Current Report Filing (8-k)

March 02 2020 - 7:43AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported):

|

March 2, 2020

|

Hercules Capital, Inc.

(Exact name of registrant as specified in its charter)

|

Maryland

|

814-00702

|

74-3113410

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File No.)

|

(I.R.S. Employer

Identification No.)

|

|

400 Hamilton Ave., Suite 310

Palo Alto, CA

|

|

94301

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (650) 289-3060

|

Not Applicable

|

|

(Former name or address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

HTGC

|

New York Stock Exchange

|

|

5.25% Notes due 2025

|

HCXZ

|

New York Stock Exchange

|

|

6.25% Notes due 2033

|

HCXY

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

Hercules Capital, Inc. (“we”, “us” or the “Company”) previously filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form N-2 on April 29, 2019 (File No.: 333-231089) (the “Registration Statement”) using the “shelf” registration process as a “well-known seasoned issuer” in reliance on the Small Business Credit Availability Act. Certain items required by Form N-2 have been incorporated by reference into the Registration Statement through documents filed pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including the Company’s most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed on February 20, 2020 (the “Form 10-K”), that are incorporated or deemed incorporated by reference into the prospectus that is part of the Registration Statement (the “Prospectus”).

The purpose of this Current Report on Form 8-K (the “Report”) is to file certain information that is required to be disclosed on Form N-2 but that was not required to be disclosed in the Form 10-K, so that this information is incorporated by reference into the Registration Statement. This Report should be read in conjunction with the Form 10-K, which is incorporated by reference herein. A copy of the consent of PricewaterhouseCoopers LLP, the Company’s independent registered public accounting firm, is also attached as an exhibit to the Report and incorporated by reference into the Registration Statement.

Item 8.01 Other Events

FEES AND EXPENSES

The following table is intended to assist you in understanding the various costs and expenses that an investor in our common stock will bear directly or indirectly. However, we caution you that some of the percentages indicated in the table below are estimates and may vary. The footnotes to the fee table state which items are estimates. Except where the context suggests otherwise, whenever this prospectus contains a reference to fees or expenses paid by “you” or “us” or that “we” will pay fees or expenses, stockholders will indirectly bear such fees or expenses as investors in Hercules Capital, Inc.

|

Stockholder Transaction Expenses (as a percentage of the public offering price):

|

|

|

|

|

|

Sales load (as a percentage of offering price)(1)

|

|

|

—

|

%

|

|

Offering expenses

|

|

|

—

|

%(2)

|

|

Dividend reinvestment plan fees

|

|

|

—

|

%(3)

|

|

Total stockholder transaction expenses (as a percentage of the public offering price)

|

|

|

—

|

%(4)

|

|

Annual Expenses (as a percentage of net assets attributable to common stock):(5)

|

|

|

|

|

|

Operating expenses

|

|

|

6.03

|

%(6)(7)

|

|

Interest and fees paid in connection with borrowed funds

|

|

|

5.92

|

%(8)

|

|

Total annual expenses

|

|

|

11.95

|

%(9)

|

|

(1)

|

In the event that our securities are sold to or through underwriters, a corresponding prospectus supplement to the Prospectus will disclose the applicable sales load.

|

|

(2)

|

In the event that we conduct an offering of our securities, a corresponding prospectus supplement to this prospectus will disclose the estimated offering expenses.

|

|

(3)

|

The expenses associated with the administration of our dividend reinvestment plan are included in “Operating expenses.” We pay all brokerage commissions incurred with respect to open market purchases, if any, made by the administrator under the plan. For more details about the plan, see “Dividend Reinvestment Plan.”

|

|

(4)

|

Total stockholder transaction expenses may include sales load and will be disclosed in a future prospectus supplement, if any.

|

|

(5)

|

“Net assets attributable to common stock” equals the weighted average net assets for the year ended December 31, 2019, which is approximately $1.0 billion.

|

|

(6)

|

“Operating expenses” represents our actual operating expenses incurred for the year ended December 31, 2019, including all fees and expenses of our consolidated subsidiaries and excluding interests and fees on indebtedness.

|

|

(7)

|

We do not have an investment adviser and are internally managed by our executive officers under the supervision of our Board of Directors. As a result, we do not pay investment advisory fees, but instead we pay the operating costs associated with employing investment management professionals.

