Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

January 04 2021 - 8:21AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Report on Form 6-K for January, 2021

Commission File Number 1-31615

Sasol Limited

50 Katherine Street

Sandton 2196

South Africa

(Name and address of registrant’s principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20-F or Form 40-F.

Form 20-F __X__

Form 40-F _____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1):

Yes _____

No __X__

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

Yes _____

No __X__

Indicate by check mark whether the registrant by furnishing the information contained in this

Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes _____

No __X__

ENCLOSURES: SASOL LIMITED | SUCCESSFUL COMPLETION OF THE

DIVESTMENT OF SASOL’S 50% EQUITY INTEREST IN GEMINI HDPE LLC

[[5557939v.2]]

Sasol Limited

(Incorporated in the Republic of South Africa)

(Registration number 1979/003231/06)

Sasol Ordinary Share codes: JSE: SOL NYSE: SSL

Sasol Ordinary ISIN codes: ZAE000006896 US8038663006

Sasol BEE Ordinary Share code: JSE: SOLBE1

Sasol BEE Ordinary ISIN code: ZAE000151817

(“Sasol” or “the Company”)

SUCCESSFUL COMPLETION OF THE DIVESTMENT OF SASOL’S 50% EQUITY INTEREST

IN GEMINI HDPE LLC

Sasol shareholders are referred to the Company’s Stock Exchange News Service

announcement dated 24 November 2020, in relation to the divestment of its 50% interest in the

Gemini high-density polyethylene joint ventures to INEOS Gemini HDPE LLC

(the “Divestment”).

Sasol is pleased to announce that the Divestment successfully closed on 31 December 2020.

The consideration of US$404 million was satisfied through a combination of cash and release

from debt obligations. The relevant debt facilities and security package have now been

successfully restructured, releasing Sasol and its subsidiaries from any obligation to provide

further security. The cash proceeds from the transaction were received on 31 December 2020,

and will be used by Sasol to repay near-term debt obligations.

4 January 2021

Johannesburg

Sponsor: Merrill Lynch South Africa Proprietary Limited

[[5557939v.2]]

Disclaimer - Forward-looking statements

Sasol may, in this document, make certain statements that are not historical facts and relate to

analyses and other information which are based on forecasts of future results and estimates of

amounts not yet determinable. These statements may also relate to our future prospects,

expectations, developments and business strategies. Examples of such forward-looking

statements include, but are not limited to, the impact of the novel coronavirus (COVID-19)

pandemic on Sasol’s business, results of operations, financial condition and liquidity and

statements regarding the effectiveness of any actions taken by Sasol to address or limit any

impact of COVID-19 on its business; statements regarding exchange rate fluctuations, changing

crude oil prices , volume growth, increases in market share, total shareholder return, executing

our growth projects (including LCCP), oil and gas reserves, cost reductions, our climate change

strategy and business performance outlook. Words such as “believe”, “anticipate”, “expect”,

“intend", “seek”, “will”, “plan”, “could”, “may”, “endeavour”, “target”, “forecast” and “project” and

similar expressions are intended to identify such forward-looking statements, but are not the

exclusive means of identifying such statements. By their very nature, forward-looking

statements involve inherent risks and uncertainties, both general and specific, and there are

risks that the predictions, forecasts, projections and other forward-looking statements will not be

achieved. If one or more of these risks materialise, or should underlying assumptions prove

incorrect, our actual results may differ materially from those anticipated. You should understand

that a number of important factors could cause actual results to differ materially from the plans,

objectives, expectations, estimates and intentions expressed in such forward-looking

statements. These factors and others are discussed more fully in our most recent annual report

on Form 20-F filed on 24 August 2020 and in other filings with the United States Securities and

Exchange Commission. The list of factors discussed therein is not exhaustive; when relying on

forward-looking statements to make investment decisions, you should carefully consider both

these factors and other uncertainties and events. Forward-looking statements apply only as of

the date on which they are made, and we do not undertake any obligation to update or revise

any of them, whether as a result of new information, future events or otherwise.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant, Sasol Limited,

has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: 4 January 2021

By:

/s/ M du Toit

Name:

Title:

M du Toit

Group Company Secretary

This regulatory filing also includes additional resources:

sasol_release.pdf

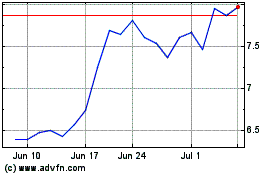

Sasol (NYSE:SSL)

Historical Stock Chart

From Aug 2024 to Sep 2024

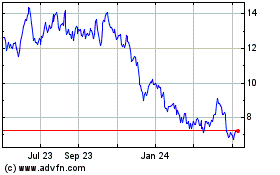

Sasol (NYSE:SSL)

Historical Stock Chart

From Sep 2023 to Sep 2024