Otter Tail Corporation (NASDAQ:OTTR) today announced financial

results for the quarter ended June 30, 2017.

Summary:

- Consolidated operating revenues were $212.1 million compared

with $203.5 million for the second quarter of 2016.

- Consolidated net income and diluted earnings from continuing

operations totaled $16.7 million and $0.42 per share, respectively,

compared with $15.6 million and $0.41 per share for the second

quarter of 2016.

- Given our strong first half 2017 results we are raising our

2017 consolidated earnings guidance range to $1.65 - $1.80 per

diluted share from $1.60 - $1.75 per diluted share.

CEO Overview“Employees across the organization

improved operations to deliver second quarter earnings per share of

$0.42 compared with $0.41 in the second quarter of 2016,” said

Otter Tail Corporation President and CEO Chuck MacFarlane. “Our

Electric and Plastics segments drove the earnings improvement. The

utility had higher transmission service revenues and lower

generating plant operating and maintenance costs this quarter

compared to second quarter last year and the PVC pipe companies

earned higher margins. Our second quarter Manufacturing segment

results and corporate costs were in line with our expectations,

although unfavorable to last year’s second quarter results, which

included favorable product mix in the Manufacturing segment and

nontaxable benefit proceeds from corporate-owned life insurance

that did not occur in 2017.

“Highlights this quarter included two special acknowledgements

for the utility. In May a Regulatory Research Associates report

recognized Otter Tail Power Company as one of the five lowest price

providers among utility operating companies. In June the Edison

Electric Institute presented Otter Tail Power Company with the

association’s Emergency Recovery Award for its outstanding

restoration efforts after a snow and ice storm hit South Dakota on

Christmas Day. We are proud of employees for these efforts.

“We also are pleased that two 345-kilovolt transmission projects

under construction and designated as Multi-Value Projects by the

Midcontinent Independent System Operator remain on schedule and on

budget. We are a 50 percent owner in both the Big Stone

South-Brookings line, scheduled for completion later this year, and

the Big Stone South-Ellendale line, scheduled for completion in

2019. Otter Tail Power Company, manager on the Big Stone

South-Ellendale project, has obtained all easements for the route

and set approximately a third of the structures. Our combined

investment in these two projects will be approximately $250

million.

“Otter Tail Power Company expects to invest $862 million from

2017 through 2021, including investments in these two regional

transmission projects as well as new natural gas and wind

generation associated with the company’s approved integrated

resource plan. This will produce a projected compounded annual

growth rate of 7.5 percent in utility rate base from 2015 through

2021.

“BTD, our custom metal fabricator, continues to make steady

improvement in its Minnesota plants with improved plant flow,

reduced logistics costs and added paint capabilities. BTD’s

Illinois plant continues to perform well despite a reduction in

wind fixture work compared with last year, and its Georgia plant,

acquired in September 2015, continues to be integrated into BTD’s

operations. The Georgia plant along with the other BTD’s facilities

are on a common technology platform that facilitates common

estimating, production scheduling, and inventory management. T.O.

Plastics, our thermoforming manufacturer, also continues to improve

operations and experienced increased sales in all its major end

markets this quarter.

“These results provide a foundation for raising our 2017

earnings guidance range to $1.65 - $1.80 per diluted share from

$1.60 - $1.75 per diluted share.”

Cash Flow from Operations, and Liquidity

Consolidated cash provided by continuing operations for the six

months ended June 30, 2017 was $69.3 million compared with $64.2

million for the six months ended June 30, 2016. Contributing to the

$5.1 million increase in cash provided by continuing operations

between the periods was a $10.0 million reduction in discretionary

contributions to the corporation’s funded pension plan and a $6.2

million increase in net income from continuing operations. These

increases were partially offset by an $8.6 million increase in cash

used for working capital items, a $1.1 million decrease in

depreciation expense and $1.0 million less in deferred income taxes

between periods. The increase in cash used for working capital

items between the periods is primarily due to a $7.7 million

increase in cash used to build inventories between the periods. All

operating segments experienced increases in inventories in the

first six months of 2017 compared with decreases in the first six

months of 2016.

The following table presents the status of the corporation’s

lines of credit:

| (in

thousands) |

Line Limit |

In Use On June 30, 2017 |

Restricted due to Outstanding Letters of

Credit |

Available on June 30, 2017 |

Available on December 31, 2016 |

| Otter Tail Corporation

Credit Agreement |

$ |

130,000 |

$ |

117 |

$ |

-- |

$ |

129,883 |

$ |

|

130,000 |

| Otter

Tail Power Company Credit Agreement |

|

170,000 |

|

58,000 |

|

300 |

|

111,700 |

|

|

127,067 |

|

Total |

$ |

300,000 |

$ |

58,117 |

$ |

300 |

$ |

241,583 |

$ |

|

257,067 |

Board of Directors Declared Quarterly Dividend

On August 3, 2017 the corporation’s Board of Directors declared a

quarterly common stock dividend of $0.32 per share. This dividend

is payable September 9, 2017 to shareholders of record on

August 15, 2017.

