____________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of October 2017

Commission File Number: 001-15102

__________________________________

Embraer S.A.

__________________________________

Av. Brigadeiro Faria Lima, 2170

12227-901 São José dos Campos, São Paulo, Brazil

(Address of principal executive offices)

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

¨

HIGHLIGHTS

·

During 3Q17, Embraer delivered 25 commercial jets and 20 executive jets (13 light and 7 large);

·

The Company’s firm order backlog at the end of 3Q17 was US$ 18.8 billion, representing an increase from the US$ 18.5 billion reported at the end of 2Q17

;

·

Consolidated revenues in 3Q17 were US$ 1,310.4 million, representing a decline of 13.5% compared to 3Q16 due to lower deliveries in the Commercial Aviation and Executive Jets segments;

·

Adjusted EBIT and Adjusted EBITDA

1

margins were 5.3% and 10.9%, respectively, in 3Q17. Adjusted EBIT and Adjusted EBITDA exclude US$ 3.6 million in net non-recurring charges in 3Q17;

·

3Q17 Net income attributable to Embraer shareholders and Earnings per ADS were US$ 110.0 million and US$ 0.60, respectively. Adjusted Net income (excluding the impact of FX-related non-cash deferred income tax and social contribution and non-recurring items) for the quarter was US$ 75.2 million, representing Adjusted Earnings per ADS of US$ 0.41;

·

The Company reiterates all formal aspects of its financial and deliveries Guidance for 2017;

·

Embraer expects 2018 to be a transition year due to the entry into service of the first E2 model, the E190-E2, combined with a still flattish market for Executive Jets and Defense & Security. In this transition scenario of ramp-up costs for the initial E2 deliveries, the Company releases 2018 Outlook for total revenues of US$ 5.3 to US$ 6.0 billion, with deliveries of 85 to 95 jets in Commercial Aviation and 105 to 125 jets in Executive Jets. Consolidated EBIT margin is expected to be within a range of 5.0% to 6.0%, and Guidance for Free Cash Flow is for a usage of US$ (150) million or better for 2018.

Main financial indicators

2

|

|

|

|

|

|

|

in millions of U.S dollars, except % and earnings per share data

|

|

IFRS

|

(1)

|

(1)

|

(1)

|

(1)

|

|

2Q17

|

3Q16

|

3Q17

|

YTD17

|

|

Revenue

|

1,769.6

|

1,514.3

|

1,310.4

|

4,106.3

|

|

EBIT

|

174.0

|

(28.9)

|

65.2

|

262.6

|

|

EBIT Margin %

|

9.8%

|

-1.9%

|

5.0%

|

6.4%

|

|

Adjusted EBIT

|

164.6

|

94.7

|

68.8

|

264.4

|

|

Adjusted EBIT Margin %

|

9.3%

|

6.3%

|

5.3%

|

6.4%

|

|

EBITDA

|

254.8

|

54.3

|

139.8

|

490.4

|

|

EBITDA Margin %

|

14.4%

|

3.6%

|

10.7%

|

11.9%

|

|

Adjusted EBTIDA

|

245.4

|

177.9

|

143.4

|

492.2

|

|

Adjusted EBTIDA Margin %

|

13.9%

|

11.7%

|

10.9%

|

12.0%

|

|

Adjusted Net Income

2

|

123.0

|

38.9

|

75.2

|

221.4

|

|

Adjusted earnings per share - ADS basic

|

0.6688

|

0.2135

|

0.4089

|

1.2039

|

|

Net income (loss) attributable to Embraer Shareholders

|

59.1

|

(33.7)

|

110.0

|

211.6

|

|

Earnings (losses) per share - ADS basic (US$)

|

0.3214

|

(0.1848)

|

0.5982

|

1.1507

|

|

Net debt

|

(661.5)

|

(652.7)

|

(722.8)

|

(722.8)

|

|

(1) Derived from unaudited financial information.

|

1

EBIT and EBITDA are non-GAAP measures. For more detailed information please refer to page 10.

2

Adjusted Net Income is a non-GAAP measure, calculated by adding Net Income attributable to Embraer Shareholders plus Deferred income tax and social contribution for the period, in addition to adjusting for non-recurring items. Under IFRS for Embraer’s Income Tax benefits (expenses) the Company is required to record taxes resulting from unrealized gains or losses due to the impact of changes in the

Real

to US Dollar exchange rate over non-monetary assets (primarily Inventory, Intangibles, and PP&E). The taxes resulting from gains or losses over non-monetary assets are considered deferred taxes and are presented in the consolidated Cash Flow statement, under Deferred income tax and social contribution, which was US$ (10.8) million in 3Q16, US$ (38.4) million in 3Q17 and US$ 68.9 million in 2Q17. Adjusted Net Income also excludes the net after-tax non-recurring items of US$ 83.4 million in 3Q16, US$ 3.6 million in 3Q17 and US$ (5.0) million in 2Q17.

1

São Paulo, Brazil, October 27, 2017

- (BM&FBOVESPA: EMBR3, NYSE: ERJ).

The Company's operating and financial information is presented, except where otherwise stated, on a consolidated basis in United States dollars (US$) in accordance with IFRS. The financial data presented in this document as of and for the quarters ended September 30, 2016 (3Q16), June 30, 2017 (2Q17) and September 30, 2017 (3Q17), are derived from the unaudited financial statements, except annual financial data and where otherwise stated.

REVENUES and gross margin

Consolidated revenues of US$ 1,310.4 million in 3Q17 represented a year-over-year decline of 13.5% compared to the US$ 1,514.3 million in revenues in 3Q16, driven primarily by lower deliveries in the Commercial Aviation and Executive Jets segments, as well as a 12.0% decline in Defense & Security segment revenues as compared to 3Q16. Over the first nine months of the year, revenues were US$ 4,106.3 million versus US$ 4,189.7 million over the first nine months of 2016, representing a decline of 2.0%. During 3Q17, the Company delivered 25 commercial jets and 20 executive jets (13 light and 7 large jets), compared to deliveries of 29 commercial jets and 25 executive jets (13 light and 12 large jets) in 3Q16. Year-to-date, Embraer has delivered 78 commercial jets and 59 executive jets (40 light jets and 19 large jets) as compared to 76 commercial jets and 74 executive jets (48 light and 26 large) delivered in the first three quarters of 2016.

The Company’s gross margin in 3Q17 was 19.0% compared to 18.8% in 3Q16, largely due to improvement in the Commercial Aviation segment, more than offsetting declines in the Executive Jets and Defense & Security segments. In the first nine months of 2017, consolidated gross margin was 17.5% versus 19.8% in the first nine months of 2016.

EBIT AND ADJUSTED EBIT

For 3Q17, EBIT and EBIT margin were US$ 65.2 million and 5.0%, respectively, up from the operating loss of US$ (28.9) million in 3Q16. Embraer’s results include non-recurring items in both 3Q17 and 3Q16. In 3Q17, the reported EBIT includes US$ 3.6 million in expenses related to taxes on remittances for payments following the finalization of the FCPA investigation. Reported EBIT in 3Q16 includes US$ 123.6 million in total non-recurring charges (US$ 118.1 million in provisions related to the Company’s voluntary dismissal program and US$ 5.5 million in additional charges related to the finalization of the FCPA investigation). Excluding these non-recurring items, Adjusted EBIT and Adjusted EBIT margin in 3Q17 were US$ 68.8 million and 5.3%, compared to Adjusted EBIT of US$ 94.7 million and Adjusted EBIT margin of 6.3% in 3Q16.

