Sears Closing More Stores as Sales Shrink For 26th Quarter in a Row

May 31 2018 - 7:28AM

Dow Jones News

By Suzanne Kapner and Allison Prang

Sears Holdings Corp. said Thursday that it plans to close

another 72 stores it has deemed unprofitable, as the company

continues to struggle with falling sales.

Sears has been closing hundreds of stores in recent years,

selling brands and spinning off divisions to stay afloat as losses

have mounted and as it struggles to keep its customers away from

Walmart Inc., Amazon.com Inc. and other outlets.

The company said a list of the 72 stores would be posted later

Thursday.

The new round of store closures comes as the retailer reported

sales fell in the latest quarter, extending a streak of declines

that stretches back more than six years at the once dominant

retailer.

The last time Sears's sales increased from the previous year was

in the third quarter of 2011, when the company had $9.4 billion in

revenue, according to data from Thomson Reuters.

In the latest quarter, total merchandise sales fell 34% to $2.2

billion. Total revenue, which includes money generated from

appliance and product-repair services, fell 31% to $2.89

billion.

Same-store sales at Sears locations fell 13.4%, while they

declined 9.5% at Kmart locations. The company operated 894 total

locations as of May 5, down from 1,275 as of around the same time

the year prior.

Sears is currently weighing whether to divest its Kenmore

appliance brand and other units. The moves follow prodding by Sears

Chief Executive Edward Lampert, who has proposed that his hedge

fund purchase the assets if the company is unable to find other

buyers.

Mr. Lampert, who is also Sears's biggest investor and among its

biggest lenders, said in an April letter to the Sears board that

his ESL Investments Inc., which owns a controlling stake in the

retailer, is willing to submit offers for Kenmore, the Sears Home

Improvement and Parts Direct businesses as well as some real

estate, including $1.2 billion in debt secured by the

properties.

Sears has hired advisers and said earlier this month that it

initiated a formal sale process. On Tuesday, ESL, in another letter

to the Sears board, said it had "received numerous inbound

inquiries from potential partners," and has requested permission

from the special committee of the board to engage with such

partners in order "to put forward a definitive proposal."

Investors, suppliers and landlords have grown increasingly

concerned about the company's future, forcing Sears to pay cash up

front for many goods and ESL to regularly extend the company

credit. Sears' Canadian arm filed for protection from creditors

last year and decided to liquidate. Sears spun off most of its

stake in Sears Canada in recent years, but retained a 12%

stake.

The company's shares, which more than a decade ago traded above

$100, now languish at around $3. Sears shares fell 3.4% premarket

trading Thursday.

Last year, Sears struck a deal to sell Kenmore products on

Amazon.com Inc., broadening its reach beyond Sears and Kmart

stores. It also began selling its DieHard batteries on Amazon. In

2017, it sold its Craftsman brand to Stanley Black & Decker

Inc., which is expanding distribution of the tools, lawn and garden

equipment to other retailers.

Mr. Lampert's interest in purchasing Kenmore and the other

businesses extends a string of transactions in which he is often on

both sides. In addition to serving as Sears's chairman and CEO, he

is also chairman of, and a major investor in, Seritage, which ranks

among Sears's biggest landlords.

Theo Francis contributed to this article.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com and Allison

Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

May 31, 2018 07:13 ET (11:13 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

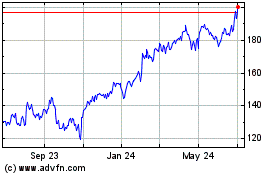

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Aug 2024 to Sep 2024

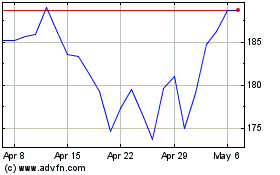

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Sep 2023 to Sep 2024