Mandates, Not Market Prices, Likely to Keep U.S. Solar Growing

February 20 2018 - 7:29AM

Dow Jones News

By Erin Ailworth

Government mandates should keep U.S. solar power growing,

despite new Trump administration tariffs on imported solar panels

that are poised to raise prices.

While the tariffs may slow the rate of solar expansion, local

and state policies requiring utilities to procure renewable energy

will continue to help create a baseline market for solar power,

particularly for large, utility-scale projects.

New York, for instance, has called for three gigawatts of solar

capacity to be installed in the state by 2023, roughly three times

the amount installed at the end of 2017.

The Trump administration tariffs -- 30% in the first year,

declining to 15% by the fourth -- will raise the price of

foreign-made solar panels and cells. But technological improvements

and cost savings in other areas are expected to help the industry

at least partially offset the increases, utility executives and

analysts say.

"We are still bullish that solar prices will continue to come

down -- maybe not at the pace they've been coming down," said

Robert Caldwell, president of Duke Energy Corp.'s renewable and

distributed energy technology businesses.

Duke says it currently has about 2.5 gigawatts of solar energy

generating capacity in North Carolina and South Carolina, and has

plans to build or procure more than three gigawatts in the next

five years.

To prepare for the tariffs, solar developers like NextEra Energy

Inc. and Cypress Creek Renewables have been stockpiling solar

panels.

NextEra Chief Executive James Robo recently told analysts on a

conference call that his company already has purchased all the

panels its needs to build in 2018 and 2019, as well as the panels

for "a significant portion of our 2020 build."

Cypress Creek Chief Executive Matthew McGovern said his company

also pre-purchased many of the panels it will need this year, and

has been pushing projects out to the later years of the tariff,

when the trade protection will be less stringent, or beyond.

"We're trying to do everything we can to keep projects from

dying out," he said.

U.S. solar costs have fallen in recent years, partly due to a

flood of cheap, foreign-made solar panels and cells, the component

that converts sunlight to energy.

A residential solar installation now costs $2.93 a watt on

average, compared with $6.61 in 2010, according to data from GTM

Research, which tracks trends in renewable energy. In the same time

frame, the price of a large, utility-scale solar system has fallen

by nearly 70%, to $1.11 a watt from $3.58 a watt on average,

according to GTM.

GTM forecasts the price of solar panels will rise 10 cents a

watt on average in the first year of the new Trump trade

protections. It predicts demand -- already down after a record

2016, when installers raced to take advantage of tax credits --

will drop by some 7.6 gigawatts between now and 2022 compared with

previous forecasts. However, GTM expects solar should start to rise

again and begin approaching 2016 levels by the end of that time

frame.

GTM predicts utility-scale solar projects will take the hardest

hit because they will be less competitive compared with other forms

of energy generation, including wind turbines and natural gas power

plants.

Government mandates, however, are expected to blunt the losses.

Several states have set aggressive renewable energy goals,

including California and New York, which are aiming to procure half

their electricity from renewable resources by 2030.

(END) Dow Jones Newswires

February 20, 2018 07:14 ET (12:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

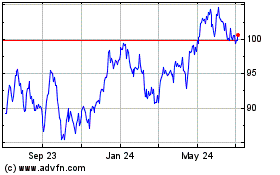

Duke Energy (NYSE:DUK)

Historical Stock Chart

From Mar 2024 to Apr 2024

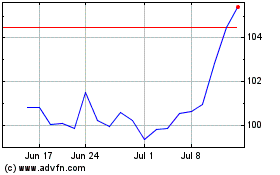

Duke Energy (NYSE:DUK)

Historical Stock Chart

From Apr 2023 to Apr 2024