Segment Performance

Summary

Electric

|

|

|

Three Months ended June 30, |

|

|

| |

($s in

thousands) |

|

2017 |

|

2016 |

Change |

% Change |

| |

Retail Electric

Revenues |

$ |

86,255 |

$ |

85,985 |

$ |

270 |

|

0.3 |

|

| |

Wholesale Electric

Revenues |

|

1,184 |

|

859 |

|

325 |

|

37.8 |

|

| |

Other

Electric Revenues |

|

14,797 |

|

11,081 |

|

3,716 |

|

33.5 |

|

| |

Total Electric Revenues |

$ |

102,236 |

$ |

97,925 |

$ |

4,311 |

|

4.4 |

|

| |

Net Income |

$ |

10,134 |

$ |

9,148 |

$ |

986 |

|

10.8 |

|

| |

Heating Degree

Days |

|

420 |

|

455 |

|

(35 |

) |

(7.7 |

) |

| |

Cooling Degree

Days |

|

96 |

|

133 |

|

(37 |

) |

(27.8 |

) |

The following table shows heating and cooling degree days as a

percent of normal:

|

|

|

Three Months ended June 30, |

| |

|

2017 |

|

2016 |

|

| |

Heating Degree Days

|

80.9 |

% |

87.7 |

% |

| |

Cooling Degree

Days |

90.6 |

% |

125.5 |

% |

The following table summarizes the estimated effect on diluted

earnings per share of the difference in retail kilowatt-hour (kwh)

sales under actual weather conditions and expected retail kwh sales

under normal weather conditions in the second quarters of 2017 and

2016 and between the quarters:

| |

|

Three Months ended June 30, |

| |

|

2017 vs Normal |

2016 vs Normal |

2017 vs 2016 |

|

|

Effect on Diluted

Earnings Per Share |

$ |

(0.01 |

) |

$ |

0.00 |

($ |

0.01 |

) |

The $0.3 million increase in retail electric revenues

includes:

- A $3.4 million increase in retail revenue related to the

recovery of increased fuel and purchased power costs due to an

increase in the price per kwh purchased and an increase in fuel

costs per kwh generated to serve retail customers.

- A $0.9 million increase in revenue due to increased kwh sales

to commercial and industrial customers.

offset by:

- A $1.5 million net decrease in retail revenue primarily due to

an increase in the interim rate refund accrual in the second

quarter of 2017 related to the final order in Otter Tail Power

Company’s 2016 Minnesota general rate case.

- A $0.8 million decrease in Environmental Costs Recovery rider

revenue mainly due to a reduction in the unrecovered balance of

environmental upgrades due to depreciation.

- A $0.6 million negative price variance related to increased

sales of electricity to customers with lower rate tariffs.

- A $0.6 million decrease in Transmission Cost Recovery rider

revenue due to a reduction in transmission services and costs from

another regional transmission provider.

- A $0.4 million decrease in revenue related to decreased

consumption due to milder weather in the second quarter of 2017,

evidenced by a 7.7% decrease in heating degree days and a 27.8%

decrease in cooling degree days between the quarters.

- A $0.1 million decrease in North Dakota Renewable Resource

Adjustment rider revenue mainly due to an increase in Production

Tax Credits that reduces rider revenue requirements.

Other electric revenues increased $3.7 million, primarily due to

a $3.3 million increase in Midcontinent Independent System

Operator, Inc. (MISO) transmission tariff revenues related to

increased investment in regional transmission lines.

Production fuel costs increased $2.5 million as a result of a

23.5% increase in kwhs generated combined with a 1.1% increase in

the cost of fuel per kwh generated from our steam-powered and

combustion turbine generators. The increase in generation was

mainly at Coyote Station, which was down for maintenance for eight

weeks of the second quarter of 2016 but fully operational during

the second quarter of 2017.

The cost of purchased power to serve retail customers increased

$1.2 million, despite an 11.2% decrease in kwh purchases, as a

result of a 21.9% increase in the cost per kwh purchased due to

higher market prices and increased prices for energy purchases

under a long‑term contract.

Other electric operating and maintenance expenses decreased $1.1

million as a result of:

- A $1.2 million reduction in external service costs mostly due

to a decrease in costs related to a maintenance shutdown at Coyote

Station in April and May of 2016 in conjunction with the Coyote

Creek Coal Mine tie-in project.

- A $0.6 million decrease in Southwest Power Pool and MISO

transmission service charges, with the MISO decrease mainly related

to a decrease in the return on equity component of the MISO tariff

from 12.38% to 10.82%.

offset by:

- A $0.3 million increase in labor costs mainly related to work

required to respond to storm outages.

