AptarGroup, Inc. (NYSE:ATR) today reported first quarter results

and declared a quarterly dividend.

First Quarter Summary

- Reported sales increased 17%,

including the positive effect of currency rates (+10%)

- Core sales, excluding currency

effects, rose 7% driven by growth in each business segment

- Reported net income (8% of net

sales) increased 14% to $59 million

- Adjusted EBITDA (19% of net sales)

increased 17% to $134 million

- Reported earnings per share grew 14%

to $0.92 and included costs associated with our business

transformation ($0.07 per share)

- Adjusted earnings per share of $0.99

compared to prior year reported earnings per share of $0.81 (+22%)

and to prior year currency adjusted earnings per share of $0.90

(+10%)

- Business transformation progressing

as planned

First Quarter Results

For the quarter ended March 31, 2018, reported sales increased

17% over the prior year to $703 million. Core sales, which exclude

the positive impact from changes in currency exchange rates,

increased approximately 7%.

First Quarter Segment Sales Analysis

(Change Over Prior Year)

Beauty + Food +

Total

Home Pharma

Beverage AptarGroup Core

Sales Growth 8% 6% 10% 7% Currency Effects(1) 9% 11%

6% 10% Total Reported Sales Growth 17%

17% 16% 17% (1) - Currency

effects are approximated by translating last year's amounts at this

year's foreign exchange rates.

Commenting on the quarter, Stephan Tanda, President and CEO,

said, “We are pleased to report a positive start to 2018. Driven by

broad-based demand for our value-adding innovative dispensing

solutions, core sales grew in each business segment. Our Beauty +

Home segment had another strong quarter with robust core sales

growth, especially in the beauty and personal care markets. Our

Pharma segment had another excellent quarter with increased demand

for our leading drug delivery systems, particularly in the consumer

healthcare market where the aggressive flu season helped drive

demand for our nasal spray and saline systems. Our Food + Beverage

segment had a mixed quarter with increased core sales to the food

market and sluggish sales to the beverage market, primarily due to

weak volumes in China. In addition to the top line growth, our

Beauty + Home and Pharma segments reported adjusted EBITDA growth

over the prior year, while our Food + Beverage segment had a slight

decrease in adjusted EBITDA, in part due to the mix of business and

the timing of our pass-through of higher resin costs.”

Aptar’s reported earnings per share of $0.92 is an increase of

14% over the prior year level of $0.81 despite the negative impacts

of our business transformation initiatives, higher raw material

costs and a slightly higher tax rate. Comparable adjusted earnings

per share, excluding the business transformation initiatives in the

current period, increased 10% to $0.99 compared to currency

adjusted prior year results of $0.90.

Business Transformation

Our business transformation to become a more agile, competitive

and customer-centric business is progressing as planned. Tanda

commented on the progress by stating, “While we are at the

beginning stages of the implementation, the initiatives we put in

place are beginning to gain traction. With broad engagement across

our organization and our energetic transformation leadership team,

we are creating great momentum and implementing positive changes

throughout the organization.”

Outlook

Commenting on Aptar’s outlook, Tanda stated, “I am encouraged by

the underlying strength of our portfolio of differentiating

packaging solutions and the momentum we are seeing across the

different markets. For the second quarter of 2018, we expect

continued core sales growth over the prior year in each business

segment. We also anticipate that aggregate currency effects will

continue to be a tailwind on reported results. The tax rate

guidance for the coming quarter reflects our current analysis of

the recent U.S. tax reform legislation.”

Aptar expects earnings per share for the second quarter to be in

the range of $0.99 to $1.04, excluding any costs related to our

business transformation, compared to $1.01 per share reported in

the prior year. Adjusting for changes in currency translation

rates, earnings per share for the prior year were approximately

$1.08. Our guidance earnings per share range is based on an

effective tax rate range of 30% to 32% and the effective tax rate

for the prior year second quarter reported results was

approximately 18%. Had our current guidance effective tax rate

range been applied to prior year results, prior year second quarter

earnings per share would have been lower by approximately $0.16 per

share.

Cash Dividend

On April 25, 2018, the Board declared a quarterly cash dividend

of $0.32 per share. The payment date is May 30, 2018, to

stockholders of record as of May 9, 2018.