For the first nine months of 2017, EBIT and EBIT margin as reported were US$ 262.6 million and 6.4%, respectively, versus an operating loss of US$ (70.6) million over the first nine months of 2016. The reported amounts included net non-recurring charges/expenses totaling US$ 1.8 million over the nine months of 2017 and US$ 323.6 million over the nine months of 2016. Excluding these items Adjusted EBIT and Adjusted EBIT margin in the first nine months of 2017 were US$ 264.4 million and 6.4%, respectively, compared to Adjusted EBIT of US$253.0 million and Adjusted EBIT margin of 6.0% in the first nine months of 2016.

Administrative expenses totaled US$ 47.8 million in 3Q17, which was up from the US$ 33.1 million registered in 3Q16. Selling expenses declined from US$ 86.7 million in last year’s 3Q to US$ 68.4 million in 3Q17, due to a combination of lower revenues in the period and results from the Company’s ongoing efficiency efforts. It is important to highlight that the Air Show this year fell in 2Q17 while the Air Show in 2016 fell in 3Q16, positively affecting this year’s selling expenses. Research expenses totaled US$ 14.2 million in 3Q17, as compared to US$ 11.9 million in 3Q16. In addition to the aforementioned impacts, there was a less favorable exchange rate in the current year’s quarter, as the average Brazilian

Real

to U.S. Dollar exchange rate in 3Q17 appreciated roughly 3% relative to the average exchange rate in 3Q16.

Other operating income (expense), net, excluding the impact of the aforementioned non-recurring items described in the paragraph above (US$ 3.6 million in 3Q17 and US$ 123.6 million in 3Q16) was an expense of US$ 49.1 million in 3Q17 as compared to an expense of US$ 58.0 million in 3Q16. The year-over-year decline was due to a combination of lower impairments on the Company’s used aircraft portfolio and lower

2

taxes on remittances, partially offset by lower cancellation revenues and higher expenses for IT and corporate projects in 3Q17 as compared to 3Q16.

net income

Net income (loss) attributable to Embraer shareholders and earnings (losses) per ADS for 3Q17 were US$ 110.0 million and US$ 0.60 per basic ADS, respectively. This compares to net income (loss) attributable to Embraer shareholders and earnings (losses) per ADS in 3Q16 of US$ (33.7) million and US$ (0.18) per basic ADS, respectively. In the first nine months of 2017, net income (loss) attributable to Embraer shareholders was US$ 211.6 million, compared to a net loss of US$ (29.2) million in the first nine months of 2016. Earnings (loss) per basic ADS in the first nine months of 2017 was US$ 1.15 versus the US$ (0.16) per ADS reported in the same period of 2016.

Adjusted net income (loss), excluding deferred income tax and social contribution as well as the after-tax impacts of the aforementioned non-recurring items, was US$ 75.2 million in 3Q17 as compared to US$ 38.9 million in 3Q16. Adjusted earnings per ADS excluding deferred income tax and social contribution and non-recurring items was US$ 0.41 per basic ADS in 3Q17, compared to an adjusted earnings per ADS of US$ 0.21 in 3Q16. Year-to-date, adjusted net income attributable to Embraer shareholders was US$ 221.4 million in 2017, compared to adjusted net income of US$ 121.5 million in the first nine months of 2016. Adjusted earnings per share on a year-to-date basis was US$ 1.20 per basic ADS versus US$ 0.67 in the same period of 2016.

monetary balance sheet accounts and other measures

The Company ended 3Q17 with a net debt position of US$ 722.8 million, compared to the net debt position of US$ 661.5 million at the end of 2Q17, mostly due to the Free cash flow usage in the quarter. Embraer’s total loans position at the end of the quarter was US$ 4,306.9 million, while the total cash position stood at US$ 3,584.1 million at the end of 3Q17.

|

|

|

|

|

|

in millions of U.S.dollars

|

|

FINANCIAL POSITION DATA

|

(1)

|

(1)

|

(1)

|

|

2Q17

|

3Q16

|

3Q17

|

|

Cash and cash equivalents

|

1,207.4

|

1,455.5

|

772.5

|

|

Financial investments

|

2,343.1

|

1,714.9

|

2,811.6

|

|

Total cash position

|

3,550.5

|

3,170.4

|

3,584.1

|

|

Loans short-term

|

304.2

|

498.5

|

289.0

|

|

Loans long-term

|

3,907.8

|

3,324.6

|

4,017.9

|

|

Total loans position

|

4,212.0

|

3,823.1

|

4,306.9

|

|

|

|

Net debt*

|

(661.5)

|

(652.7)

|

(722.8)

|

|

* Net debt = Cash and cash equivalents + Financial investments short-term and long term - Loans

short-term and long-term

|

|

(1) Derived from unaudited financial information.

|

Adjusted net cash generated by operating activities net of adjustments for financial investments (and excluding cash payments for non-recurring items) was US$ 135.7 million in 3Q17 and adjusted Free cash flow for the quarter was US$ (22.7) million. This compares to adjusted net cash generated by operating activities net of financial investments of US$ 235.3 million and adjusted Free cash flow of US$ (20.5) million in 3Q16. During the first nine months of 2017, adjusted Free cash flow was US$ (2.0) million, compared to adjusted Free cash flow of US$ (692.7) million in the first nine months of 2016.

3

|

|

|

|

|

|

|

|

|

in millions of U.S.dollars

|

|

IFRS

|

3Q16

|

4Q16

|

1Q17

|

2Q17

|

3Q17

|

YTD17

|

|

Net cash generated (used) by operating activities (1)

|

235.3

|

249.3

|

(64.9)

|

361.6

|

115.3

|

412.0

|

|

Adjustment for non-recurring cash impacts

|

-

|

248.2

|

17.2

|

36.1

|

20.4

|

73.7

|

|

Adj. Net cash generated (used) by operating activities

|

235.3

|

497.5

|

(47.7)

|

397.7

|

135.7

|

485.7

|

|

|

|

Net additions to property, plant and equipment

|

(125.9)

|

(75.3)

|

(34.5)

|

(60.5)

|

(47.3)

|

(142.3)

|

|

Additions to intangible assets

|

(129.9)

|

(137.2)

|

(117.1)

|

(117.2)

|

(111.1)

|

(345.4)

|

|

Adjusted Free Cash Flow

|

(20.5)

|

285.0

|

(199.3)

|

220.0

|

(22.7)

|

(2.0)

|

|

(1) Net of financial investments: 3Q16 (66.4), 4Q16 50.2, 1Q17 503.6, 2Q17 (96.2), 3Q17 (30.8)

|

Net additions to total PP&E were US$ 47.3 million in 3Q17. Of the total 3Q17 additions to PP&E, CAPEX amounted to US$ 30.1 million, additions of aircraft available for lease was US$ 4.8 million, and additions of pool program spare parts was US$ 12.1 million. A portion of the reported CAPEX includes investments related to certain contracted capital expenditures in the Defense & Security segment, which reached US$ 0.8 million in 3Q17. Excluding these expenditures, CAPEX for 3Q17 was US$ 29.3 million, and for the first nine months of 2017 was US$ 107.3 million. The Company’s CAPEX outlook for the year remains US$ 200 million.

