Oil Gains Ahead of U.S. Rig-Count Data

July 28 2017 - 7:00AM

Dow Jones News

By Justin Yang and Jenny W. Hsu

Oil prices ticked higher Friday, hitting a two-month high ahead

of a key reading on U.S. production activity.

Brent crude, the global oil benchmark, rose 0.06% to $51.55 a

barrel on London's ICE Futures exchange. On the New York Mercantile

Exchange, West Texas Intermediate futures were trading up 0.08% at

$49.08 a barrel.

Analysts say the weekly report on U.S. oil-rig activity due

later Friday will be an important factor in determining how

producers there are coping with prolonged soft prices. A further

drop in the active oil-drilling rig count could offer a short-term

lift to prices, said a note from ING Bank.

"What we will be looking for is if the growth has plateaued,"

said Gao Jian, an energy analyst at Shandong-based SCI

International.

Crude is up more than 6% week-to-date on a raft of positive U.S.

data points and a renewed commitment from the Organization of the

Petroleum Exporting Countries to rein in production and exports.

But doubts on whether oil can sustain its recent price increases

persist.

Saudi Arabia could be challenged to maintain its promised export

cuts after the region's own high-demand summer season ends and

there is more crude available to export in the autumn, said

Commerzbank in a note.

"We consider the current prices a bit high today, ahead of the

fundamentals. We expect prices to lower over the next weeks," said

Eugen Weinberg, head of commodity research at Commerzbank.

Nymex reformulated gasoline blendstock--the benchmark gasoline

contract--rose 0.01% to $1.62 a gallon. ICE gas oil changed hands

at $477.00 a metric ton, up/down $1.75 from the previous

settlement.

Write to Jenny W. Hsu at jenny.hsu@wsj.com

(END) Dow Jones Newswires

July 28, 2017 06:45 ET (10:45 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

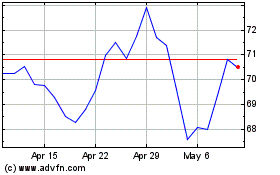

Service (NYSE:SCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

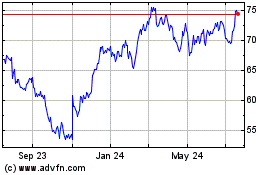

Service (NYSE:SCI)

Historical Stock Chart

From Apr 2023 to Apr 2024