|

|

(8)

|

“Interest and fees paid in connection with borrowed funds” represents our estimated interest, fees and credit facility expenses by annualizing our actual interest, fees and credit facility expenses incurred for the year ended December 31, 2019, including our $75.0 million revolving senior secured credit facility with Wells Fargo Capital Finance, LLC, or the Wells Facility, $200.0 million revolving senior secured credit facility with MUFG Union Bank, N.A., or the Union Bank Facility, and, together with the Wells Facility, the Credit Facilities, 4.625% notes due 2022, or the 2022 Notes, 6.25% notes due 2024, or the 2024 Notes, 4.77% notes due 2024, or the July 2024 Notes, 5.25% notes due 2025, or the 2025 Notes, 6.25% notes due 2033, or the 2033 Notes, 4.375% convertible notes due 2022, or the 2022 Convertible Notes, fixed rate asset-backed notes due 2027, or the 2027 Asset-Backed Notes, fixed rate asset-backed notes due 2028, or the 2028 Asset-Backed Notes, and the Small Business Administration, or SBA, debentures.

|

|

(9)

|

“Total annual expenses” is the sum of “operating expenses,” and “interest and fees paid in connection with borrowed funds.” “Total annual expenses” is presented as a percentage of weighted average net assets attributable to common stockholders because the holders of shares of our common stock (and not the holders of our debt securities or preferred stock, if any) bear all of our fees and expenses, including the fees and expenses of our wholly-owned consolidated subsidiaries, all of which are included in this fee table presentation.

|

Example

The following example demonstrates the projected dollar amount of total cumulative expenses that would be incurred over various periods with respect to a hypothetical investment in our common stock. These amounts are based upon our payment of annual operating expenses at the levels set forth in the table above and assume no additional leverage.

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

You would pay the following expenses on a $1,000 common stock investment, assuming a 5% annual return

|

|

$

|

115

|

|

|

$

|

324

|

|

|

$

|

505

|

|

|

$

|

861

|

|

The example and the expenses in the tables above should not be considered a representation of our future expenses, and actual expenses may be greater or lesser than those shown. Moreover, while the example assumes, as required by the applicable rules of the SEC, a 5% annual return, our performance will vary and may result in a return greater or lesser than 5%. In addition, while the example assumes reinvestment of all distributions at our net asset value, or NAV, participants in our dividend reinvestment plan may receive shares valued at the market price in effect at that time. This price may be at, above or below NAV. See the section of our Registration Statement entitled “Dividend Reinvestment Plan” for additional information regarding our dividend reinvestment plan.

PRICE RANGE OF COMMON STOCK AND DISTRIBUTIONS

Our common stock is traded on the NYSE under the symbol “HTGC.”

The following table sets forth the range of high and low sales prices of our common stock, the sales price as a percentage of NAV and the distributions declared by us for each fiscal quarter. The stock quotations are interdealer quotations and do not include markups, markdowns, or commissions.

|

|

|

|

|

|

|

Price Range

|

|

|

Premium/

Discount of

High Sales

|

|

|

Premium/

Discount of

Low Sales

|

|

|

Cash

Distribution Declared

|

|

|

|

|

NAV(1)

|

|

|

High

|

|

|

Low

|

|

|

Price to NAV

|

|

|

Price to NAV

|

|

|

per Share

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First quarter

|

|

$

|

9.72

|

|

|

$

|

13.25

|

|

|

$

|

11.89

|

|

|

|

36.3

|

%

|

|

|

22.3

|

%

|

|

$

|

0.310

|

|

|

Second quarter

|

|

$

|

10.22

|

|

|

$

|

12.97

|

|

|

$

|

11.99

|

|

|

|

26.9

|

%

|

|

|

17.3

|

%

|

|

$

|

0.310

|

|

|

Third quarter

|

|

$

|

10.38

|

|

|

$

|

13.64

|

|

|

$

|

12.71

|

|

|

|

31.4

|

%

|

|

|

22.4

|

%

|

|

$

|

0.330

|

(2)

|

|

Fourth quarter

|

|

$

|

9.90

|

|

|

$

|

13.28

|

|

|

$

|

10.63

|

|

|

|

34.1

|

%

|

|

|

7.4

|

%

|

|

$

|

0.310

|

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First quarter

|

|

$

|

10.26

|

|

|

$

|

14.04

|

|

|

$

|

11.23

|

|

|

|

36.8

|

%

|

|

|

9.5

|

%

|

|

$

|

0.330

|

(2)

