By Akane Otani and Michael Wursthorn

Investors once attracted to the steady payouts of companies

selling staples like breakfast cereal, toothpaste and razors are

shopping elsewhere.

A series of disappointing earnings reports from industry giants

like Philip Morris International Inc., Procter & Gamble Co. and

Kimberly-Clark Corp. have sent consumer-goods shares tumbling in

recent days -- a sign many investors remain skeptical of the

companies' ability to cope with rising costs, as well as to fend

off online competitors like Amazon.com Inc.

The sector's underperformance comes as a surprise to analysts

who had expected signs of a pickup in inflation to drive investors

into shares of businesses that sell household goods and basic

necessities: products that consumers would typically be willing to

buy, even when rising prices crimp their spending elsewhere.

Instead, companies competing with discount retailers are struggling

to raise prices for their marquee products -- something recent

earnings reports show has become a growing headwind for their

businesses.

Even hefty dividend payouts haven't been enough to lure

investors into shares of consumer-staples companies, which have

shed 13% in the S&P 500 this year and posted the biggest losses

of the broad index's 11 sectors. The S&P 500 has fallen

1.5%.

The industry's pricing issues have many money managers wondering

whether the biggest makers of household staples have already seen

their best days.

"What's happening is that these firms are struggling to pass on

rising costs to consumers," said Shawn Cruz, manager of trader

strategy at TD Ameritrade. "Big brands have counted on their brand

name drawing customers in, and that's not necessarily happening

anymore."

One of the worst days of the year for the consumer-staples

sector came Thursday, when tobacco giant Philip Morris said

quarterly shipments fell more than expected as consumers world-wide

continued to turn away from cigarettes. Philip Morris shares fell

16%, posting their biggest one-day percentage decline since going

public in 2008, according to FactSet. The stock is off 22% for the

year.

Many companies serving up consumer staples have suffered more

broadly, though, from rising competition from online retail giants,

which have put pressure on firms to keep product prices low.

Shares of Procter & Gamble, the maker of Tide detergent and

Pampers diapers, have shed 21% this year, making them one of the

worst performers in the sector. The company has cut prices across

its businesses, including its Gillette razors, to try to stave off

competition from other low-cost rivals like Dollar Shave Club --

something that crimped its sales growth in the most-recent

quarter.

Another company that has fallen behind: General Mills Inc.,

whose shares have tumbled 25% this year as it has grappled with

what Chief Executive Jeff Harmening said was an "unprecedented rise

in logistics costs."

That has forced it to lower its earnings expectations for the

year, with company projections now suggesting per-share earnings

for the fiscal year ending in May will rise by just 1% compared

with the 4% increase previously estimated. Although freight and

commodity costs have increased, companies like General Mills,

Campbell Soup Co., Kellogg Co. and Conagra Brands Inc. have

struggled to protect profits by raising prices for products, citing

steep competition from discount retailers.

Some consumer-products companies are taking more drastic steps

to slash costs to protect thinning profit margins. Kimberly-Clark,

which makes Huggies diapers and Kleenex tissues, kicked off a

massive restructuring of its operations earlier this year that is

expected to deliver annual pretax savings of as much as $550

million by the end of 2021. But the overhaul is projected to be

pricey, with total costs reaching as much as $1.9 billion before

then.

Those charges weighed on Kimberly-Clark's first-quarter

earnings, which were reported Monday, but the company boosted its

sales forecast for the year. Shares fell 1.5% Monday. CEO Thomas

Mr. Falk said the cost cuts are necessary, along with the

development of new products and some stronger pricing, to put the

company, and the industry at large, on firmer footing.

Some analysts believe a wave of stock volatility that spurs

demand for so-called haven assets could prompt a rebound in

consumer-staples shares, which many consider bondlike because of

their dividends.

As of the end of March, 33 of 34 companies in the

consumer-staples sector had boosted dividend payouts to

shareholders, according to data from S&P Dow Jones Indices,

with the average yield clocking in at 3%, above the broader S&P

500's average dividend yield of 2.4%.

Still, sectors that investors tend to think of as safety plays

-- telecom, real estate and utilities -- have fallen alongside

staples to rank as the worst-performing sectors in the S&P 500.

Meanwhile, investors have extended bets on technology companies

that they believe will be able to deliver faster earnings

growth.

And with recent earnings reports pointing to sluggish sales

growth among several consumer giants, many anticipate a tough road

ahead for the sector.

"It's concerning for these companies," said Charlie Smith, chief

investment officer of Fort Pitt Capital Group. "There's just not a

lot of inflation in the system and the ability of these

consumer-product companies to push pricing just isn't there."

Write to Akane Otani at akane.otani@wsj.com and Michael

Wursthorn at Michael.Wursthorn@wsj.com

(END) Dow Jones Newswires

April 25, 2018 05:44 ET (09:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

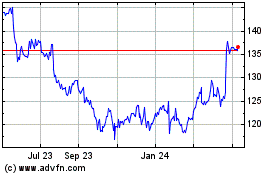

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

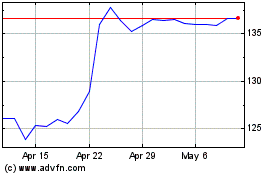

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Apr 2023 to Apr 2024