Current Report Filing (8-k)

January 04 2022 - 6:05AM

Edgar (US Regulatory)

0001309082false00013090822022-01-032022-01-03iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 3, 2022

|

Camber Energy, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

001-32508

|

|

20-2660243

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

15915 Katy Freeway, Suite 450, Houston, Texas, 77094

(Address of principal executive offices)

(281) 404-4387

(Registrant’s telephone number, including area code)

__________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☒ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 Par Value Per Share

|

CEI

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

As disclosed by Camber Energy, Inc. (the “Company”) in a Current Report Filed on Form 8-K filed with the Securities and Exchange Commission on December 27, 2021, the Company entered into a Loan Agreement on December 24, 2021 with the investor named therein (the “Investor”) pursuant to which the Investor agreed to loan the Company $25,000,000 subject to, among other things, the Company having increased its authorized capital of common shares on or before December 31, 2021, which increase occurred on December 30, 2021.

On January 3, 2022 the Company received $25,000,000 (the “Loan Proceeds”) from the Investor, and in connection therewith executed and delivered the following in favor of the Investor: (i) a promissory note dated on or about December 31, 2021 in the principal amount of $26,315,789.47, representing a 5% original issue discount (the “Investor Note”), accruing interest at a rate equal to the Wall Street Journal Prime Rate, payable at maturity, and maturing January 1, 2027; (ii) a Security Agreement-Pledge (the “Pledge Agreement”) granting the Investor a first-priority security interest in Camber’s common shares of Viking Energy Group, Inc.; and (iii) a general security agreement (the “Security Agreement”) granting the Investor a first-priority security interest in Camber’s other assets. The Investor may convert amounts owing under the Investor Note into shares of common stock of Camber at a fixed price of $1.50 per share, subject to beneficial ownership limitations. The obligations under the Investor Note are supported by a Guaranty from Viking Energy Group, Inc.

The Company also executed a Warrant Agreement in favor of the Investor entitling the Investor to purchase up to 50,000,000 shares of common stock of the Company at an exercise price of ten dollars ($10.00) per share for the first 25,000,000 shares, and twenty dollars ($20.00) per share for the remaining 25,000,000 shares (the “Warrant Agreement”). The Warrant Agreement has a term of five years, and there is no adjustment to the exercise price of the warrants as a result of the Company issuing securities at lower prices during the term pursuant to agreements which the Company was a party as of the date of the Warrant Agreement.

The majority of the Loan Proceeds of the loan were used to: (i) redeem shares of Series C Redeemable Convertible Preferred Stock of the Company not owned by the Investor or its affiliates; and (ii) pay in full the secured loan disclosed by the Company in a Current Report Filed on Form 8-K filed with the SEC on December 17, 2021 that was due on March 8, 2022. The balance of the Loan Proceeds are available to the Company for working capital purposes.

The foregoing descriptions of the Investor Note, Pledge Agreement, Security Agreement and Warrant Agreement, do not purport to be complete and are qualified in their entirety by reference to the Investor Note, Pledge Agreement, Security Agreement and Warrant Agreement, copies of which are filed as Exhibits 10.1, 10.2, 10.3 and 10.4 to this Current Report on Form 8-K, respectively, and incorporated in this Item 1.01 by reference in their entirety.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure in Item 1.01 is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibit.

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Promissory Note issued by Camber Energy, Inc. to the Investor Named Therein, dated on or about December 31, 2021

|

|

10.2

|

|

Pledge Agreement by and between Camber Energy, Inc. and the Investor Named Therein, dated on or about December 31, 2021

|

|

10.3

|

|

Security Agreement by and between Camber Energy, Inc. and the Investor Named Therein, dated on or about December 31, 2021

|

|

10.4

|

|

Warrant Agreement issued by Camber Energy, Inc. to the Investor Named Therein, dated on or about December 31, 2021

|

|

104

|

|

Cover Page Interactive Data File (embedded within Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CAMBER ENERGY, INC.

|

|

|

|

|

|

|

|

Date: January 4, 2022

|

By:

|

/s/ James A. Doris

|

|

|

|

Name:

|

James A. Doris

|

|

|

|

Title:

|

Chief Executive Officer

|

|

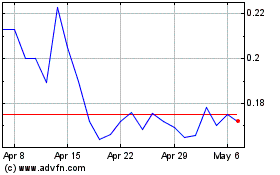

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Apr 2023 to Apr 2024