- A $0.3 million increase in filing expenses related to the 2016

Minnesota general rate case.

Depreciation and amortization expense decreased $0.3 million as

a result of extending the depreciable lives of certain assets and

other assets reaching the end of their depreciable lives in

2016.

Income tax expense in the Electric segment increased $0.5

million mainly as a result of a $1.5 million increase in income

before income taxes.

Manufacturing

|

|

|

Three Months ended June 30, |

|

|

| |

(in

thousands) |

|

2017 |

|

2016 |

Change |

% Change |

| |

Operating Revenues

|

$ |

59,304 |

$ |

58,452 |

$ |

852 |

|

1.5 |

|

| |

Net Income |

|

2,955 |

|

3,009 |

|

(54 |

) |

(1.8 |

) |

At BTD Manufacturing, Inc. (BTD), revenues increased $0.2

million as a result of a $0.5 million increase in scrap revenue

mainly due to higher scrap metal prices and a $0.2 million increase

in revenue from parts sales, offset by a $0.5 million reduction in

tooling revenue. Operating margins were lower in the second quarter

of 2017 compared with the second quarter of 2016 due to unfavorable

product mix in our Minnesota and Illinois plants compared to the

second quarter of 2016 along with increased costs for scrapped

parts and obsolete inventory in the second quarter of 2017. A

$0.4 million decrease in interest expense as a result of the

December 2016 refinancing of long-term debt at lower interest rates

and a $0.4 million decrease in income tax expense related to the

reduction in BTD’s income before income taxes resulted in a $0.4

million decrease in quarter-over-quarter net income at BTD.

At T.O. Plastics, Inc. (T.O. Plastics), revenues increased $0.6

million with increases in all end markets served. Costs of products

sold remained flat quarter over quarter as a result of lower

material costs in the second quarter of 2017, resulting in improved

margins and a $0.4 million increase in net income at T.O.

Plastics.

Plastics

|

|

|

Three Months ended June 30, |

|

|

| |

(in

thousands) |

|

2017 |

|

2016 |

Change |

% Change |

| |

Operating Revenues

|

$ |

50,551 |

$ |

47,112 |

$ |

3,439 |

7.3 |

| |

Net Income |

|

4,637 |

|

3,485 |

|

1,152 |

33.1 |

Plastics segment revenues and net income increased $3.4 million

and $1.2 million, respectively. Revenues increased despite a 1.9%

decrease in pounds of polyvinyl chloride (PVC) pipe sold as a

result of a 9.4% increase in PVC pipe prices between the quarters.

The increase in revenue more than offset a $1.6 million increase in

cost of products sold, which was primarily due to a 6.3% increase

in the cost per pound of PVC pipe sold.

Corporate

Corporate’s $0.9 million increase in net-of-tax costs reflects

the receipt of $0.9 million in nontaxable corporate-owned life

insurance benefit proceeds in the second quarter of 2016 while no

similar benefit proceeds were received in the second quarter of

2017.

2017 Business Outlook

We are raising our 2017 consolidated earnings guidance range to

$1.65 - $1.80 per diluted share from $1.60 ‑ $1.75 per

diluted share. This guidance reflects the current mix of businesses

we own, considers the cyclical nature of some of our businesses,

and reflects current regulatory factors and economic challenges

facing our Electric, Manufacturing and Plastics segments and

strategies for improving future operating results. We expect

capital expenditures for 2017 to be $149 million compared with

actual cash used for capital expenditures of $161 million in 2016.

Major projects in our planned expenditures for 2017 include

investments in two large transmission line projects for the

Electric segment, which positively impact earnings by providing an

immediate return on invested funds through rider recovery

mechanisms.

Segment components of our 2017 earnings per share guidance range

compared with 2016 actual earnings are as follows:

| Diluted Earnings Per Share |

2016 EPS by Segment |

2017 GuidanceFebruary 6, 2017 |

2017 GuidanceMay 1, 2017 |

2017 GuidanceAugust 7, 2017 |

| Low |

High |

Low |

High |

Low |

High |

|

Electric |

$ |

1.29 |

|

$ |

1.31 |

|

$ |

1.34 |

|

$ |

1.31 |

|

$ |

1.34 |

|

$ |

1.31 |

|

$ |

1.34 |

|

|

Manufacturing |

$ |

0.15 |

|

$ |

0.17 |

|

$ |

0.21 |

|

$ |

0.17 |

|

$ |

0.21 |

|

$ |

0.17 |

|

$ |

0.21 |

|

|

Plastics |

$ |

0.27 |

|

$ |

0.26 |

|

$ |

0.30 |

|

$ |

0.26 |

|

$ |

0.30 |

|

$ |

0.31 |

|

$ |

0.35 |

|

|

Corporate |

($ |

0.11 |

) |

($ |

0.14 |

) |

($ |

0.10 |

) |

($ |

0.14 |

) |

($ |

0.10 |

) |

($ |

0.14 |

) |

($ |

0.10 |

) |

|

Total –

Continuing Operations |

$ |

1.60 |

|

$ |

1.60 |

|

$ |

1.75 |

|

$ |

1.60 |

|

$ |

1.75 |

|

$ |

1.65 |

|

$ |

1.80 |

|

|

Return on Equity |

|

9.8 |

% |

|

9.3 |

% |

|

10.2 |

% |

|

9.3 |

% |

|

10.2 |

% |

|

9.7 |

% |

|

10.5 |

% |

Contributing to our earnings guidance for 2017 are the following

items:

