Company maintaining FY’17 adjusted EPS

guidance

Caleres (NYSE: CAL) (caleres.com), a diverse portfolio of global

footwear brands which fit people’s lives, today reported third

quarter 2017 financial results.

“Our strong start to the third quarter in August was interrupted

by hurricanes in September and an unseasonably warm start to fall

in October. Even though the quarter became progressively more

challenging, we delivered improvement in gross margin and generated

strong cash flow, while paying down our revolver borrowings,” said

Diane Sullivan, CEO, president and chairman of Caleres. “While

weather-related events had a negative impact to topline sales of

approximately $35 million, sales have improved in November, as more

seasonal weather arrived. As a result, we are maintaining our

fiscal 2017 adjusted EPS guidance.”

Third Quarter 2017 Results Versus 2016

- Consolidated sales of $774.7 million

were up 5.8%, including Allen Edmonds.

- Famous Footwear total sales of $473.1

million were up 1.1%, while back-to-school same-store-sales were up

2.6% and third quarter same-store-sales were up 0.9%.

- Brand Portfolio sales of $301.5 million

were up 14.0% including contribution from Allen Edmonds, which was

acquired in December of 2016.

- In total, third quarter sales were

negatively impacted by approximately $35 million, due to the

hurricanes in Texas and Florida and the delayed start to the fall

boot season.

- Gross profit was $316.9 million, while

gross margin of 40.9% was up 79 basis points.

- SG&A expense of $264.0 million was

up 10.8%, including Allen Edmonds.

- Operating earnings were $52.9 million,

while operating margin was 6.8%.

- Net earnings were $34.4 million, while

diluted earnings per share were $0.80.

First Nine Months of 2017 Results Versus 2016

- Consolidated sales of $2,083.1 million

were up 7.4%, including Allen Edmonds.

- Gross profit of $875.3 million –

including $4.9 million of expected fair value inventory adjustment

amortization related to the Allen Edmonds acquisition – was up

9.3%, while gross margin of 42.0% was up 72 basis points.

- SG&A expense of $761.6 million was

up 11.2%, including Allen Edmonds.

- Operating earnings were $109.7 million

and operating margin was 5.3%, while adjusted operating earnings

were $118.6 million and adjusted operating margin was 5.7%.

- Net earnings were $66.9 million, while

diluted earnings per share were $1.55 and included $0.13 of charges

related to the acquisition, integration and reorganization of men’s

brands.

- Adjusted net earnings of $72.5 million

were up $0.2 million, while adjusted diluted earnings per share of

$1.68 were up 0.6%.

Balance Sheet and Cash Flow

- Cash and equivalents were $31.4

million.

- Outstanding borrowings under the

revolving credit facility of $20 million – associated with the

December 2016 acquisition of Allen Edmonds – were down from $110

million at the end of 2016.

- Inventory of $598.4 million was up

14.0% year-over-year, including Allen Edmonds.

- Year-to-date capital expenditures of

$38.9 million were down 20.1% year-over-year.

Outlook for 2017 all including

Allen Edmonds

Consolidated net sales $2.7B to

$2.8B Famous Footwear same-store-sales Up low-single digits Brand

Portfolio sales Up high-teens Gross margin Up 70 to 80 bps SG&A

as a percent of revenue Up 70 to 80 bps Effective tax rate 30% to

32% Adjusted earnings per diluted share*

$2.10 to $2.20

* Excludes $0.13 of costs related

to the acquisition, integration and reorganization of the company’s

men's brands

Investor Conference Call

Caleres will host an investor conference call at 4:30 p.m. ET

today, Tuesday, November 21. The webcast and slides will be

available at investor.caleres.com/news/events. A live conference

call will be available at (877) 217-9089 for analysts in North

America or (706) 679-1723 for international analysts by using the

conference ID 8686459. A replay will be available at

investor.caleres.com/news/events/archive for a limited period.

