Increased Communication & Coordination Are Key to Sustaining Fintech Sector’s High Growth, According to Report from Accentu...

February 26 2018 - 8:03AM

Business Wire

Report points to best practices for

streamlining technology adoption in financial services

Better aligning communications and actions between financial

institutions and fintech companies is the next critical step to

ensuring the continued growth of the fintech sector, according to a

new report by Accenture (NYSE: ACN) and the Partnership Fund for

New York City.

Based on a survey of nearly 90 executives at financial

institutions and fintechs in New York, London and Hong Kong, the

report, “Mind the Gap: Addressing Challenges to Fintech Adoption,”

notes that while the ability to adopt external innovation is

creating competitive advantages for financial services companies,

collaboration between those companies and fintechs remains

challenging and time-consuming.

The report also shows that these organizations are not

adequately addressing their shared problems and have different

perceptions regarding what’s occurring in the technology onboarding

process between banking, insurance, asset management and other

financial institutions and their partnering entrepreneurial

fintechs.

“By taking a few pragmatic actions – including reconciling any

disconnects in the fintech adoption process and agreeing on best

practices – these organizations can help ensure the growth and

success of the fintechs, which will benefit all parties,” said

Maria Gotsch, president and CEO of the Partnership Fund for New

York City and co-director of the Fintech Innovation Lab.

The survey identified a number of disconnects between the

perceptions of financial institutions and fintechs, particularly

when it comes to regulatory concerns. For instance, 60 percent of

the financial institutions, versus only 17 percent of the fintechs,

are actively working with regulators to address concerns associated

with fintech adoption. In fact, nearly four in 10 (38 percent)

of the fintechs said they are not currently addressing regulatory

issues with the financial institutions at all. In addition, when

asked to identify the top reason that products stall during the

proof-of-concept phase, New York financial institutions cited

compliance and security issues, whereas fintechs cited a lack of

dedicated employees or funding resources and misalignment between

use cases and product roadmaps.

“The great success and rapid expansion of fintech has been so

dramatic that financial institutions and technology entrepreneurs

haven’t yet had time to merge key existing best practices with the

innovative new capabilities,” said David Treat, a managing director

at Accenture and co-director of the Fintech Innovation Lab.

“Sustained growth now requires increased communication and

coordination between financial services companies and fintechs in

areas like security and compliance, signoffs and approvals, and

resources.”

The report also found that fintechs and financial institutions

disagree on the time prospecting should take, with nearly

two-thirds (62 percent) of fintechs saying it takes longer

than four months, while 80 percent of financial institutions say it

should take less than three months. One factor both parties agree

on is the need for financial institutions to have a dedicated

point-person for fintechs to work with to ensure the process runs

smoothly. However, only about half (53 percent) of financial

institutions actually have such a point person assigned.

The report recommends specific steps that financial services

firms and fintechs take to increase adoption of fintech innovation,

including:

- developing process maps to sequence

steps and clarify roles;

- streamlining the pathway to “go” or “no

go” decisions during proof of concept;

- creating sandboxes, or safe work areas,

to avoid potential security, compliance and risk management

roadblocks; and

- emphasizing regular, timely

communications between financial institutions and fintechs.

Methodology

For the research, the New York Fintech Innovation Lab queried 87

executives at financial services firms and fintechs in New York,

London and Hong Kong regarding their views on the innovation

onboarding process. The respondents comprised 52 Fintech Innovation

Lab alumni (typically fintech CEOs) and 35 chief information

officers and chief technology officers of financial services

companies that serve as senior sponsors of the 2016 and 2017

Labs.

About the Partnership Fund for New York City

The Partnership Fund for New York City is the $150 million

investment arm of the Partnership for New York City, New York’s

leading business organization. The Fund’s mission is to engage the

City’s business leaders to identify and support promising NYC-based

entrepreneurs – in both the for-profit and non-profit sectors – to

create jobs, spur new business and expand opportunities for New

Yorkers to participate in the City’s economy. As an “evergreen”

fund, its realized gains are continuously reinvested. The

Partnership Fund Board is led by Co-Chairmen Charles R. Kaye and

Tarek Sherif. Maria Gotsch, President and CEO, leads the team.

About Accenture

Accenture is a leading global professional services company,

providing a broad range of services and solutions in strategy,

consulting, digital, technology and operations. Combining unmatched

experience and specialized skills across more than 40 industries

and all business functions – underpinned by the world’s largest

delivery network – Accenture works at the intersection of business

and technology to help clients improve their performance and create

sustainable value for their stakeholders. With more than 435,000

people serving clients in more than 120 countries, Accenture drives

innovation to improve the way the world works and lives. Visit us

at www.accenture.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180226005249/en/

AccentureMelissa Volin, +1 267 216

1815Melissa.volin@accenture.comorPartnership Fund for NYC /

Rubenstein CommunicationsKaty Feinberg, +1 212 843

8047kfeinberg@Rubenstein.com

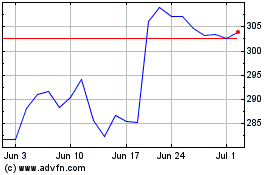

Accenture (NYSE:ACN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Accenture (NYSE:ACN)

Historical Stock Chart

From Apr 2023 to Apr 2024