Ross Stores, Inc. (Nasdaq: ROST) today reported earnings per

share for the second quarter ended July 29, 2017 of $.82, up 15%

from $.71 last year. Net earnings grew to $317 million, compared to

$282 million in the prior year. Sales rose 8% to $3.432 billion,

with comparable store sales up 4% on top of 4% growth last

year.

For the first six months of fiscal 2017, earnings per share were

$1.64, up 14% on top of a 9% gain last year. Net earnings were $638

million, up from $573 million in the prior year. Sales rose 7% to

$6.738 billion, with comparable store sales up 4% versus a 3% gain

in the same period last year.

Barbara Rentler, Chief Executive Officer, commented, “We are

pleased with the better-than-expected growth we delivered in both

sales and earnings in the second quarter, especially given our

strong multi-year comparisons and today’s volatile retail climate.

Operating margin of 14.9% outperformed our projections, mainly due

to a combination of higher merchandise margin and leverage on our

above-plan sales gains.”

Ms. Rentler continued, “During the second quarter and first six

months of fiscal 2017, we repurchased 3.6 million and 6.9 million

shares of common stock, respectively, for an aggregate price of

$215 million in the quarter and $430 million year-to-date. As

planned, we expect to buy back a total of $875 million in common

stock during fiscal 2017 under the two-year $1.75 billion

authorization approved by our Board of Directors in February of

this year.”

Looking ahead, Ms. Rentler said, “For the third quarter ending

October 28, 2017, we are forecasting a same store sales gain of 1%

to 2% on top of a robust 7% increase in the prior year. Earnings

per share for the period are projected to be $.64 to $.67, up from

$.62 in last year’s third quarter. For the fourth quarter ending

February 3, 2018, we are also forecasting same store sales to grow

1% to 2% versus a strong 4% increase last year, with earnings per

share expected to be $.88 to $.92, up from $.77 in the 2016 fourth

quarter. Based on our first half results and second half guidance,

fiscal 2017 earnings per share for the 53 weeks ending February 3,

2018 are now planned to increase 12% to 14% to $3.16 to $3.23, on

top of a 13% gain last year. As a reminder, both our fourth quarter

and full year guidance include an approximate $.08 benefit from the

53rd week in fiscal 2017.”

The Company will host a conference call on Thursday, August 17,

2017 at 4:15 p.m. Eastern time to provide additional details

concerning its second quarter results and management’s outlook for

the remainder of the year. A real-time audio webcast of the

conference call will be available in the Investors section of the

Company’s website, located at www.rossstores.com. An audio playback

will be available at 404-537-3406, PIN #61894409 until 8:00 p.m.

Eastern time on August 24, 2017, as well as on the Company’s

website.

Forward-Looking Statements:

This press release contains forward-looking statements regarding

expected sales, earnings levels, and other financial results in

future periods that are subject to risks and uncertainties which

could cause our actual results to differ materially from

management’s current expectations. The words “plan,” “expect,”

“target,” “anticipate,” “estimate,” “believe,” “forecast,”

“projected,” “guidance,” “outlook,” “looking ahead” and similar

expressions identify forward-looking statements. Risk factors for

Ross Dress for Less® (“Ross”) and dd’s DISCOUNTS® include without

limitation, competitive pressures in the apparel or home-related

merchandise retailing industry; changes in the level of consumer

spending on or preferences for apparel and home-related

merchandise; market availability, quantity, and quality of

attractive brand name merchandise at desirable discounts and our

buyers’ ability to purchase merchandise that enables us to offer

customers a wide assortment of merchandise at competitive prices;

impacts from the macro-economic environment, financial and credit

markets, and geopolitical conditions that affect consumer

confidence and consumer disposable income; our ability to

continually attract, train, and retain associates to execute our

off-price strategies; unseasonable weather trends; potential

information or data security breaches, including cyber-attacks on

our transaction processing and computer information systems, which

could result in theft or unauthorized disclosure of customer,

credit card, employee, or other private and valuable information

that we handle in the ordinary course of our business; potential

disruptions in our supply chain or information systems; issues

involving the quality, safety, or authenticity of products we sell,

which could harm our reputation, result in lost sales, and/or

increase our costs; our ability to effectively manage our

inventories, markdowns, and inventory shortage to achieve planned

gross margin; changes in U.S. tax or tariff policy regarding

apparel and home-related merchandise produced in other countries

that could adversely affect our business; volatility in revenues

and earnings; an adverse outcome in various legal, regulatory, or

tax matters; a natural or man-made disaster in California or in

another region where we have a concentration of stores, offices, or

a distribution center; unexpected issues or costs from expanding in

existing markets and entering new geographic markets; obtaining

acceptable new store sites with favorable consumer demographics;

damage to our corporate reputation or brands; effectively

advertising and marketing our brands; issues from selling and

importing merchandise produced in other countries; and maintaining

sufficient liquidity to support our continuing operations, new

store and distribution center growth plans, and stock repurchase

and dividend programs. Other risk factors are set forth in our SEC

filings including without limitation, the Form 10-K for fiscal

2016, and Form 10-Q and 8-Ks for fiscal 2017. The factors

underlying our forecasts are dynamic and subject to change. As a

result, our forecasts speak only as of the date they are given and

do not necessarily reflect our outlook at any other point in time.

We do not undertake to update or revise these forward-looking

statements.