Investors may also access the replay by dialing (855) 859-2056 in

North America or (404) 537-3406 internationally and using the

conference ID 8686459 through Tuesday, December 5.

Definitions

All references in this press release, outside of the condensed

consolidated financial statements that follow, unless otherwise

noted, related to net earnings attributable to Caleres, Inc. and

diluted earnings per common share attributable to Caleres, Inc.

shareholders, are presented as net earnings and earnings per

diluted share, respectively.

Non-GAAP Financial Measures

In this press release, the company’s financial results are

provided both in accordance with generally accepted accounting

principles (GAAP) and using certain non-GAAP financial measures. In

particular, the company provides historic and estimated future

gross profit, operating earnings, net earnings and earnings per

diluted share adjusted to exclude certain gains, charges and

recoveries, which are non-GAAP financial measures. These results

are included as a complement to results provided in accordance with

GAAP because management believes these non-GAAP financial measures

help identify underlying trends in the company’s business and

provide useful information to both management and investors by

excluding certain items that may not be indicative of the company’s

core operating results. These measures should not be considered a

substitute for or superior to GAAP results.

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995

This press release contains certain forward-looking statements

and expectations regarding the company’s future performance and the

performance of its brands. Such statements are subject to various

risks and uncertainties that could cause actual results to differ

materially. These risks include (i) changing consumer demands,

which may be influenced by consumers' disposable income, which in

turn can be influenced by general economic conditions; (ii) rapidly

changing fashion trends and purchasing patterns; (iii) intense

competition within the footwear industry; (iv) political and

economic conditions or other threats to the continued and

uninterrupted flow of inventory from China and other countries,

where the Company relies heavily on third-party manufacturing

facilities for a significant amount of its inventory; (v) the

ability to accurately forecast sales and manage inventory levels;

(vi) cybersecurity threats or other major disruption to the

Company’s information technology systems; (vii) transitional

challenges with acquisitions; (viii) customer concentration and

increased consolidation in the retail industry; (ix) a disruption

in the Company’s distribution centers; (x) the ability to recruit

and retain senior management and other key associates; (xi) foreign

currency fluctuations; (xii) compliance with applicable laws and

standards with respect to labor, trade and product safety

issues; (xiii) the ability to secure/exit leases on favorable

terms; (xiv) the ability to maintain relationships with current

suppliers; (xv) the ability to attract, retain and maintain good

relationships with licensors and protect intellectual property

rights; and (xvi) changes to tax laws, policies and treaties. The

company's reports to the Securities and Exchange Commission contain

detailed information relating to such factors, including, without

limitation, the information under the caption Risk Factors in Item

1A of the company’s Annual Report on Form 10-K for the year ended

January 28, 2017, which information is incorporated by reference

herein and updated by the company’s Quarterly Reports on Form 10-Q.

The company does not undertake any obligation or plan to update

these forward-looking statements, even though its situation may

change.

About Caleres

Caleres is a diverse portfolio of global footwear brands. Our

products are available virtually everywhere - in the over 1,200

retail stores we operate, in hundreds of major department and

specialty stores, on our branded e-commerce sites, and on many

additional third-party retail websites. Famous Footwear

and Famous.com serve as our Family brands. Our

Contemporary Fashion brands include Sam Edelman, Allen Edmonds,

Franco Sarto, Vince, Via Spiga, George Brown Bilt, Diane von

Furstenberg, Fergie Footwear and Carlos Santana. Naturalizer, Dr.

Scholl's Shoes, LifeStride, Bzees and Ryka represent our Healthy

Living brands. Combined, these brands help make Caleres a company

with both a legacy and a mission. Our legacy is our more than

130-years of craftsmanship, our passion for fit and our business

savvy, while our mission is to continue to inspire people to feel

good…feet first. Visit caleres.com to learn more about

us.

