By Caitlin McCabe, Anna Hirtenstein and Xie Yu

U.S. stocks ran out of steam Tuesday in volatile trading session

that saw the Dow Jones Industrial Average give up an early gain of

more than 900 points.

Major indexes appeared poised to build on Monday's mammoth gains

but wobbled in the final hour of the trading session and slid into

the red as the closing bell rang. Stocks from Intel to UnitedHealth

to Morgan Stanley ended lower after rallying earlier in the

day.

Much of the early optimism was tied to small signs of success in

the global fight against the coronavirus pandemic. Stocks were

buoyed by an announcement from New York Gov. Andrew Cuomo, who said

the state -- the hardest hit in the U.S. by the virus -- has

projected that it is reaching a plateau of daily hospitalizations.

And globally, countries including Spain have seen the daily toll of

new infections and deaths slow.

Still, by the end of the day, investors appeared unable to put

their faith in projections that coronavirus hot spots had turned a

corner.

"This is slowly degrading like the Titanic," said Ken Moraif,

founder of Retirement Planners of America. "The people who are

buying right now don't believe how bad this really is."

The Dow industrials shed 26.13 points, or 0.1%, to finish the

day at 22653.86. The blue chips rose as much as 4.1% earlier in the

session as they attempted to build on Monday's 7.7% gain. The

S&P 500 lost 4.27 points, or 0.2%, to 2659.41.

Both indexes suffered their steepest intraday reversals in more

than a decade: For the Dow, Tuesday's was the largest blown gain

since Oct. 14, 2008, when the index climbed as much as 5.7% before

closing down 0.8%

Both indexes are still down about 20% from their mid-February

highs.

For weeks, investors have parsed economic and health data to try

to determine how severely the coronavirus pandemic will dent the

economy.

Mr. Moraif said his company, which had $4.5 billion in assets

under management at the end of 2019, sold all equity and bond

positions in recent weeks, opting instead for only cash. He remains

skeptical that the economy can make a fast recovery once businesses

begin opening up and employees return to work.

"I'm having difficulty in understanding how a small business

that has gone bankrupt is going to go back into business because we

have reached the peak of infections," Mr. Moraif said.

Authorities have warned that the coronavirus infections in the

U.S. and U.K. are likely to worsen in the coming week. Even in New

York, where demand for intensive care units has decreased, Mr.

Cuomo said Tuesday that the state reported its highest number of

deaths in a single day. Nearly 12,000 people have died from the

virus across the U.S., and the number of infected Americans hovers

below 400,000, according to data from Johns Hopkins University.

Even more, economic indicators have shown that a deep recession

may be looming. The Mortgage Bankers Association said Tuesday that

mortgage forbearance requests surged in the second half of March as

millions of Americans sought unemployment benefits after the

pandemic shuttered businesses.

Travel and leisure stocks were again among the bright spots in

markets Tuesday. American Airlines Group rose 7.6%, JetBlue Airways

jumped 13%, and United Airlines added 1.9%.

Among cruise lines, Royal Caribbean Cruises gained 13%, Carnival

jumped more 11%, and Norwegian Cruise Line Holdings rose 10%. All

six stocks remain down more than 50% for the year.

Meanwhile, in London, EasyJet climbed 15% after the carrier

tapped a U.K. government-aid program for short-term credit. The

company's ability to access the funding suggests that it could

withstand the economic downturn, provided that the spread of the

coronavirus continues to slow, according to Michael Hewson, chief

market analyst at brokerage CMC Markets.

"Markets are pricing in a return to normality for airlines

sooner rather than later," Mr. Hewson said.

Global leaders and corporate executives have warned this week

that a U.S. recession could be deep and severe. Former Federal

Reserve Chair Janet Yellen said Monday in an interview on CNBC that

she expects the U.S. economy to decline at least 30% in the second

quarter. She also said she was "afraid we will see bankruptcies"

and that "companies may end up with debt burdens that make them

unwilling to restore investment spending or re-hire workers."

Still, some appetite for risk among investors prompted investors

to sell the safest government bonds. The yield on the 10-year U.S.

Treasury note rose to 0.735%, from 0.675% Monday. Yields rise as

bond prices fall.

Meanwhile, oil prices fell after starting the day higher. Brent

crude, the global gauge of oil prices, slid 3.6% to $31.87 a

barrel, as demand for oil has fallen during the pandemic and Russia

and Saudi Arabia continue a price war.

Beyond the U.S., the pan-continental Stoxx Europe 600 ended the

day higher, rising 1.9%. Japan's Nikkei 225 and China's Shanghai

Composite both rose more than 2%.

"People are trying to identify risks and opportunities now,"

said Bruce Pang, head of macro and strategy research at China

Renaissance Securities.

"China's case shows when new infections peaked out, the market

would bottom out," he added, noting that the trend is what some

global investors may now expect.

Write to Caitlin McCabe at caitlin.mccabe@wsj.com, Anna

Hirtenstein at anna.hirtenstein@wsj.com and Xie Yu at

Yu.Xie@wsj.com

(END) Dow Jones Newswires

April 07, 2020 18:00 ET (22:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

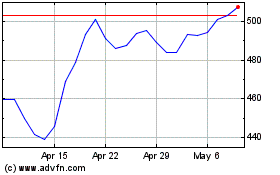

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024