Stronger U.S. Demand Bolsters Profit at UPS -- 2nd Update

October 22 2019 - 11:07AM

Dow Jones News

By Paul Ziobro

United Parcel Service Inc. benefited from a continued surge in

overnight air shipments in the third quarter, as speedy next-day

delivery increasingly becomes the standard for online orders.

The delivery company also announced the departure of Chief

Operating Officer Jim Barber, who since his appointment to the role

in March 2018 was viewed as the top candidate to replace Chief

Executive David Abney. Mr. Barber, 59 years old, is retiring at the

end of the year, the company said, opening up the CEO succession

race.

Mr. Barber, a 35-year UPS veteran, returned to the U.S. from a

long stint working internationally to help improve performance in

domestic operations. His promotion to COO made him a

CEO-in-waiting, as Mr. Abney previously held that position briefly

before becoming CEO in 2014.

Mr. Barber helped oversee the increasing automation of the UPS

network and new procedures that resulted in a solid peak holiday

season last year, earning him praise on Wall Street.

Citi analyst Christian Wetherbee said Mr. Barber was "well-liked

by the investment community" and that losing an executive "seen as

an operational catalyst likely will weigh on shares."

Mr. Abney said Tuesday that the company still has a strong

bench, including a mix of longtime UPS executives and some new

outside hires, that will be able to carry out the company's recent

major changes.

Shares fell 3.2% in early trading to $114.71.

UPS said the high demand for next-day shipping, with volume up

24% in the U.S., and strong cost management helped the company

boost profit in the period. Overall U.S. volume rose 9%.

The gain in air shipments comes as Amazon.com Inc., the largest

online retailer in the U.S., recently ended its shipping contracts

with UPS rival FedEx Corp. and is increasingly promising to deliver

orders to homes the next day. Other online merchants also are

trying to keep up with faster shipping speeds, which UPS expects to

continue to occur during the coming holiday season and beyond.

"We expect demand to be strong during peak as next-day delivery

increasingly becomes the new standard," Mr. Barber said on

Tuesday's earnings call.

UPS is working to lower the cost of delivering each package,

including air shipments, where carrying more online orders that are

generally lighter and cheaper to ship is driving down the average

price per shipment.

The company is achieving that in part from more automation. It

is adding nearly 5 million square feet of "highly automated"

facilities this year that can sort about 400,000 packages an

hour.

Mr. Abney said that despite softness in industrial production

and weaker global growth, a strong U.S. consumer is lifting the

company as more shopping is done online. "The consumer continues to

drive the economy," Mr. Abney said.

Overseas, UPS's international business posted a decline in

revenue amid a drop in shipments between the U.S. and Asia. Other

shipments inside Europe and in other Asia trade lanes grew.

For the period, the Atlanta-based shipper posted quarterly

earnings of $1.75 billion, or $2.01 a share, up from $1.51 billion,

or $1.73 a share, a year earlier. Excluding certain transformation

costs, per-share earnings were $2.07, slightly topping the estimate

of analysts polled by FactSet.

Revenue increased 5% from the year prior to $18.32 billion,

slightly under the consensus estimate.

The company backed its earnings guidance for the year.

Micah Maidenberg contributed to this article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

October 22, 2019 10:52 ET (14:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

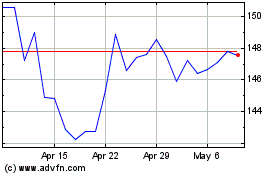

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

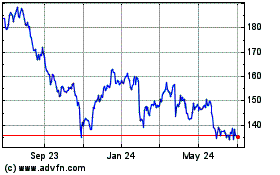

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024