SCHEDULE 1 CALERES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS

(Unaudited) Thirteen Weeks Ended Thirty-nine Weeks Ended

(Thousands, except per share data) October 28, 2017 October 29,

2016 October 28, 2017 October 29, 2016 Net sales $ 774,656 $

732,230 $ 2,083,119 $ 1,939,900 Cost of goods sold 457,771

438,459 1,207,865 1,138,781 Gross profit

316,885 293,771 875,254 801,119

Selling and administrative expenses 264,015 238,319 761,590 684,666

Restructuring and other special charges, net — —

3,973 — Operating earnings 52,870

55,452 109,691 116,453 Interest expense (4,141

) (3,475 ) (13,822 ) (10,564 ) Interest income 95 350

592 907 Earnings before income taxes 48,824

52,327 96,461 106,796 Income tax

provision (14,451 ) (17,601 ) (29,530 ) (34,514 ) Net earnings

34,373 34,726 66,931 72,282 Net (loss)

earnings attributable to noncontrolling interests (14 ) (4 ) 47

2 Net earnings attributable to Caleres, Inc. $ 34,387

$ 34,730 $ 66,884 $ 72,280 Basic

earnings per common share attributable to Caleres, Inc.

shareholders $ 0.80 $ 0.81 $ 1.56 $ 1.67

Diluted earnings per common share attributable to

Caleres, Inc. shareholders $ 0.80 $ 0.81 $ 1.55

$ 1.67

SCHEDULE 2

CALERES, INC. CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited) October 28, 2017 October 29, 2016

January 28, 2017 (Thousands)

ASSETS Cash and cash

equivalents $ 31,379 $ 173,435 $ 55,332 Receivables, net 132,942

139,475 153,121 Inventories, net 598,365 524,823 585,764 Prepaid

expenses and other current assets 40,982 31,716

49,528 Total current assets 803,668 869,449 843,745

Property and equipment, net 214,982 191,754 219,196 Goodwill

and intangible assets, net 340,182 128,141 343,758 Other assets

68,316 114,851 68,574 Total assets $ 1,427,148

$ 1,304,195 $ 1,475,273

LIABILITIES AND EQUITY

Borrowings under revolving credit agreement $ 20,000 $ — $ 110,000

Trade accounts payable 223,832 212,088 266,370 Other accrued

expenses 173,487 141,886 151,225 Total current

liabilities 417,319 353,974 527,595 Long-term

debt 197,348 196,888 197,003 Deferred rent 50,814 48,696 51,124

Other liabilities 86,580 57,574 85,065 Total other

liabilities 334,742 303,158 333,192 Total

Caleres, Inc. shareholders’ equity 673,645 646,110 613,117

Noncontrolling interests 1,442 953 1,369 Total equity

675,087 647,063 614,486 Total liabilities and equity

$ 1,427,148 $ 1,304,195 $ 1,475,273

SCHEDULE 3 CALERES, INC. CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) Thirty-nine

Weeks Ended (Thousands) October 28, 2017 October 29, 2016 OPERATING

ACTIVITIES: Net cash provided by operating activities

$ 122,261 $ 137,003 INVESTING ACTIVITIES:

Purchases of property and equipment (34,364 ) (43,019 ) Capitalized

software (4,531 ) (5,672 ) Net cash used for investing activities

(38,895 ) (48,691 ) FINANCING ACTIVITIES: Borrowings under

revolving credit agreement 450,000 103,000 Repayments under

revolving credit agreement (540,000 ) (103,000 ) Dividends paid

(9,033 ) (9,094 ) Acquisition of treasury stock (5,993 ) (23,139 )

Issuance of common stock under share-based plans, net (2,477 )

(4,205 ) Excess tax benefit related to share-based plans —

3,264 Net cash used for financing activities (107,503 )

(33,174 ) Effect of exchange rate changes on cash and cash

equivalents 184 146 (Decrease) increase in cash and

cash equivalents (23,953 ) 55,284 Cash and cash equivalents at

beginning of period 55,332 118,151 Cash and cash

equivalents at end of period $ 31,379 $ 173,435

SCHEDULE 4

CALERES, INC. RECONCILIATION OF NET EARNINGS AND

DILUTED EARNINGS PER SHARE (GAAP BASIS) TO ADJUSTED NET EARNINGS

AND ADJUSTED DILUTED EARNINGS PER SHARE (NON-GAAP BASIS)

(Unaudited) Thirteen Weeks Ended October 29, 2017 October 28, 2016

(Thousands, except per share data)

Pre-TaxImpact ofCharges/Other Items

NetEarningsAttributable toCaleres,

Inc.