• We expect 2017 Electric segment net income to be higher

than 2016 segment net income based on:

- Normal weather for the remainder of 2017. Milder than normal

weather in 2016 negatively impacted diluted earnings per share by

$0.07. Milder than normal weather has negatively impacted diluted

earnings per share by $0.03 through the six months ended June 30,

2017.

- A full year of increased rates compared with 8.5 months in

2016. In March 2017, the Minnesota Public Utilities Commission

granted Otter Tail Power Company a revenue increase of

approximately 6.2% with a 9.41% return on equity.

- Rider recovery increases primarily from transmission riders

related to the Electric segment’s continuing investments in its

share of the Multi-Value Transmission Projects in South

Dakota.

- Expected increases in sales to industrial and commercial

customers.

offset by:

- Increased operating and maintenance expenses of $0.04 per share

due to inflationary increases and increasing benefit costs.

Included is an increase in pension costs as a result of a decrease

in the discount rate from 4.76% to 4.60% and a decrease in the

assumed long-term rate of return on plan assets from 7.75% to

7.50%.

- Higher property tax expense due to large capital projects being

put into service.

- Lower Conservation Improvement Program (CIP) incentives of

$0.03 per share in Minnesota as a result of program changes made by

the Minnesota Department of Commerce that reduced the CIP incentive

cap by 32.5% compared to 2016.

- Increased costs related to contractual price increases in

certain capacity agreements.

• We expect 2017 net income from our Manufacturing

segment to increase over 2016 due to:

- A slight increase in sales at BTD due to higher lawn and garden

end market sales offset by lower end market recreational vehicle

sales, capturing new business with existing customers and higher

scrap sales.

- Improved margins on parts and tooling sales at BTD combined

with lower interest costs as a result of the refinancing of

long-term debt at a lower interest rate in the fourth quarter of

2016.

- An increase in earnings from T.O. Plastics mainly driven by

year-over-year sales growth in our horticulture, life science and

industrial markets and lower interest costs as a result of the

refinancing of long-term debt at a lower interest rate in the

fourth quarter of 2016.

- Backlog for the manufacturing companies of approximately $84

million for 2017 compared with $81 million one year ago.

• We are raising our 2017 net income expectations

from the Plastics segment to be higher than our original plan,

primarily due to our strong second quarter results. The Plastics

segment also benefits from lower interest costs as a result of the

refinancing of long-term debt completed in the fourth quarter of

2016.

• Corporate costs in 2017 are expected to be in line

with 2016 costs.

CONFERENCE CALL AND WEBCAST The corporation

will host a live webcast on Tuesday, August 8, 2017 at 10:00 a.m.

CDT to discuss its financial and operating performance.

The presentation will be posted on our website before the

webcast. To access the live webcast go to

www.ottertail.com/presentations.cfm and select “Webcast.” Please

allow extra time prior to the call to visit the site and download

any software needed to listen to the webcast. An archived copy of

the webcast will be available on our website shortly following the

call.

If you are interested in asking a question during the

live webcast, the Dial-In Number

is: 877-312-8789.

Risk Factors and Forward-Looking Statements that Could

Affect Future ResultsThe information in this release

includes certain forward-looking information, including 2017

expectations, made under the Safe Harbor provisions of the Private

Securities Litigation Reform Act of 1995. Although we believe our

expectations are based on reasonable assumptions, actual results

may differ materially from those expectations. The following

factors, among others, could cause our actual results to differ

materially from those discussed in the forward-looking

statements:

- Federal and state environmental regulation could require us to

incur substantial capital expenditures and increased operating

costs.

- Volatile financial markets and changes in our debt ratings

could restrict our ability to access capital and increase borrowing

costs and pension plan and postretirement health care

expenses.

- We rely on access to both short- and long-term capital markets

as a source of liquidity for capital requirements not satisfied by

cash flows from operations. If we are unable to access capital at

competitive rates, our ability to implement our business plans may

be adversely affected.

- Disruptions, uncertainty or volatility in the financial markets

can also adversely impact our results of operations, the ability of

customers to finance purchases of goods and services, and our

financial condition, as well as exert downward pressure on stock

prices and/or limit our ability to sustain our current common stock

dividend level.