During 3Q17, Embraer invested a total of US$ 111.1 million in product development, related to the development of the E-Jets E2 commercial jet program, which continues to progress according to schedule. During the quarter, the Company did not receive any contributions from risk-sharing partners; therefore net development was also US$ 111.1 million in the period. Over the first nine months of 2017, Embraer invested US$ 345.4 million in product development and received US$ 86.0 million in contributions from suppliers, yielding net development expenditures of US$ 259.4 million. The Company continues to project net development expenditures to finish near the US$ 400 million Outlook for 2017.

|

|

|

|

|

|

|

|

|

in millions of U.S.dollars

|

|

|

3Q16

|

4Q16

|

1Q17

|

2Q17

|

3Q17

|

YTD17

|

|

CAPEX

|

73.6

|

60.7

|

35.4

|

45.5

|

30.1

|

111.0

|

|

Contracted CAPEX (Included in CAPEX)

|

12.5

|

9.8

|

2.4

|

0.5

|

0.8

|

3.7

|

|

Additions of aircraft available for or under lease

|

27.8

|

9.5

|

4.8

|

4.8

|

4.8

|

14.4

|

|

Additions of Pool programs spare parts

|

24.5

|

7.9

|

12.3

|

11.4

|

12.1

|

35.8

|

|

PP&E

|

125.9

|

78.1

|

52.5

|

61.7

|

47.0

|

161.2

|

|

Proceeds from sale of PP&E

|

-

|

(2.8)

|

(18.0)

|

(1.2)

|

0.3

|

(18.9)

|

|

Net Additions to PP&E

|

125.9

|

75.3

|

34.5

|

60.5

|

47.3

|

142.3

|

|

|

|

in millions of U.S.dollars

|

|

|

3Q16

|

4Q16

|

1Q17

|

2Q17

|

3Q17

|

YTD17

|

|

Additions to intangible

|

129.9

|

137.2

|

117.1

|

117.2

|

111.1

|

345.4

|

|

Contributions from suppliers

|

(25.0)

|

-

|

(86.0)

|

-

|

-

|

(86.0)

|

|

Development (Net of contributions from suppliers)

|

104.9

|

137.2

|

31.1

|

117.2

|

111.1

|

259.4

|

|

Research

|

11.9

|

18.8

|

8.2

|

9.3

|

14.2

|

31.7

|

|

R&D

|

116.8

|

156.0

|

39.3

|

126.5

|

125.3

|

291.1

|

The Company’s total debt increased US$ 94.9 million to US$ 4,306.9 million in 3Q17 compared to US$ 4,212.0 million at the end of 2Q17. Short-term debt at the end of 3Q17 was US$ 289.0 million and long-term debt was US$ 4,017.9 million. The average loan maturity of the Company’s debt at the end of 3Q17 declined to 6.1 years from the 6.2 years reported in 2Q17. The cost of Dollar denominated loans at the end of 3Q17 was 5.19% p.a. compared to 5.13% p.a. at the end of 2Q17. The cost of Real denominated loans decreased from 4.45% at the end of 2Q17 to 3.83% p.a. at the end of 3Q17.

The Company’s EBITDA over the last 12 months (EBITDA LTM) to financial expenses (gross) for 3Q17 increased to 3.78 relative to last quarter’s value of 3.46. At the end of 3Q17, 17% of total debt was denominated in Reais, vs. 18% at the end of 2Q17.

4

|

|

|

|

|

|

Embraer’s cash allocation management strategy continues to be one of its most important tools to mitigate exchange rate risks. By balancing cash allocation in

Real

and Dollar

denominated assets, the Company attempts to neutralize its balance sheet exchange rate exposure. Of total cash at the end of 3Q17, 72% was denominated in US Dollars.

Complementing its strategy to mitigate exchange rate risks, the Company entered into certain financial hedges in order to reduce its 2017 cash flow exposure. The Company’s cash flow exposure is due to the fact that approximately 10% of its net revenues are

|

|

denominated in

Reais

while approximately 20% of total costs are denominated in

Reais

. Having more

Real

denominated costs than revenues generates this cash flow exposure.For 2017, around 45% of the Company’s

Real

cash flow exposure is hedged if the US Dollar depreciates below an average rate floor of R$ 3.40. For exchange rates above this level, the Company will benefit up to an average exchange rate cap of R$ 3.76. Embraer has also put in place the majority of its zero cost collar hedging program for 2018, with an average floor of R$ 3.32 and an average cap of R$ 3.75.

|

|

|

operational balance sheet accounts

|

|

|

|

|

|

in millions of U.S.dollars

|

|

SELECT BALANCE SHEET DATA

|

(1)

|

(1)

|

(1)

|

|

2Q17

|

3Q16

|

3Q17

|

|

Trade accounts receivable

|

752.9

|

720.2

|

708.3

|

|

Customer and commercial financing

|

33.2

|

27.6

|

17.0

|

|

Inventories

|

2,460.9

|

2,838.8

|

2,443.3

|

|

Property, plant and equipment

|

2,158.9

|

2,145.7

|

2,125.3

|

|

Intangible

|

1,770.5

|

1,574.4

|

1,857.9

|

|

Trade accounts payable

|

923.9

|

1,125.9

|

786.3

|

|

Advances from customers

|

848.6

|

937.1

|

873.0

|

|

Total shareholders' equity

|

4,054.1

|

3,783.7

|

4,172.8

|

|

(1) Derived from unaudited financial information.

|

The Company reported solid working capital management during the third quarter, which is usually negative in preparation for the traditional ramp in fourth quarter deliveries. Trade accounts receivable declined US$ 44.6 million to end 3Q17 at US$ 708.3 million, which is the second lowest level since the end of 2014. Inventories also declined US$ 17.6 million to US$ 2,443.3 million at the end of 3Q17, despite a traditional seasonal build in inventories in anticipation of increased deliveries in the Company’s fourth quarter. Other drivers of the more efficient working capital level in 3Q17 included an increase in advances from customers of US$ 24.4 million to US$ 873.0 million, following positive order activity, and a reduction of US$ 16.2 million in customer and commercial financing to end the quarter at US$ 17.0 million. These positive impacts were offset by a US$ 137.6 million decrease in accounts payable during the quarter to US$ 786.3 million at the end of 3Q17.

5

Intangibles increased US$ 87.4 million, from US$ 1,770.5 million at the end of 2Q17 to US$ 1,857.9 million at the end of 3Q17 as a consequence of continued investments in product development. Property, plant and equipment ended 3Q17 at US$ 2,125.3 million, compared to the US$ 2,158.9 million at the end of 2Q17.

Total Backlog

Considering all deliveries as well as firm orders obtained during the period, the Company’s firm order backlog increased US$ 0.3 billion during 3Q17 to end the quarter at US$ 18.8 billion.

segment Results

The Commercial Aviation segment represented 64.6% of consolidated revenues in 3Q17, as compared to the 61.3% reported in 3Q16, despite a year-over-year revenue decline of 8.7%. The portion of Executive Jets revenues decreased from 24.2% in 3Q16 to 20.3% in 3Q17, as the segment’s revenues were down 27.3% compared to the prior year’s quarter. The share of Defense & Security segment revenues increased slightly from 14.2% in 3Q16 to 14.5% in 3Q17 despite 12% lower revenues in the quarter. Other segment revenues as a percentage of total 3Q17 revenues were 0.6% versus 0.3% in the prior year period.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in millions of U.S.dollars

|

|

NET REVENUES

|

(1)

|

|

(1)

|

|

(1)

|

|

(1)

|

|

|

BY SEGMENT

|

2Q17

|

%

|

3Q16

|

%

|

3Q17

|

%

|

YTD17

|

%

|

|

Commercial Aviation

|

1,088.5

|

61.5

|

926.9

|

61.3

|

846.1

|

64.6

|

2,571.0

|

62.6

|

|

Executive Jets

|

339.5

|

19.2

|

366.6

|

24.2

|

266.7

|

20.3

|

832.2

|

20.3

|

|

Defense & Security

|

334.6

|

18.9

|

215.5

|

14.2

|

189.7

|

14.5

|

679.9

|

16.6

|

|

Others

|

6.9

|

0.4

|

5.3

|

0.3

|

8.0

|

0.6

|

23.2

|

0.5

|

|

Total

|

1,769.6

|

100.0

|

1,514.3

|

100.0

|

1,310.4

|

100.0

|

4,106.3

|

100.0

|

|

(1) Derived from unaudited financial information.

|

Commercial Aviation

In 3Q17 Embraer delivered 25 commercial aircraft, and over the first nine months of the year delivered 78 commercial aircraft, as shown below:

|

|

|

|

|

|

|

DELIVERIES

|

2Q17

|

3Q16

|

3Q17

|

YTD17

|

|

Commercial Aviation

|

35

|

29

|

25

|

78

|

|

EMBRAER 175

|

31

|

24

|

18

|

65

|

|

EMBRAER 190

|

2

|

4

|

5

|

7

|

|

EMBRAER 195

|

2

|

1

|

2

|

6

|

6

In July, the current family of E-Jets commercial aircraft accomplished the impressive milestone of 1 billion passengers transported worldwide since entry into service.

