IBM Earnings Hint at Signs of Turnaround -- 2nd Update

January 21 2020 - 7:49PM

Dow Jones News

By Asa Fitch

International Business Machines Corp. reported a slight increase

in quarterly revenue, ending a streak of falling sales and

providing a first indication Chief Executive Ginni Rometty's

roughly $33 billion acquisition of open-source software giant Red

Hat may help turn around Big Blue's fortunes.

The company on Tuesday said fourth-quarter revenue rose 0.1% to

$21.78 billion after five straight quarters of year-over-year

declines.

Adjusted earnings per share fell around 3% to $4.71 but came in

ahead of expectations of analysts surveyed by FactSet. Adjusted net

income fell by about 5% to $4.2 billion, IBM said.

Boosting IBM sales has been a difficult task for Ms. Rometty

since she took over in 2012 as CEO of the iconic tech company.

Quarterly sales slid throughout her first several years as

customers changed their IT spending priorities and IBM was slow to

respond. IBM briefly halted that slide in 2017 and 2018, only for

quarterly revenue to fall again.

IBM was slow to embrace the cloud-computing model where

customers rent computing horsepower rather than buy and pay to

maintain the equipment. But cloud computing took off over the past

decade, delivering strong earnings growth for market leaders

Amazon.com Inc. and Microsoft Corp.

Buying Red Hat, IBM's biggest acquisition in its 108 years,

represents a big bet for Ms. Rometty to finally deliver lasting

top-line growth. Red Hat sells support for open-source software

that IBM expects more companies will use as they crunch more of

their data in the cloud. Ms. Rometty said Red Hat would help IBM be

a leader as that market evolves to the so-called hybrid cloud,

where companies mix on-site storage and rented server capacity.

IBM said the fourth quarter was its strongest yet in the cloud,

with 21% growth to $6.8 billion of sales. Amazon and Microsoft

still post higher growth rates in this market, though companies

differ in what cloud services they offer and how they calculate

those sales.

IBM also issued an upbeat outlook across its businesses for the

current year. Adjusted earnings per share for this year should be

at least $13.35, up from $12.81 in 2019, the company said, and

above what analysts forecast.

IBM shares rose 3.5% in aftermarket trading.

IBM doesn't provide revenue guidance, but Ms. Rometty said sales

should continue on an upward trajectory. "This positions us for

sustained revenue growth in 2020," she said.

IBM is expected to get a boost this year from a new generation

of mainframe computers introduced late last year and from Red Hat,

where adjusted revenue grew by 24% in the quarter. IBM finalized

its purchase of Red Hat, which sells open-source software support

and training services, in July.

James Kavanaugh, IBM's chief financial officer, said the

combination with Red Hat is already paying dividends. Red Hat

signed 21 deals worth more than $10 million in the fourth quarter,

he said, doubling the total for the previous quarter.

The gains for IBM from the addition of Red Hat haven't yet fully

hit the bottom line. IBM can't immediately count all of Red Hat's

deferred revenue as its own sales under accounting rules, while the

company has to reflect all costs it has taken on.

The systems segment, which includes sales of the new mainframe

computers, delivered $3 billion in sales, a 16% increase compared

with the prior year.

Some of IBM's legacy businesses continued to struggle, though.

The technology-services segment, which includes tech support and

outsourcing services, saw a 4.8% fall in revenue to about $6.9

billion.

Mr. Kavanaugh said IBM was reorganizing that segment to make it

more cost-competitive. He didn't specify specific actions the

company would take to lower costs.

"We're going to take aggressive structural actions to reposition

the business overall," he said.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

January 21, 2020 19:34 ET (00:34 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

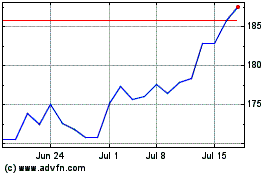

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024