Consumers Are Eating Healthier and Cooking More, Food Executives Say

October 05 2020 - 4:09PM

Dow Jones News

By Julie Wernau and Anni Gasparro

Food company executives say they are expecting new consumer

habits formed during the pandemic to stick, with a renewed focus on

health and cooking at home.

Mark Clouse, the chief executive of Campbell Soup Co. speaking

at The Wall Street Journal's Global Food Forum on Monday, said

eating on the go, which had been popular before the pandemic, has

declined dramatically.

People turned to comfort food initially during the outbreak, Mr.

Clouse said. "What we're seeing now is a greater level of balance

and a return to some of those health and wellness trends," he

added.

Kellogg Co. Chief Executive Steve Cahillane told attendees at

Monday's virtual forum that the company has a chance to appeal to

more people given their change in habits. "People are having

breakfast together with their families," Mr. Cahillane said.

Mars Inc. President of Innovation Jean-Christophe Flatin said in

a discussion at the forum that consumers are paying more attention

to nutrition and packaged-food labels than they did before the

public-health crisis. But they don't just want food that's

nutritious -- it still has to taste good, he said.

The shift in consumer behavior is creating a rare opportunity

for old-line food makers that have struggled to make their canned

and packaged foods relevant and modern. Big food companies,

including Campbell and Kellogg, initially faced a surge in March

and April when shoppers filled up their pantries and refrigerators

amid lockdowns to curtail the spread of the coronavirus.

Grocery shopping is still at elevated levels. Overall packaged

food and beverage sales remain up about 13% from a year ago at

grocery stores and mass retailers, according to the IRI CPG Demand

Index. However, in recent weeks, sales growth for groceries broadly

has moderated, pressuring brands to ramp up marketing to keep the

momentum going.

Campbell has shifted advertising to focus on how people can cook

with its soups now that they have them in their pantries, and on

connecting with younger families.

Mr. Clouse said that in prior years the company had allowed

itself to become "less relevant" by focusing on niche consumer

brands and trends instead of their core comfort foods. The surge in

demand for Campbell products like Chunky soup and Pepperidge Farm

Goldfish crackers has taught the company that "it doesn't require a

new brand to meet some of these needs people are looking for."

Companies across the food sector are trying to shift their

priorities to capitalize on the pandemic-driven demand. Kellogg is

spending more on smaller brands that didn't get much investment

before, such as Corn Pops and Corn Flakes cereal in the U.S.

Last month, General Mills Inc., maker of Cheerios, Yoplait and

Betty Crocker, said it's spending more on marketing to ensure its

brands eventually come out of the pandemic in a better position.

Its chief executive, Jeff Harmening, said ingredient changes that

General Mills made in recent years to make its products trendier,

tastier or more nutritious have helped it gain market share during

the crisis.

Conagra Brands Inc., which makes Healthy Choice frozen meals,

Slim Jim meat snacks and Hunt's tomatoes, said Thursday that it

also expects new habits to stick.

Chief Executive Sean Connolly pointed to higher sales of kitchen

appliances and living room furniture and more Netflix subscriptions

as evidence that people are staying put. He said in an interview

following Conagra's earnings that he has seen consumers gravitate

back toward healthier eating in recent months.

Earlier in the pandemic, the food giant saw Duncan Hines baking

mixes jump, whereas lately, Healthy Choice frozen meals are on the

rise. "Consumers might have gained a few pounds during quarantine,"

Mr. Connolly added.

Write to Julie Wernau at Julie.Wernau@wsj.com

(END) Dow Jones Newswires

October 05, 2020 15:54 ET (19:54 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

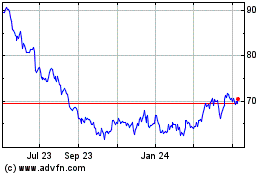

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

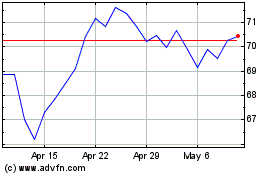

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024