Ross Stores, Inc. is an S&P 500, Fortune 500 and Nasdaq 100

(ROST) company headquartered in Dublin, California, with fiscal

2016 revenues of $12.9 billion. The Company operates Ross Dress for

Less® (“Ross”), the largest off-price apparel and home fashion

chain in the United States with 1,384 locations in 37 states, the

District of Columbia and Guam as of July 29, 2017. Ross offers

first-quality, in-season, name brand and designer apparel,

accessories, footwear, and home fashions for the entire family at

savings of 20% to 60% off department and specialty store regular

prices every day. The Company also operates 205 dd’s DISCOUNTS® in

16 states as of July 29, 2017 that feature a more moderately-priced

assortment of first-quality, in-season, name brand apparel,

accessories, footwear, and home fashions for the entire family at

savings of 20% to 70% off moderate department and discount store

regular prices every day. Additional information is available at

www.rossstores.com.

Ross Stores, Inc. Condensed Consolidated

Statements of Earnings

Three Months Ended Six Months

Ended ($000, except stores and per share data, unaudited)

July 29, 2017 July 30, 2016

July 29, 2017 July 30, 2016

Sales $ 3,431,603 $ 3,180,917

$

6,738,032 $ 6,269,912

Costs and Expenses Cost

of goods sold

2,420,942 2,251,845

4,750,908 4,428,050

Selling, general and administrative

498,276

469,511

973,095 906,435 Interest expense, net

2,341 4,213

5,510

8,577 Total costs and expenses

2,921,559 2,725,569

5,729,513 5,343,062 Earnings before taxes

510,044 455,348

1,008,519 926,850 Provision for taxes

on earnings

193,505 173,442

370,962 354,310 Net earnings

$

316,539 $ 281,906

$ 637,557

$ 572,540

Earnings per share Basic

$

0.83 $ 0.72

$ 1.66 $ 1.45 Diluted

$

0.82 $ 0.71

$ 1.64

$

1.44

Weighted average shares outstanding (000)

Basic

383,011 393,568

384,722 394,684 Diluted

385,571 395,930

387,657 397,381

Dividends Cash dividends declared per share

$

0.1600 $ 0.1350

$ 0.3200 $ 0.2700

Stores open at end of period

1,589 1,501

1,589

1,501

Ross Stores, Inc. Condensed

Consolidated Balance Sheets

($000, unaudited)

July 29, 2017

July 30, 2016

Assets Current Assets Cash and

cash equivalents

$ 1,150,932 $ 927,718 Short-term

investments

- 1,213 Accounts receivable

103,359

97,139 Merchandise inventory

1,608,333 1,560,209 Prepaid

expenses and other

141,793 127,401

Total current assets

3,004,417 2,713,680 Property and

equipment, net

2,327,113 2,310,481 Long-term investments

1,259 1,325 Other long-term assets

181,690

168,748 Total assets

$ 5,514,479

$ 5,194,234

Liabilities and Stockholders’ Equity

Current Liabilities Accounts payable

$

1,172,847 $ 1,125,836 Accrued expenses and other

411,083 397,150 Accrued payroll and benefits

245,031 228,195 Total current liabilities

1,828,961 1,751,181 Long-term debt

396,729

396,259 Other long-term liabilities

319,770 296,867 Deferred

income taxes

129,135 135,597 Commitments and

contingencies

Stockholders’ Equity

2,839,884 2,614,330 Total liabilities and

stockholders’ equity

$ 5,514,479 $ 5,194,234

Ross Stores, Inc. Condensed Consolidated

Statements of Cash Flows

Six Months Ended ($000, unaudited)

July 29, 2017 July 30, 2016

Cash Flows From

Operating Activities Net earnings

$ 637,557 $

572,540

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation and amortization

150,905 148,630 Stock-based

compensation

42,719 36,206 Deferred income taxes

8,426 5,509 Change in assets and liabilities: Merchandise

inventory

(95,447 ) (141,105 ) Other current assets

(56,520 ) (34,773 ) Accounts payable

154,828

192,610 Other current liabilities

(59,104 ) (13,108 )

Other long-term, net

14,566

13,045 Net cash provided by operating activities

797,930 779,554

Cash

Flows From Investing Activities Additions to property and

equipment

(169,316 ) (147,426 ) Increase in

restricted cash and investments

(247 ) (143 )

Proceeds from investments

19 514

Net cash used in investing activities

(169,544

) (147,055 )

Cash Flows From

Financing Activities Excess tax benefit from stock-based

compensation

- 22,682 Issuance of common stock related to

stock plans

9,157 9,862 Treasury stock purchased

(43,163 ) (39,328 ) Repurchase of common stock

(430,085 ) (351,515 ) Dividends paid

(124,962 ) (108,084 ) Net cash used in

financing activities

(589,053 )

(466,383 ) Net increase in cash and cash equivalents

39,333 166,116 Cash and cash equivalents: Beginning

of period

1,111,599 761,602

End of period

$ 1,150,932 $

927,718

Supplemental Cash Flow Disclosures

Interest paid

$ 9,053 $ 9,053 Income taxes paid

$ 379,154 $ 313,142

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170817005946/en/

Ross Stores, Inc.Michael Hartshorn, 925-965-4503Group Senior

Vice President,Chief Financial OfficerorConnie Kao,

925-965-4668Vice President, Investor

Relationsconnie.kao@ros.com

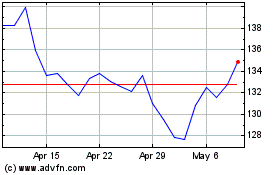

Ross Stores (NASDAQ:ROST)

Historical Stock Chart

From Aug 2024 to Sep 2024

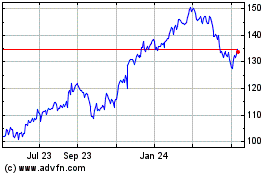

Ross Stores (NASDAQ:ROST)

Historical Stock Chart

From Sep 2023 to Sep 2024