DilutedEarningsPer Share

Pre-TaxImpact ofCharges/Other Items

NetEarningsAttributable toCaleres,

Inc.

DilutedEarningsPer Share

GAAP earnings $ 34,387 $ 0.80 $ 34,730 $ 0.81

Charges/other

items:

Acquisition, integration and reorganization of men's brands $ —

— — $ — —

— Total charges/other items $ — $ —

$ — $ — $ — $ — Adjusted

earnings $ 34,387 $ 0.80 $ 34,730

$ 0.81 (Unaudited) Thirty-nine Weeks Ended October

29, 2017 October 28, 2016 (Thousands, except per share data)

Pre-TaxImpact ofCharges/Other Items

NetEarningsAttributable toCaleres,

Inc.

DilutedEarningsPer Share

Pre-TaxImpact ofCharges/Other Items

NetEarningsAttributable toCaleres,

Inc.

DilutedEarningsPer Share

GAAP earnings $ 66,884 $ 1.55 $ 72,280 $ 1.67

Charges/other

items:

Acquisition, integration and reorganization of men's brands $ 8,912

$ 5,569 0.13 — —

— Total charges/other items $ 8,912 $

5,569 $ 0.13 $ — $ —

$ — Adjusted earnings $ 72,453 $ 1.68 $

72,280 $ 1.67

SCHEDULE 5

CALERES,

INC. SUMMARY FINANCIAL RESULTS BY SEGMENT

SUMMARY FINANCIAL RESULTS

(Unaudited) Thirteen Weeks Ended Famous Footwear

Brand Portfolio Other Consolidated (Thousands)

October 28,2017

October 29,2016

October 28,2017

October 29,2016

October 28,2017

October 29,2016

October 28,2017

October 29,2016

Net sales $ 473,118 $ 467,816 $ 301,538 $ 264,414 $ — $ — $ 774,656

$ 732,230 Gross profit $ 198,073 $ 194,659 $ 118,812 $ 99,112 $ — $

— $ 316,885 $ 293,771 Adjusted gross profit $ 198,073 $ 194,659 $

118,812 $ 99,112 $ — $ — $ 316,885 $ 293,771 Gross profit rate 41.9

% 41.6 % 39.4 % 37.5 % — % — % 40.9 % 40.1 % Adjusted gross profit

rate 41.9 % 41.6 % 39.4 % 37.5 % — % — % 40.9 % 40.1 % Operating

earnings (loss) $ 33,747 $ 32,709 $ 24,281 $ 30,454 $ (5,158 ) $

(7,711 ) $ 52,870 $ 55,452 Adjusted operating earnings (loss) $

33,747 $ 32,709 $ 24,281 $ 30,454 $ (5,158 ) $ (7,711 ) $ 52,870 $

55,452 Operating earnings % 7.1 % 7.0 % 8.1 % 11.5 % — % — % 6.8 %

7.6 % Adjusted operating earnings % 7.1 % 7.0 % 8.1 % 11.5 % — % —

% 6.8 % 7.6 % Same-store sales % (on a 13-week basis) (1) 0.9 % 2.1

% 2.4 % (5.4 )% — % — % — % — % Number of stores 1,042

1,051 235 167

— — 1,277 1,218

RECONCILIATION OF ADJUSTED RESULTS (NON-GAAP)

(Unaudited) Thirteen Weeks Ended Famous Footwear Brand

Portfolio Other Consolidated (Thousands)