- We could be required to contribute additional capital to the

pension plan in the future if the market value of pension plan

assets significantly declines, plan assets do not earn in line with

our long-term rate of return assumptions or relief under the

Pension Protection Act is no longer granted.

- Any significant impairment of our goodwill would cause a

decrease in our asset values and a reduction in our net operating

income.

- Declines in projected operating cash flows at BTD or the

Plastics segment may result in goodwill impairments that could

adversely affect our results of operations and financial position,

as well as financing agreement covenants.

- The inability of our subsidiaries to provide sufficient

earnings and cash flows to allow us to meet our financial

obligations and debt covenants and pay dividends to our

shareholders could have an adverse effect on us.

- We rely on our information systems to conduct our business and

failure to protect these systems against security breaches or

cyber-attacks could adversely affect our business and results of

operations. Additionally, if these systems fail or become

unavailable for any significant period of time, our business could

be harmed.

- Economic conditions could negatively impact our

businesses.

- If we are unable to achieve the organic growth we expect, our

financial performance may be adversely affected.

- Our plans to grow and realign our business mix through capital

projects, acquisitions and dispositions may not be successful,

which could result in poor financial performance.

- We may, from time to time, sell assets to provide capital to

fund investments in our electric utility business or for other

corporate purposes, which could result in the recognition of a loss

on the sale of any assets sold and other potential liabilities. The

sale of any of our businesses could expose us to additional risks

associated with indemnification obligations under the applicable

sales agreements and any related disputes.

- Significant warranty claims and remediation costs in excess of

amounts normally reserved for such items could adversely affect our

results of operations and financial condition.

- We are subject to risks associated with energy markets.

- Changes in tax laws, as well as judgments and estimates used in

the determination of tax-related asset and liability amounts, could

materially adversely affect our business, financial condition,

results of operations and prospects.

- We may experience fluctuations in revenues and expenses related

to our electric operations, which may cause our financial results

to fluctuate and could impair our ability to make distributions to

our shareholders or scheduled payments on our debt obligations, or

to meet covenants under our borrowing agreements.

- Actions by the regulators of our electric operations could

result in rate reductions, lower revenues and earnings or delays in

recovering capital expenditures.

- Otter Tail Power Company’s operations are subject to an

extensive legal and regulatory framework under federal and state

laws as well as regulations imposed by other organizations that may

have a negative impact on our business and results of

operations.

- Otter Tail Power Company’s electric transmission and generation

facilities could be vulnerable to cyber and physical attack that

could impair its ability to provide electrical service to its

customers or disrupt the U.S. bulk power system.

- Otter Tail Power Company’s electric generating facilities are

subject to operational risks that could result in unscheduled plant

outages, unanticipated operation and maintenance expenses and

increased power purchase costs.

- Changes to regulation of generating plant emissions, including

but not limited to carbon dioxide emissions, could affect our

operating costs and the costs of supplying electricity to our

customers.

- Competition from foreign and domestic manufacturers, the price

and availability of raw materials, prices and supply of scrap or

recyclable material and general economic conditions could affect

the revenues and earnings of our manufacturing businesses.

- Our plastics operations are highly dependent on a limited

number of vendors for PVC resin and a limited supply of resin. The

loss of a key vendor, or any interruption or delay in the supply of

PVC resin, could result in reduced sales or increased costs for

this segment.

- We compete against a large number of other manufacturers of PVC

pipe and manufacturers of alternative products. Customers may not

distinguish the pipe companies’ products from those of our

competitors.

- Changes in PVC resin prices can negatively affect our plastics

business.

For a further discussion of other risk factors and cautionary

statements, refer to reports we file with the Securities and

Exchange Commission.

About The Corporation: Otter Tail Corporation

has interests in diversified operations that include an electric

utility and manufacturing businesses. Otter Tail Corporation stock

trades on the NASDAQ Global Select Market under the symbol OTTR.

The latest investor and corporate information is available at

www.ottertail.com. Corporate offices are located

in Fergus Falls, Minnesota, and Fargo, North Dakota.

See Otter Tail Corporation’s results of

operations for the three and six months ended June 30, 2017 and

2016 in the following financial statements: Consolidated Statements

of Income, Consolidated Balance Sheets – Assets, Consolidated

Balance Sheets – Liabilities and Equity, and Consolidated

Statements of Cash Flows.