|

|

Second quarter

|

|

$

|

10.59

|

|

|

$

|

13.75

|

|

|

$

|

12.57

|

|

|

|

29.8

|

%

|

|

|

18.7

|

%

|

|

$

|

0.340

|

(2)

|

|

Third quarter

|

|

$

|

10.38

|

|

|

$

|

13.44

|

|

|

$

|

12.66

|

|

|

|

29.5

|

%

|

|

|

22.0

|

%

|

|

$

|

0.350

|

(2)

|

|

Fourth quarter

|

|

$

|

10.55

|

|

|

$

|

14.44

|

|

|

$

|

12.98

|

|

|

|

36.9

|

%

|

|

|

23.0

|

%

|

|

$

|

0.400

|

(2)

|

|

2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First quarter (through February 27, 2020)

|

|

|

*

|

|

|

$

|

15.99

|

|

|

$

|

13.97

|

|

|

|

*

|

|

|

|

*

|

|

|

|

**

|

|

|

(1)

|

NAV per share is generally determined as of the last day in the relevant quarter and therefore may not reflect the NAV per share on the date of the high and low sales prices. The NAVs shown are based on outstanding shares at the end of each period.

|

|

(2)

|

Includes a supplemental distribution.

|

|

*

|

NAV has not yet been calculated for this period.

|

|

**

|

Cash distribution per share has not yet been determined for this period.

|

The last reported price for our common stock on February 27, 2020 was $14.60 per share.

Shares of business development companies, or BDCs, may trade at a market price that is less than the value of the net assets attributable to those shares. The possibility that our shares of common stock will trade at a discount from NAV or at premiums that are unsustainable over the long term are separate and distinct from the risk that our NAV will decrease. At times, our shares of common stock have traded at a premium to NAV and at times our shares of common stock have traded at a discount to the net assets attributable to those shares. It is not possible to predict whether the shares offered hereby will trade at, above, or below NAV.

SENIOR SECURITIES

Information about our senior securities is shown in the following table for the periods as of December 31, 2019, 2018, 2017, 2016, 2015, 2014, 2013, 2012, 2011, and 2010. The information as of December 31, 2019, 2018, 2017, 2016, 2015, 2014, 2013, 2012, 2011 and 2010 has been derived from our audited financial statements for these periods, which have been audited by PricewaterhouseCoopers LLP, our independent registered public accounting firm. The report of PricewaterhouseCoopers LLP on the senior securities table as of December 31, 2019 is attached hereto as Exhibit 99.1. The “N/A” indicates information that the SEC expressly does not require to be disclosed for certain types of senior securities.

|

Class and Year

|

|

Total Amount

Outstanding

Exclusive of

Treasury Securities(1)

|

|

|

Asset Coverage

per Unit(2)

|

|

|

Average

Market

Value

per Unit(3)

|

|

|

Securitized Credit Facility with Wells Fargo Capital Finance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2010(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

December 31, 2011

|

|

$

|

10,186,830

|

|

|

$

|

73,369

|

|

|

|

N/A

|

|

|

December 31, 2012(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

December 31, 2013(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

December 31, 2014(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

December 31, 2015

|

|

$

|

50,000,000

|

|

|

$

|

26,352

|

|

|

|

N/A

|

|

|

December 31, 2016

|

|

$

|

5,015,620

|

|

|

$

|

290,234

|

|

|

|

N/A

|

|

|

December 31, 2017(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

December 31, 2018

|

|

$

|

13,106,582

|

|

|

$

|

147,497

|

|

|

|

N/A

|

|

|

December 31, 2019(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

Securitized Credit Facility with Union Bank, NA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2010(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

December 31, 2011(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

December 31, 2012(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

December 31, 2013(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

December 31, 2014(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

December 31, 2015(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

December 31, 2016(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

December 31, 2017(6)

