Report of Foreign Issuer (6-k)

August 14 2017 - 9:19AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of

August 2017

Commission File Number

000-20181

SAPIENS INTERNATIONAL CORPORATION N.V.

(Translation of registrant’s name

into English)

Azrieli Center

26 Harukmim St.

Holon, 5885800 Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

o

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

o

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

o

CONTENTS

Rating for Non-Convertible Debentures

On August 13, 2017,

Sapiens International Corporation N.V. (“

Sapiens

”) filed with the Israeli Securities Authority (“

ISA

”)

and the Tel Aviv Stock Exchange (“

TASE

”) a rating report (the “

Rating Report

”) published

by Ma’alot S&P Global (a part of the global rating firm Standard & Poor's Financial Services LLC) with respect to

each of Sapiens and the new series of Sapiens’ debentures—Series B Debentures (the “

Debentures

”)—that

Sapiens is considering offering publicly in Israel, pursuant to Sapiens’ Israeli shelf prospectus (the “

Israeli

Shelf Prospectus

”). Sapiens’ filing of the Israeli Shelf Prospectus, and its report to the ISA and TASE that it

is considering offering the Debentures, were described in the Report of Foreign Private Issuer on Form 6-K (a “

Form 6-K

”)

that Sapiens furnished to the SEC on August 7, 2017, which description is incorporated herein by reference.

An English translation

of the Rating Report is furnished as Exhibit 99.1 to this Form 6-K.

Important Note re: Debenture Offering

and Related Disclosures

This Form 6-K is not

an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent registration

under the Securities Act or an exemption from the registration requirements thereunder. Any offering of securities pursuant to

the Israeli Shelf Prospectus and any supplemental shelf offering report will be made only in Israel to residents of Israel, will

not be registered under the Securities Act of 1933, as amended (the “

Securities Act

”) and will not be offered

or sold in the United States or to U.S. persons (as defined in Regulation S under the Securities Act), except pursuant to an applicable

exemption from registration under the Securities Act.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

SAPIENS INTERNATIONAL CORPORATION N.V.

|

|

|

|

|

|

Date: August 14, 2017

|

By:

|

/s/ Roni Giladi

|

|

|

|

Name: Roni Giladi

|

|

|

|

Title: Chief Financial Officer

|

EXHIBIT INDEX

The following exhibit

is furnished as part of this Form 6-K:

|

Exhibit

|

|

Description

|

|

|

|

|

|

99.1

|

|

Rating

report published by Ma’alot S&P Global (a part of the global rating firm Standard & Poor's Financial Services

LLC) with respect to each of Sapiens and its potential Series B Non-Convertible Debentures that may be offered in Israel

|

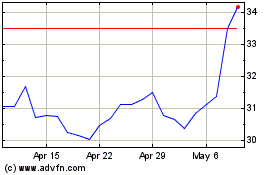

Sapiens International Co... (NASDAQ:SPNS)

Historical Stock Chart

From Aug 2024 to Sep 2024

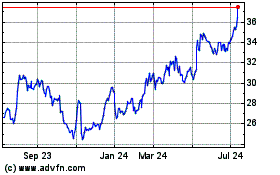

Sapiens International Co... (NASDAQ:SPNS)

Historical Stock Chart

From Sep 2023 to Sep 2024