By Keiko Morris

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 18, 2018).

Sales of the city's office towers, apartment buildings,

development sites and other properties rose to $12.42 billion in

the first quarter, a 70% increase from the same period last year,

according to real-estate services firm Cushman & Wakefield.

Manhattan transactions more than doubled to $8.9 billion.

Google's $2.4 billion purchase of the Chelsea Market building,

one of the highest-priced office sales in the city's history,

helped those numbers. But other large deals also closed, such as

the $700 million acquisition of the 3.25-acre St. John's Terminal

site by Oxford Properties Group and Canada Pension Plan Investment

Board.

And there are a number of deals on the horizon, including Pfizer

Inc.'s agreement to sell its headquarters at 219 E. 42nd St. and

235 E. 42nd St. to investor David Werner for about $360 million,

according to a person familiar with the deal.

"2018's first-quarter activity has showcased a well-balanced

offense with several individual transactions contributing to the

overall return of confidence and healthy transaction levels," said

Douglas Harmon, chairman of Cushman's capital markets group and

part of the team representing the sellers in the Chelsea Market and

St. John's Terminal deals. "This should portend well for the rest

of the year."

Sales began rising steadily in 2010 and shot up in 2014 and

2015, the most recent peak, when deals reached $80.4 billion,

according to Cushman. By the end of 2017, the dollar amount of

transactions had dropped by 55%.

Real-estate brokers and executives have cited a number of

reasons for the nosedive after 2015, including the uncertainty of

the presidential election, wariness of being in the late stages of

a long economic expansion and a pricing gap between sellers and

bidders. Inexpensive and abundant financing also made it possible

for owners to continue holding their properties.

"I think a lot of people went to the sidelines last year saying,

'I spent a lot of money in 2014, 2015 and 2016,'" said Darcy

Stacom, chairman of the New York City capital markets group for

CBRE Group Inc.

The absence of megadeals drove much of the sales slowdown in

2017, Mr. Harmon said. The first quarter of 2018 demonstrated the

return of the larger deals, even setting aside the Chelsea Market

sale. A preliminary tally from Real Capital Analytics showed about

12 deals of $250 million or more in Manhattan for the first quarter

of 2018, compared with four such deals in the same period of

2017.

Sales of multifamily apartment buildings also increased in the

first quarter, more than doubling to $2.9 billion throughout the

city, according to a preliminary analysis by Ariel Property

Advisors. Expectations of buyers and sellers have adjusted,

depending on the property, Shimon Shkury, Ariel's president,

said.

"Properties that are in prime locations or have a clear

value-add proposition are trading with no discount, at pricing they

used to trade before 2017," said Mr. Shkury. Meanwhile, more

"vanilla" apartment buildings likely will sell for 5% less than

2016 prices, he said.

Office properties played a significant part in Manhattan's sales

increase in the first quarter and have accounted for more than half

of the investment activity since 2016, according to a report from

real-estate services firm JLL. The city's continued addition of

jobs and low unemployment rates have made the office sector

attractive to investors, and Google's recent acquisition plays into

that premise, said Craig Leibowitz, director of JLL's New York

research.

Ruben Cos. sold its office tower at 1700 Broadway to the

Rockpoint Group for about $465 million, according to people

familiar with the deal. The company had developed the building in

the 1960s and purchased the land beneath the tower a few years ago,

said Richard Ruben, chief executive of Ruben Cos.

"I would say there is a huge abundance of capital chasing these

products, especially on the debt side, and not a whole lot of

product on the market," Mr. Ruben said. "So whenever something

comes to market it is strongly bid."

Manhattan isn't the only focus for investors. Jamestown, the

firm that sold the Chelsea Market building to Google, is bullish on

places like the Bronx as well as Sunset Park, Brooklyn, where the

firm and its partners have redeveloped an industrial complex into a

business hub.

"We've focused on aspirational and inclusive places," said

Michael Phillips, Jamestown president. "Places like the Bronx,

Sunset Park and Long Island City all kind of meet that

description."

While most brokers anticipate sales will increase from 2017

levels, some say it is unclear how robust that will be. Rising

interest rates could pose a headwind, some brokers said.

Pricing also might not be high enough to pull some sellers off

the sidelines, Ms. Stacom said.

"I think we still have reluctant sellers who love owning New

York real estate, who can finance it pretty inexpensively," Ms.

Stacom said.

Write to Keiko Morris at Keiko.Morris@wsj.com

(END) Dow Jones Newswires

April 18, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

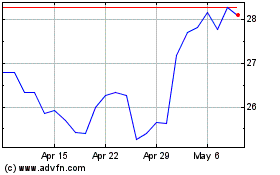

Pfizer (NYSE:PFE)

Historical Stock Chart

From Aug 2024 to Sep 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

From Sep 2023 to Sep 2024