In September, Embraer added a total of 45 orders to its firm order backlog for the current generation of E-Jets with two separately announced deals with SkyWest. The orders comprised 15 E175 jets in the 76-seat configuration and 30 E175 SC (Special Configuration) jets, which feature an E175 airframe in a 70-seat configuration. The deals’ combined value is slightly above US$ 2 billion at current list prices.

The E-Jets E2 program continues on time, on specification, and on budget, and in just six months from now (April of 2018), the first E-Jet E2, the E190-E2, will be handed over to launch customer Widerøe of Norway. The airline will start flying its new 114-seat, single class layout in revenue service in the same month.

Important test campaign milestones were accomplished during 3Q17 on the path towards E2 certification. The E190-E2 prototype concluded its cabin evacuation test successfully in August, and also finalized a new phase of icing condition tests in September.

Embraer also announced that it has selected new IFEC systems suppliers for the E-Jets E2. Meggitt Polymers & Composites will design and produce a high performance radome assembly for in-flight connectivity (IFC), while KID-Systeme was selected by Embraer to provide the SKYfi Club – a wireless streaming onboard platform.

In the segment of commercial aircraft with up to 150 seats, Embraer maintains its leadership of deliveries in the world market.

|

|

|

|

|

|

|

COMMERCIAL AVIATION

BACKLOG

|

Firm Orders

|

Options

|

Total

|

Deliveries

|

Firm Backlog

|

|

E170

|

191

|

5

|

196

|

190

|

1

|

|

E175

|

578

|

188

|

766

|

486

|

92

|

|

E190

|

592

|

55

|

647

|

541

|

51

|

|

E195

|

168

|

1

|

169

|

160

|

8

|

|

E175-E2

|

100

|

100

|

200

|

-

|

100

|

|

E190-E2

|

80

|

107

|

187

|

-

|

80

|

|

E195-E2

|

105

|

90

|

195

|

-

|

105

|

|

TOTAL E-JETS

|

1.814

|

546

|

2.360

|

1.377

|

437

|

Executive JETS

The Executive Jets segment delivered 13 light and 7 large jets, totaling 20 aircraft in 3Q17, five units less than the same period of 2016. Year-to-date deliveries totaled 59 executive jets as of the end of 3Q17.

|

|

|

|

|

|

|

DELIVERIES

|

2Q17

|

3Q16

|

3Q17

|

YTD17

|

|

Executive Aviation

|

24

|

25

|

20

|

59

|

|

Light Jets

|

16

|

13

|

13

|

40

|

|

Large Jets

|

8

|

12

|

7

|

19

|

During the third quarter of 2017, Embraer appointed Stephen Friedrich as Chief Commercial Officer for the Company´s Executive Jets business unit, reporting to Michael Amalfitano, President & CEO of the business unit. Mr. Friedrich is responsible for the direct management of the global sales organization for new and pre-flown aircraft as well as the oversight of relationships with customers and industry collaborators. He brings a wealth of experience in sales, marketing, finance, customer support and services programs with over 30 years of experience in the leasing and aerospace sectors.

Also in the quarter, Embraer delivered the first Legacy 500 business jet assembled at its Melbourne, Florida plant. Since the delivery of the first Phenom 100 made in Melbourne, in December 2011, over 250

aircraft have been delivered from this site, across the U.S. and to over a dozen countries, as close as Mexico and Canada, and as far away as China and Australia.

7

Embraer Executive Jets once again ranked first in customer support, according to Aviation International News’ 2017 Product Support Survey. The company retained its leadership position, receiving a score of 8.4 out of a possible 10, for new and pre-flown business jets. This is the second consecutive year where Embraer received the number one ranking, and being ranked first in product support year-after-year reflects Embraer’s continued commitment to providing customers with the best service and experience.

Air Hamburg, one of the largest operators of Embraer business jets in Europe, took delivery of the first Legacy 650E. The Legacy 650E, which has a 3,900nm (7,220km) range, includes a host of features, such as synthetic vision system and autothrottle as standard, a re-styled, three-cabin zone interior with full HD in-flight entertainment, and an industry leading 10-year or 10,000 flight-hour warranty.

Defense & security

In 3Q17, the development and certification of the KC-390 program has been advancing as planned with the two prototypes (aircraft 001 and 002) exceeding 1,350-flight-hours, with high-altitude paratrooper and night-vision tests occurring successfully. The KC-390 performed a demonstration tour to Air Forces in Europe, Asia-Pacific, Africa and the Middle East. There are sales campaigns taking place in several countries around the world, and in Portugal there is a potential for 5 aircraft (plus a 6th optional aircraft), and a logistics package, in an advanced stage of negotiation. The serial production progresses with the assembly of the aircraft 003, 004 and 005, as well as the beginning of the parts manufacturing processes for the aircraft 006, 007 and 008.

With regards to the A-29 Super Tucano, Embraer Defense & Security, together with the US partner Sierra Nevada Corporation, participated in the United States Air Force (USAF) Capability Assessment of Non-Developmental Light Attack Platforms. As a result of this evaluation, the A-29 Super Tucano fulfilled all mission requirements, being classified as Tier-1 for the OA-X experiment. The evaluation for the OA-X experiment took place at Holloman Air Force Base, New Mexico. This initiative is part of USAF's effort to explore the benefits of acquiring a new low-cost light attack aircraft that does not require future development, providing close air support and other missions in permissive and semi-permissive environments, as well as reducing training costs for fighter pilots, and accelerating pilot proficiency.

In the F-39 program, over 100 engineers from Embraer remain dedicated, both in Brazil and in Sweden, to the maintenance and development training of Gripen NG together with SAAB’s engineers.

During this quarter, two additional Phenom 100s were delivered to Affinity Flying Training Services to the United Kingdom’s Ministry of Defence to support the pilot training of the Armed Forces.

Related to the Air Traffic Flow Management Systems Modernization Program, Atech signed with the Brazilian Air Force (DECEA) a SIGMA - PHASE 3 modernization contract for the development and implementation of system evolutions, which also includes the integration of the FPLBR application, which will enable the submission of flight plan messages on iOS and Android mobile platforms. In the area of Air Traffic Control, Atech also signed with the Aeronautical Material Park of Rio de Janeiro (PAME-RJ) the calibration agreement of the AMAN (Arrival Management) and MST (Multi Sensor Tracking) subsystems, both parts of SAGITARIO.

At Savis and Bradar, the Sisfron project is evolving in line with the redesign undertaken by the Brazilian Army (EB), with roughly 2/3 of the project already delivered by the end of 3Q17, and conclusion expected by 2H19.

During 3Q17, the system (payload, platform and ground systems) of the Geostationary Defense and Strategic Communications Satellite (SGDC) was successfully tested and approved. The satellite control was transferred to Telebras and its assisted operation was initiated. In addition, a contract was signed for Specialized Technical support to the satellite flight planning. Visiona Tecnologia Espacial is responsible for the integration of the SGDC Program which will provide coverage of Internet services throughout the country, as well as secure and sovereign means for the strategic communications of the Brazilian government.