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

December 31, 2018

|

|

$

|

39,849,010

|

|

|

$

|

48,513

|

|

|

|

N/A

|

|

|

December 31, 2019

|

|

$

|

103,918,736

|

|

|

$

|

23,423

|

|

|

|

N/A

|

|

|

Small Business Administration Debentures (HT II)(4)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2010

|

|

$

|

150,000,000

|

|

|

$

|

3,942

|

|

|

|

N/A

|

|

|

December 31, 2011

|

|

$

|

125,000,000

|

|

|

$

|

5,979

|

|

|

|

N/A

|

|

|

December 31, 2012

|

|

$

|

76,000,000

|

|

|

$

|

14,786

|

|

|

|

N/A

|

|

|

December 31, 2013

|

|

$

|

76,000,000

|

|

|

$

|

16,075

|

|

|

|

N/A

|

|

|

December 31, 2014

|

|

$

|

41,200,000

|

|

|

$

|

31,535

|

|

|

|

N/A

|

|

|

December 31, 2015

|

|

$

|

41,200,000

|

|

|

$

|

31,981

|

|

|

|

N/A

|

|

|

December 31, 2016

|

|

$

|

41,200,000

|

|

|

$

|

35,333

|

|

|

|

N/A

|

|

|

December 31, 2017

|

|

$

|

41,200,000

|

|

|

$

|

39,814

|

|

|

|

N/A

|

|

|

December 31, 2018

|

|

|

—

|

|

|

|

—

|

|

|

|

N/A

|

|

|

Small Business Administration Debentures (HT III)(5)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2010

|

|

$

|

20,000,000

|

|

|

$

|

29,564

|

|

|

|

N/A

|

|

|

December 31, 2011

|

|

$

|

100,000,000

|

|

|

$

|

7,474

|

|

|

|

N/A

|

|

|

December 31, 2012

|

|

$

|

149,000,000

|

|

|

$

|

7,542

|

|

|

|

N/A

|

|

|

December 31, 2013

|

|

$

|

149,000,000

|

|

|

$

|

8,199

|

|

|

|

N/A

|

|

|

December 31, 2014

|

|

$

|

149,000,000

|

|

|

$

|

8,720

|

|

|

|

N/A

|

|

|

December 31, 2015

|

|

$

|

149,000,000

|

|

|

$

|

8,843

|

|

|

|

N/A

|

|

|

December 31, 2016

|

|

$

|

149,000,000

|

|

|

$

|

9,770

|

|

|

|

N/A

|

|

|

December 31, 2017

|

|

$

|

149,000,000

|

|

|

$

|

11,009

|

|

|

|

N/A

|

|

|

December 31, 2018

|

|

$

|

149,000,000

|

|

|

$

|

12,974

|

|

|

|

N/A

|

|

|

December 31, 2019

|

|

$

|

149,000,000

|

|

|

$

|

16,336

|

|

|

|

N/A

|

|

|

Class and Year

|

|

Total Amount

Outstanding

Exclusive of

Treasury Securities(1)

|

|

|

Asset Coverage

per Unit(2)

|

|

|

Average

Market

Value

per Unit(3)

