professional organizations. We also had approximately 170

respiratory therapists and health care professionals retained on a non-exclusive, independent contractor basis to provide training

to our customers in the U.S. None of our employees are covered by a collective bargaining agreement. We believe our relations

with our employees are good.

We

are committed to attracting, retaining, and developing diverse and high-performing talent that includes a strong focus on performance

and development, total rewards, diversity, inclusion and equity, and employee safety. These serve as the pillars to our human

capital management framework.

We

understand that our success and growth depend on attracting, retaining, and developing talent across all levels of the organization.

Our recruitment strategies are continuously reviewed with leadership and partners to ensure our practices align with our mission,

purpose, and values.

We

believe in ensuring that employees understand our mission, purpose, and goals as well as their impact on our success. We use an

annual performance review process to support development and performance discussions with employees. In addition, every employee

is eligible to participate in our incentive plan, which allows us to share the rewards of the company with the people who significantly

contribute to our success.

To

cultivate a learning culture that provides enhancement and growth for our people, we offer educational assistance, online training,

seminars, specific skill training, and participation in business and industry organizations. We are also committed to contributing

our talents and resources to serve the communities in which we live and work through various charitable campaigns, employee programs

and volunteerism. We believe that this commitment assists in our efforts to attract and retain employees.

We

believe that sharing rewards is essential to increasing employee engagement and improving morale and creating a positive culture.

We also offer our employees a competitive salary and benefits package and are committed to continuous review of these programs.

These benefits include but are not limited to retirement savings, a variety of health insurance options and other benefits programs,

including dental and vision, disability insurance, contributions to health savings accounts, paid maternity/paternity leave, and

wellness resources. In addition, we offer opportunities for remote work and flexible schedules and location, depending on business

needs and the specific role.

We

are committed to ensuring a diverse workforce in a safe environment by maintaining compliance with applicable employment laws

and governmental regulations. Treating employees with dignity and equality is of utmost importance in everything we do. We take

pride in the fact that women represent 54% of our total managerial roles. We pride ourselves on accepting, hearing, and celebrating

multiple approaches and points of view and building on an inclusive and diverse culture.

Safety

is a vital aspect of the success of our people and business. We are proud of our employees’ collective commitment to secure

and maintain safe work practices within our manufacturing operations. We also provide wellbeing services to support each employee’s

physical and mental health and will continue to emphasize the importance of the safety and health of our employees in all we do.

Available

Information

Our

Internet address is www.smartvest.com. We have made available on our website, free of charge, our Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and, if applicable, amendments to those reports, as soon as reasonably

practicable after we electronically file these materials with, or furnish them to, the SEC. Reports of beneficial ownership filed

by our directors and executive officers pursuant to Section 16(a) of the Exchange Act are also available on our website. We are

not including the information contained on our website as part of, or incorporating it by reference into, this Annual Report on

Form 10-K. The SEC also maintains an Internet site that contains our reports, proxy and information statements, and other information

we file or furnish with the SEC, available at www.sec.gov.

As

a smaller reporting company, we are not required to provide disclosure pursuant to this item.

| Item

1B. | Unresolved

Staff Comments. |

As

a smaller reporting company, we are not required to provide disclosure pursuant to this item.

Item

1C. Cybersecurity.

Protecting

the privacy of customer and personnel information is important to us, and we maintain security protocols and processes, including

ongoing training and education for all personnel, designed to combat the risk of unauthorized access or inadvertent disclosure.

Our business operations involve confidential information, including patient health information subject to regulation as discussed

under “HIPAA, HITECH and Other Privacy Regulations” above. Our information technology infrastructure is designed

to offer reliability, scalability, performance, security and privacy for our personnel, clients, and third-party contractors.

Cybersecurity

Risk Management and Strategy

We

have designed and implemented a cybersecurity risk management program to help us identify, assess, and mitigate cybersecurity

risks relevant to our business, based on the National Institute of Standards and Technology (NIST) Cyber Security Framework. The

cybersecurity risk management program is integrated into our Enterprise Risk Management (ERM) program.

Our

cybersecurity risk management program includes:

| ● | dedicated

cybersecurity professionals who analyze cybersecurity threats, define cybersecurity policy

and requirements, implement protections, and monitor and respond to cybersecurity incidents; |

| ● | cybersecurity

regulatory-based risk assessments for the Company’s systems and applications (where

required); |

| ● | a

formal incident response plan, in which incidents are classified based upon the severity,

impact, and the potential harm that can be caused by the incident; |

| ● | monthly

information security training program for all employees, including phishing awareness

training; and |

| ● | engagement

of third-party service providers to conduct assessments of the Company’s cybersecurity

risk management program, penetration testing, and vulnerability testing. |

To

date, the Company is not aware of any cybersecurity incident that has had or is reasonably likely to have a material impact on

the Company’s business strategy, results of operations or financial condition. However, despite our security measures, there

can be no assurance that the Company, or the third parties with which we interact, will not experience a cybersecurity incident

in the future that may materially affect us.

Cybersecurity

Governance

The

Audit Committee and the Board of Directors provide oversight of cybersecurity risk management. The cybersecurity risk management

program is co-led by senior leaders of our management and third-party service providers. Between our senior leaders, there is

a combined 30+ years of experience assisting public and privately held companies in a variety of industries, leading several enterprise-wide

transformation initiatives to adapt to changing cybersecurity threats. Our Director of IT leads the IT organization, reports directly

to the Chief Financial Officer and works closely with the President and Chief Executive Officer to guide strategic direction and

IT decisions to drive business outcomes. Our Board of Directors is engaged in the Company’s Enterprise Risk Management (ERM)

program and receives briefings on the outcomes of the ERM program and the steps the Company takes to mitigate risks that the program

identifies. The Audit Committee oversees the Company’s cybersecurity strategies, systems, and controls to ensure reliability

and prevent unauthorized access. The Audit Committee discusses policies with respect to risk assessment and risk management, including

risks associated with the reliability and security of the Company’s information technology and security systems, and the

steps management has undertaken to monitor and control such exposures. The Audit Committee and Board of Directors receives regular

updates on the Company’s cybersecurity risk management program from the Chief Financial Officer, Director of IT and third

party managed service provider CISO.

We

own our principal headquarters and manufacturing facilities, consisting of approximately 37,000 square feet, which are located

on an approximately 2.3-acre parcel in New Prague, Minnesota. Nearly all of the Company’s revenues, profits, and assets

are associated with this facility. We believe that our facilities are satisfactory for our long-term growth plans.

| Item

3. | Legal

Proceedings. |

The

disclosure regarding legal proceedings set forth in Note 11 to our Financial Statements in Part II, Item 8 of this Annual Report

on Form 10-K is incorporated herein by reference. Occasionally, we may be party to legal actions, proceedings, or claims in the

ordinary course of business, including claims based on the assertions of patent and trademark infringement. Corresponding costs

are accrued when it is probable that loss will be incurred, and the amount can be precisely or reasonably estimated. We are not

aware of any undisclosed actual or threatened litigation that would have a material adverse effect on our financial condition

or results of operations.

| Item

4. | Mine

Safety Disclosures. |

None.

PART

II

| Item

5. | Market

For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities. |

Market

Information

Our

common stock is listed on the NYSE American under the symbol “ELMD”.

As

of August 20, 2024, there were 53 registered holders of our common stock.

Dividends

We

have never paid cash dividends on any of our shares of common stock. We currently intend to retain any earnings for use in operations

and do not anticipate paying cash dividends to our shareholders in the foreseeable future. The agreement governing our credit

facility restricts our ability to pay dividends.

Recent