8

class action UPDATE

In August, 2016, a putative securities class action was filed in a U.S. court against the Company and certain of its former and current executives, asserting claims in connection with allegedly false and misleading statements and omissions concerning the FCPA investigation and related matters. In October, 2016, a federal Court in New York appointed a lead plaintiff and a leading counsel for the putative class action. In December 2016, lead plaintiff filed an amended complaint. In June 2017, the Company filed a motion to dismiss all claims asserted in the amended complaint. At this time, the motion is pending before the court, and the Company believes that there is no adequate basis for estimating provisions related to this matter.

2018 outlook

Embraer expects 2018 to be a transition year, as the Company ramps up the production of the first E2 model, the E190-E2, which is on track for entry into service (EIS) in April 2018. Embraer continues its investments in the E-Jets E2 family of commercial jets with the E195-E2 and E175-E2 models on schedule for their respective EIS in the first half of 2019 and in 2021. The Company also will be ramping up production of its new medium-lift cargo and transport jet, the KC-390, in the Defense & Security segment, with first delivery of this jet expected in the second half of 2018. In addition, regarding the executive jets market, Embraer remains cautiously optimistic that industry-wide new jet deliveries in 2018 could be flat to slightly up relative to 2017. Embraer continues its strategic shift from price to value creation for its executive jet customers, increasing brand desirability and customer loyalty with industry-leading customer satisfaction and post-sales support. Within this scenario, Embraer will continue to focus on cost control and efficiency improvements that will translate to higher competitiveness across all business units. The combination of our modern portfolio of products and financial discipline are important pillars to face the current market environment.

It is important to mention that the Aerospace Industry is a capital intensive business with longer product cycles of 15 to 20 years. In general, the cycles include a development phase of five years or more followed by a transition period with production ramp up of one to two years before reaching higher maturity levels where cost efficiencies and scale gains are fully captured. In this context, we see Embraer in the middle of a transition phase with negative impacts on short-term results as presented in our 2018 Outlook below. In our view, Embraer’s current portfolio should reach steady-state levels in three to four years with meaningful gains to our profitability and cash generation as (1) commercial jets deliveries return to historical levels, (2) the entry into service and ramp up of the E2 family is completed; (3) the overall market conditions in the executive jets industry are improved, (4) services & support of new products continue to gain relevance; and (5) capex and development spending are reduced with the conclusion of the E-Jets E2 investments.

For 2018, Embraer expects commercial jet deliveries to decline to a range of 85 to 95 jets as the Company goes through the first year of transition from the E1 to the E2 family of commercial jets. Given recent order activity, in which Embraer captured the majority share from US carriers in the regional market, deliveries of the E175 jet model are likely to continue to represent the majority of 2018 deliveries. The Company expects a gradual production ramp of the E190-E2 in order to ensure the product reaches the highest possible quality and performance standards for our customers, and deliveries of this new jet should amount to roughly 10% of 2018 deliveries.

Guidance for deliveries in the Executive Jets segment is the same for 2018 as compared to the 2017 deliveries outlook, given our expectation for a flattish overall market and the Company’s renewed focus on the unique value proposition of our broad portfolio of business jets. Embraer expects total deliveries of executive jets to be within the range of 105 to 125 units.

Consolidated revenues are expected to be in the range of US$ 5.3 billion to US$ 6.0 billion in 2018, largely reflecting lower deliveries in the Commercial Aviation segment. Consolidated EBIT is expected to be in the range of US$ 265 million to US$ 360 million, representing EBIT margin of between 5.0% and 6.0% for the year. Free cash flow is expected to be a use of US$ (150) million or better in 2018, reflecting the lower number of jet deliveries and continued investments for development of the E-Jets E2 family of commercial jets.

9

|

|

|

|

|

|

2018 CONSOLIDATED GUIDANCE

|

|

(US$ MILLION)

|

|

Commercial Aviation unit deliveries

|

85

|

-

|

95

|

|

Executive Jets unit deliveries

|

105

|

-

|

125

|

|

Consolidated Revenues

|

$5,30

|

-

|

$6,00

|

|

EBIT

|

$265

|

-

|

$360

|

|

EBIT Margin

|

5,0%

|

-

|

6,0%

|

|

Free Cash Flow

|

> ($150)

|

|

This Outlook is based on assumptions which are subject to various factors, many of which are not and neither will be under the control of the Company.

Reconciliation OF IFRS and “non gaap” information

|

|

|

|

|

|

in millions of U.S.dollars

|

|

EBITDA RECONCILIATION

|

(1)

|

(1)

|

(1)

|

|

LTM* (IFRS)

|

2Q17

|

3Q16

|

3Q17

|

|

Net Income Attributable to Embraer

|

263.1

|

83.2

|

406.8

|

|

Noncontrolling interest

|

14.0

|

4.0

|

14.1

|

|

Income tax income

|

106.5

|

(112.9)

|

83.5

|

|

Financial income, net

|

72.1

|

23.6

|

49.4

|

|

Foreign exchange gain (loss), net

|

(10.7)

|

(2.0)

|

(14.7)

|

|

Depreciation and amortization

|

338.3

|

313.6

|

329.7

|

|

EBITDA LTM

|

783.3

|

309.5

|

868.8

|

|

(1) Derived from unaudited financial information.

|

|

* Last Twelve Months

|

We define Free cash flow as operating cash flow less Additions to property, plant and equipment, Additions to intangible assets, Financial investments and Other assets. Free cash flow is not an accounting measure under IFRS. Free cash flow is presented because it is used internally as a measure for evaluating certain aspects of our business. The Company also believes that some investors find it to be a useful tool for measuring Embraer's cash position. Free cash flow should not be considered as a measure of the Company's liquidity or as a measure of its cash flow as reported under IFRS. In addition, Free cash flow should not be interpreted as a measure of residual cash flow available to the Company for discretionary expenditures, since the Company may have mandatory debt service requirements or other nondiscretionary expenditures that are not deducted from this measure. Other companies in the industry may calculate Free cash flow differently from Embraer for purposes of their earnings releases, thus limiting its usefulness for comparing Embraer to other companies in the industry.

EBITDA LTM represents earnings before interest, taxation, depreciation and amortization accumulated over a period of the last 12 months. It is not a financial measure of the Company’s financial performance under IFRS. EBIT as mentioned in this press release refers to earnings before interest and taxes, and for purposes of reporting is the same as that reported on the Income Statement as Operating Profit before Financial Income.

10

|

|

|

|

|

|

|

in millions of U.S.dollars

|

|

EBITDA RECONCILIATION

|

(1)

|

(1)

|

(1)

|

(1)

|

|

2Q17

|

3Q16

|

3Q17

|

YTD17

|

|

Net Income (loss) Attributable to Embraer

|

59.1

|

(33.7)

|

110.0

|

211.6

|

|

Noncontrolling interest

|

10.4

|

1.2

|

1.3

|

13.6

|

|

Income tax (expense) income

|

85.9

|

(16.5)

|

(39.5)

|

27.6

|

|

Financial income (expense), net

|

11.5

|

21.0

|

(1.7)

|

14.5

|

|

Foreign exchange gain (loss), net

|

7.1

|

(0.9)

|

(4.9)

|

(4.7)

|

|

Depreciation and amortization

|

80.8

|

83.2

|

74.6

|

227.8

|

|

EBITDA

|

254.8

|

54.3

|

139.8

|

490.4

|

|

EBITDA Margin

|

14.4%

|

3.6%

|

10.7%

|

11.9%

|

|

(1) Derived from unaudited financial information.

