Chinese Ride-Hailing App Didi Seeks $2 Billion -- WSJ

July 18 2019 - 3:02AM

Dow Jones News

By Julie Steinberg

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 18, 2019).

China's dominant ride-hailing company Didi Chuxing Technology

Co. is working to raise up to $2 billion from investors, according

to people familiar with the matter, the latest sign that firms in

the sector including Uber Technologies Inc. and Lyft Inc. are eager

to raise money to fuel investments while posting steep losses.

The Beijing company plans to sell additional shares at the same

price when it raised money in July 2018 from Booking Holdings Inc.,

the online travel company formerly known as Priceline, the people

said. The company's valuation at that time couldn't be learned.

After the cash is injected from this round, the seven-year-old

company is likely to have a paper valuation of around $62 billion,

one of the people said. That is up from a valuation of $56 billion

from a 2017 funding round.

Despite being the biggest player in China's ride-hailing market,

Didi is still struggling to reach profitability as it faces smaller

rivals; it expands into other forms of transportation businesses

such as auto services, including leasing and vehicle maintenance;

and it hires hundreds of employees to improve customer service.

Earlier this year a Didi executive said that for every ride in

China it facilitated in the three months ended December, the

company lost on average 2% of the fare paid. That means it cost the

company $1.02 for every dollar generated from fares.

Didi's shareholders include some of the world's most valuable

tech firms and investors -- SoftBank Group Corp., Apple Inc.,

Alibaba Group Holding Ltd. and Tencent Holdings Ltd. It isn't clear

how current investors will respond to Didi's search for fresh

funds. SoftBank and Tencent representatives declined to comment.

Apple and Alibaba spokesmen didn't immediately comment.

Last year, Didi considered issuing a convertible bond, as well

as launching an IPO. But it pulled back on both efforts after two

female passengers were murdered, and the company focused on

revamping its safety measures. An IPO isn't expected until at least

next year, according to people familiar with the company.

Both Lyft and Uber flopped in trading after their initial public

offerings earlier this year, testing investors' appetites for

companies with big losses in an otherwise strong IPO market. Both

companies continue to trade below their respective IPO prices, but

have recovered from their lowest trading levels in May.

Uber reported an accumulated deficit of about $7.9 billion as of

Dec. 31, while Lyft's was more than $2.9 billion, according to

securities filings, and both have warned operating costs will rise

as part of investments in their respective platforms.

Revenue growth for ride-hailing companies is expected to rise

nearly 20% this year to $183.7 billion, with the U.S. being the

world's largest market, according to analytics firm Statista. While

ride-sharing continues to gain in popularity world-wide, growth is

expected to slow in the years ahead.

At the new $62 billion valuation, Didi would rank in the top

three private tech companies globally, after Ant Financial Services

Group and Bytedance Ltd. The increase in valuation size is modest,

reflecting the subdued atmosphere for tech companies, especially in

China.

Uber, which owns 15.4% of Didi, implied in securities filings

earlier this year that the Chinese firm was valued at $51.6 billion

as of December. Uber in 2016 sold its operations in China to Didi

in exchange for a minority stake in the company.

Didi is soliciting funds amid what people in the tech industry

are calling a "capital winter," meaning it is difficult for Chinese

companies to raise money. That has been especially true for those

focused on consumers. After years of sky-high valuations and

lackluster market performance for some IPOs, many Chinese tech

companies have slowed their frenzied capital-raising and have

focused on executing their business plans instead.

Didi had $7.7 billion in net cash after debt at the end of 2018,

said a person familiar with the situation. The firm had $12 billion

in cash reserves when it raised money in 2017, the Journal earlier

reported.

The company has been spending on developing new technologies

such as autonomous driving. Didi also has reached deals with car

makers like Germany's Volkswagen AG and China's Guangzhou

Automobile Group Co. to explore self-driving and other technologies

or design vehicles for car-sharing.

--Yoko Kubota contributed to this article.

Write to Julie Steinberg at julie.steinberg@wsj.com

(END) Dow Jones Newswires

July 18, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

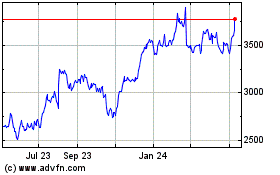

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Sep 2023 to Sep 2024