UPS Plans to Ramp Up Spending After Struggles With Holiday Season Delays -- Update

February 01 2018 - 12:25PM

Dow Jones News

By Paul Ziobro

United Parcel Service Inc. will spend up to $7 billion this year

to upgrade its delivery network, adding jumbo jets and automating

facilities, as it tries to fix service issues that hurt profits

during its latest quarter.

The network came under pressure during the past holiday season,

as UPS delivered 762 million packages during the peak period, more

than its initial forecast of 750 million. The company said Thursday

it incurred an extra $125 million in costs as it scrambled to lease

planes and trucks to handle the extra volume and clear backlogs

that hit the network during the week after Thanksgiving.

The added costs caused UPS operating profit to fall 5.5% in its

large domestic segment during the fourth quarter, even as the extra

business and higher prices boosted revenue 8.4%. Overall for the

period, UPS operating profit, excluding a pension accounting

charge, rose 3.2% while revenue surged 11% to $18.83 billion.

UPS did try a new pricing strategy during the period, hitting

shippers with additional surcharges for residential deliveries

during the busiest shipping weeks. UPS said the extra fees, which

also applied to oversize packages, helped increase revenue and

shifted some deliveries to less congested weeks, but not enough to

avoid problems early on.

"We didn't have quite the success that we thought we would in

shaping [demand] and we're going to look into that," Chief

Executive David Abney said Thursday on the earnings call.

In an interview, Mr. Abney said UPS's volume in the week after

Thanksgiving rose 20% compared with the prior year, much more than

the 9% increase it expected. UPS also had to cap its volume on

certain days, adding to shipping times.

UPS needs to work closer with its shippers to anticipate the

higher demand, which was widespread among shippers of all sizes, he

said. "It's not just the big ones you can think of. It was the

small ones, the medium ones and the big ones," Mr. Abney said.

FedEx Corp., which devotes a smaller portion of its business to

home deliveries, didn't appear to suffer similar setbacks during

the holidays. In a research note Thursday, Citi analysts said FedEx

didn't incur "meaningful disruptions" during the holiday period and

also seemed to avoid "elevated costs." A FedEx spokesman declined

to comment.

UPS's capital spending plans this year are a significant step up

from 2017, when the company spent $5.2 billion on capital projects.

Executives said that benefits from the new corporate tax law as

well as plans for increasing demand caused the company to move up

its spending budgets.

The added spending, however, worried investors, as the company's

recent upgrades to its network haven't been able to keep up with

demand and margins have decreased. In recent trading, UPS shares

fell almost 6% to $120.05.

The outlays include automating more parts of its network. UPS

plans to build or retrofit 18 facilities, including three new major

ground hubs in the U.S., the first such facilities its added in two

decades. Most of the extra capacity will be built in parts of its

network that suffered bottlenecks during the holiday period.

Mr. Abney said UPS is now able to accelerate automation projects

because the technology needed to retrofit existing facilities is

more compact. Previously, adding the equipment could eat up to a

third of a 30,000-square-foot buildings space. But now, UPS can

make the upgrades without sacrificing the footprint.

UPS will also expand Saturday delivery, which they began last

year, to more markets.

The company said Thursday it also plans to buy another 14 747-8

aircraft, exercising options for the freighter version of the jumbo

jet granted when it made a firm order for 14 of the Boeing Co.

planes last September. UPS is also adding four new 767-300Fs to the

59 it already operates. The company operates more than 500 aircraft

that it owns or leases.

The Atlanta-based company also said it made a $5 billion

contribution to its pension plan last year, seeking to bolster the

plan and optimize tax benefits under the new law.

For the fourth quarter, UPS reported a profit of $1.1 billion,

or $1.27 a share, compared with a loss of $239 million, or 27 cents

a share, a year earlier. The prior-year quarter was hurt by a $1.90

per share pension-related charge while the current quarter results

were boosted by 30 cents due to the tax overhaul.

The courier also said it expected 2018 adjusted per-share

earnings of $7.03 to $7.37. Analysts polled by Thomson Reuters had

forecast annual profit of $7.16 per share.

Imani Moise contributed to this article

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

February 01, 2018 12:10 ET (17:10 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

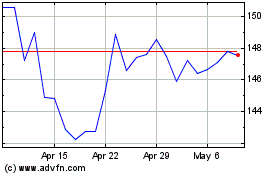

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

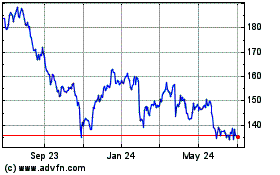

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024