Open Conference Call

There will be a conference call on Friday, April 27, 2018, at

8:00 a.m. Central Time to discuss the Company’s first quarter

results for 2018. The call will last approximately one-hour.

Interested parties are invited to listen to a live webcast by

visiting the Investor Relations page at www.aptar.com. Replay of

the conference call can also be accessed for a limited time on the

Investor Relations page of the website.

Aptar is a leading global supplier of a broad range of

innovative dispensing and sealing solutions for the beauty,

personal care, home care, prescription drug, consumer health care,

injectables, food, and beverage markets. AptarGroup is

headquartered in Crystal Lake, Illinois, with manufacturing

facilities in North America, Europe, Asia and South America. For

more information, visit www.aptar.com.

Presentation of Non-GAAP Information

This press release refers to certain non-GAAP financial

measures, including current and prior year adjusted earnings per

share and consolidated adjusted EBITDA, which exclude the impact of

our business transformation charges (also referred to as

restructuring initiatives in the accompanying tables) in the first

quarter of 2018. Adjusted earnings per share also excludes the

impact of currency translation effects, and core sales excludes the

impact of currency translation effects. Aptar’s non-GAAP financial

measures may not be comparable to similarly titled financial

measures provided by other companies. Aptar’s management believes

these non-GAAP financial measures are useful to our investors

because they allow for a better period over period comparison of

operating results by removing the impact of items that, in

management’s view, do not reflect our core operating performance.

These non-GAAP financial measures also provide investors with

certain information used by our management when making financial

and operational decisions. These non-GAAP financial measures should

not be considered in isolation or as a substitute for GAAP

financial results, but should be read in conjunction with the

unaudited condensed consolidated statements of income and other

information presented herein. A reconciliation of non-GAAP

financial measures to the most directly comparable GAAP measures is

included in the accompanying tables. Our long-term financial

targets are provided on a non-GAAP basis because certain

reconciling items are dependent on future events that either cannot

be controlled, such as the impact of currency translation effects,

or reliably predicted because they are not part of Aptar’s routine

activities, such as acquisitions and business transformation

charges.

This press release contains forward-looking statements,

including certain statements set forth under the “Outlook” and

“Business Transformation” sections of this press release. Words

such as “expects,” “anticipates,” “believes,” “estimates,”

“future,” “potential” and other similar expressions or future or

conditional verbs such as “will,” “should,” “would” and “could” are

intended to identify such forward-looking statements.

Forward-looking statements are made pursuant to the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934 and are based on our

beliefs as well as assumptions made by and information currently

available to us. Accordingly, our actual results may differ

materially from those expressed or implied in such forward-looking

statements due to known or unknown risks and uncertainties that

exist in our operations and business environment including, but not

limited to, the impact of tax reform legislation; the execution of

the business transformation; the impact and extent of contamination

found at the Company’s facility in Brazil; economic conditions

worldwide including potential deflationary conditions in regions we

rely on for growth; political conditions worldwide; significant

fluctuations in foreign currency exchange rates or our effective

tax rate; changes in customer and/or consumer spending levels;

financial conditions of customers and suppliers; consolidations

within our customer or supplier bases; fluctuations in the cost of

materials, components and other input costs; the availability of

raw materials and components; our ability to successfully implement

facility expansions and new facility projects; our ability to

increase prices, contain costs and improve productivity; changes in

capital availability or cost, including interest rate fluctuations;

volatility of global credit markets; cybersecurity threats that

could impact our networks and reporting systems; fiscal and

monetary policies and other regulations, including changes in tax

rates; direct or indirect consequences of acts of war or terrorism;

work stoppages due to labor disputes; and competition, including

technological advances. For additional information on these and

other risks and uncertainties, please see our filings with the

Securities and Exchange Commission, including the discussion under

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” in our Form 10-Ks

and Form 10-Qs. We undertake no obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

AptarGroup, Inc. Condensed Consolidated Financial

Statements (Unaudited) (In Thousands, Except Per Share Data)

Consolidated Statements of Income

Three Months Ended March 31,

2018

2017

Net Sales $ 703,350 $ 601,316 Cost of Sales (exclusive of

depreciation and amortization shown below) 455,822 384,684 Selling,

Research & Development and Administrative 112,461 101,282

Depreciation and Amortization 41,175 37,331 Restructuring

Initiatives

5,936 -

Operating Income 87,956 78,019 Other Income/(Expense):

