Firms Vie For Unit of Warehouse Giant GLP -- WSJ

May 24 2019 - 3:02AM

Dow Jones News

By Liz Hoffman, Cara Lombardo and Miriam Gottfried

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 24, 2019).

Blackstone Group LP and Prologis Inc. are vying to buy the U.S.

arm of Singapore's GLP in a deal that could be worth roughly $20

billion, including debt, and create an industrial-warehouse giant,

according to people familiar with the matter.

GLP had been gearing up to take its U.S. business public later

this year, The Wall Street Journal reported in April. It is now

focused on selling the business outright and could reach a deal

with Blackstone, Prologis or another party as soon as next week,

the people said.

There is no guarantee a takeover deal will be reached and an IPO

remains an option, some of the people said.

If struck, an acquisition of the GLP business would be one of

the largest real-estate takeovers since the financial crisis.

Prologis is the biggest industrial real-estate investment trust,

with a market capitalization of nearly $50 billion and a portfolio

of 772 million square feet. The company has been an aggressive

acquirer, most recently buying DCT Industrial Trust Inc. last year

for about $8.5 billion including debt.

The GLP business up for sale is the second-largest owner of

industrial warehouses in the U.S. It has almost 200 million square

feet across some 1,350 properties, with Amazon.com Inc. as its

largest tenant. The growth of e-commerce and same- or next-day

shipping has generated demand for industrial real estate in

logistics hubs near big cities around the country.

A deal with either Prologis or Blackstone would be a round trip

of sorts for GLP.

GLP was born by a carve-out of Prologis' Asian assets in 2009

and then expanded internationally. One of its founders was Jeffrey

Schwartz, Prologis' former chief executive who died in 2014.

That year, Blackstone sold most of its warehouses to GLP. Since

then, the private-equity firm has been reassembling a large

portfolio of industrial properties and last year spent $4.4 billion

to buy Gramercy Property Trust. A deal for the GLP operation would

increase by a third Blackstone's warehouse space in the U.S.

Blackstone's real-estate business, which has $140 billion in

assets under management and more than 500 employees, is a major

global player and one of the largest owners of property in the U.S.

It owns Chicago's Willis Tower, the Cosmopolitan of Las Vegas

resort and casino, and thousands of homes through a stake in

Invitation Homes Inc. The private-equity firm had 561 million

square feet of logistics properties as of the end of the first

quarter.

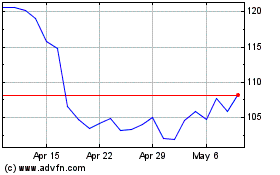

Shares of industrial real-estate investment trusts, a type of

tax-advantaged corporate setup that pays out most of its earnings

to shareholders, have soared this year as investors seek bigger

yields with interest rates at historic lows -- and that surely adds

to the allure of GLP. Prologis shares were recently up 34% this

year, while Terreno Realty Corp.'s had gained 34% and Duke Realty

Corp.'s 23%.

Write to Liz Hoffman at liz.hoffman@wsj.com, Cara Lombardo at

cara.lombardo@wsj.com and Miriam Gottfried at

Miriam.Gottfried@wsj.com

(END) Dow Jones Newswires

May 24, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

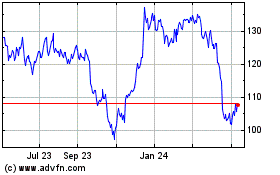

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024