AT&T's Interest in Ad Tech Gets Thumbs Up on Madison Avenue

June 22 2018 - 3:06PM

Dow Jones News

By Lara O'Reilly and Alexandra Bruell

CANNES, France -- News of AT&T Inc.'s talks to acquire

advertising technology firm AppNexus was welcomed by marketers, who

are eager to have more options in the online ad sector beyond

Google Inc. and Facebook Inc., the dominant players.

AT&T, which is fresh off its acquisition of Time Warner

Inc., has a treasure trove of TV and digital content from brands

such as CNN and TNT. Now the telecom giant is in talks to buy

AppNexus for $1.6 billion, a deal that would help it monetize that

content better, using data from wireless customers to serve highly

targeted ads.

"It's a lightning bolt across the industry," said Bob

Rupczynski, McDonald's global vice president of media and customer

relationship management, on the sidelines of the ad industry's

annual Cannes Lions festival on the French Riviera. Mr. Rupczynski

said the deal would give AT&T immediate infrastructure and more

data and could give marketers "more leverage" in dealing with

Google and Facebook.

"The more options we have available, the better it's going to be

for the market," said Antonio Lucio, chief marketing officer at

Hewlett-Packard Co.

Some industry executives speculated that AT&T could also

look for further advertising technology acquisitions in the coming

months to strengthen its offering to marketers.

AppNexus's technology helps advertisers buy ads using automated

systems, across swaths of websites and apps. The firm also supplies

technology to publishers so they can manage and sell the

advertising space on their websites. Its marketplace, which

connects the buyers and sellers of ads, also extends into video and

the web-connected TV space.

AppNexus's capabilities could be useful as AT&T launches new

streaming services of its own that aim to generate some revenue

from ads. On Thursday, the company unveiled a $15-a-month video

service offering a "skinny bundle" of TV channels. Unlimited data

plan subscribers will get free access to the service, which is

called WatchTV.

The AppNexus deal "would be a key step towards helping AT&T

build out a much more significant digital advertising business than

it currently has, " said Brian Wieser, a senior analyst at Pivotal

Research, in a note.

Marketers are all "very keen for diversification," said Quentin

George, founder of the ad-tech consultancy Unbound. "They're

concerned about their reliance on Facebook and Google."

Google took a 31.7% share of the $232.27 billion spent globally

on digital advertising last year, according to eMarketer, while

Facebook took a 17.9% share. Their market share in the U.S. is even

higher.

AppNexus should help AT&T develop a more advanced business

in targeted TV ads, said industry executives.

"It would provide some of the capabilities the company would

expect it needs in order to apply data and automation to

traditional TV advertising," said Mr. Wieser in his note. However,

he added, "we think this latter opportunity is relatively limited

in the near-term."

On closing the Time Warner deal, AT&T restructured the

combined company into four units, including an advertising and

analytics business. Brian Lesser, who was on the board of AppNexus,

joined last October from WPP's GroupM media-buying division to

oversee those operations.

If AT&T does acquire AppNexus, it is unclear whether it

would continue the ad tech firm's offering for third-party

publisher websites or focus on monetizing its own content with

ads.

"One has to ask how other media companies feel about working

with a very large competitor now that AT&T is a media company

via their Time Warner acquisition," said Anthony Katsur, senior

vice president of digital strategy at Nexstar Media Group. "That

could create a natural tension."

AT&T declined to comment.

Around one-third of AppNexus's business is in Europe, according

to people familiar with the matter. That means AT&T will also

need to be mindful of compliance with the region's sweeping new

General Data Protection Regulation, also known as GDPR.

One of AT&T's strongest assets is its customer data, said

Michael Nevins, chief marketing officer at Paris-based ad-tech

company Smart. "GDPR would certainly be one of the filters they

would have to be thinking through when they think about how they

activate that data [in Europe]," Mr. Nevins said.

Write to Lara O'Reilly at lara.o'reilly@wsj.com and Alexandra

Bruell at alexandra.bruell@wsj.com

(END) Dow Jones Newswires

June 22, 2018 14:51 ET (18:51 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

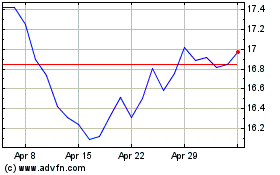

AT&T (NYSE:T)

Historical Stock Chart

From Aug 2024 to Sep 2024

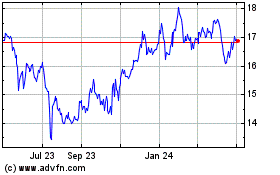

AT&T (NYSE:T)

Historical Stock Chart

From Sep 2023 to Sep 2024