Interest Expense (8,055 ) (8,262 ) Interest Income 2,248 330 Equity

in Results of Affiliates (65 ) (48 ) Miscellaneous, net

(867 ) (559

) Income before Income Taxes 81,217 69,480 Provision

for Income Taxes

21,929

17,675 Net Income $ 59,288 $ 51,805 Net

Loss Attributable to Noncontrolling Interests

12 15 Net Income

Attributable to AptarGroup, Inc.

$ 59,300

$ 51,820 Net Income

Attributable to AptarGroup, Inc. per Common Share: Basic

$ 0.95 $

0.83 Diluted

$ 0.92

$ 0.81 Average

Numbers of Shares Outstanding: Basic 62,128 62,355 Diluted 64,414

64,234

AptarGroup, Inc. Condensed Consolidated

Financial Statements (Unaudited) (continued) ($ In Thousands)

Consolidated Balance Sheets

March 31,

2018

December 31,

2017

ASSETS Cash and Equivalents $ 741,062 $ 712,640 Receivables,

net 586,592 510,426 Inventories 347,791 337,216 Other Current

Assets

117,678 109,791

Total Current Assets 1,793,123 1,670,073 Net Property, Plant and

Equipment 884,551 867,906 Goodwill 451,243 443,887 Other Assets

154,777 155,957 Total

Assets

$ 3,283,694 $

3,137,823 LIABILITIES AND EQUITY

Short-Term Obligations $ 70,344 $ 66,169 Accounts Payable and

Accrued Liabilities

496,409

461,579 Total Current Liabilities 566,753 527,748

Long-Term Obligations 1,199,975 1,191,146 Deferred Liabilities

112,190 106,881 Total

Liabilities 1,878,918 1,825,775 AptarGroup, Inc.

Stockholders' Equity 1,404,467 1,311,738 Noncontrolling Interests

in Subsidiaries

309 310

Total Equity

1,404,776

1,312,048 Total Liabilities and Equity

$ 3,283,694 $

3,137,823 AptarGroup, Inc.

Reconciliation of EBIT, Adjusted EBIT, EBITDA and Adjusted

EBITDA to Net Income (Unaudited) ($ In Thousands)

Three Months Ended March 31,

2018 Beauty + Food + Corporate & Consolidated

Home Pharma Beverage Other Net Interest

Net Sales $ 703,350 378,173 230,127 95,050 - -

Reported net income $ 59,288

Reported income taxes 21,929

Reported income before income taxes 81,217

26,707 68,292 5,926 (13,901 )

(5,807 ) Adjustments: Restructuring initiatives 5,936

5,016 364 315 241 Adjusted earnings before income taxes

87,153 31,723 68,656 6,241 (13,660 ) (5,807 ) Interest expense

8,055 8,055 Interest income (2,248 )

(2,248 ) Adjusted

earnings before net interest and taxes (Adjusted EBIT) 92,960

31,723 68,656 6,241 (13,660 ) - Depreciation and amortization

41,175 21,412

11,184 6,498 2,081

- Adjusted earnings before net interest,

taxes, depreciation and amortization (Adjusted EBITDA) $ 134,135

$ 53,135 $ 79,840 $

12,739 $ (11,579 ) $ - Adjusted

EBITDA margins (Adjusted EBITDA / Reported Net Sales) 19.1 % 14.1 %

34.7 % 13.4 % Three Months Ended March 31, 2017

Beauty + Food + Corporate & Consolidated Home

Pharma Beverage Other Net Interest

Net

Sales $ 601,316 322,448 196,912 81,956 - -

Reported net income $ 51,805 Reported

income taxes 17,675

Reported income

before income taxes 69,480 22,208 59,070

7,140 (11,006 ) (7,932 )

Adjustments: None - -

Earnings before income

taxes 69,480 22,208 59,070 7,140 (11,006 ) (7,932 ) Interest

expense 8,262 8,262 Interest income (330 )

(330 )

Earnings before net interest and taxes (EBIT) 77,412 22,208 59,070

7,140 (11,006 ) - Depreciation and amortization 37,331

19,880 9,771

5,806 1,874

- Earnings before net interest, taxes, depreciation and

amortization (EBITDA) $ 114,743 $ 42,088

$ 68,841 $ 12,946 $ (9,132 )

$ - EBITDA margins (EBITDA / Reported Net

Sales) 19.1 % 13.1 % 35.0 % 15.8 %

AptarGroup, Inc.

