By Stu Woo and Ben Dummett

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 21, 2018).

LONDON -- Comcast Corp. and 21st Century Fox Inc. will settle

their takeover battle for Sky PLC in a weekend auction run by

British regulators, setting up a dramatic climax to a 21-month sale

process that has pitted some of the world's biggest media giants

against each other.

The U.K. Takeover Panel, which polices deal making in the

country, laid out rules for the auction on Thursday. It is a

process the regulator hasn't run many times previously -- and never

before with such a large company as the prize. London-listed Sky

has a market value of some $36 billion.

Such government-mandated auctions of big, publicly traded

companies are rare. The Sky auction pits Rupert Murdoch's 21st

Century Fox, which already owns 39% of Sky, against Comcast. Walt

Disney Co. has separately agreed to buy a big chunk of Fox,

including its Sky stake, for $71 billion.

That puts Disney Chief Executive Bob Iger and Mr. Murdoch on the

same team, bidding against Comcast CEO Brian Roberts. Because Fox

already owns a big stake in Sky, the Disney-Fox team has an

interest in driving up the bidding, even if it doesn't ultimately

win. That would make the stake more valuable should it decide to

sell it to Comcast.

The three media companies have competed against each other --

and made deals with each other -- over years, as they each steered

their respective companies and helped reshape the U.S. media

industry. Fox and Comcast declined to comment. Representatives from

Disney weren't immediately available for comment.

Mr. Murdoch has long sought to consolidate his holding in

London-based Sky. Disney and Comcast see Sky as a way to expand

internationally. The broadcaster also sells wireless, TV and

internet services throughout Europe, and it is a media company that

produces its own news, entertainment and sports programming.

Mr. Murdoch and his family are major shareholders in Fox and

News Corp, which owns The Wall Street Journal.

Regulators resorted to an auction process after Fox, backed by

Disney, and Comcast engaged in what was starting to look like an

endless series of bids and counterbids for the broadcaster.

The auction will start Friday evening and run through Saturday,

and consist of a maximum three rounds of bidding. The winner will

be announced shortly after the auction ends Saturday evening. If

there is a third and final round, it will be conducted with sealed

bids -- secret, final offers made to the regulator.

Fox first offered in December 2016 to buy the rest of Sky it

didn't already own for GBP10.75 ($14.27) a share. After Fox's

merger proposal hit regulatory and political delays, Comcast made a

surprise offer last February, for GBP12.50 a share.

Comcast made the most recent offer in July, for GBP14.75

($19.57) a share, valuing Sky at $34 billion. That is above Fox's

current bid, also made in July, of GBP14 a share.

Investors have long expected higher offers. Sky's shares were

flat Thursday, closing at GBP15.80. The two sides could also

increase their bids before the auction, or drop out before it

starts, though there is little incentive to do so.

Under the auction rules, only Fox can bid in the first round. In

the second round, Comcast can counterbid. If that doesn't determine

a winner, each side can submit sealed-bid offers in the third and

final round. The sides can also make a conditional bid. That is a

bid that counts only if the other side also makes a bid.

British regulators most recently held a takeover auction in

2008, when Wisconsin-based Manitowoc Co. beat Illinois Tool Works

Inc. with a $2.7 billion bid for British food-equipment

manufacturer Enodis. In that case, the panel and companies agreed

to disclose only the winning bid.

In 2007, India's Tata Steel Ltd. and Brazil's Companhia

Siderúrgica Nacional agreed to as many as nine, rapid-fire bidding

rounds, in their duel to acquire Anglo-Dutch steelmaker Corus Group

PLC. After an auction that went late into the following morning,

Tata won with a bid of GBP6.08 a share, or GBP6.2 billion. CSN bid

GBP6.03 a share.

Also called blind auctions, sealed-bid auctions are common for

selling real estate, professional-athletes rights and cellular

airwaves. In cellular-airwave auctions, wireless carriers hire

game-theory experts to help them figure out the value of the

airwaves they want and a strategy for winning the bidding, said

Steve Blythe, whose job is to oversee such auctions for French

wireless operator Orange SA.

Often, part of the calculus is trying to ensure that even if a

bids fail, rivals spend as much as possible, said Mr. Blythe, who

has participated in about a dozen auctions.

In a sealed-bid auction with only two contestants, only the last

round really matters, he said. Early-round bids could contain

useful information -- or be bluffs -- but "it's what happens in the

last round that matters," he said.

Write to Stu Woo at Stu.Woo@wsj.com and Ben Dummett at

ben.dummett@wsj.com

(END) Dow Jones Newswires

September 21, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

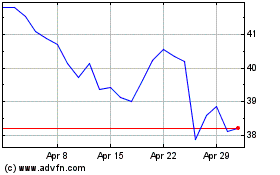

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024