Marlboro Sales Drop Sharply in a Shrinking Market--Update

July 26 2018 - 11:47AM

Dow Jones News

By Jennifer Maloney and Austen Hufford

Altria Group Inc.'s revenue declined in its latest quarter as it

lost share in a shrinking U.S. smoking market, fanning fears the

Marlboro maker is losing customers to e-cigarette startups like

Juul Labs Inc.

The company said Marlboro volumes fell 10% in the quarter,

faster than expected. Overall, Altria said its cigarettes U.S.

retail market share declined to 50.2% in the second quarter from

50.9% in the same quarter a year before.

Altria CEO Howard Willard played down the threat to the

traditional cigarette business from the popularity of e-cigarettes,

saying the new offerings hadn't changed the long-term decline of 3%

to 4% annually for U.S. cigarette volumes.

"The real question here is, is there an abnormal amount of

impact on the secular decline rate?," Mr. Willard said. "Given the

3.5% decline for the cigarette category in the second quarter, I

think it seems to be covered by that long-term decline trend."

Big Tobacco has long been under threat from the steady decline

of smoking, particularly in the developed world. But in recent

years, the industry has been able to push through price increases

to make up for falling volumes -- boosting profits and stock

prices. That has enabled big investments aimed at developing

smoking alternatives, like e-cigarette devices and other gadgets

that promise to deliver nicotine but not the more harmful effects

that come with lighting up.

In recent months, though, investor concerns about how consumers

abroad have responded to cigarette alternatives have weighed on

share prices.

Juul Labs, whose device delivers more nicotine than most other

commercially available e-cigarettes, has been rapidly expanding and

captured about two-thirds of the U.S. e-cigarette market this year.

It recently raised more than $600 million to fund its expansion and

marketing. Juul says it is targeting adult smokers but the company

has faced scrutiny for its popularity among teens.

Asked to comment on the Massachusetts attorney general's

investigation into whether Juul and other online retailers are

illegally selling to minors, Mr. Howard said: "As an experienced

player in the category, we're not surprised and, frankly, we

appreciate the AGs making sure that there is a minimum level of

performance expected from everybody in the industry."

Mr. Willard said it was difficult to gauge the impact of vaping

on cigarette sales since most e-cigarettes are sold in vape shops

or online rather than traditional retail stores. He said

e-cigarettes were likely capturing some smokers who would otherwise

have switched to smokeless tobacco.

Altria has an e-cigarette brand called MarkTen. It is also

working with Philip Morris International Inc. on a device called

IQOS, which is billed as a "heat not burn" product. While Philip

Morris has rolled the product out in a number of international

markets, Altria said Thursday that it is ready to deploy it in the

U.S. if the Food and Drug Administration gives its approval.

The FDA said earlier this year that the science on the device's

relative safety wasn't yet conclusive. The FDA has also been

pushing a separate initiative to cut the nicotine content in

traditional cigarettes to nonaddictive levels.

Shares of competitor British American Tobacco PLC rose 5.3% in

London trading on Thursday as the company said it has received FDA

approval to bring one of its own heat-not-burn products to market

in the U.S.

In morning trading, Altria shares fell 2%. The stock has

declined 21% this year.

Altria said volumes in the U.S. cigarette industry declined 3.5%

in the second quarter and the company's volume fell 5% after

adjusting for inventory shifts.

Price increases weren't enough to offset Altria's volume

decline, leading to a total revenue decrease of 5.4% to $6.32

billion. Profit came in at $1.88 billion, compared with $1.99

billion in the same period a year before.

Write to Jennifer Maloney at jennifer.maloney@wsj.com and Austen

Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

July 26, 2018 11:32 ET (15:32 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

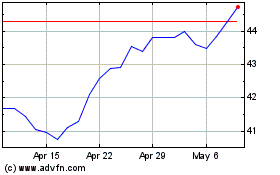

Altria (NYSE:MO)

Historical Stock Chart

From Aug 2024 to Sep 2024

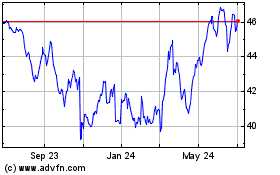

Altria (NYSE:MO)

Historical Stock Chart

From Sep 2023 to Sep 2024