Fannie, Freddie to Consider Alternatives to FICO Scores Under New Rule

August 13 2019 - 2:32PM

Dow Jones News

By Andrew Ackerman

WASHINGTON -- One firm's dominance over the credit scores used

to vet many U.S. mortgages is getting a shake-up.

Fannie Mae and Freddie Mac, two mortgage-finance firms that back

nearly half of U.S. mortgages, will have to consider credit-score

alternatives to Fair Isaac Corp.'s FICO score when determining a

mortgage applicant's creditworthiness, under a new rule completed

on Tuesday by the mortgage-finance giants' federal overseer.

The move by the Federal Housing Finance Agency is seen as a win

for VantageScore, a credit-score system by VantageScore Solutions

LLC, which is owned by the three large credit-reporting firms:

Equifax Inc., TransUnion and Experian PLC.

Tuesday's rule sets up a four-phase process for Fannie and

Freddie to validate and approve credit score models. The measure is

required by a regulatory rollback signed into law last year.

(More)

AnnaMaria Andriotis contributed to this article.

(END) Dow Jones Newswires

August 13, 2019 14:17 ET (18:17 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

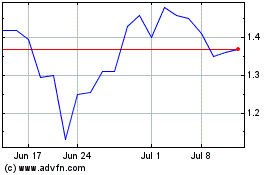

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

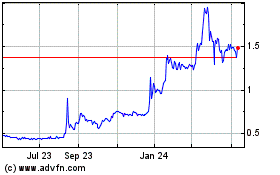

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Apr 2023 to Apr 2024