| Otter Tail Corporation |

| Consolidated Statements of

Income |

| In thousands, except share and per share amounts |

| (not audited) |

| |

| |

Quarter Ended June 30, |

Year-to-Date June 30, |

|

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Operating

Revenues by Segment |

|

|

|

|

|

Electric |

$ |

102,236 |

|

$ |

97,925 |

|

$ |

220,787 |

|

$ |

210,919 |

|

|

Manufacturing |

|

59,304 |

|

|

58,452 |

|

|

117,721 |

|

|

118,272 |

|

|

Plastics |

|

50,551 |

|

|

47,112 |

|

|

87,708 |

|

|

80,549 |

|

|

Intersegment Eliminations |

|

(5 |

) |

|

(7 |

) |

|

(13 |

) |

|

(16 |

) |

|

Total Operating Revenues |

|

212,086 |

|

|

203,482 |

|

|

426,203 |

|

|

409,724 |

|

| Operating

Expenses |

|

|

|

|

| Fuel and

Purchased Power |

|

28,853 |

|

|

25,117 |

|

|

64,423 |

|

|

57,703 |

|

|

Nonelectric Cost of Products Sold (depreciation included

below) |

|

84,013 |

|

|

80,949 |

|

|

159,290 |

|

|

153,588 |

|

| Electric

Operating and Maintenance Expense |

|

37,850 |

|

|

38,981 |

|

|

76,229 |

|

|

78,999 |

|

|

Nonelectric Operating and Maintenance Expense |

|

10,164 |

|

|

9,238 |

|

|

20,602 |

|

|

20,693 |

|

|

Depreciation and Amortization |

|

17,908 |

|

|

18,525 |

|

|

35,762 |

|

|

36,814 |

|

|

Property Taxes - Electric |

|

3,709 |

|

|

3,589 |

|

|

7,507 |

|

|

7,268 |

|

|

Total Operating Expenses |

|

182,497 |

|

|

176,399 |

|

|

363,813 |

|

|

355,065 |

|

| Operating

Income (Loss) by Segment |

|

|

|

|

|

Electric |

|

18,730 |

|

|

16,806 |

|

|

46,468 |

|

|

40,034 |

|

|

Manufacturing |

|

5,049 |

|

|

5,805 |

|

|

8,805 |

|

|

9,660 |

|

|

Plastics |

|

7,635 |

|

|

6,005 |

|

|

11,591 |

|

|

9,752 |

|

|

Corporate |

|

(1,825 |

) |

|

(1,533 |

) |

|

(4,474 |

) |

|

(4,787 |

) |

|

Total Operating Income |

|

29,589 |

|

|

27,083 |

|

|

62,390 |

|

|

54,659 |

|

| Interest

Charges |

|

7,527 |

|

|

7,976 |

|

|

14,989 |

|

|

15,970 |

|

| Other

Income |

|

552 |

|

|

1,532 |

|

|

1,105 |

|

|

1,932 |

|

| Income Tax

Expense – Continuing Operations |

|

5,897 |

|

|

5,083 |

|

|

12,260 |

|

|

10,575 |

|

| Net Income

(Loss) by Segment – Continuing Operations |

|

|

|

|

|

Electric |

|

10,134 |

|

|

9,148 |

|

|

25,694 |

|

|

21,686 |

|

|

Manufacturing |

|

2,955 |

|

|

3,009 |

|

|

5,127 |

|

|

4,862 |

|

|

Plastics |

|

4,637 |

|

|

3,485 |

|

|

7,074 |

|

|

5,637 |

|

|

Corporate |

|

(1,009 |

) |

|

(86 |

) |

|

(1,649 |

) |

|

(2,139 |

) |

| Net Income from

Continuing Operations |

|

16,717 |

|

|

15,556 |

|

|

36,246 |

|

|

30,046 |

|

| Income from

Discontinued Operations - net of Income Tax

Expense of $40, $80, $78 and $100 for the respective

periods |

|

61 |

|

|

119 |

|

|

117 |

|

|

149 |

|

|

Net Income |

$ |

16,778 |

|

$ |

15,675 |

|

$ |

36,363 |

|

$ |

30,195 |

|

| Average Number

of Common Shares Outstanding |

|

|

|

|

|

Basic |

|

39,462,865 |

|

|

38,179,371 |

|

|

39,406,834 |

|

|

38,058,157 |

|

|

Diluted |

|

39,702,499 |

|

|

38,321,289 |

|

|

39,671,612 |

|

|

38,183,249 |

|

| |

|

|

|

|

| Basic Earnings

Per Common Share: |

|

|

|

|

|

Continuing Operations |

$ |

0.43 |

|

$ |

0.41 |

|

$ |

0.92 |

|

$ |

0.79 |

|

|

Discontinued Operations |

|

-- |

|

|

-- |

|

|

-- |

|

|

-- |

|

| |

$ |

0.43 |

|

$ |

0.41 |

|

$ |

0.92 |

|

$ |

0.79 |

|

| Diluted

Earnings Per Common Share: |

|

|

|

|

|

