Barclays Agrees $2 Billion U.S. Settlement Over Mortgage-Backed Securities

March 29 2018 - 10:06AM

Dow Jones News

By Adam Clark

The U.S. Department of Justice said on Thursday that Barclays

PLC (BARC.LN) has agreed to pay $2 billion in civil penalties to

resolve claims for fraud in the sale of residential mortgage-backed

securities, or RMBS.

The Department of Justice said the settlement will dismiss the

civil action filed in December 2016, which alleged Barclays caused

billions of dollars in losses to investors in deals involving over

$31 billion of securitized mortgage loans between 2005 and

2007.

The filed complaint alleged that Barclays systematically and

intentionally misrepresented key characteristics of the loans, with

the borrowers being significantly less creditworthy than

represented, leading to exceptionally high default rates early in

the life of the deals.

An agreement has also been reached with former Barclays

executives Paul Menefee, former head banker of subprime RMBS

securitizations, and John Carroll, former head trader for subprime

loan acquisitions. The two former executives have agreed to pay a

combined $2 million in civil penalties.

Barclays said it will recognize the penalty in its first-quarter

results for 2018, resulting in a 45 basis points hit to its common

equity tier one ratio. The bank said that it remains well

positioned to produce stronger earnings going forward and still

intends to pay a 6.5 pence a share dividend for 2018.

Shares at 1324 GMT were up 0.40 pence, or 0.2%, at 206.40

pence.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

March 29, 2018 09:51 ET (13:51 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

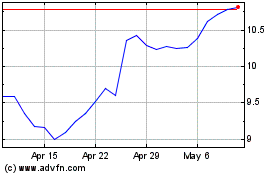

Barclays (NYSE:BCS)

Historical Stock Chart

From Aug 2024 to Sep 2024

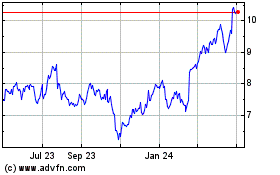

Barclays (NYSE:BCS)

Historical Stock Chart

From Sep 2023 to Sep 2024