Ackman Nets $100 Million in Nike -- WSJ

March 23 2018 - 3:02AM

Dow Jones News

Pershing Square sold stock after a 32% rise; activist needs a

gain to hold on to investors

By David Benoit

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 23, 2018).

William Ackman's Pershing Square Capital Management LP cashed

out of its brief holding in Nike Inc. in recent weeks, for a profit

of around $100 million.

The activist had taken the stake in the fourth quarter, it

disclosed in January, but Pershing Square intended to keep it as a

passive bet on a company it believed was undervalued. After the

stock jumped some 32% from Pershing Square's purchasing costs, it

sold the stake, people familiar with the matter said.

Pershing Square had owned about 5.8 million shares at the end of

2017, it had disclosed, which would mean the bet scored about $100

million in profits. The exact size couldn't be determined given the

potential for other trading that wasn't disclosed.

This year is critical for Pershing Square and Mr. Ackman. As a

result of bad bets on companies including Valeant Pharmaceuticals

International Inc. and Herbalife Ltd., the firm has suffered three

straight years of declines that have spurred investor withdrawals

and dragged down assets. It needs wins to convince remaining

investors to hang around. The publicly traded Pershing Square

Holdings Ltd., which closely tracks his private funds, had lost

6.2% this year through Tuesday with bets on Fannie Mae and Freddie

Mac, Mondelez International Inc. and Automatic Data Processing Inc.

all in the red.

For Nike, the exit alleviates at least one potential pressure

point on a management team juggling several issues. The company has

faced continuing challenges in its home market in North America as

consumer shopping habits change and more people shop online, and

Nike has worked to expand its digital and direct sales.

Last week, two prominent executives, including the heir-apparent

to be CEO, left their positions in the wake of an internal probe

into inappropriate behavior at Nike. Trevor Edwards, Nike's brand

president, resigned his post and intends to retire from the company

in August. Jayme Martin, a vice president, was forced out, The Wall

Street Journal reported.

Nike is due to report quarterly results after market close on

Thursday. Analysts polled by FactSet expect net income of $868

million on sales of $8.9 billion for the period ended in February,

compared with $1.1 billion and $8.4 billion, respectively, a year

ago.

Sara Germano contributed to this article.

Write to David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

March 23, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

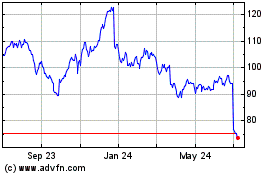

Nike (NYSE:NKE)

Historical Stock Chart

From Aug 2024 to Sep 2024

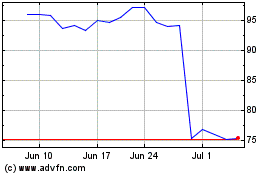

Nike (NYSE:NKE)

Historical Stock Chart

From Sep 2023 to Sep 2024