Carvana Co. Announces $250.0 Million Private Offering of Senior Notes

May 20 2019 - 4:16PM

Business Wire

Carvana Co. (NYSE: CVNA), a leading e-commerce platform for

buying and selling used cars, today announced it is planning to

offer, subject to market conditions and other factors, $250.0

million of additional 8.875% senior notes due 2023 (the “new

notes”) in a private offering. The new notes will be issued as

additional notes under the indenture governing the outstanding

$350.0 million in aggregate principal amount of Carvana’s 8.875%

senior notes due 2023 that were issued on September 21, 2018 (the

“existing notes”).

Concurrently with the offering of new notes, Carvana intends to

offer 3,500,000 shares of Carvana's Class A common stock in an

underwritten public offering, subject to market conditions. Carvana

also expects to grant the underwriters a 30-day option to purchase

up to an additional 525,000 shares of Carvana’s Class A common

stock. The new notes offering is not contingent upon the concurrent

public offering of Class A common stock, and the concurrent public

offering of Class A common stock is not contingent upon the new

notes offering.

Carvana intends to use the net proceeds from the new notes

offering and the public offering of Class A common stock for

general corporate purposes. Carvana may use the net proceeds from

these offerings to partially repay borrowings under its floor plan

facility until it identifies other specific uses.

The new notes will not be registered under the Securities Act of

1933, as amended (“Securities Act”), or the securities laws of any

other jurisdiction, and will not be offered or sold in the United

States or to U.S. persons absent registration or an applicable

exemption from the registration requirements. The offering of the

new notes will be made only to persons reasonably believed to be

qualified institutional buyers in accordance with Rule 144A under

the Securities Act and to non-U.S. persons in accordance with

Regulation S under the Securities Act. The new notes and the

existing notes are expected to trade fungibly with one another.

This press release is issued pursuant to Rule 135c of the

Securities Act and does not constitute an offer to sell, or a

solicitation of an offer to buy, any security. No offer,

solicitation, or sale will be made in any jurisdiction in which

such an offer, solicitation, or sale would be unlawful. Any offers

of the new notes will be made only by means of a private offering

memorandum.

About Carvana Co.

Founded in 2012 and based in Phoenix, Carvana’s mission is to

change the way people buy cars. By removing the traditional

dealership infrastructure and replacing it with technology and

exceptional customer service, Carvana offers consumers an intuitive

and convenient online car buying and financing platform.

Carvana.com enables consumers to quickly and easily shop more than

18,000 vehicles, finance, trade-in or sell their current vehicle to

Carvana, sign contracts, and schedule as-soon-as-next-day delivery

or pickup at one of Carvana’s patented, automated Car Vending

Machines.

Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect Carvana’s current

intentions, expectations or beliefs regarding the new notes

offering and the proposed public offering of its Class A common

stock. These statements may be preceded by, followed by or include

the words "aim," "anticipate," "believe," "estimate," "expect,"

"forecast," "intend," "likely," "outlook," "plan," "potential,"

"project," "projection," "seek," "can," "could," "may," "should,"

"would," "will," the negatives thereof and other words and terms of

similar meaning. Forward-looking statements include all statements

that are not historical facts. Such forward-looking statements are

subject to various risks and uncertainties. Accordingly, there are

or will be important factors that could cause actual outcomes or

results to differ materially from those indicated in these

statements. There is no assurance that any forward-looking

statements will materialize. You are cautioned not to place undue

reliance on forward-looking statements, which reflect expectations

only as of this date. Carvana does not undertake any obligation to

publicly update or review any forward-looking statement, whether as

a result of new information, future developments, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190520005775/en/

Investor Relations:CarvanaMike

Levininvestors@carvana.com

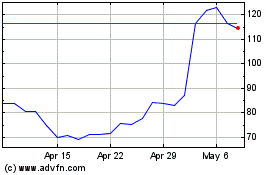

Carvana (NYSE:CVNA)

Historical Stock Chart

From Aug 2024 to Sep 2024

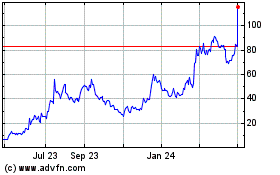

Carvana (NYSE:CVNA)

Historical Stock Chart

From Sep 2023 to Sep 2024