|

|

|

2016 Convertible Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2011

|

|

$

|

75,000,000

|

|

|

$

|

10,623

|

|

|

$

|

885

|

|

|

December 31, 2012

|

|

$

|

75,000,000

|

|

|

$

|

15,731

|

|

|

$

|

1,038

|

|

|

December 31, 2013

|

|

$

|

75,000,000

|

|

|

$

|

16,847

|

|

|

$

|

1,403

|

|

|

December 31, 2014

|

|

$

|

17,674,000

|

|

|

$

|

74,905

|

|

|

$

|

1,290

|

|

|

December 31, 2015

|

|

$

|

17,604,000

|

|

|

$

|

74,847

|

|

|

$

|

1,110

|

|

|

December 31, 2016

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

April 2019 Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2012

|

|

$

|

84,489,500

|

|

|

$

|

13,300

|

|

|

$

|

986

|

|

|

December 31, 2013

|

|

$

|

84,489,500

|

|

|

$

|

14,460

|

|

|

$

|

1,021

|

|

|

December 31, 2014

|

|

$

|

84,489,500

|

|

|

$

|

15,377

|

|

|

$

|

1,023

|

|

|

December 31, 2015

|

|

$

|

64,489,500

|

|

|

$

|

20,431

|

|

|

$

|

1,017

|

|

|

December 31, 2016

|

|

$

|

64,489,500

|

|

|

$

|

22,573

|

|

|

$

|

1,022

|

|

|

December 31, 2017

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

September 2019 Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2012

|

|

$

|

85,875,000

|

|

|

$

|

13,086

|

|

|

$

|

1,003

|

|

|

December 31, 2013

|

|

$

|

85,875,000

|

|

|

$

|

14,227

|

|

|

$

|

1,016

|

|

|

December 31, 2014

|

|

$

|

85,875,000

|

|

|

$

|

15,129

|

|

|

$

|

1,026

|

|

|

December 31, 2015

|

|

$

|

45,875,000

|

|

|

$

|

28,722

|

|

|

$

|

1,009

|

|

|

December 31, 2016

|

|

$

|

45,875,000

|

|

|

$

|

31,732

|

|

|

$

|

1,023

|

|

|

December 31, 2017

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

2022 Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2017

|

|

$

|

150,000,000

|

|

|

$

|

10,935

|

|

|

$

|

1,014

|

|

|

December 31, 2018

|

|

$

|

150,000,000

|

|

|

$

|

12,888

|

|

|

$

|

976

|

|

|

December 31, 2019

|

|

$

|

150,000,000

|

|

|

$

|

16,227

|

|

|

$

|

1,008

|

|

|

2024 Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2014

|

|

$

|

103,000,000

|

|

|

$

|

12,614

|

|

|

$

|

1,010

|

|

|

December 31, 2015

|

|

$

|

103,000,000

|

|

|

$

|

12,792

|

|

|

$

|

1,014

|

|

|

December 31, 2016

|

|

$

|

252,873,175

|

|

|

$

|

5,757

|

|

|

$

|

1,016

|

|

|

December 31, 2017

|

|

$

|

183,509,600

|

|

|

$

|

8,939

|

|

|

$

|

1,025

|

|

|

December 31, 2018

|

|

$

|

83,509,600

|

|

|

$

|

23,149

|

|

|

$

|

1,011

|

|

|

December 31, 2019

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

2025 Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2018

|

|

$

|

75,000,000

|

|

|

$

|

25,776

|

|

|

$

|

962

|

|

|

December 31, 2019

|

|

$

|

75,000,000

|

|

|

$

|

32,454

|

|

|

$

|

1,032

|

|

|

2033 Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2018

|

|

$

|

40,000,000

|

|

|

$

|

48,330

|

|

|

$

|

934

|

|

|

December 31, 2019

|

|

$

|

40,000,000

|

|

|

$

|

60,851

|

|

|

$

|

1,054

|

|

|

July 2024 Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2019

|

|

$

|

105,000,000

|

|

|

$

|

23,181

|

|

|

|

N/A

|

|

|

2017 Asset-Backed Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2012

|

|

$

|

129,300,000

|

|

|

$

|

8,691

|

|

|

$

|

1,000

|

|

|

December 31, 2013

|

|

$

|

89,556,972

|

|

|

$

|

13,642

|

|

|

$

|

1,004

|

|

|

December 31, 2014

|

|

$

|

16,049,144

|

|

|

$

|

80,953

|

|

|

$

|

1,375

|

|

|

December 31, 2015

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

2021 Asset-Backed Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2014

|

|

$

|

129,300,000

|

|

|

$

|

10,048

|

|

|

$

|

1,000

|

|

|

December 31, 2015

|

|

$

|

129,300,000

|

|

|

$

|

10,190

|

|

|

$

|

996

|

|

|

December 31, 2016

|

|

$

|

109,205,263

|

|

|

$

|

13,330

|

|

|

$

|

1,002

|

|

|

December 31, 2017

|

|

$

|

49,152,504

|

|

|

$

|

33,372

|

|

|

$

|

1,001

|

|

|

December 31, 2018

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

2027 Asset-Backed Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2018

|

|

$

|

200,000,000

|

|

|

$

|

9,666

|

|

|

$

|

1,006

|

|

|

December 31, 2019

|

|

$

|

200,000,000

|

|

|

$

|

12,170

|

|

|

$

|

1,004

|

|

|

2028 Asset-Backed Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2019

|

|

$

|

250,000,000

|

|

|

$

|

9,736

|

|

|

$

|

1,004

|

|

|

2022 Convertible Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2017

|

|

$

|

230,000,000

|

|

|

$

|

7,132

|

|

|

$

|

1,028

|

|

|

December 31, 2018

|

|

$

|

230,000,000

|

|

|

$

|

8,405

|

|

|

$

|

946

|

|

|

December 31, 2019

|

|

$

|

230,000,000

|

|

|

$

|

10,583

|

|

|

$

|

1,021

|

|

|

Total Senior Securities(7)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2010

