Stocks Drop as Hopes for a Trade Truce Fade

September 24 2018 - 11:29AM

Dow Jones News

By Christopher Whittall

U.S. stocks slipped Monday, retreating further from their

all-time highs, as tensions over the U.S. and China's trade fight

stoked cautiousness among investors.

The Dow Jones Industrial Average fell 139 points, or 0.4%, to

26603. The S&P 500 dropped 0.5% and the Nasdaq Composite lost

0.4%.

Major indexes began the week on a downbeat note after China

pulled out of trade talks with the U.S., suggesting a resolution to

the two countries' trade conflict could be a way off.

Shares of industrial companies, which many analysts have said

are particularly vulnerable to tariffs, were among the biggest

decliners in the S&P 500. Aerospace-parts maker Arconic lost

2.6%, while Illinois Tool Works fell 1.8% and tool manufacturer

Stanley Black & Decker shed 2.1%.

The losses offset a rally in the S&P 500 energy sector,

which headed for its biggest one-day gain since July. The sector

rose 1.1% after a Sunday meeting of oil-producing countries failed

to produce a consensus on how to contain prices. U.S. crude oil

rose 1.9% to $72.11 a barrel.

Despite an uptick in volatility in recent weeks, many investors

are continuing to bet stocks will be able to keep nudging higher.

Economic data have pointed to strength in the U.S. labor market and

sustained growth in corporate earnings. Some investors are also

holding out hope that the back-and-forth between the U.S. and China

will eventually give way to a trade deal.

Fabrizio Quirighetti, co-head of multiasset investments at SYZ

Asset Management, is looking through the near-term headlines in the

belief that the U.S. and China will reach an agreement after the

midterm elections in November.

Having favored U.S. stocks over the summer, he is now buying

equities in other regions including Europe, where he thinks growth

is firming after a slowdown earlier in 2018.

"We have become more constructive on the rest of the world,"

said Mr. Quirighetti.

Elsewhere, the Stoxx Europe 600 slipped 0.6% as declines in

shares of automakers and construction firms offset a rally in the

energy sector.

Mergers and acquisitions also drove European markets, with

shares in Sky rising nearly 9% after Comcast outbid 21st Century

Fox to buy the European pay-TV giant. In the U.S., Comcast shares

fell 8%.

Randgold Resources jumped 5.7% on news that Barrick Gold had

agreed to buy the company in an all-share merger that would create

the world's largest gold miner.

In Asia, there were signs of last week's positive momentum

reversing, though many markets were closed for holidays.

Hong Kong's Hang Seng Index slumped 1.6% after rising 2.4% last

week. Australia's S&P/ASX 200 declined 0.1%.

Investors' attention will return to central banks this week,

with the Federal Reserve due to release its policy statement

Wednesday. The Fed is on track to raise interest rates amid solid

U.S. growth, while investors will look for clues on the path of

rate increases in 2019.

"We don't think there'll be a dovish surprise coming out of the

meeting, " said Ian Samson, markets research analyst at Fidelity

International.

Write to Christopher Whittall at

christopher.whittall@wsj.com

(END) Dow Jones Newswires

September 24, 2018 11:14 ET (15:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

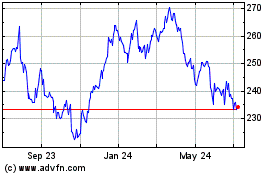

Illinois Tool Works (NYSE:ITW)

Historical Stock Chart

From Aug 2024 to Sep 2024

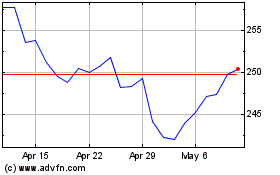

Illinois Tool Works (NYSE:ITW)

Historical Stock Chart

From Sep 2023 to Sep 2024