October 28,2017

October 29,2016

October 28,2017

October 29,2016

October 28,2017

October 29,2016

October 28,2017

October 29,2016

Gross profit $ 198,073 $ 194,659 $ 118,812 $ 99,112 $ — $ — $

316,885 $ 293,771

Charges/Other

Items:

Acquisition, integration and reorganization of men's brands —

— — — —

— — — Total

charges/other items — — —

— — — — —

Adjusted gross profit $ 198,073 $ 194,659

$ 118,812 $ 99,112 $ —

$ — $ 316,885 $ 293,771

Operating earnings (loss) $ 33,747 $ 32,709 $ 24,281 $

30,454 $ (5,158 ) $ (7,711 ) $ 52,870 $ 55,452

Charges/Other

Items:

Acquisition, integration and reorganization of men's brands —

— — — —

— — — Total

charges/other items — — —

— — — — —

Adjusted operating earnings (loss) $ 33,747

$ 32,709 $ 24,281 $ 30,454

$ (5,158 ) $ (7,711 ) $ 52,870

$ 55,452

(1) Excludes sales from Allen Edmonds

SCHEDULE 5

CALERES, INC. SUMMARY FINANCIAL

RESULTS BY SEGMENT

SUMMARY FINANCIAL RESULTS (Unaudited)

Thirty-nine Weeks Ended Famous Footwear Brand Portfolio

Other Consolidated (Thousands)

October 28,2017

October 29,2016

October 28,2017

October 29,2016

October 28,2017

October 29,2016

October 28,2017

October 29,2016

Net sales $ 1,244,542 $ 1,222,535 $ 838,577 $ 717,365 $ — $ — $

2,083,119 $ 1,939,900 Gross profit $ 549,072 $ 540,774 $ 326,182 $

260,345 $ — $ — $ 875,254 $ 801,119 Adjusted gross profit $ 549,072

$ 540,774 $ 331,121 $ 260,345 $ — $ — $ 880,193 $ 801,119 Gross

profit rate 44.1 % 44.2 % 38.9 % 36.3 % — % — % 42.0 % 41.3 %

Adjusted gross profit rate 44.1 % 44.2 % 39.5 % 36.3 % — % — % 42.3

% 41.3 % Operating earnings (loss) $ 79,137 $ 81,067 $ 53,511 $

57,539 $ (22,957 ) $ (22,153 ) $ 109,691 $ 116,453 Adjusted

operating earnings (loss) $ 79,137 $ 81,067 $ 59,932 $ 57,539 $

(20,466 ) $ (22,153 ) $ 118,603 $ 116,453 Operating earnings % 6.4

% 6.6 % 6.4 % 8.0 % — % — % 5.3 % 6.0 % Adjusted operating earnings

% 6.4 % 6.6 % 7.1 % 8.0 % — % — % 5.7 % 6.0 % Same-store sales %

(on a 39-week basis) (1) 1.0 % 0.7 % 6.7 % (5.2 )% — % — % — % — %

Number of stores 1,042 1,051 235

167 — —

1,277 1,218

RECONCILIATION OF ADJUSTED RESULTS (NON-GAAP)

(Unaudited) Thirty-nine Weeks Ended Famous Footwear

Brand Portfolio Other Consolidated (Thousands)

October 28,2017

October 29,2016

October 28,2017

October 29,2016

October 28,2017

October 29,2016

October 28,2017

October 29,2016

Gross profit $ 549,072 $ 540,774 $ 326,182 $ 260,345 $ — $ — $

875,254 $ 801,119

Charges/Other

Items:

Acquisition, integration and reorganization of men's brands —

— 4,939 — —

— 4,939 — Total

charges/other items — — 4,939

— — — 4,939

— Adjusted gross profit $ 549,072 $

540,774 $ 331,121 $ 260,345

$ — $ — $ 880,193

$ 801,119 Operating earnings (loss) $ 79,137 $ 81,067 $

53,511 $ 57,539 $ (22,957 ) $ (22,153 ) $ 109,691 $ 116,453

Charges/Other

Items:

