Current Report Filing (8-k)

September 18 2020 - 4:16PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): September 15, 2020

AgeX

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

1-38519

|

|

82-1436829

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

965

Atlantic Avenue

Suite

101

Alameda,

California 94501

(Address

of principal executive offices)

(510)

671-8370

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol

|

|

Name

of exchange on which registered

|

|

Common

Stock, par value $0.0001 per share

|

|

AGE

|

|

NYSE

American

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Forward-Looking

Statements

Any

statements that are not historical fact (including, but not limited to statements that contain words such as “may,”

“will,” “believes,” “plans,” “intends,” “anticipates,” “expects,”

“estimates”) should also be considered to be forward-looking statements. Additional factors that could cause actual

results to differ materially from the results anticipated in these forward-looking statements are contained in AgeX’s periodic

reports filed with the Securities and Exchange Commission under the heading “Risk Factors” and other filings that

AgeX may make with the SEC. Undue reliance should not be placed on these forward-looking statements which speak only as of the

date they are made, and the facts and assumptions underlying these statements may change. Except as required by law, AgeX disclaims

any intent or obligation to update these forward-looking statements.

References

in this Report to “AgeX,” “we” or “us” refer to AgeX Therapeutics, Inc.

The

description or discussion, in this Form 8-K, of any contract or agreement is a summary only and is qualified in all respects by

reference to the full text of the applicable contract or agreement.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

On

September 15, 2020, AgeX borrowed an additional $1.0 million of its available credit under a Secured Convertible Facility Agreement

(the “New Loan Agreement”), dated March 30, 2020 and as amended July 21, 2020, with Juvenescence Limited (“Juvenescence”).

The outstanding principal balance of the loans under the New Loan Agreement will become due and payable on March 30, 2023 (the

“Repayment Date”).

Juvenescence

may declare the outstanding principal balance of the loans and other sums owed under the New Loan Agreement immediately due and

payable prior to the Repayment Date if an Event of Default occurs and continues uncured for 10 business days after notice of default

from Juvenescence. Events of Default under the New Loan Agreement include: (i) AgeX fails to pay any amount in the manner and

at the time provided in the New Loan Agreement and the failure to pay is not remedied within 10 business days; (ii) AgeX fails

to perform any of its obligations under the New Loan Agreement and if the failure can be remedied it is not remedied to the satisfaction

of Juvenescence within 10 business days after notice to AgeX; (iii) other indebtedness for money borrowed in excess of $100,000

becomes due and payable or can be declared due and payable prior to its due date or if indebtedness for money borrowed in excess

of $25,000 is not paid when due; (iv) AgeX stops payment of its debts generally or discontinues its business or becomes unable

to pay its debts as they become due or enters into any arrangement with creditors generally, (v) AgeX becoming insolvent or in

liquidation or administration or other insolvency procedures, or a receiver, trustee or similar officer is appointed in respect

of all or any part of its assets and such appointment continues undischarged or unstayed for sixty days, (vi) it becomes illegal

for AgeX to perform its obligations under the New Loan Agreement or any governmental permit, license, consent, exemption or similar

requirement for AgeX to perform its obligations under the New Loan Agreement or to carry out its business is not obtained or ceases

to remain in effect; (vii) the issuance or levy of any judgment, writ, warrant of attachment or execution or similar process against

all or any material part of the property or assets of AgeX if such process is not released, vacated or fully bonded within sixty

calendar days after its issue or levy; (viii) any injunction, order or judgement of any court is entered or issued which in the

opinion of Juvenescence materially and adversely affects the ability of AgeX to carry out its business or to pay amounts owed

to Juvenescence under the New Loan Agreement, (ix) there is a change in AgeX’s financial condition that in the opinion of

Juvenescence materially and adversely affects, or is likely to so affect, its ability to perform any of its obligations under

the New Loan Agreement, (x) AgeX or any of its subsidiaries that guarantee’s AgeX’s obligations or becomes a co-obligor

under the New Loan Agreement (each a “Guarantor Subsidiary” and collectively the “Guarantor Subsidiaries”)

sells, leases, licenses, consigns, transfers, or otherwise disposes of a material part of its assets other than inventory in the

ordinary course of business or certain intercompany transactions, or certain other limited permitted transactions, unless Juvenescence

approves, (xi) the security interests under a Security Agreement, if in effect, are not valid or perfected, or AgeX or a Guarantor

Subsidiary contests the validity of its obligations under the New Loan Agreement or Security Agreement or other related agreement

with Juvenescence, or there is a loss, theft, damage or destruction of a material portion of the collateral, (xii) any representation,

warranty, or other statement made by AgeX or a Guarantor Subsidiary under the New Loan Agreement is incomplete, untrue, incorrect,

or misleading, or (xiii) AgeX or a Guarantor Subsidiary suspends or ceases to carry on all or a material part of its business

or threatens to do so.

Item

3.02 Unregistered Sales of Equity Securities.

In

connection with AgeX’s September 15 draw of loan funds under the New Loan Agreement (as defined in Item 2.03 of this Report),

AgeX will issue to Juvenescence upon approval for listing by the NYSE American warrants to purchase 588,235 shares of AgeX common

stock (“Warrants”) at an exercise price of $0.85 per share:

The

Warrants are subject to the terms of a Warrant Agreement, as amended, between AgeX and Juvenescence. A copy of the Warrant Agreement

has been filed as an exhibit to AgeX’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March

30, 2020 and a copy of an amendment of the Warrant Agreement has been filed as an exhibit to AgeX’s Quarterly Report on

Form 10-Q filed with the Securities and Exchange Commission on August 14, 2020.

The

Warrants will be issued without registration under the Securities Act of 1933, as amended in reliance upon the exemption from

registration provided under Section 4(a)(2) thereof and Regulation S thereunder.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

AGEX

THERAPEUTICS, INC.

|

|

|

|

|

|

Date:

September 18, 2020

|

By:

|

/s/

Andrea Park

|

|

|

|

Chief

Financial Officer

|

AgeX Therapeutics (AMEX:AGE)

Historical Stock Chart

From Aug 2024 to Sep 2024

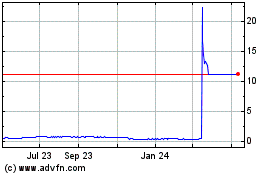

AgeX Therapeutics (AMEX:AGE)

Historical Stock Chart

From Sep 2023 to Sep 2024