Reconciliation of Adjusted Earnings Per Diluted Share

(Unaudited) (In Thousands, Except Per Share Data)

Three Months Ended March 31,

2018

2017

Income before Income Taxes $ 81,217

$ 69,480

Adjustments:

Restructuring initiatives 5,936 Foreign currency effects (1)

8,740 Adjusted Income before Income Taxes $

87,153 $ 78,220

Provision for Income

Taxes $ 21,929 $ 17,675

Adjustments:

Restructuring initiatives 1,602 Foreign currency effects (1)

2,462 Adjusted Provision for Income Taxes $

23,531 $ 20,137

Net Loss

Attributable to Noncontrolling Interests $ 12

$ 15 Net Income Attributable to AptarGroup,

Inc. $ 59,300 $ 51,820

Adjustments:

Restructuring initiatives 4,334 Foreign currency effects (1)

6,278 Adjusted Net Income Attributable to

AptarGroup, Inc. $ 63,634 $ 58,098

Average

Number of Diluted Shares Outstanding 64,414

64,234 Net Income Attributable to AptarGroup, Inc.

Per Diluted Share $ 0.92 $ 0.81

Adjustments:

Restructuring initiatives 0.07 Foreign currency effects (1)

0.09 Adjusted Net Income Attributable to

AptarGroup, Inc. Per Diluted Share $ 0.99 $ 0.90

(1) Foreign currency effects are approximations of the

adjustment necessary to state the prior year earnings and earnings

per share using current period foreign currency exchange rates.

AptarGroup, Inc. Reconciliation of Adjusted

Earnings Per Diluted Share (Unaudited) (In Thousands, Except

Per Share Data) Three Months Ended

June 30,

Expected

2018

2017

Income before Income Taxes $ 79,568

Adjustments:

Foreign currency effects (1) 6,545 Adjusted Income

before Income Taxes $ 86,113

Provision for

Income Taxes $ 14,379

Adjustments:

Foreign currency effects (1) 1,887 Adjusted Provision

for Income Taxes $ 16,266

Net Income

Attributable to Noncontrolling Interests $ (15

) Net Income Attributable to AptarGroup, Inc.

$ 65,174

Adjustments:

Foreign currency effects (1) 4,658 Adjusted Net

Income Attributable to AptarGroup, Inc. $ 69,832

Average Number of Diluted Shares Outstanding 64,828

Net Income Attributable to AptarGroup, Inc. Per Diluted

Share (2) $ 0.99 - $1.04

$ 1.01

Adjustments:

Foreign currency effects (1) 0.07

Adjusted Net Income Attributable to AptarGroup, Inc. Per

Diluted Share (2) $ 0.99 - $1.04 $ 1.08

(1) Foreign currency effects are approximations of the adjustment

necessary to state the prior year earnings per share using foreign

currency exchange rates as of March 31, 2018. (2)

AptarGroup’s expected earnings per share range for the second

quarter of 2018 is based on an effective tax rate range of 30% to

32%, which includes estimated effects of the recent tax reform

legislation. The effective tax rate for the second quarter of 2017

was approximately 18%.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180426006767/en/

AptarGroup, Inc.Investor Relations

Contact:Matt

DellaMariamatt.dellamaria@aptar.com815-477-0424orMedia Contact:Katie

Reardonkatie.reardon@aptar.com815-477-0424

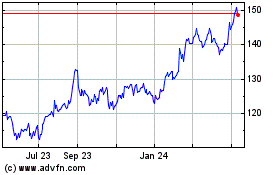

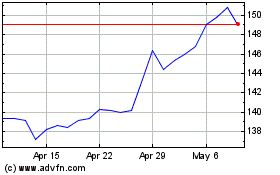

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Mar 2024 to Apr 2024

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Apr 2023 to Apr 2024