Halliburton Says Rail Delays Take Toll -- WSJ

February 16 2018 - 3:02AM

Dow Jones News

By Christopher M. Matthews

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 16, 2018).

Halliburton Co. warned Thursday that its first-quarter earnings

would take a hit due to delays on delivery of a key ingredient used

to hydraulically fracture shale wells: sand.

Trading in shares of the oil-field services giant was briefly

halted Thursday morning before Chris Weber, Halliburton's chief

financial officer, said the company expected an impact of 10 cents

per share on its first-quarter earnings due to delays by Canadian

rail companies that would slow sand delivery.

Trading resumed minutes after Mr. Weber made the announcement

during remarks at the Credit Suisse Energy Summit, and the

company's stock fell 2.1% to $46.89 by 4 p.m. On the day, the

S&P 500 gained 1.2%, while its energy sector lost 0.4%.

Oil-field services companies like Halliburton pump millions of

pounds of sand in each shale well to help producers prop open rocks

cracked during hydraulic fracturing, to help oil and gas seep

out.

Any delays in sand delivery could slow the uptick in production

in oil-rich regions like Texas' Permian basin.

Investment bank Evercore ISI said in a note to investors that it

expects "customer frustration is rampant given the impact to

production. Most other pressure pumpers will likely see similar

headwinds, further hampered by the cold weather Texas experienced

in January."

Fracking companies have traditionally hauled sand from mines in

the Midwest by rail to shale sites across the country, from Texas

to North Dakota. The Canadian National Railway Company said in

January that severe cold conditions in its Canadian and U.S.

Midwest rail network would cause it to run shorter trains in those

regions, reducing capacity.

Evercore said it expects Halliburton will buy sand on the spot

market from new, local suppliers in Texas to supplement the lost

volumes, but that it will not be enough to cover all the needed

sand. More than a dozen companies have flocked to mine sand in West

Texas close to production activity, but only five out of 20 planned

mines are active, Evercore said.

Mr. Weber said that despite the delays, Halliburton is still on

track for normalized margins of around 20% in North America in

2018, following years of steep pricing cuts in the industry due to

low oil prices.

Write to Christopher M. Matthews at

christopher.matthews@wsj.com

(END) Dow Jones Newswires

February 16, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

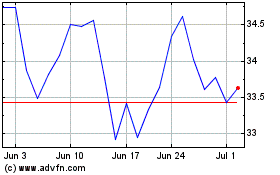

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

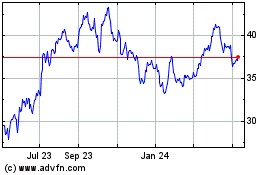

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024