|

EBIT and EBITDA are presented because they are used internally as measures to evaluate certain aspects of the business. The Company also believes that some investors find them to be useful tools for measuring a Company’s financial performance. EBIT and EBITDA should not be considered as alternatives to, in isolation from, or as substitutes for, analysis of the Company’s financial condition or results of operations, as reported under IFRS. Other companies in the industry may calculate EBIT and EBITDA differently from Embraer for the purposes of their earnings releases, limiting EBIT and EBITDA’s usefulness as comparative measures.

|

|

|

|

|

|

|

in millions of U.S.dollars

|

|

ADJUSTED EBIT RECONCILIATION

|

(1)

|

(1)

|

(1)

|

(1)

|

|

2Q17

|

3Q16

|

3Q17

|

YTD17

|

|

Operating profit (loss) before financial income (EBIT)

|

174.0

|

(28.9)

|

65.2

|

262.6

|

|

Provision for voluntary redundancy scheme

|

(1.2)

|

118.1

|

-

|

6.4

|

|

Impact of Penalty Provision

|

3.5

|

5.5

|

3.6

|

7.1

|

|

Republic shares remeasurement (converted from claims)

|

(11.7)

|

-

|

-

|

(11.7)

|

|

Adjusted EBIT

|

164.6

|

94.7

|

68.8

|

264.4

|

|

Adjusted EBIT Margin %

|

9.3%

|

6.3%

|

5.3%

|

6.4%

|

|

(1) Derived from unaudited financial information.

|

|

|

|

in millions of U.S.dollars

|

|

ADJUSTED EBITDA RECONCILIATION

|

(1)

|

(1)

|

(1)

|

(1)

|

|

2Q17

|

3Q16

|

3Q17

|

YTD17

|

|

EBITDA

|

254.8

|

54.3

|

139.8

|

490.4

|

|

Provision for voluntary redundancy scheme

|

(1.2)

|

118.1

|

-

|

6.4

|

|

Impact of Penalty Provision

|

3.5

|

5.5

|

3.6

|

7.1

|

|

Republic shares remeasurement (converted from claims)

|

(11.7)

|

-

|

-

|

(11.7)

|

|

Adjusted EBITDA

|

245.4

|

177.9

|

143.4

|

492.2

|

|

Adjusted EBITDA Margin %

|

13.9%

|

11.7%

|

10.9%

|

12.0%

|

|

(1) Derived from unaudited financial information.

|

Adjusted EBIT and Adjusted EBITDA are non-GAAP measures, and both exclude the impact of several non-recurring items, as described in the tables above.

|

|

|

|

|

|

|

|

|

|

in millions of U.S.dollars

|

|

ADJUSTED NET INCOME (LOSS) RECONCILIATION

|

(1)

|

(1)

|

(1)

|

(1)

|

|

2Q17

|

3Q16

|

3Q17

|

YTD17

|

|

Net Income (loss) Attributable to Embraer

|

59.1

|

(33.7)

|

110.0

|

211.6

|

|

Net change in Deferred income tax & social contribution

|

68.9

|

(10.8)

|

(38.4)

|

6.2

|

|

After-tax provision for voluntary redundancy scheme

|

(0.8)

|

77.9

|

-

|

4.2

|

|

Impact of Penalty Provision

|

3.5

|

5.5

|

3.6

|

7.1

|

|

After-tax Republic shares remeasurement (converted from claims)

|

(7.7)

|

-

|

-

|

(7.7)

|

|

Adjusted Net Income

|

123.0

|

38.9

|

75.2

|

221.4

|

|

Adjusted Net Margin

|

6.9%

|

5.2%

|

5.7%

|

5.4%

|

|

(1) Derived from unaudited financial information.

|

11

Adjusted Net Income is a non-GAAP measure, calculated by adding Net Income attributable to Embraer Shareholders plus Deferred Income tax and social contribution for the period, as well as removing the impact of non-recurring items. Furthermore, under IFRS for purposes of calculating Embraer’s Income Tax benefits (expenses), the Company is required to record taxes resulting from gains or losses due to the impact of the changes in the Real to the US Dollar exchange rate over non-monetary assets (primarily Inventories, Intangibles, and PP&E). It is important to note that taxes resulting from gains or losses over non-monetary assets are considered deferred taxes and are accounted for in the Company’s consolidated Cash Flow statement, under Deferred income tax and social contribution.

Some Financial Ratios based on “non GAAP” information

|

|

|

|

|

|

CERTAIN FINANCIAL RATIOS - IFRS

|

(1)

|

(1)

|

(1)

|

|

2Q17

|

3Q16

|

3Q17

|

|

Total debt to EBITDA (i)

|

5.38

|

11.01

|

4.96

|

|

Net debt to EBITDA (ii)

|

0.84

|

(1.88)

|

0.83

|

|

Total debt to capitalization (iii)

|

0.51

|

0.50

|

0.51

|

|

LTM EBITDA to financial expense (gross) (iv)

|

3.46

|

1.46

|

3.78

|

|

LTM EBITDA (v)

|

783.3

|

309.5

|

868.8

|

|

LTM Interest and commissions on loans (vi)

|

226.2

|

211.8

|

229.9

|

|

(1) Derived from unaudited financial information.

|

(i) Total debt represents short and long-term loans and financing.

(ii) Net cash represents cash and cash equivalents, plus financial investments, minus short and long-term loans and financing.

(iii) Total capitalization represents short and long-term loans and financing, plus shareholders equity.

(iv) Financial expense (gross) includes only interest and commissions on loans.

(v) The table at the end of this release sets forth the reconciliation of Net income to adjusted EBITDA, calculated on the basis of financial information prepared with IFRS data, for the indicated periods.

(vi) Interest expense (gross) includes only interest and commissions on loans, which are included in Interest income (expense), net presented in the Company’s consolidated Income Statement.

12

FINANCial statements

|

|

|

|

|

|

|

EMBRAER S.A.

|

|

CONSOLIDATED STATEMENTS OF INCOME

|

|

(in millions of U.S.dollars, except earnings per share)

|

|

|

|

|

(1)

|

(1)

|

|

|

Three months ended on

|

Nine months ended on

|

|

|

30 Sep, 2016

|

30 Sep, 2017

|

30 Sep, 2016

|

30 Sep, 2017

|

|

|

|

Revenue

|

1,514.3

|

1,310.4

|

4,189.7

|

4,106.3

|

|

Cost of sales and services

|

(1,229.7)

|

(1,062.0)

|

(3,360.1)

|

(3,386.3)

|

|

|

|

Gross profit

|

284.5

|

248.4

|

829.6

|

720.0

|

|

Operating Income (Expense)

|

|

|

|

|

|

Administrative

|

(33.1)

|

(47.8)

|

(120.3)

|

(130.1)

|

|

Selling

|

(86.7)

|

(68.4)

|

(287.2)

|

(224.2)

|

|

Research

|

(11.9)

|

(14.2)

|

(28.8)

|

(31.7)

|

|

Other operating income (expense), net

|

(181.6)

|

(52.7)

|

(463.7)

|

(71.2)

|

|

Equity in gain or losses of associates

|

(0.1)

|

(0.1)

|

(0.2)

|

(0.2)

|

|

|

|

Operating profit (loss) before financial income

|

(28.9)

|

65.2

|

(70.6)

|

262.6

|

|

Financial expenses, net

|

(21.0)

|

1.7

|

(16.5)

|

(14.5)

|

|

Foreign exchange gain (loss), net

|

0.9

|

4.9

|

(5.5)

|

4.7

|

|

|

|

Profit (loss) before taxes on income

|

(49.0)

|

71.8

|

(92.6)

|

252.8

|

|

Income tax (expense) income

|

16.5

|

39.5

|

64.6

|

(27.6)

|

|

|

|

Net Income (loss)

|

(32.5)

|

111.3

|

(28.0)

|

225.2

|

|

Attributable to:

|

|

|

|

|

|

Owners of Embraer

|

(33.7)

|

110.0

|

(29.2)

|

211.6

|

|

Noncontrolling interest

|

1.2

|

1.3

|

1.2

|

13.6

|

|

|

|

Weighted average number of shares (in thousands)

|

|

|

|

|

|

Basic

|

729.5

|

735.5

|

729.5

|

735.5

|

|

Diluted

|

730.1

|

736.1

|

731.5

|

736.1

|

|

|

|

Earnings per share

|

|

|

|

|

|

Basic

|

(0.0462)

|

0.1495

|

(0.0400)

|

0.2877

|

|

Diluted

|

(0.0461)

|

0.1494

|

(0.0399)

|

0.2875

|

|

|

|

Earnings per share - ADS basic (US$)

|

(0.1848)

|

0.5982

|

(0.1601)

|

1.1507

|

|

Earnings per share - ADS diluted (US$)

|

(0.1843)

|

0.5977

|

(0.1597)

|

1.1498

|

|

(1) Derived from unaudited financial statements.

