CSX Board to Require CEOs to Get Annual Physical Exam -- Update

January 23 2018 - 7:46PM

Dow Jones News

By Paul Ziobro

CSX Corp. will require the railroad's chief executive to submit

to an annual physical exam that will be reviewed by the board,

adopting an unusually aggressive approach to a delicate issue just

weeks after the death of its previous CEO.

The railroad's board was under fire last year after it agreed to

hire Hunter Harrison even though he declined to get a physical exam

or provide access to his medical records -- despite concerns about

the then 72-year-old railroad veteran's health.

The board ultimately asked shareholders to vote on a pay package

that in effect would bless the arrival of Mr. Harrison. The

resolution passed with overwhelming support.

Mr. Harrison, who signed a four-year contract with the

Jacksonville, Fla., company in March 2017, died Dec. 16 following

unspecified health issues.

CSX's latest move is an attempt to address the sensitive issue

of CEO health and how much boards are entitled to know about it,

especially in cases where a company's fortunes are so closely tied

to their leaders. CSX shares surged in January 2017 on news that

Mr. Harrison wanted to run the company.

Securities laws don't explicitly require companies to disclose

executive health problems, though companies must share material

information that might affect investors' decisions to buy or sell

stock.

Apple Inc.'s board never disclosed the specific reasons for two

extended medical leaves by co-founder Steve Jobs, decisions that

angered some shareholders. Mr. Jobs died in 2011 after battling

pancreatic cancer.

United Continental Holdings Inc. told investors in October 2015

that its new CEO Oscar Munoz had been hospitalized but didn't

initially disclose that he had suffered a heart attack. He took a

medical leave, had a transplant and returned the following

year.

In 2015, Goldman Sachs Group CEO Lloyd Blankfein disclosed a

lymphoma diagnosis shortly after receiving the news from his

doctor. He said he planned to continue working through treatment

and returned to work full-time the following year.

While some companies do require CEOs to undergo annual

physicals, it isn't clear how many have to share results with the

board. The research firm Equilar Inc. couldn't find evidence that

any of the largest 500 U.S. companies considered a similar proposal

over the past five years.

Requiring executives to share their physicals with the board

could violate employment laws and at the least requires waiving a

right to privacy. "I regard that as a slippery slope," said Thomas

Flannery, managing partner at the executive search firm Boyden. "It

could have a bigger downside than upside."

Instead, Mr. Flannery said he encourages both the CEO and the

board to be open about health problems and whether they affect the

executive's ability to fulfill his or her duties.

At its meeting next month, the CSX board will adopt a policy

that requires its CEO get a comprehensive physical performed by a

medical provider chosen by the board, according to a letter

submitted to the Securities and Exchange Commission reviewed by The

Wall Street Journal. A CSX spokesman declined to comment.

The new policy will avoid a shareholder vote on a resolution

that had been proposed by an individual CSX investor for the

company's next annual meeting. "This is an important victory for

shareholders," said John Fishwick, a Virginia attorney who

submitted the proposal, in a video posted on Facebook. Mr. Fishwick

owns 1,000 CSX shares.

The rule comes after a year in which Mr. Harrison's health had

overshadowed his attempt to turn around the railroad operator. Mr.

Harrison was named CEO following a brief battle with an activist

shareholder. The shareholder wanted the veteran railroader to

implement a new operating plan at CSX modeled after prior

turnaround he executed at two major Canadian railways.

Mr. Harrison had a history of health issues and required the use

of a portable oxygen tank to treat an unspecified medical

condition. He declined the board's request to review his medical

records or submit to a physical as part of being named CEO.

His hiring included an $84 million payment to Mr. Harrison to

cover compensation he left behind when he quit his job at another

railroad to lead CSX.

CSX faced a difficult decision. Word that Mr. Harrison was

interested in leading CSX added $10 billion to the company's market

value. Blocking his appointment, even with unspecified health

issues, likely would have caused shares to drop, analysts said at

the time.

Mr. Harrison moved quickly to change CSX, idling hundreds of

locomotives, closing several rail yards and overhauling train

schedules, which caused delays during much of the summer. The

railway has since recovered, although the company is still working

to win back customers lost last year.

Mr. Harrison died two days after taking a medical leave of

absence. Jim Foote, who was hired as Mr. Harrison's No. 2 in

October as three other senior executives were leaving, was named

permanent CEO shortly after Mr. Harrison's death.

Mr. Foote this month acknowledged that the speed at which Mr.

Harrison made changes at CSX was broadly disruptive to the

railroad's operations. The company has since hired another

operations executive to work under Mr. Foote and expanded its

senior management team with leaders to help carry out the remaining

phase of the turnaround.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

January 23, 2018 19:31 ET (00:31 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

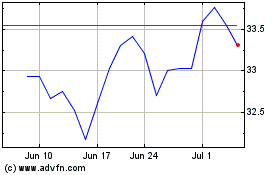

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024