By Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 20, 2018).

Shares of tobacco companies tumbled after Philip Morris

International Inc. said cigarette shipments fell more than expected

and sales for its cigarette alternative started to stall in a key

market -- raising wider alarm about the health of the entire

tobacco industry.

Shares in the New York-listed, Switzerland-based tobacco giant

ended down 16%. That was its biggest one-day slide since becoming a

public company in March 2008. The disappointing first-quarter

results dragged down shares of other giants, like Altria Group

Inc., British American Tobacco PLC and Imperial Brands PLC.

Big Tobacco has long been under threat from the steady decline

of smoking, particularly in the developed world. But in recent

years, the industry has been able to push through price increases

to make up for falling volumes -- boosting profits and stock

prices. That has enabled big investments aimed at developing

smoking alternatives, like e-cigarette devices and other gadgets

that promise to deliver nicotine but not the more harmful effects

that come with tobacco combustion.

New headwinds have emerged, punctuated by Philip Morris's

disappointing quarterly results on Thursday. Overall, the Marlboro

maker reported earnings of $1.56 billion on revenue that climbed

14% to $6.9 billion, slightly less than the $7 billion analysts

polled by Thomson Reuters had expected.

The company, which sells cigarettes under brands like Marlboro

around the world, but not in the U.S., said shipments fell 5.3%

during the first three months of the year. That was much steeper

than expected -- even considering what analysts expected to be a

fairly easy comparison from the year-earlier period.

Drops came in big markets that had traditionally held up better

than most, such as Japan, Russia and Saudi Arabia. That underscored

fears that decline rates for smoking in some of the markets seen as

relatively robust may also be increasing.

More worrying for many investors was Philip Morris's

disappointing sales growth for its biggest bet on cigarette

alternatives -- a device called IQOS and billed as a "heat not

burn" product. The electric device heats a plug of ground tobacco

-- but doesn't combust it -- delivering nicotine and an experience

that smokers have said is closer to real smoking than vaping or

other alternatives. The company says because users don't inhale

many of the toxins associated with combustion, the device is

safer.

While Philip Morris has rolled the product out in a number of

markets, the company is awaiting approval from the Food and Drug

Administration in the U.S., which said earlier this year that the

science on the device's relative safety wasn't yet conclusive.

One of the most promising markets for the device has been Japan,

where IQOS has eaten quickly into the market share of regular

cigarettes. But Philip Morris said Thursday that IQOS gained just 3

percentage points of the country's overall cigarette market share,

almost half the percentage-point increase in the previous

quarter.

"Device sales were slower than our ambitious expectations,"

Philip Morris Chief Financial Officer Martin King said on a call

with investors.

That surprised many observers who had been used to heady growth.

The double hit to sentiment about traditional cigarettes and their

potential replacements raised broader concern about the future of

the industry. BAT and Imperial Brands closed down 5.4% and 2.9%,

respectively, in London. Altria -- which Philip Morris hopes to

team up with to sell IQOS in the U.S. should it receive approval

from the FDA -- was off 6% in trading in New York.

All three companies didn't immediately return calls for

comment.

While tobacco companies have so far been able to offset

declining volumes with rising prices, that strategy is seen as

having limits, and companies are scaling back investments in

traditional tobacco operations. Philip Morris and its rivals have

spent billions of dollars in recent years to research and market

tobacco-heating and other new products they believe will help lure

smokers from conventional cigarettes.

Japan has been a bellwether for the industry -- both because of

the country's still-large smoking population and its recent, fast

embrace of smoking alternatives.

Philip Morris launched IQOS there in 2016, and its performance

has been closely watched by investors and public-health researchers

as a test case for how so-called reduced-risk products could catch

on with consumers.

Smoking rates in the country have plummeted after IQOS's

introduction. Japan Tobacco Inc., Japan's biggest cigarette company

and a proxy for the market, said sales fell 14.5% in March, in line

with declines in February and January attributed to smokers turning

to smoking alternatives, like IQOS. The shortfalls were even

sharper this time last year and analysts had hoped to see less grim

results.

Instead, "cigarette sales are falling at a rate never before

seen in a major market," said David Sweanor, chair of the advisory

board of the Centre for Health Law, Policy & Ethics at the

University of Ottawa.

IQOS has captured 16% of the Japanese tobacco market -- and

Philip Morris has pointed to that success as an indication of what

could be achieved elsewhere.

Mr. King, the company's finance chief, warned of a maturing

market in Japan, saying Philip Morris had run through early

adopters quicker than expected and must win over "the

more-conservative consumers, especially the age 50-plus smoker

segment, which represents approximately 40% of the total adult

smoker population."

He added: "We are therefore adjusting our commercial plans in

terms of the timing, intensity and content of communication to

specifically address the needs of these adult smokers."

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

April 20, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

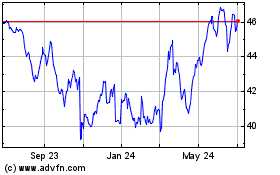

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

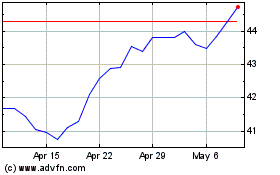

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024