Acquisition, integration and reorganization of men's brands —

— 6,421 —

2,491 — 8,912 —

Total charges/other items — — 6,421

— 2,491 —

8,912 — Adjusted operating earnings (loss)

$ 79,137 $ 81,067 $ 59,932

$ 57,539 $ (20,466 ) $ (22,153 )

$ 118,603 $ 116,453

(1) Excludes sales from Allen Edmonds

SCHEDULE 6 CALERES,

INC. BASIC AND DILUTED EARNINGS PER SHARE RECONCILIATION

(Unaudited) Thirteen Weeks Ended

Thirty-nine Weeks Ended (Thousands, except per share data) October

28, 2017 October 29, 2016 October 28, 2017 October

29, 2016 Net earnings attributable to Caleres, Inc.: Net

earnings $ 34,373 $ 34,726 $ 66,931 $ 72,282 Net loss (earnings)

attributable to noncontrolling interests 14 4

(47 ) (2 ) Net earnings attributable to Caleres, Inc. 34,387

34,730 66,884 72,280 Net earnings allocated to participating

securities (949 ) (910 ) (1,841 ) (1,933 ) Net

earnings attributable to Caleres, Inc. after allocation of earnings

to participating securities $ 33,438 $ 33,820

$ 65,043 $ 70,347 Basic and diluted

common shares attributable to Caleres, Inc.: Basic common shares

41,788 41,802 41,801 42,093 Dilutive effect of share-based awards

182 137 173 144 Diluted

common shares attributable to Caleres, Inc. 41,970

41,939 41,974 42,237 Basic

earnings per common share attributable to Caleres, Inc.

shareholders $ 0.80 $ 0.81 $ 1.56

$ 1.67 Diluted earnings per common share

attributable to Caleres, Inc. shareholders $ 0.80 $

0.81 $ 1.55 $ 1.67

SCHEDULE 7 CALERES, INC.

BASIC AND DILUTED ADJUSTED EARNINGS PER SHARE RECONCILIATION

(Unaudited) Thirteen Weeks Ended Thirty-nine

Weeks Ended (Thousands, except per share data) October 28, 2017

October 29, 2016 October 28, 2017 October 29, 2016

Adjusted net earnings attributable to Caleres, Inc.:

Adjusted net earnings $ 34,373 $ 34,726 $ 72,500 $ 72,282 Net loss

(earnings) attributable to noncontrolling interests 14

4 (47 ) (2 ) Adjusted net earnings

attributable to Caleres, Inc. 34,387 34,730 72,453 72,280 Net

earnings allocated to participating securities (949 ) (910 )

(1,995 ) (1,933 ) Adjusted net earnings attributable to

Caleres, Inc. after allocation of earnings to participating

securities $ 33,438 $ 33,820 $ 70,458

$ 70,347 Basic and diluted common shares

attributable to Caleres, Inc.: Basic common shares 41,788 41,802

41,801 42,093 Dilutive effect of share-based awards 182

137 173 144 Diluted common

shares attributable to Caleres, Inc. 41,970 41,939

41,974 42,237 Basic adjusted

earnings per common share attributable to Caleres, Inc.

shareholders $ 0.80 $ 0.81 $ 1.69

$ 1.67 Diluted adjusted earnings per common

share attributable to Caleres, Inc. shareholders $ 0.80

$ 0.81 $ 1.68 $ 1.67

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171121006027/en/

CaleresPeggy Reilly Tharp, 314-854-4134ptharp@caleres.com

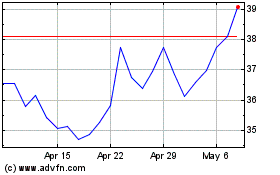

Caleres (NYSE:CAL)

Historical Stock Chart

From Aug 2024 to Sep 2024

Caleres (NYSE:CAL)

Historical Stock Chart

From Sep 2023 to Sep 2024