Rite Aid and Albertsons Companies Mutually Agree to Terminate Merger Agreement

August 08 2018 - 8:05PM

Business Wire

Evaluating Governance Changes in

Consultation with Stockholders

Schedules Annual Meeting of

Stockholders

Rite Aid Corporation (NYSE: RAD) today announced that it has

mutually agreed with Albertsons Companies Inc. (“Albertsons”) to

terminate their previously announced merger agreement.

“While we believed in the merits of the combination with

Albertsons, we have heard the views expressed by our stockholders

and are committed to moving forward and executing our strategic

plan as a standalone company,” said Rite Aid Chairman and Chief

Executive Officer John Standley. “We remain focused on leveraging

our network of conveniently located retail pharmacies, our

EnvisionRxOptions PBM and our trusted brand of health and wellness

offerings. We will continue building momentum for key areas of our

business like our innovative Wellness store format, highly

successful customer loyalty program and expanded pharmacy service

offerings, as we also enhance our omni-channel and own brand

offerings to strengthen our competitive position and create

long-term value for stockholders.”

As a result, the special meeting of Rite Aid’s stockholders,

which was to be held on August 9, 2018, will not take place.

Under the terms of the merger agreement, neither Rite Aid nor

Albertsons will be responsible for any payments to the other party

as a result of the termination of the merger agreement.

The company also announced its board of directors is evaluating

governance changes at the company. As it considers these changes,

Rite Aid will continue to engage with stockholders to ensure

alignment between the company and its investors.

The company also announced that its 2018 annual meeting of

stockholders will be held on October 30, 2018 at 8:30 a.m. at a

location to be determined.

About Rite Aid Corporation

Rite Aid Corporation (NYSE: RAD) is one of the nation's leading

drugstore chains with fiscal 2018 annual revenues of $21.5 billion.

The company also owns EnvisionRxOptions, a multi-faceted healthcare

and pharmacy benefit management (PBM) company supporting a

membership base of more than 22 million members; RediClinic, a

convenient care clinic operator with locations in Delaware, New

Jersey, Pennsylvania, Texas and Washington; and Health Dialog, a

leading provider of population health management solutions

including analytics, a multi-channel coaching platform and shared

decision-making tools. Information about Rite Aid, including

corporate background and press releases, is available through the

company's website at www.riteaid.com.

Important Notice Regarding Forward-Looking Statements

This communication contains certain “forward-looking statements”

within the meaning of the Securities Act of 1933 and the Securities

Exchange Act of 1934, both as amended by the Private Securities

Litigation Reform Act of 1995. Statements that are not historical

facts are forward-looking statements, and such statements include,

but are not limited to, statements regarding the termination of the

proposed merger (the “Merger”) between Rite Aid Corporation (“Rite

Aid”) and Albertsons Companies, Inc. (“Albertsons”); the outcome of

legal and regulatory matters in connection with the Merger or the

termination of the merger agreement; the obligations of Rite Aid or

Albertsons related to the termination of the merger agreement; the

expected governance of Rite Aid; the competitive ability and

position of Rite Aid following the termination of the merger

agreement; the ability of Rite Aid to implement new business

strategies following the termination of the merger agreement and

any assumptions underlying any of the foregoing. Words such as

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “plan,” “predict,” “project,” “should,” and “will”

and variations of such words and similar expressions are intended

to identify such forward-looking statements. These forward-looking

statements are not guarantees of future performance and involve

risks, assumptions and uncertainties, including, but not limited

to, our high level of indebtedness and our ability to make interest

and principal payments on our debt and satisfy the other covenants

contained in our debt agreements; general economic, industry,

market, competitive, regulatory and political conditions; our

ability to improve the operating performance of our stores in

accordance with our long term strategy; the impact of private and

public third-party payers continued reduction in prescription drug

reimbursements and efforts to encourage mail order; our ability to

manage expenses and our investments in working capital; outcomes of

legal and regulatory matters; changes in legislation or

regulations, including healthcare reform; our ability to achieve

the benefits of our efforts to reduce the costs of our generic and

other drugs; risks related to the pending transactions with WBA,

including the possibility that the remaining sales of distribution

centers and related assets may not close, or the business of Rite

Aid may suffer as a result of uncertainty surrounding the pending

transactions; the risk that any announcements relating to the

termination of the merger agreement could have adverse effects on

the market price of Rite Aid’s common stock, and the risk that the

termination of the merger agreement and its announcement could have

an adverse effect on the ability of Rite Aid to retain customers

and retain and hire key personnel and maintain relationships with

their suppliers and customers and on their operating results and

businesses generally; the risk that Rite Aid's stock price may

decline significantly if the sale of distribution centers and

related assets to WBA is not completed; significant transaction

costs from the terminated Merger; unknown liabilities; the risk of

litigation and/or regulatory actions related to the Merger or the

termination of the merger agreement; potential changes to our

strategy as a result of the termination of the merger agreement,

which may include delaying or reducing capital or other

expenditures, selling assets or other operations, attempting to

restructure or refinance our debt, or seeking additional capital,

and other business effects. These and other risks, assumptions and

uncertainties are more fully described in Item 1A (Risk Factors) of

our most recent Annual Report on Form 10-K and in other

documents that we file or furnish with the Securities and Exchange

Commission, which you are encouraged to read. Should one or more of

these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by such forward-looking

statements. Accordingly, you are cautioned not to place undue

reliance on these forward- looking statements, which speak only as

of the date they are made. Rite Aid expressly disclaims any current

intention to update publicly any forward-looking statement after

the distribution of this release, whether as a result of new

information, future events, changes in assumptions or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180808005866/en/

Rite Aid CorporationINVESTORS: Byron Purcell, (717)

975-5809MEDIA: Ashley Flower, (717) 975-5718

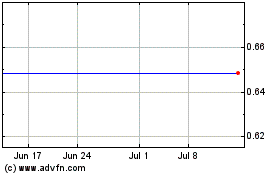

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Apr 2023 to Apr 2024