Continuing Operations |

$ |

0.42 |

|

$ |

0.41 |

|

$ |

0.92 |

|

$ |

0.79 |

|

|

Discontinued Operations |

|

-- |

|

|

-- |

|

|

-- |

|

|

-- |

|

| |

$ |

0.42 |

|

$ |

0.41 |

|

$ |

0.92 |

|

$ |

0.79 |

|

| Otter Tail Corporation |

| Consolidated Balance Sheets |

| ASSETS |

| in thousands |

| (not audited) |

| |

June 30, |

December 31, |

|

|

2017 |

2016 |

| |

|

|

| Current

Assets |

|

|

| Cash and

Cash Equivalents |

$ |

-- |

$ |

-- |

| Accounts

Receivable: |

|

|

|

Trade—Net |

|

79,029 |

|

68,242 |

|

Other |

|

7,895 |

|

5,850 |

|

Inventories |

|

87,267 |

|

83,740 |

| Unbilled

Revenues |

|

15,560 |

|

20,080 |

| Income

Taxes Receivable |

|

-- |

|

662 |

|

Regulatory Assets |

|

16,540 |

|

21,297 |

|

Other |

|

14,352 |

|

8,144 |

|

Total Current Assets |

|

220,643 |

|

208,015 |

| |

|

|

|

Investments |

|

8,156 |

|

8,417 |

| Other

Assets |

|

35,253 |

|

34,104 |

|

Goodwill |

|

37,572 |

|

37,572 |

| Other

Intangibles—Net |

|

14,391 |

|

14,958 |

| Regulatory

Assets |

|

127,479 |

|

132,094 |

| |

|

|

|

Plant |

|

|

| Electric

Plant in Service |

|

1,870,928 |

|

1,860,357 |

|

Nonelectric Operations |

|

214,925 |

|

211,826 |

|

Construction Work in Progress |

|

188,450 |

|

153,261 |

|

Total Gross Plant |

|

2,274,303 |

|

2,225,444 |

|

Less Accumulated Depreciation and Amortization |

|

773,741 |

|

748,219 |

|

Net Plant |

|

1,500,562 |

|

1,477,225 |

|

Total |

$ |

1,944,056 |

$ |

1,912,385 |

| Otter Tail Corporation |

| Consolidated Balance Sheets |

| Liabilities and Equity |

| in thousands |

| (not audited) |

| |

June 30, |

December 31, |

|

|

|

2017 |

|

|

2016 |

|

| |

|

|

| Current

Liabilities |

|

|

|

Short-Term Debt |

$ |

58,117 |

|

$ |

42,883 |

|

| Current

Maturities of Long-Term Debt |

|

42,200 |

|

|

33,201 |

|

| Accounts

Payable |

|

94,353 |

|

|

89,350 |

|

| Accrued

Salaries and Wages |

|

15,115 |

|

|

17,497 |

|

| Accrued

Taxes |

|

10,954 |

|

|

16,000 |

|

| Other

Accrued Liabilities |

|

15,142 |

|

|

15,377 |

|

|

Liabilities of Discontinued Operations |

|

1,113 |

|

|

1,363 |

|

|

Total Current Liabilities |

|

236,994 |

|

|

215,671 |

|

| |

|

|

| Pensions

Benefit Liability |

|

98,297 |

|

|

97,627 |

|

| Other

Postretirement Benefits Liability |

|

62,980 |

|

|

62,571 |

|

| Other

Noncurrent Liabilities |

|

22,441 |

|

|

21,706 |

|

| |

|

|

| Deferred

Credits |

|

|

| Deferred

Income Taxes |

|

235,554 |

|

|

226,591 |

|

| Deferred

Tax Credits |

|

22,115 |

|

|

22,849 |

|

|

Regulatory Liabilities |

|

83,561 |

|

|

82,433 |

|

|

Other |

|

5,324 |

|

|

7,492 |

|

|

Total Deferred Credits |

|

346,554 |

|

|

339,365 |

|

| |

|

|

|

Capitalization |

|

|

| Long-Term

Debt—Net |

|

490,386 |

|

|

505,341 |

|

| |

|

|

|

Cumulative Preferred Shares |

|

-- |

|

|

-- |

|

| |

|

|

|

Cumulative Preference Shares |

|

-- |

|

|

-- |

|

| |

|

|

|

Common Equity |

|

|

| Common

Shares, Par Value $5 Per Share |

|

197,775 |

|

|

196,741 |

|

| Premium

on Common Shares |

|

341,657 |

|

|

337,684 |

|

| Retained

Earnings |

|

150,558 |

|

|

139,479 |

|

|

Accumulated Other Comprehensive Loss |

|

(3,586 |

) |

|

(3,800 |

) |

|

Total Common Equity |

|

686,404 |

|

|

670,104 |

|

|

Total Capitalization |

|

1,176,790 |

|

|

1,175,445 |

|

|

Total |

$ |

1,944,056 |

|

$ |

1,912,385 |

|

| Otter Tail Corporation |

| Consolidated Statements of Cash

Flows |