|

|

|

13

|

|

|

|

|

|

|

|

|

|

|

EMBRAER S.A.

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

(in millions of U.S.dollars)

|

|

|

|

|

(1)

|

(1)

|

|

|

Three Months Ended

|

Nine Months Ended

|

|

|

30 Sep, 2016

|

30 Sep, 2017

|

30 Sep, 2016

|

30 Sep, 2017

|

|

Operating activities

|

|

|

|

|

|

Net income (loss)

|

(32.5)

|

111.3

|

(28.0)

|

225.2

|

|

Items not affecting cash and cash equivalents

|

|

|

|

|

|

Depreciation

|

50.3

|

47.7

|

137.3

|

150.9

|

|

Government grants amortization

|

-

|

(0.7)

|

-

|

(2.2)

|

|

Amortization

|

42.3

|

31.6

|

116.9

|

94.1

|

|

Amortization contribution from suppliers

|

(9.4)

|

(4.7)

|

(26.0)

|

(17.2)

|

|

Allowance (reversal) for inventory obsolescence

|

(12.5)

|

5.4

|

(8.0)

|

10.8

|

|

Provision for adjustment to market value

|

(43.3)

|

10.6

|

19.1

|

25.5

|

|

Provision (reversal) allowance for doubtful accounts

|

(1.0)

|

2.2

|

12.6

|

7.9

|

|

Gains on fixed assets disposal

|

3.3

|

5.9

|

7.9

|

13.1

|

|

Deferred income tax and social contribution

|

(10.8)

|

(38.4)

|

(172.9)

|

6.2

|

|

Accrued interest

|

2.4

|

(1.7)

|

4.1

|

16.2

|

|

Interest over marketable securities

|

(6.6)

|

(1.0)

|

(20.6)

|

(7.9)

|

|

Equity in the losses of associates

|

0.2

|

0.1

|

0.2

|

0.2

|

|

Share-based remuneration

|

0.4

|

0.1

|

1.1

|

0.4

|

|

Foreign exchange gain (loss), net

|

(0.5)

|

(3.5)

|

(2.8)

|

1.5

|

|

Residual value guarantee

|

18.6

|

(3.5)

|

24.7

|

(13.8)

|

|

Accounts payable for penalties

|

5.5

|

-

|

205.5

|

-

|

|

Provision for voluntary redundancy scheme

|

118.1

|

-

|

118.1

|

6.4

|

|

Other

|

(1.3)

|

0.5

|

(0.6)

|

(11.2)

|

|

Changes in assets

|

|

|

|

|

|

Financial investments

|

66.4

|

30.8

|

(257.5)

|

(376.6)

|

|

Derivative financial instruments

|

3.1

|

(16.8)

|

(22.2)

|

(17.4)

|

|

Collateralized accounts receivable and accounts receivable

|

128.2

|

48.7

|

123.7

|

(55.1)

|

|

Customer and commercial financing

|

13.4

|

16.2

|

28.6

|

20.4

|

|

Inventories

|

(91.8)

|

40.2

|

(505.7)

|

60.7

|

|

Other assets

|

(40.7)

|

5.9

|

(138.9)

|

184.5

|

|

Changes in liabilities

|

|

|

|

|

|

Trade accounts payable

|

59.4

|

(140.1)

|

80.2

|

(168.2)

|

|

Non-recourse and recourse debt

|

(4.5)

|

2.6

|

(3.2)

|

7.6

|

|

Other payables

|

(2.9)

|

11.2

|

10.3

|

(8.7)

|

|

Contribution from suppliers

|

25.0

|

-

|

123.9

|

86.0

|

|

Advances from customers

|

(16.4)

|

24.6

|

(16.6)

|

25.5

|

|

Taxes and payroll charges payable

|

(11.2)

|

34.2

|

11.4

|

43.0

|

|

Financial guarantees

|

25.5

|

(6.7)

|

(34.6)

|

(37.8)

|

|

Other provisions

|

10.4

|

(50.2)

|

(9.6)

|

(69.7)

|

|

Unearned income

|

14.6

|

(16.3)

|

2.0

|

(164.9)

|

|

Net cash generated (used) by operating activities

|

301.7

|

146.2

|

(219.6)

|

35.4

|

|

Investing activities

|

|

|

|

|

|

Additions to property, plant and equipment

|

(125.9)

|

(46.9)

|

(314.4)

|

(161.2)

|

|

Proceeds from sale of property, plant and equipment

|

-

|

(0.3)

|

0.1

|

18.9

|

|

Additions to intangible assets

|

(129.9)

|

(111.1)

|

(367.8)

|

(345.4)

|

|

Investments in associates

|

(1.0)

|

(0.1)

|

(2.3)

|

(0.5)

|

|

Proceeds from held to maturity securities

|

51.1

|

(471.9)

|

54.1

|

(464.0)

|

|

Loans

|

2.1

|

-

|

(13.8)

|

-

|

|

Dividends Received

|

-

|

-

|

0.1

|

0.1

|

|

Restricted cash reserved for construction of assets

|

-

|

-

|

4.3

|

1.7

|

|

Net cash used in investing activities

|

(203.6)

|

(630.3)

|

(639.7)

|

(950.4)

|

|

Financing activities

|

|

|

|

|

|

Proceeds from borrowings

|

289.9

|

153.4

|

426.7

|

918.8

|

|

Repayment of borrowings

|

(137.4)

|

(92.3)

|

(325.7)

|

(424.6)

|

|

Dividends and interest on own capital

|

(8.4)

|

(9.1)

|

(24.3)

|

(43.4)

|

|

Proceeds from stock options exercised

|

-

|

0.4

|

1.5

|

5.2

|

|

Acquisition of own shares

|

(1.2)

|

(10.1)

|

(17.1)

|

(15.0)

|

|

Net cash generated by financing activities

|

142.9

|

42.3

|

61.1

|

441.0

|

|

Increase (Decrease) in cash and cash equivalents

|

241.0

|

(441.8)

|

(798.2)

|

(474.0)

|

|

Effects of exchange rate changes on cash and cash equivalents

|

(8.7)

|

6.9

|

88.2

|

5.0

|

|

Cash and cash equivalents at the beginning of the period

|

1,223.2

|

1,207.4

|

2,165.5

|

1,241.5

|

|

Cash and cash equivalents at the end of the period

|

1,455.5

|

772.5

|

1,455.5

|

772.5

|

|

|

|

(1) Derived from unaudited financial statements.

|

|

|

14

|

|

|

|

|

|

|

|

|

EMBRAER S.A.

