MoneyBeat: Nike Leads Sportswear Rebound -- WSJ

September 21 2018 - 3:02AM

Dow Jones News

By Amrith Ramkumar

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 21, 2018).

Add another company to the list of retailers bouncing back in a

big way this year: Nike Inc.

The Beaverton, Ore., firm has led a resurgence in shares of

companies that sell athletic equipment, shoes and clothing, after

worries about the rapid rise of e-commerce hurt the group in

previous years. Nike shares are up 36% this year and closed at a

record Thursday after the stock fell from its October 2015 peak

through last fall.

Analysts say confidence in Nike's digital sales efforts --

particularly in North America -- has lifted the stock, a trend also

seen with traditional brick-and-mortar retailers such as Macy's

Inc. this year. Nike's 2018 advance has put it in the upper echelon

of the S&P 500, even topping the year-to-date climbs of

technology heavyweights like Apple Inc. and Microsoft Corp.

The gains have come despite an investigation into allegations of

inappropriate workplace behavior and flaws in Nike's

human-resources department, which were reported by The Wall Street

Journal earlier this year.

More recently, Nike shares have erased their 3.2% drop from

Sept. 4, when the company faced backlash for using National

Football League quarterback-turned-activist Colin Kaepernick at the

center of an advertising campaign.

Analysts were initially anxious about the impact of the decision

on sales, but Wall Street seems to be more confident that Nike can

keep growing revenue. Five analysts tracked by FactSet have raised

their price targets on the stock in the past week, ahead of Nike's

earnings report next Tuesday.

"I thought Nike would have problems with the Kaepernick

situation. I was wrong," said Eric Aanes, president and founder of

Titus Wealth Management. "Their edgy marketing appeared to pay off

for them."

Shares of other sporting-goods companies also have climbed.

Under Armour shares are up 39% this year. In Europe, Adidas has

risen 25% for the year and Puma has climbed 16%, outpacing middling

stock indexes in the region that have been buffeted by trade

tensions and weaker-than-expected economic growth.

Although some analysts expect heavy competition to hurt the

group moving forward, others are confident it can keep climbing

late in the year.

"We struggle to find much negative to say on sporting goods,"

HSBC analysts said in a recent note to clients.

To receive our Markets newsletter every morning in your inbox,

click here.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

September 21, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

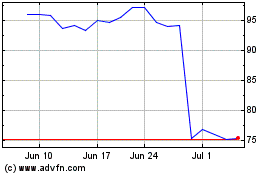

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2024 to May 2024

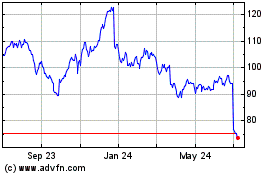

Nike (NYSE:NKE)

Historical Stock Chart

From May 2023 to May 2024