| In thousands |

| (not audited) |

| |

| |

For the Six Months Ended June 30, |

|

|

|

2017 |

|

|

2016 |

|

| Cash Flows from

Operating Activities |

|

|

| Net

Income |

$ |

36,363 |

|

$ |

30,195 |

|

|

Adjustments to Reconcile Net Income to Net Cash Provided by

Operating Activities: |

|

|

| Net

Income from Discontinued Operations |

|

(117 |

) |

|

(149 |

) |

|

Depreciation and Amortization |

|

35,762 |

|

|

36,814 |

|

| Deferred

Tax Credits |

|

(734 |

) |

|

(828 |

) |

| Deferred

Income Taxes |

|

8,666 |

|

|

9,679 |

|

| Change in

Deferred Debits and Other Assets |

|

8,075 |

|

|

2,680 |

|

|

Discretionary Contribution to Pension Plan |

|

-- |

|

|

(10,000 |

) |

| Change in

Noncurrent Liabilities and Deferred Credits |

|

(695 |

) |

|

6,404 |

|

| Allowance

for Equity/Other Funds Used During Construction |

|

(401 |

) |

|

(475 |

) |

| Stock

Compensation Expense – Equity Awards |

|

1,920 |

|

|

828 |

|

|

Other—Net |

|

39 |

|

|

(76 |

) |

| Cash

(Used for) Provided by Current Assets and Current Liabilities: |

|

|

| Change in

Receivables |

|

(12,832 |

) |

|

(12,673 |

) |

| Change in

Inventories |

|

(3,527 |

) |

|

4,218 |

|

| Change in

Other Current Assets |

|

2,095 |

|

|

(1,043 |

) |

| Change in

Payables and Other Current Liabilities |

|

(5,878 |

) |

|

(5,441 |

) |

|

Change in Interest and Income Taxes Receivable/Payable |

|

590 |

|

|

4,018 |

|

| Net Cash

Provided by Continuing Operations |

|

69,326 |

|

|

64,151 |

|

|

Net Cash (Used in) Provided by Discontinued Operations |

|

(54 |

) |

|

11 |

|

|

Net Cash Provided by Operating Activities |

|

69,272 |

|

|

64,162 |

|

| Cash Flows from

Investing Activities |

|

|

| Capital

Expenditures |

|

(56,354 |

) |

|

(79,158 |

) |

| Net

Proceeds from Disposal of Noncurrent Assets |

|

2,167 |

|

|

1,080 |

|

| Final

Purchase Price Adjustment – BTD-Georgia Acquisition |

|

-- |

|

|

1,500 |

|

|

Cash Used for Investments and Other Assets |

|

(2,431 |

) |

|

(1,719 |

) |

|

Net Cash Used in Investing Activities |

|

(56,618 |

) |

|

(78,297 |

) |

| Cash Flows from

Financing Activities |

|

|

| Changes

in Checks Written in Excess of Cash |

|

1,043 |

|

|

(2,024 |

) |

| Net

Short-Term Borrowings (Repayments) |

|

15,234 |

|

|

(31,398 |

) |

| Proceeds

from Issuance of Common Stock – net of Issuance Expenses |

|

4,266 |

|

|

21,645 |

|

| Payments

for Retirement of Capital Stock |

|

(1,799 |

) |

|

(104 |

) |

| Proceeds

from Issuance of Long-Term Debt |

|

-- |

|

|

50,000 |

|

|

Short-Term and Long-Term Debt Issuance Expenses |

|

-- |

|

|

(59 |

) |

| Payments

for Retirement of Long-Term Debt |

|

(6,114 |

) |

|

(106 |

) |

|

Dividends Paid |

|

(25,284 |

) |

|

(23,819 |

) |

|

Net Cash (Used in) Provided by Financing

Activities |

|

(12,654 |

) |

|

14,135 |

|

| Net Change in

Cash and Cash Equivalents |

|

-- |

|

|

-- |

|

|

Cash and Cash Equivalents at Beginning of

Period |

|

-- |

|

|

-- |

|

|

Cash and Cash Equivalents at End of Period |

$ |

-- |

|

$ |

-- |

|

Media contact: Cris Oehler, Vice President of Corporate Communications, (218) 531-0099 or (866) 410-8780

Investor contact: Loren Hanson, Manager of Investor Relations, (218) 739-8481 or (800) 664-1259

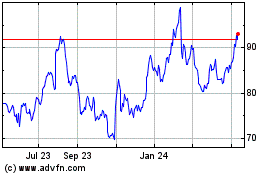

Otter Tail (NASDAQ:OTTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

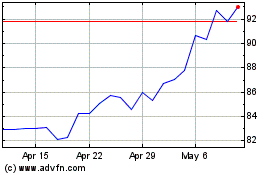

Otter Tail (NASDAQ:OTTR)

Historical Stock Chart

From Apr 2023 to Apr 2024