|

|

$

|

170,000,000

|

|

|

$

|

3,478

|

|

|

|

N/A

|

|

|

December 31, 2011

|

|

$

|

310,186,830

|

|

|

$

|

2,409

|

|

|

|

N/A

|

|

|

December 31, 2012

|

|

$

|

599,664,500

|

|

|

$

|

1,874

|

|

|

|

N/A

|

|

|

December 31, 2013

|

|

$

|

559,921,472

|

|

|

$

|

2,182

|

|

|

|

N/A

|

|

|

December 31, 2014

|

|

$

|

626,587,644

|

|

|

$

|

2,073

|

|

|

|

N/A

|

|

|

December 31, 2015

|

|

$

|

600,468,500

|

|

|

$

|

2,194

|

|

|

|

N/A

|

|

|

December 31, 2016

|

|

$

|

667,658,558

|

|

|

$

|

2,180

|

|

|

|

N/A

|

|

|

December 31, 2017

|

|

$

|

802,862,104

|

|

|

$

|

2,043

|

|

|

|

N/A

|

|

|

December 31, 2018

|

|

$

|

980,465,192

|

|

|

$

|

1,972

|

|

|

|

N/A

|

|

|

December 31, 2019

|

|

$

|

1,302,918,736

|

|

|

$

|

1,868

|

|

|

|

N/A

|

|

|

(1)

|

Total amount of each class of senior securities outstanding at the end of the period presented.

|

|

(2)

|

The asset coverage ratio for a class of senior securities representing indebtedness is calculated as our consolidated total assets, less all liabilities and indebtedness not represented by senior securities, including senior securities not subject to asset coverage requirements under the 1940 Act due to exemptive relief from the SEC, divided by senior securities representing indebtedness. This asset coverage ratio is multiplied by $1,000 to determine the Asset Coverage per Unit.

|

|

(3)

|

Not applicable because senior securities are not registered for public trading.

|

|

(4)

|

Issued by Hercules Technology II, L.P., or HT II, one of our prior SBIC subsidiaries, to the Small Business Association, or SBA. On July 13, 2018, we completed repayment of the remaining outstanding HT II debentures and subsequently surrendered the SBA license with respect to HT II. These categories of senior securities were not subject to the asset coverage requirements of the 1940 Act as a result of exemptive relief granted to us by the SEC.

|

|

(5)

|

Issued by Hercules Technology III, L.P., or HT III, our SBIC subsidiary, to the SBA. These categories of senior securities were not subject to the asset coverage requirements of the 1940 Act as a result of exemptive relief granted to us by the SEC.

|

|

(6)

|

The Company’s Wells Facility and Union Bank Facility had no borrowings outstanding during the periods noted above.

|

|

(7)

|

The total senior securities and Asset Coverage per Unit shown for those securities do not represent the asset coverage ratio requirement under the 1940 Act because the presentation includes senior securities not subject to the asset coverage requirements of the 1940 Act as a result of exemptive relief granted to us by the SEC. As of December 31, 2019, our asset coverage ratio under our regulatory requirements as a BDC was 198.0% excluding our SBA debentures as a result of our exemptive order from the SEC which allows us to exclude all SBA leverage from our asset coverage ratio.

|

OUTSTANDING SECURITIES AS OF FEBRUARY 14, 2020

|

Title of Class

|

Amount Authorized

|

Amount Held by Company for its Account

|

Amount Outstanding

|

|

Common Stock, $0.001 par value per share

|

200,000,000

|

---

|

110,550,633

|

|

5.25% Notes due 2025

|

---

|

---

|

$75.0 million aggregate principal amount

|

|

6.25% Notes due 2033

|

---

|

---

|

$40.0 million aggregate principal amount

|

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HERCULES CAPITAL, INC.

|

|

|

|

|

|

|

|

|

March 2, 2020

|

|

By:

|

/s/ Melanie Grace

|

|

|

|

|

|

Melanie Grace

General Counsel and Secretary

|

|

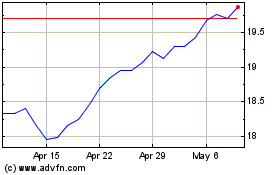

Hercules Capital (NYSE:HTGC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hercules Capital (NYSE:HTGC)

Historical Stock Chart

From Apr 2023 to Apr 2024