FedEx Cuts Outlook Again as Unit Strains -- WSJ

March 20 2019 - 3:02AM

Dow Jones News

By Paul Ziobro

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 20, 2019).

FedEx Corp. cut its outlook for the second consecutive quarter

after it reported a decline in revenue in its express unit and

lower profit in its ground business from the higher cost of

operating six days a week.

The global delivery giant said softening macroeconomic

conditions and weaker global trade trends continue to harm its

international shipping business. Shippers also are sending lighter

packages using slower, cheaper options in the express business,

where the average price charged per package fell 2%.

FedEx Chief Executive Fred Smith said the results were below

expectations. "We are focused on initiatives to improve our

performance."

FedEx is navigating a period of turbulence in its express

air-delivery unit. It has switched CEOs at the unit twice in the

past three months and is struggling to smoothly integrate the

European delivery company TNT Express, which it bought for $4.8

billion in 2016.

The Memphis, Tenn.-based company is trying to absorb the

slowdown by reducing international capacity, limiting hiring and

cutting back on discretionary spending. It recently enacted an

voluntary buyout program for employees to save up to $275 million a

year. Chief Financial Officer Alan Graf on Tuesday said FedEx is

looking at additional actions in light of weaker-than-expected

revenue.

Meanwhile, in the U.S., FedEx's ground business posted a 6% drop

in operating income, in part due to higher costs from moving to a

six-day operating schedule year-round. Previously, FedEx would

operate six or seven days a week around the holiday season but

rising demand for shipments has pushed the company to use its

delivery network more.

Investors have been hoping that FedEx could rein in some of its

capital spending and focus on boosting margins and returning more

capital to shareholders through actions like increased stock

buybacks. But Mr. Smith defended FedEx's spending on upgrading its

aircraft fleet and adding to its shipping capacity.

"The perspective of Wall Street is always, 'Give me the money,'"

Mr. Smith said. "The perspective from inside FedEx is, 'What's the

best thing we can do for the long term?'"

For the quarter ended Feb. 28, FedEx reported a profit of $739

million, or $2.80 a share, compared with $2.07 billion, or $7.59 a

share, a year earlier, when the company benefited from a lower

deferred-tax liability due to the new tax law. Adjusted for

integration expenses and the tax benefit, per-share earnings were

$3.03 compared with $3.72 last year.

Revenue rose 3% to $17 billion. The express unit posted a 1%

revenue drop, while revenue in the ground unit rose 9%.

Analysts polled by Refinitiv most recently expected earnings of

$3.11 a share on $17.67 billion in revenue.

For the year, FedEx projected earnings of between $11.95 and

$13.10 a share, down from $12.65 to $13.40 previously.

FedEx executives continued to play down the ability of

Amazon.com Inc., which is adding more planes and trucks as well as

delivering more of its orders to homes, to disrupt the delivery

market. Chief Operating Officer Rajesh Subramaniam said] Amazon

represents only 1.3% of FedEx's revenue and isn't "a threat to our

future growth."

FedEx shares, which have dropped more than 27% over the last

year, fell an additional 4.9% in after-hours trading to $172.34.

Shares of United Parcel Service Inc. also fell 1.5% in late trading

to $108.75.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

March 20, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

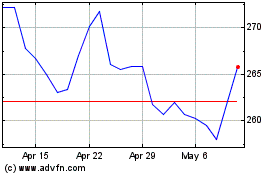

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

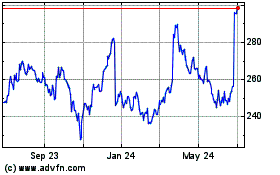

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024