|

|

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

|

|

(in millions of U.S. dollars)

|

|

|

|

A S S E T S

|

(1)

|

(1)

|

|

As of June 30,

|

As of September 30,

|

|

2017

|

2017

|

|

Current assets

|

|

|

|

Cash and cash equivalents

|

1,207.4

|

772.5

|

|

Financial investments

|

1,953.8

|

2,420.9

|

|

Trade accounts receivable, net

|

752.9

|

708.3

|

|

Derivative financial instruments

|

22.4

|

41.8

|

|

Customer and commercial financing

|

5.2

|

2.2

|

|

Collateralized accounts receivable

|

160.4

|

173.8

|

|

Inventories

|

2,460.9

|

2,443.3

|

|

Income tax and Social Contribution

|

111.2

|

127.7

|

|

Other assets

|

273.8

|

256.1

|

|

|

6,948.0

|

6,946.6

|

|

Non-current assets

|

|

|

|

Financial investments

|

389.3

|

390.7

|

|

Derivative financial instruments

|

8.6

|

8.6

|

|

Customer and commercial financing

|

28.0

|

14.8

|

|

Collateralized accounts receivable

|

143.9

|

126.6

|

|

Guarantee deposits

|

418.2

|

422.3

|

|

Deferred income tax

|

17.4

|

4.0

|

|

Other assets

|

115.0

|

119.5

|

|

|

1,120.4

|

1,086.5

|

|

Investments

|

4.0

|

4.2

|

|

Property, plant and equipment, net

|

2,158.9

|

2,125.3

|

|

Intangible assets

|

1,770.5

|

1,857.9

|

|

|

3,933.4

|

3,987.4

|

|

|

|

TOTAL ASSETS

|

12,001.8

|

12,020.5

|

|

(1) Derived from unaudited financial information.

|

|

|

15

|

|

|

|

|

|

|

|

|

EMBRAER S.A.

|

|

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

|

|

(in millions of U.S. dollars)

|

|

|

|

LIABILITIES

|

(1)

|

(1)

|

|

As of June 30,

|

As of September 30,

|

|

2017

|

2017

|

|

Current liabilities

|

|

|

|

Trade accounts payable

|

923,9

|

786,3

|

|

Loans and financing

|

304,2

|

289,0

|

|

Non-recourse and recourse debt

|

22,5

|

26,9

|

|

Other payables

|

338,5

|

322,8

|

|

Advances from customers

|

726,9

|

747,8

|

|

Derivative financial instruments

|

6,6

|

9,3

|

|

Taxes and payroll charges payable

|

38,6

|

65,1

|

|

Income tax and social contribution

|

39,4

|

46,5

|

|

Financial guarantee and residual value

|

25,1

|

20,0

|

|

Provisions

|

123,4

|

120,0

|

|

Dividends payable

|

9,5

|

9,8

|

|

Unearned income

|

172,5

|

157,9

|

|

|

2.731,1

|

2.601,4

|

|

Non-current liabilities

|

|

|

|

Loans and financing

|

3.907,8

|

4.017,9

|

|

Non-recourse and recourse debt

|

356,3

|

354,5

|

|

Other payables

|

18,1

|

27,5

|

|

Advances from customers

|

121,7

|

125,2

|

|

Derivative financial instruments

|

-

|

0,1

|

|

Taxes and payroll charges payable

|

68,7

|

72,7

|

|

Deferred income tax and social contribution

|

322,0

|

269,3

|

|

Financial guarantee and residual value

|

144,3

|

139,2

|

|

Provisions

|

174,9

|

139,5

|

|

Unearned income

|

102,8

|

100,4

|

|

|

5.216,6

|

5.246,3

|

|

|

|

TOTAL LIABILITIES

|

7.947,7

|

7.847,7

|

|

Shareholders' equity

|

|

|

|

Capital

|

1.438,0

|

1.438,0

|

|

Treasury shares

|

(44,1)

|

(53,3)

|

|

Revenue reserves

|

2.566,7

|

2.568,6

|

|

Share-based remuneration

|

37,1

|

37,2

|

|

Retained earnings (losses)

|

77,6

|

176,0

|

|

Accumulated Other Comprehensive Loss

|

(129,6)

|

(105,5)

|

|

|

3.945,7

|

4.061,0

|

|

Non-controlling interest

|

108,4

|

111,8

|

|

Total company's shareholders' equity

|

4.054,1

|

4.172,8

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

12.001,8

|

12.020,5

|

|

(1) Derived from unaudited financial information.

|

|

|

16

|

|

|

|

Investor Relations

Eduardo Couto, Chris Thornsberry, Caio Pinez, Nádia Santos, Paulo Ferreira and Viviane Pinheiro.

(+55 12) 3927- 1000

investor.relations@embraer.com.br

http://ri.embraer.com.br

Follow Embraer’s IR Department on twitter: @IREmbraer

|

CONFERENCE CALL INFORMATION

Embraer will host a conference call to present its 3Q17 Results on

Friday, October 27, 2017 at 3:00PM (SP) / 1:00PM (NY).

The conference call will also be broadcast live over the web at

http://ri.embraer.com.br

Telephones:

Operator Assisted (US/ Canada) Toll-Free Dial-In Number: (877) 846-1574

Operator Assisted International Dial-In Number: (708) 290-0687

Your own International Toll-Free number for Brazil: 0800 047 4803 (land line) and 0800 047 4801 (cell phone)

Code: 35609838

|

ABOUT EMBRAER

Embraer is a global company headquartered in Brazil with businesses in commercial and executive aviation, defense & security. The company designs, develops, manufactures and markets aircraft and systems, providing customer support and services.

Since it was founded in 1969, Embraer has delivered more than 8,000 aircraft. About every 10 seconds an aircraft manufactured by Embraer takes off somewhere in the world, transporting over 145 million passengers a year.

Embraer is the leading manufacturer of commercial jets up to 150 seats. The company maintains industrial units, offices, service and parts distribution centers, among other activities, across the Americas, Africa, Asia and Europe.

For more information, please visit www.embraer.com.br

This document may contain projections, statements and estimates regarding circumstances or events yet to take place. Those projections and estimates are based largely on current expectations, forecasts of future events and financial trends that affect Embraer’s businesses. Those estimates are subject to risks, uncertainties and suppositions that include, among others: general economic, political and trade conditions in Brazil and in those markets where Embraer does business; expectations of industry trends; the Company’s investment plans; its capacity to develop and deliver products on the dates previously agreed upon, and existing and future governmental regulations. The words “believe”, “may”, “is able”, “will be able”, “intend”, “continue”, “anticipate”, “expect” and other similar terms are intended to identify potentialities. Embraer does not undertake any obligation to publish updates nor to revise any estimates due to new information, future events or any other facts. In view of the inherent risks and uncertainties, such estimates, events and circumstances may not take place. The actual results may therefore differ substantially from those previously published as Embraer expectations.

|

|

17

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 27, 2017

|

|

|

|

|

|

|

Embraer S.A.

|

|

|

|

|

By:

|

|

/s/ José Antonio de Almeida Filippo

|

|

|

|

Name:

|

|

José Antonio de Almeida Filippo

|

|

|

|

Title:

|

|

Executive Vice-President and Chief Financial and Investor Relations Officer

|

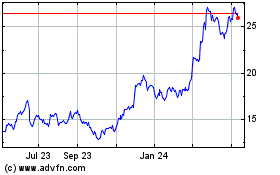

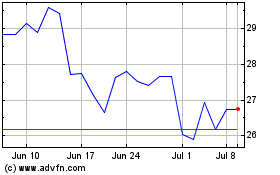

Embraer (NYSE:ERJ)

Historical Stock Chart

From Aug 2024 to Sep 2024

Embraer (NYSE:ERJ)

Historical Stock Chart

From Sep 2023 to Sep 2024